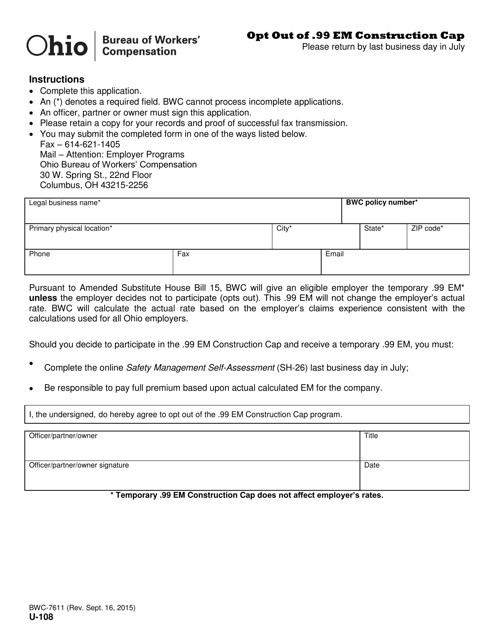

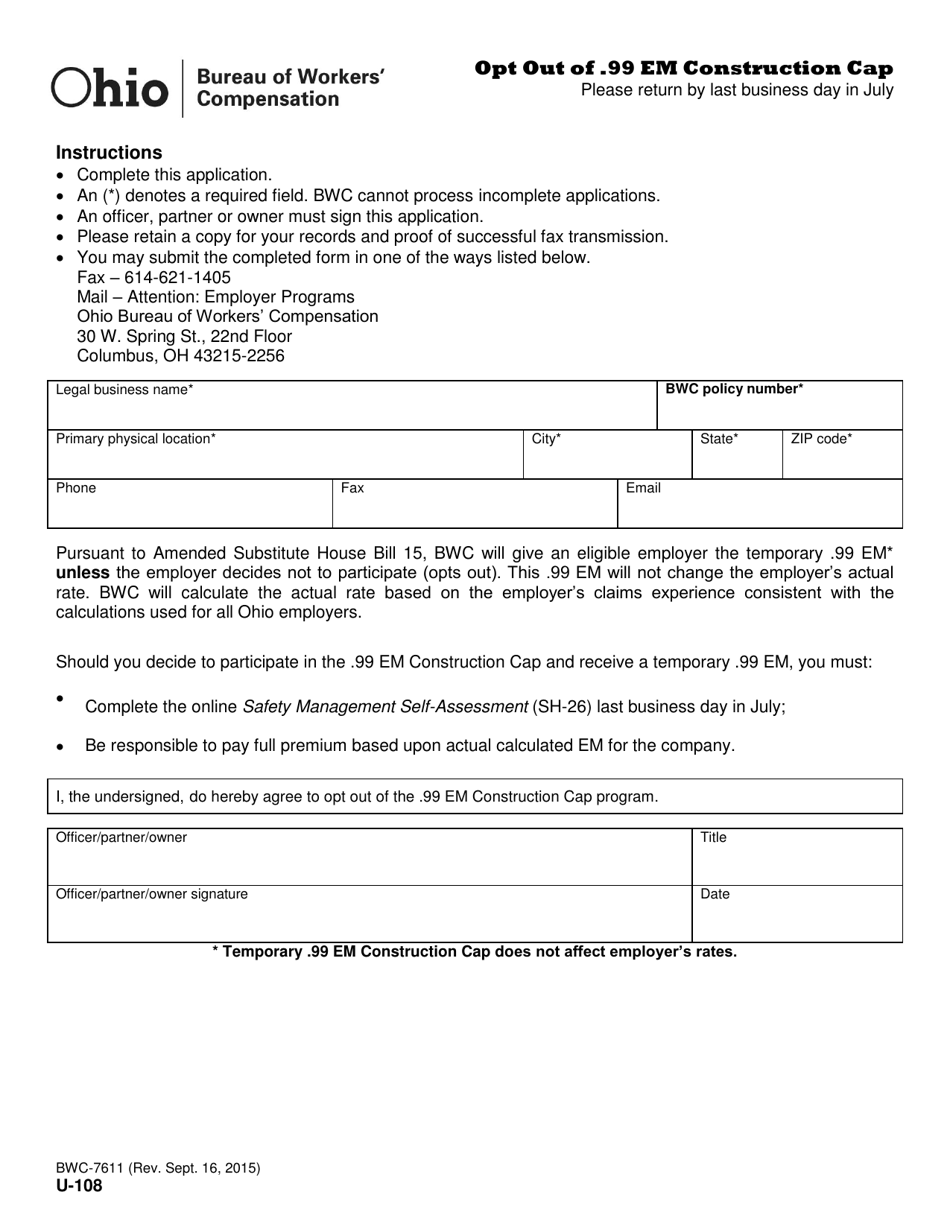

Form U-108 (BWC-7611) Opt out of .99 Em Construction Cap - Ohio

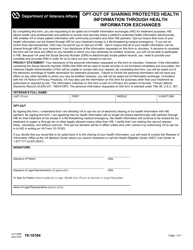

What Is Form U-108 (BWC-7611)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form U-108 (BWC-7611)?

A: Form U-108 (BWC-7611) is the form used to opt out of the .99 EM Construction Cap in Ohio.

Q: What does opting out of the .99 EM Construction Cap mean?

A: Opting out of the .99 EM Construction Cap means that you are choosing not to participate in the cap and will be subject to the standard construction employer market rates.

Q: Who needs to fill out Form U-108 (BWC-7611)?

A: Construction employers in Ohio who do not want to be subject to the .99 EM Construction Cap need to fill out Form U-108 (BWC-7611).

Q: Are there any requirements to meet when opting out of the .99 EM Construction Cap?

A: Yes, construction employers must meet certain requirements, such as providing proof of workers' compensation coverage and meeting specific payroll thresholds, to opt out of the .99 EM Construction Cap.

Q: What are the benefits of opting out of the .99 EM Construction Cap?

A: By opting out of the .99 EM Construction Cap, construction employers may be able to obtain more competitive workers' compensation rates based on their individual risk factors.

Q: Is there a deadline for submitting Form U-108 (BWC-7611)?

A: Yes, construction employers must submit Form U-108 (BWC-7611) to the Ohio Bureau of Workers' Compensation (BWC) by the specified deadline, which is usually in the early part of the calendar year.

Form Details:

- Released on September 16, 2015;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form U-108 (BWC-7611) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.