This version of the form is not currently in use and is provided for reference only. Download this version of

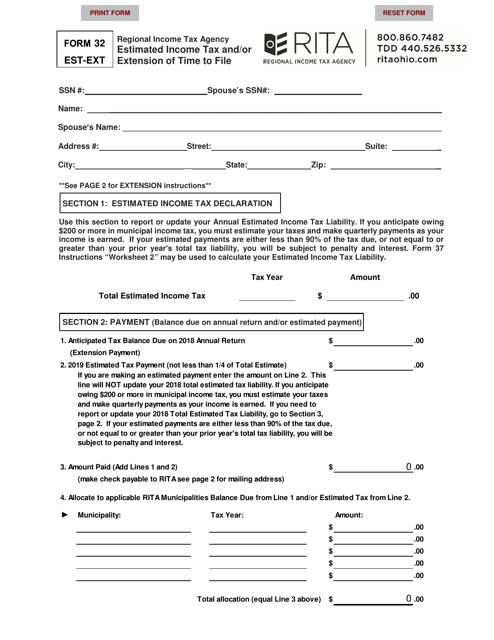

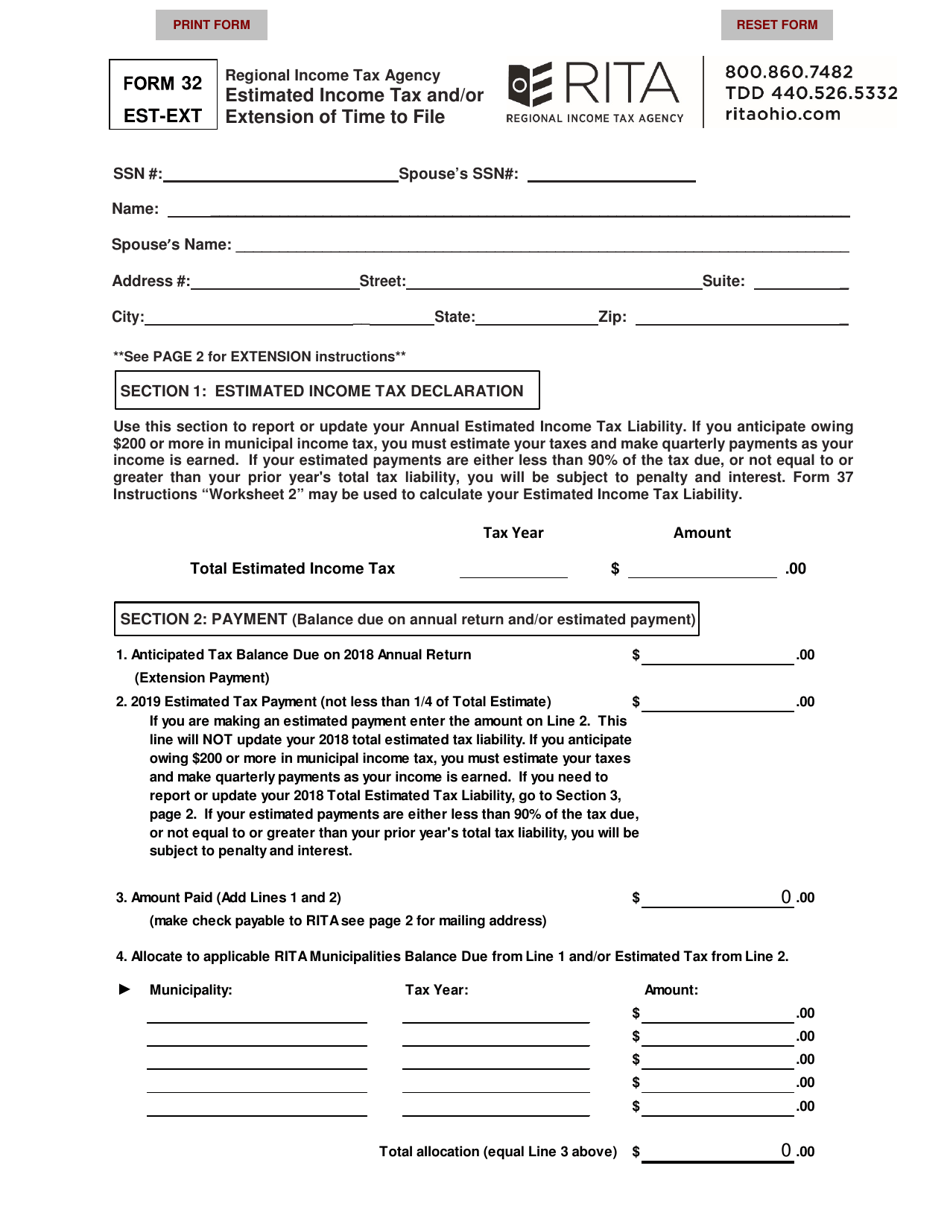

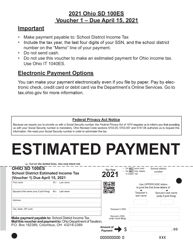

Form 32 EST-EXT

for the current year.

