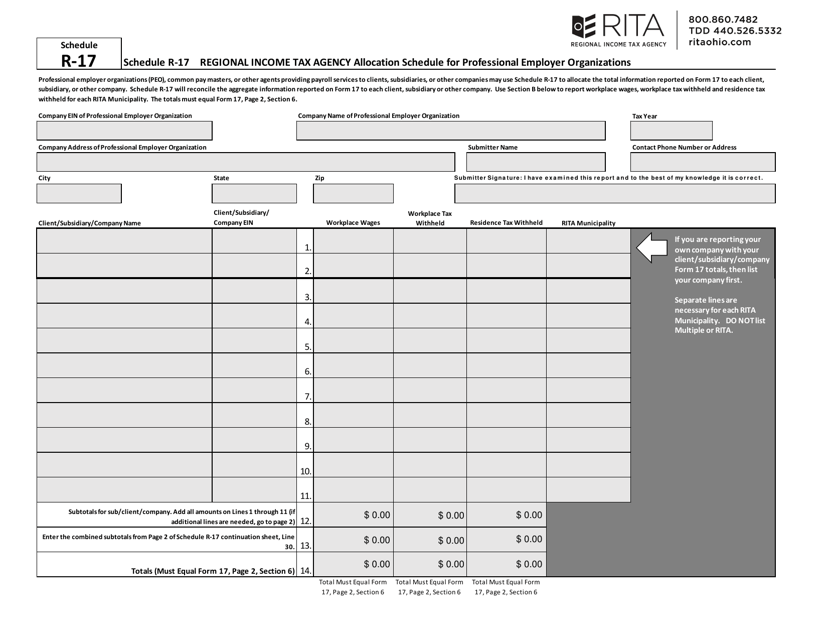

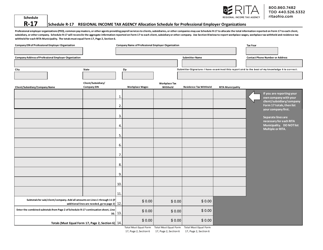

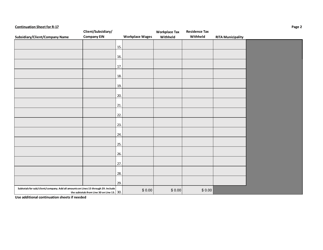

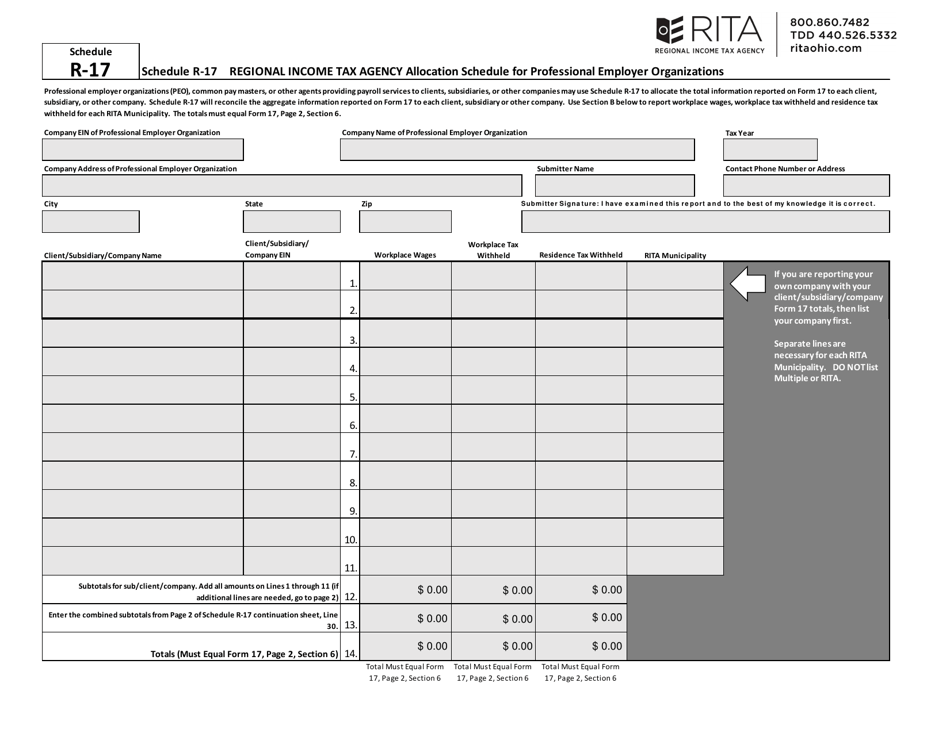

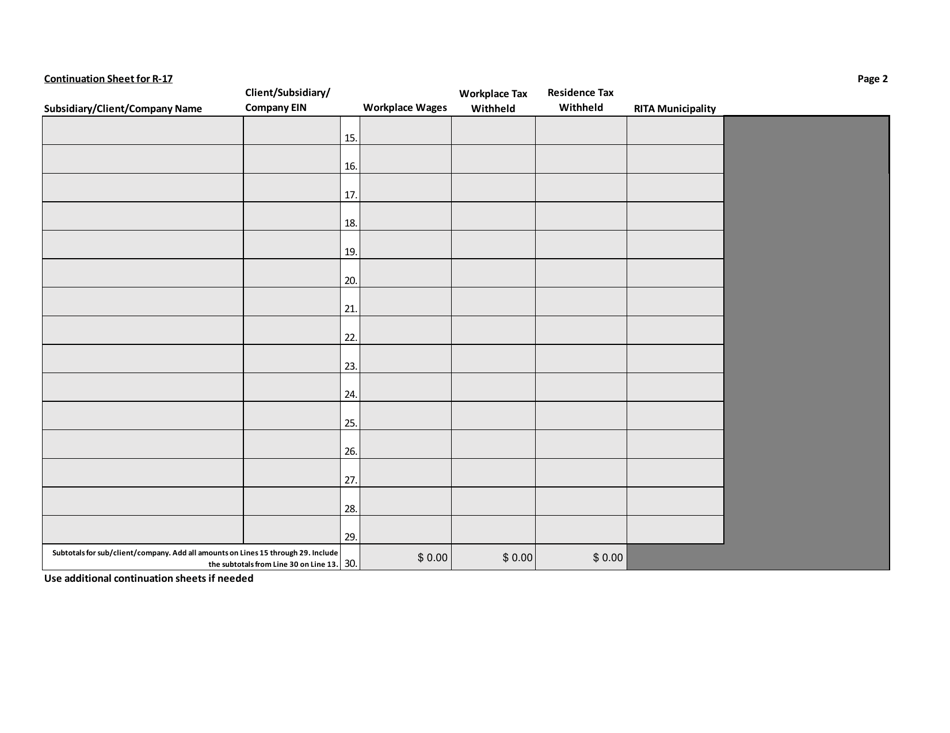

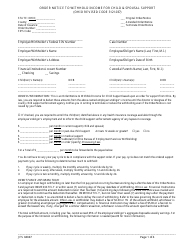

Schedule R-17 Regional Income Tax Agency Allocation Schedule for Professional Employer Organizations - Ohio

What Is Schedule R‐17?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule R-17?

A: Schedule R-17 is the Regional Income Tax Agency Allocation Schedule for Professional Employer Organizations in Ohio.

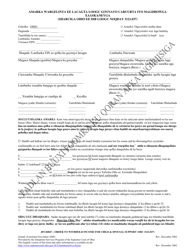

Q: What is the purpose of Schedule R-17?

A: The purpose of Schedule R-17 is to allocate income tax liability for professional employer organizations operating in multiple jurisdictions within Ohio.

Q: Who needs to file Schedule R-17?

A: Professional employer organizations operating in multiple jurisdictions within Ohio need to file Schedule R-17.

Q: What information is required on Schedule R-17?

A: Schedule R-17 requires information about the professional employer organization's total taxable income, total business income, and income allocation percentages for each jurisdiction in Ohio.

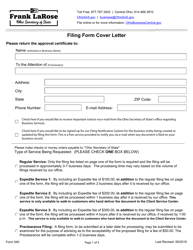

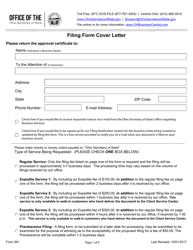

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule R‐17 by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).