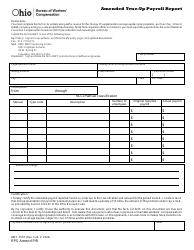

This version of the form is not currently in use and is provided for reference only. Download this version of

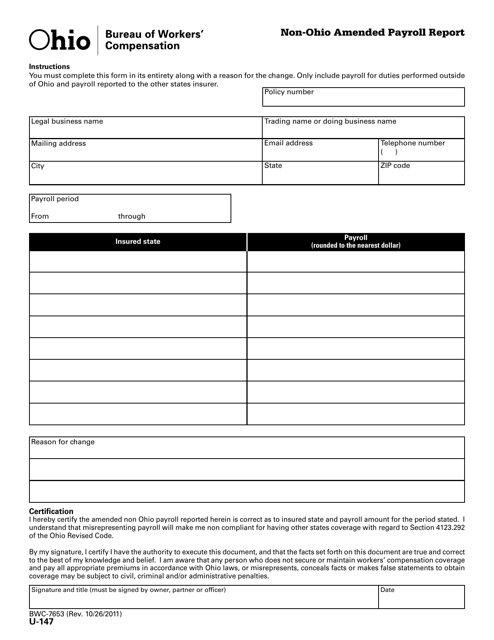

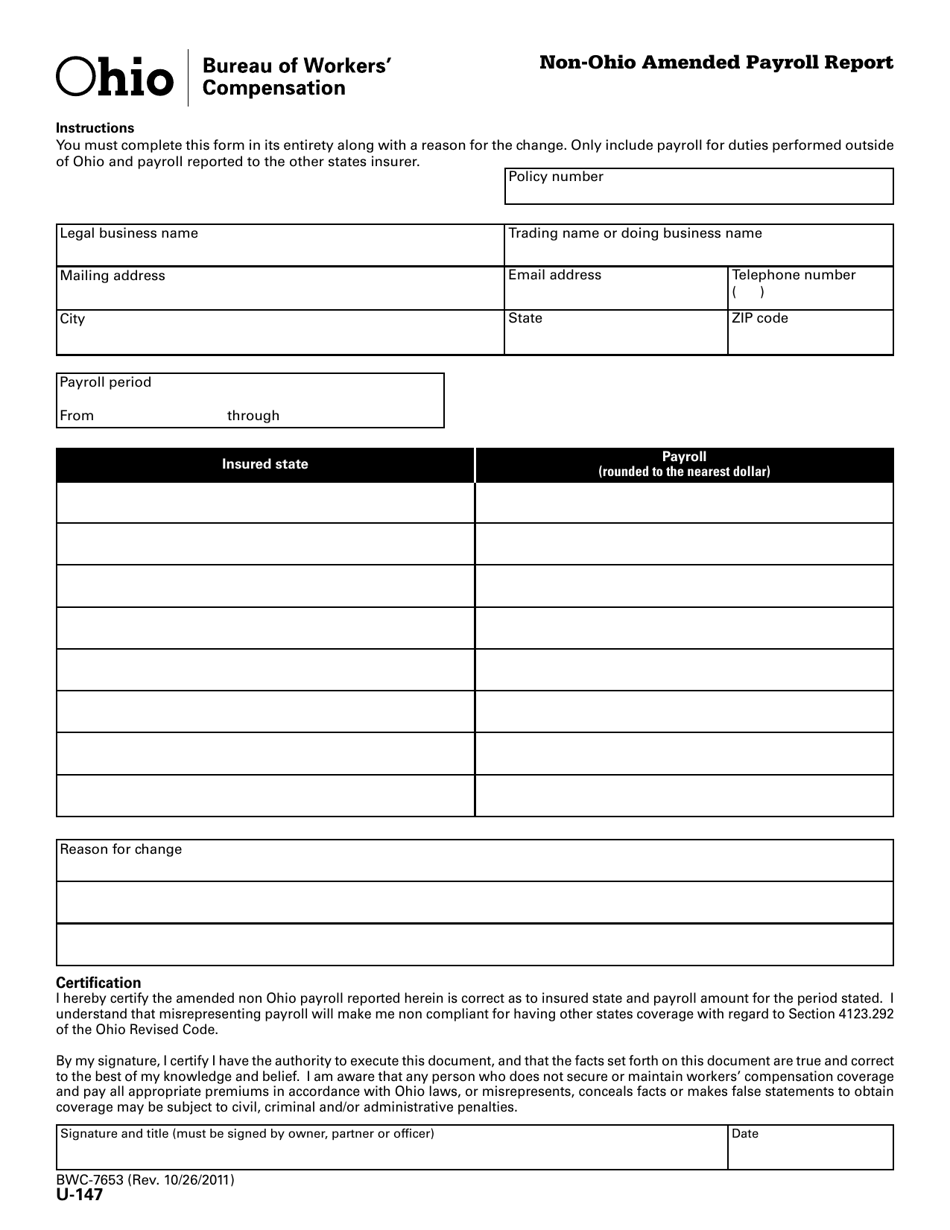

Form U-147 (BWC-7653)

for the current year.

Form U-147 (BWC-7653) Non-ohio Amended Payroll Report - Ohio

What Is Form U-147 (BWC-7653)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form U-147?

A: Form U-147 is a Non-Ohio Amended Payroll Report for the Bureau of Workers' Compensation (BWC) in Ohio.

Q: Who needs to file Form U-147?

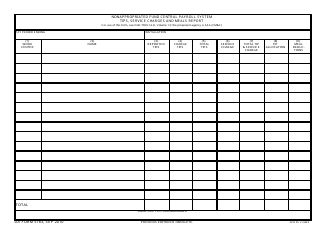

A: Non-Ohio employers who have employees working in Ohio and are required to report their payroll to the BWC need to file Form U-147.

Q: What is the purpose of Form U-147?

A: Form U-147 is used to report and amend payroll information for non-Ohio employers with employees working in Ohio for workers' compensation insurance purposes.

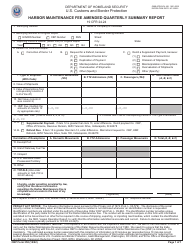

Q: What information is required on Form U-147?

A: Form U-147 requires information such as the employer's name, address, federal employer identification number (FEIN), and details about the employees and their payroll.

Q: When is Form U-147 due?

A: Form U-147 is due quarterly, following the end of each calendar quarter.

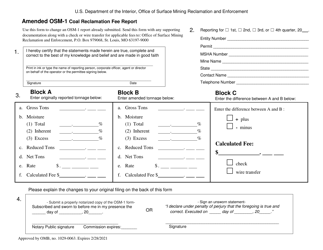

Q: What should I do if I need to amend a previously filed Form U-147?

A: If you need to amend a previously filed Form U-147, you should complete a new Form U-147 with the amended information and submit it to the Ohio BWC.

Q: Are there any penalties for not filing or filing late?

A: Yes, failure to file Form U-147 or filing late may result in penalties and interest being assessed by the Ohio BWC.

Form Details:

- Released on October 26, 2011;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form U-147 (BWC-7653) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.