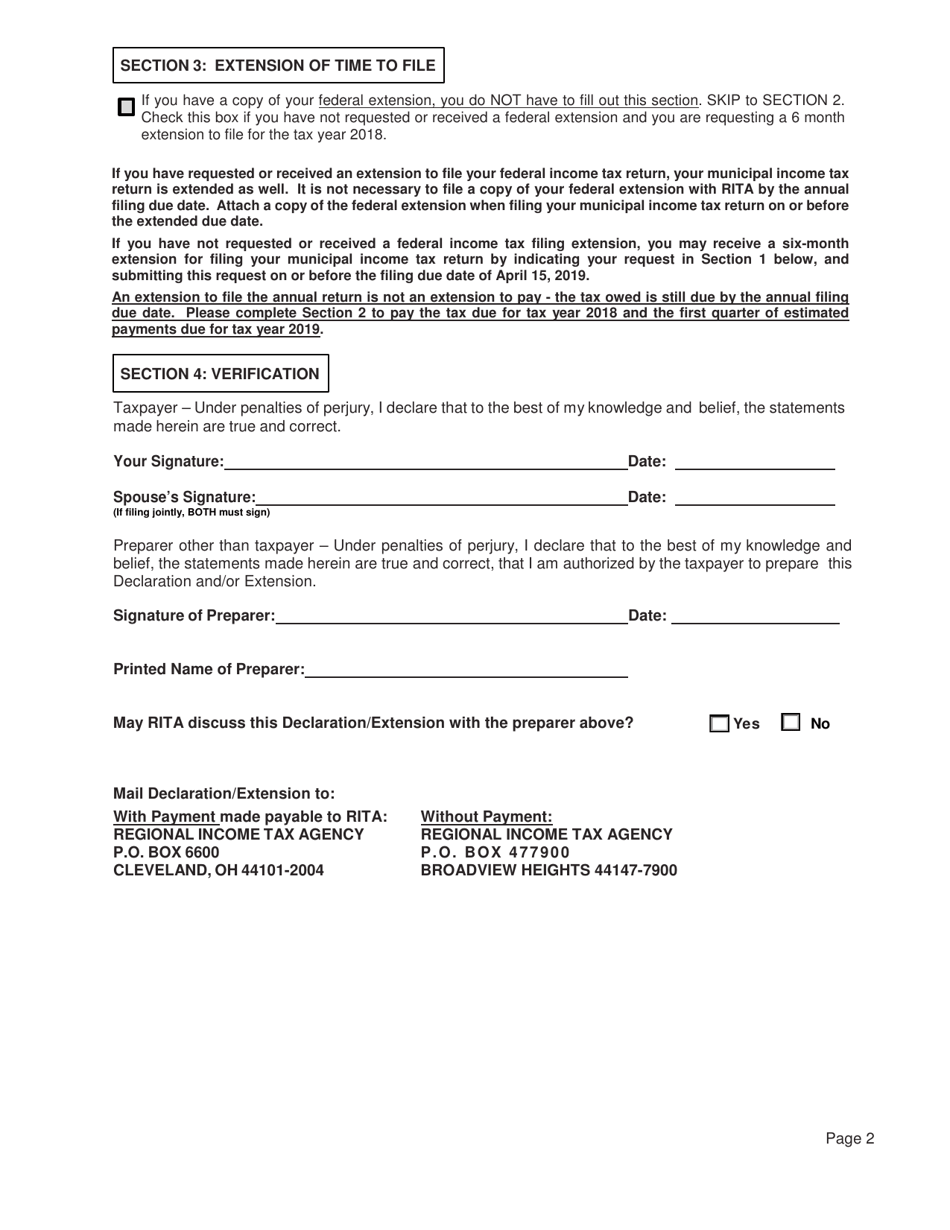

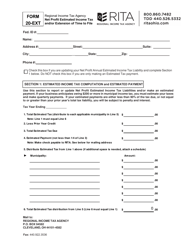

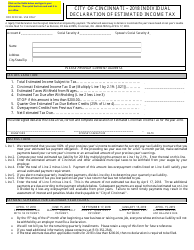

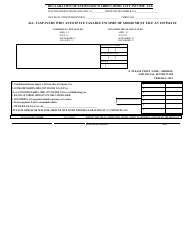

Form 32 EST-EXT Estimated Income Tax and / or Extension of Time to File - Ohio

What Is Form 32 EST-EXT?

This is a legal form that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 32 EST-EXT?

A: Form 32 EST-EXT is a tax form used in Ohio to estimate income tax or request an extension of time to file.

Q: When should I use Form 32 EST-EXT in Ohio?

A: You should use Form 32 EST-EXT if you need to estimate your income tax liability or if you need additional time to file your tax return in Ohio.

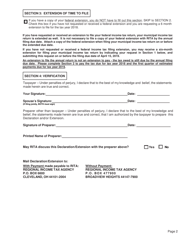

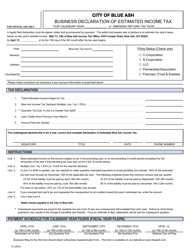

Q: What information do I need to provide on Form 32 EST-EXT?

A: You will need to provide your personal information, estimated income, deductions, and credits, as well as the reason for requesting an extension if applicable.

Q: Is there a deadline for filing Form 32 EST-EXT in Ohio?

A: Yes, the deadline for filing Form 32 EST-EXT in Ohio is typically April 15th, the same deadline as the individual income tax return.

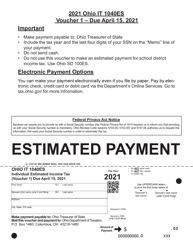

Q: Can I pay my estimated tax with Form 32 EST-EXT?

A: No, you will need to make estimated tax payments separately using Ohio Form IT 1040ES.

Q: What happens if I don't file Form 32 EST-EXT or pay my estimated tax in Ohio?

A: If you don't file Form 32 EST-EXT or pay your estimated tax, you may be subject to penalties and interest on the amount owed.

Q: Can I request an extension of time to file my Ohio tax return using Form 32 EST-EXT?

A: Yes, you can use Form 32 EST-EXT to request an extension of time to file your Ohio tax return, but you still need to pay any estimated tax owed by the original due date.

Form Details:

- The latest edition provided by the Ohio Regional Income Tax Agency (RITA);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 32 EST-EXT by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).