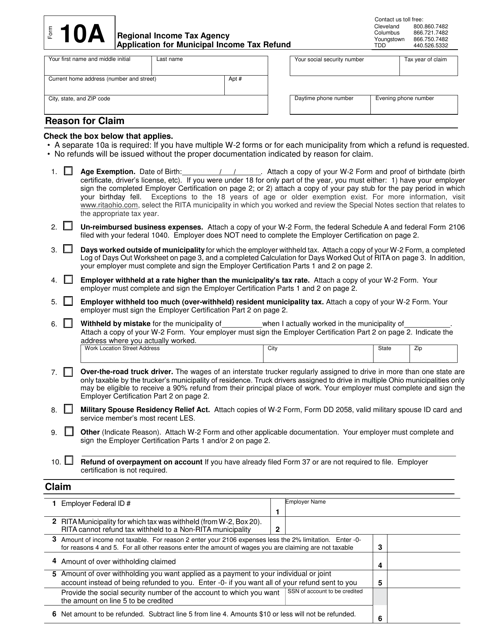

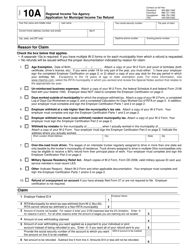

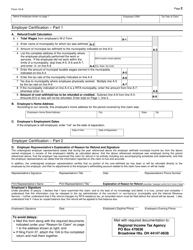

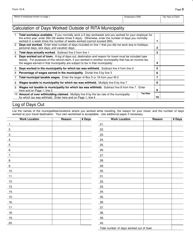

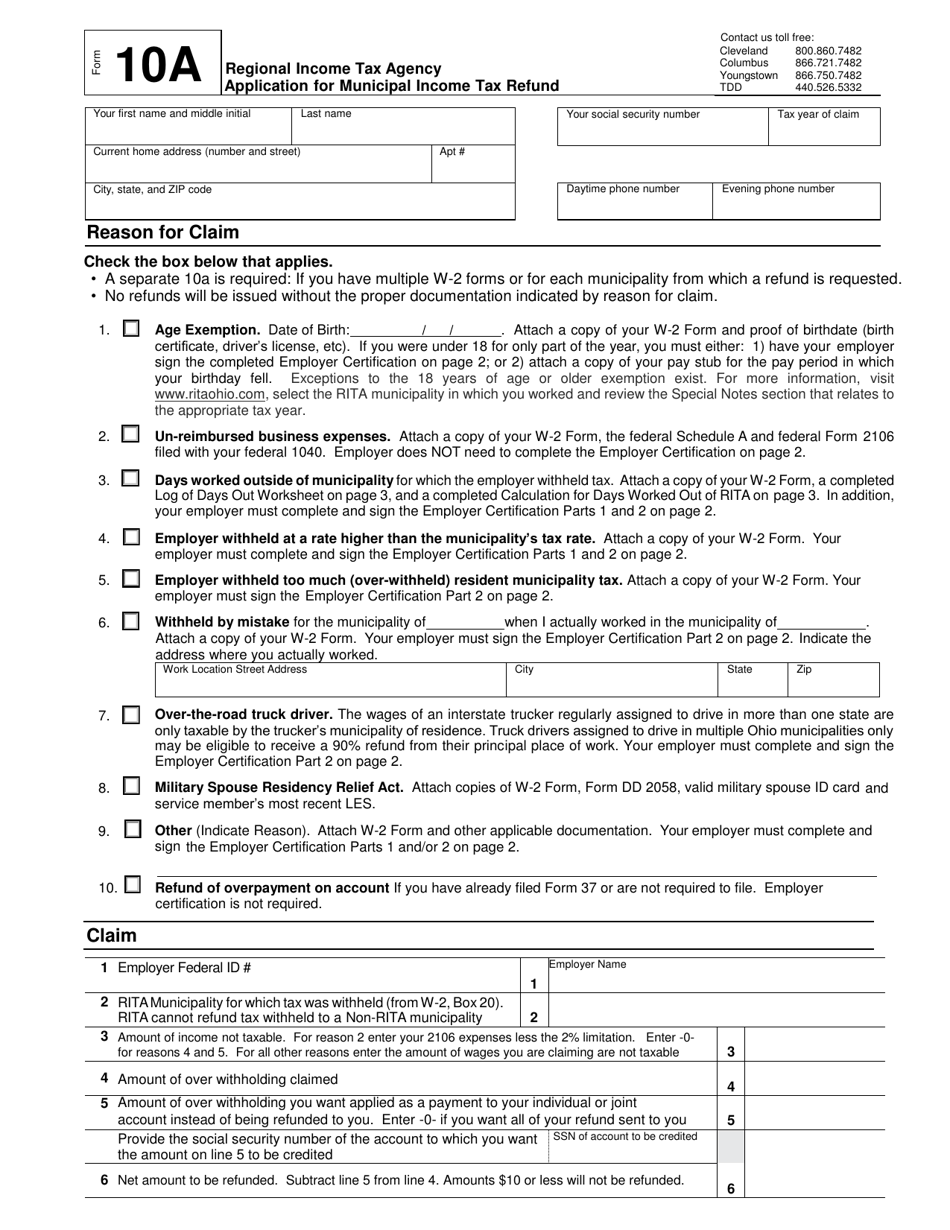

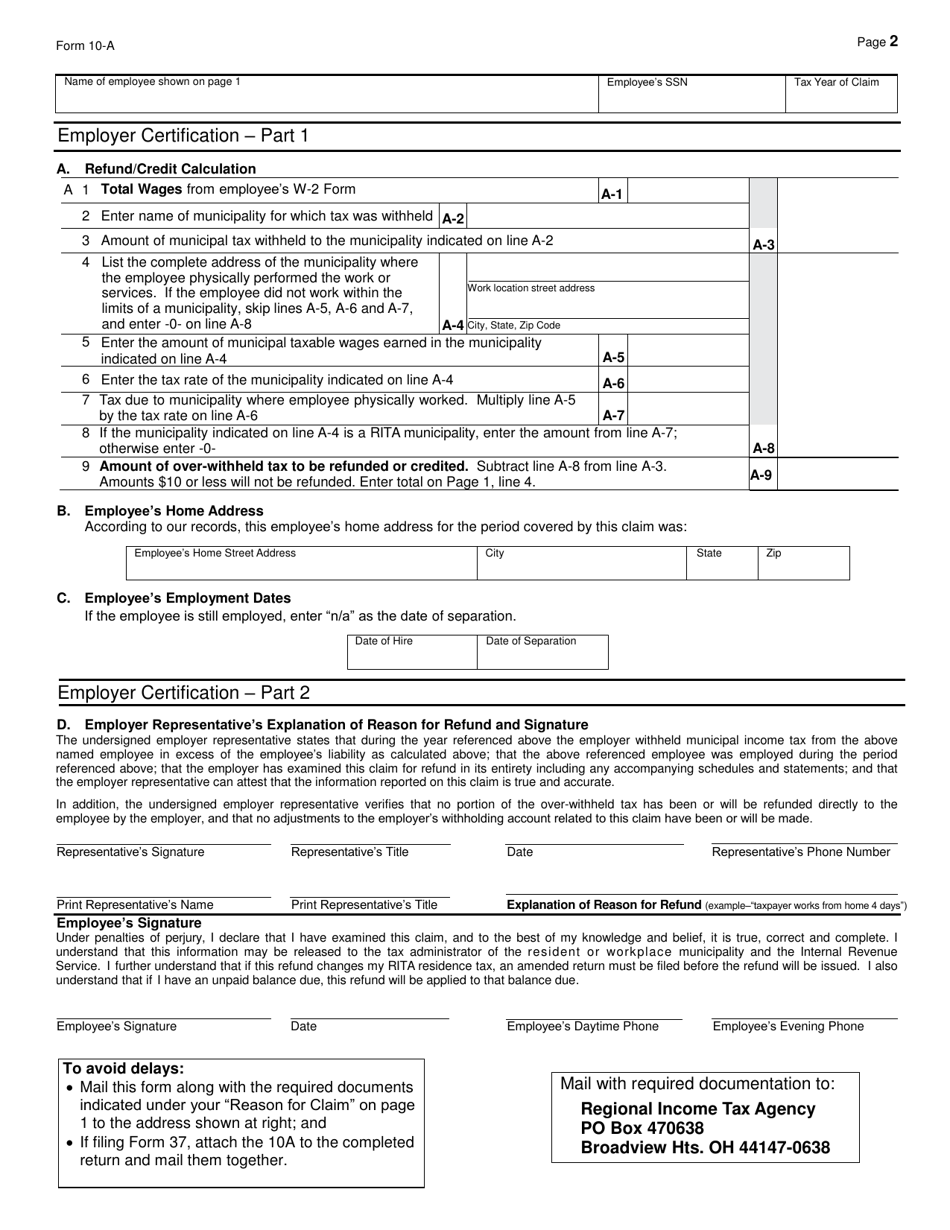

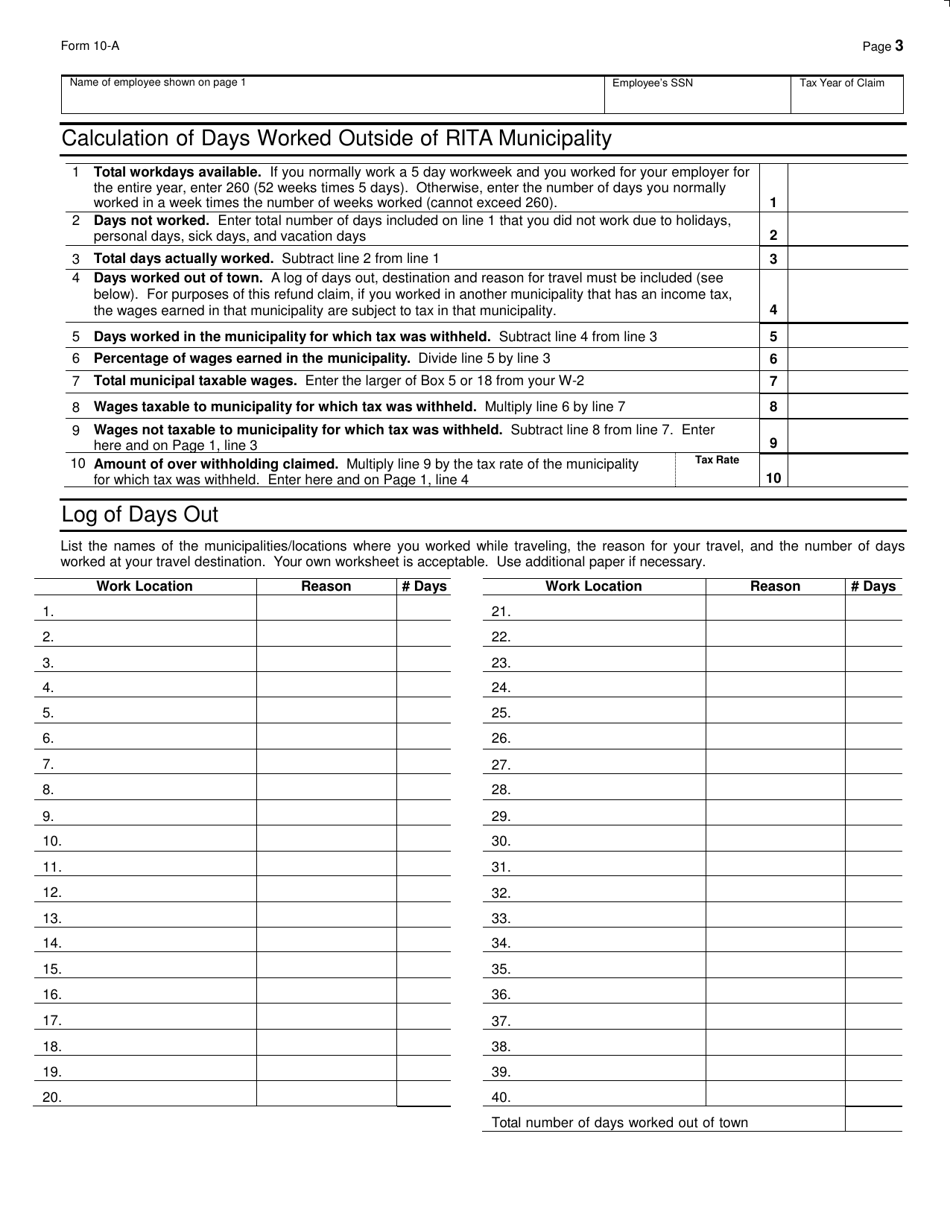

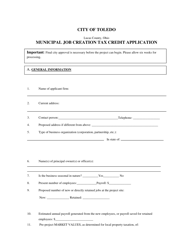

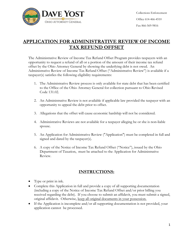

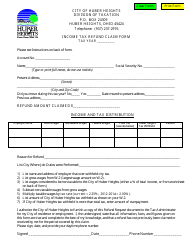

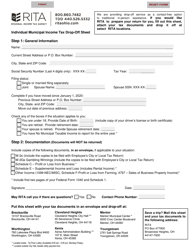

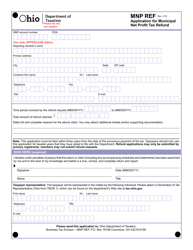

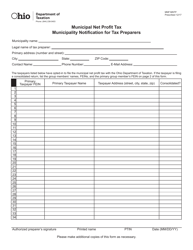

