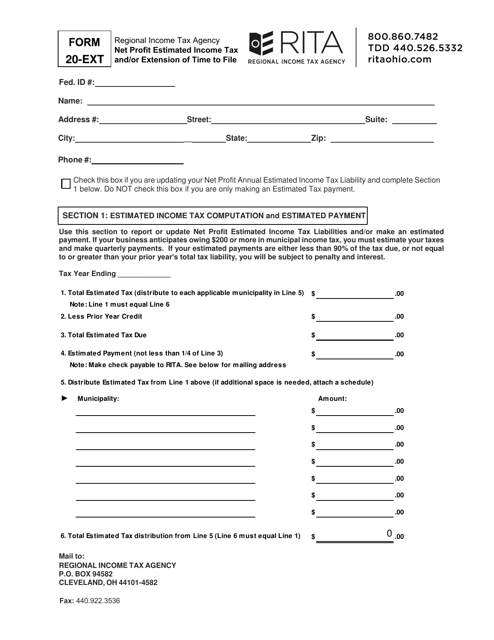

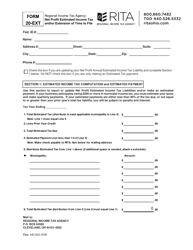

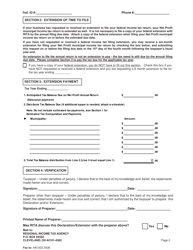

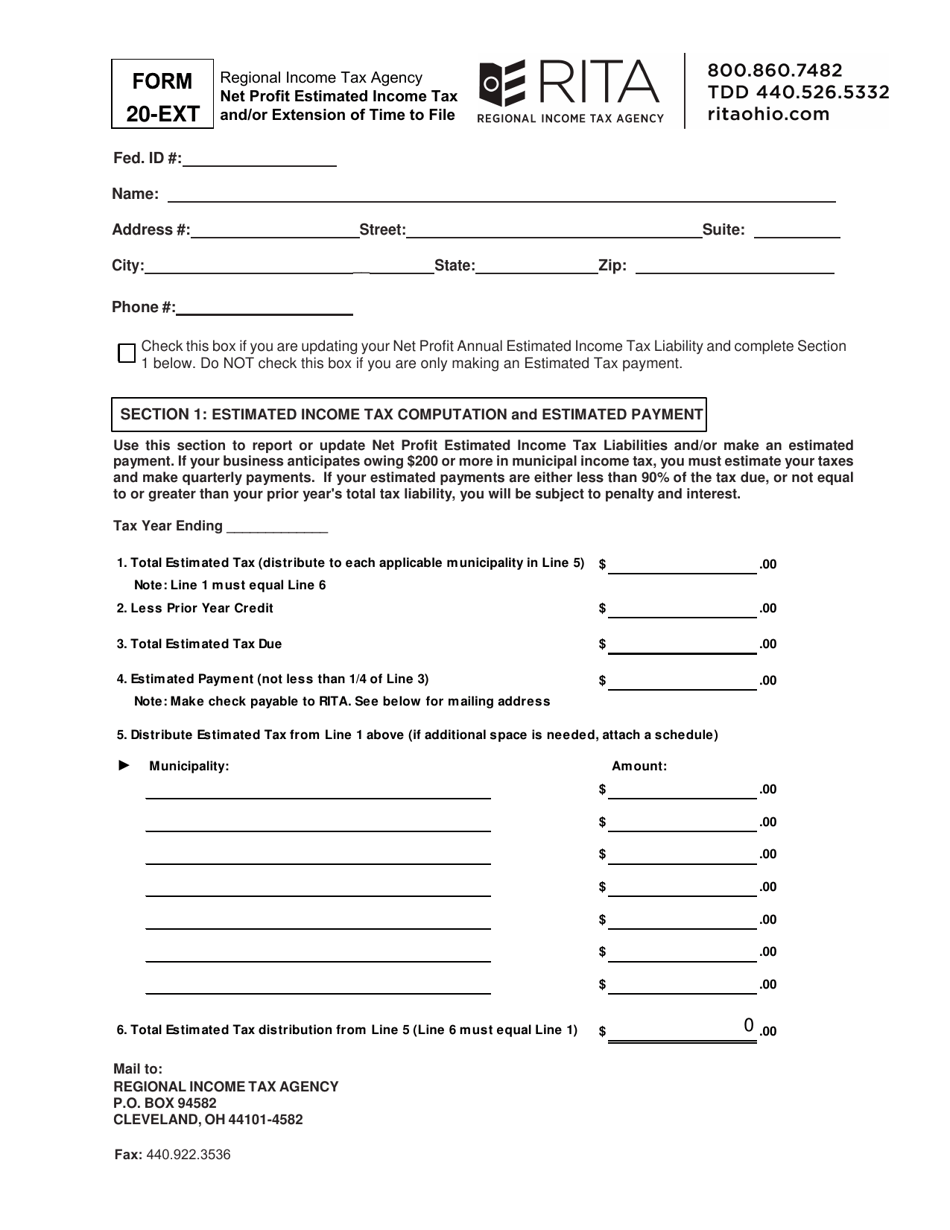

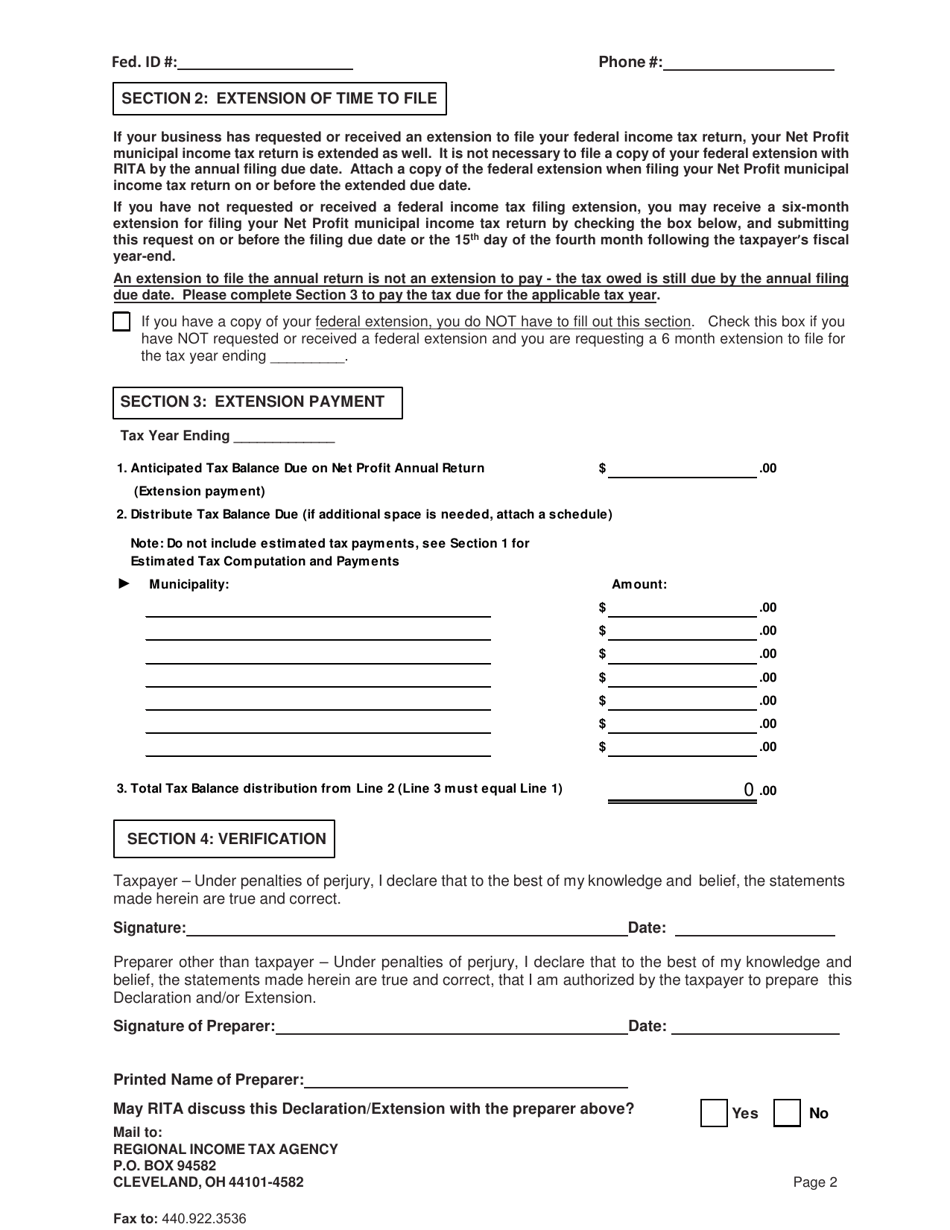

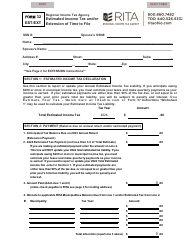

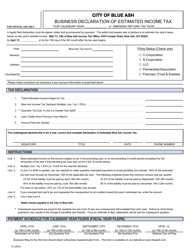

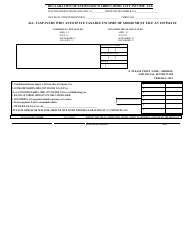

Form 20-EXT Net Profit Estimated Income Tax and / or Extension of Time to File - Ohio

What Is Form 20-EXT?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 20-EXT?

A: Form 20-EXT is a document used in Ohio for estimating net profit income tax and requesting an extension of time to file.

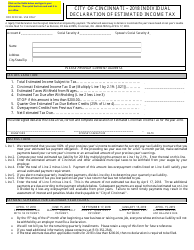

Q: Who is required to file Form 20-EXT?

A: Businesses in Ohio that need to estimate their net profit income tax and/or request an extension of time to file are required to file Form 20-EXT.

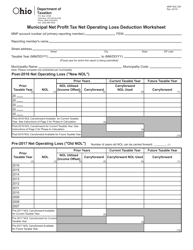

Q: What is the purpose of estimating net profit income tax?

A: Estimating net profit income tax allows businesses to make timely and accurate tax payments throughout the year, avoiding penalties and interest charges.

Q: How do I request an extension of time to file using Form 20-EXT?

A: To request an extension of time to file, you must complete and submit Form 20-EXT by the original due date of your tax return. It is important to estimate and pay any tax due to avoid penalties and interest charges.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 20-EXT by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).