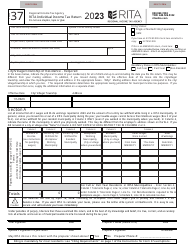

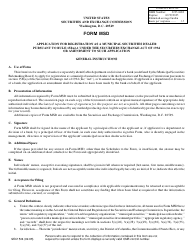

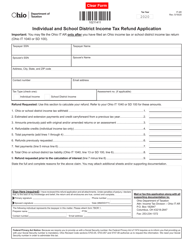

Form 10-A Application for Municipal Income Tax Refund - Ohio

What Is Form 10-A?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10-A?

A: Form 10-A is an application used to claim a municipal income tax refund in Ohio.

Q: Who can use Form 10-A?

A: Residents or individuals who have paid municipal income tax in Ohio can use Form 10-A.

Q: What is the purpose of Form 10-A?

A: The purpose of Form 10-A is to request a refund for overpaid municipal income tax in Ohio.

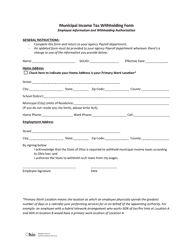

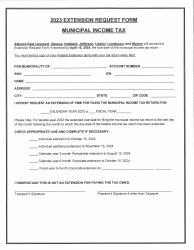

Q: What information is required on Form 10-A?

A: Form 10-A requires personal information, details of income and taxes paid, and supporting documentation.

Q: Is there a deadline for filing Form 10-A?

A: Yes, Form 10-A must be filed within the specified time limit set by your local municipality.

Q: How long does it take to receive a refund after submitting Form 10-A?

A: Refund processing times vary, but it typically takes a few weeks to receive a refund after submitting Form 10-A.

Q: Can I e-file Form 10-A?

A: No, Form 10-A can only be filed by mail or in person.

Q: What should I do if I have questions or need assistance with Form 10-A?

A: If you have questions or need assistance with Form 10-A, you should contact your local municipal tax office or the Ohio Department of Taxation.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10-A by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).