This version of the form is not currently in use and is provided for reference only. Download this version of

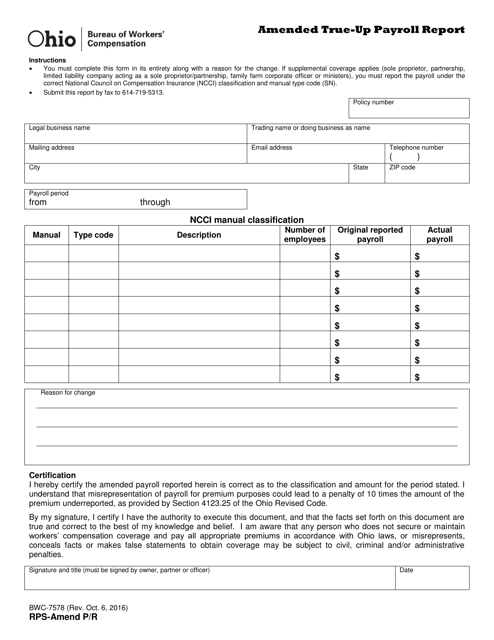

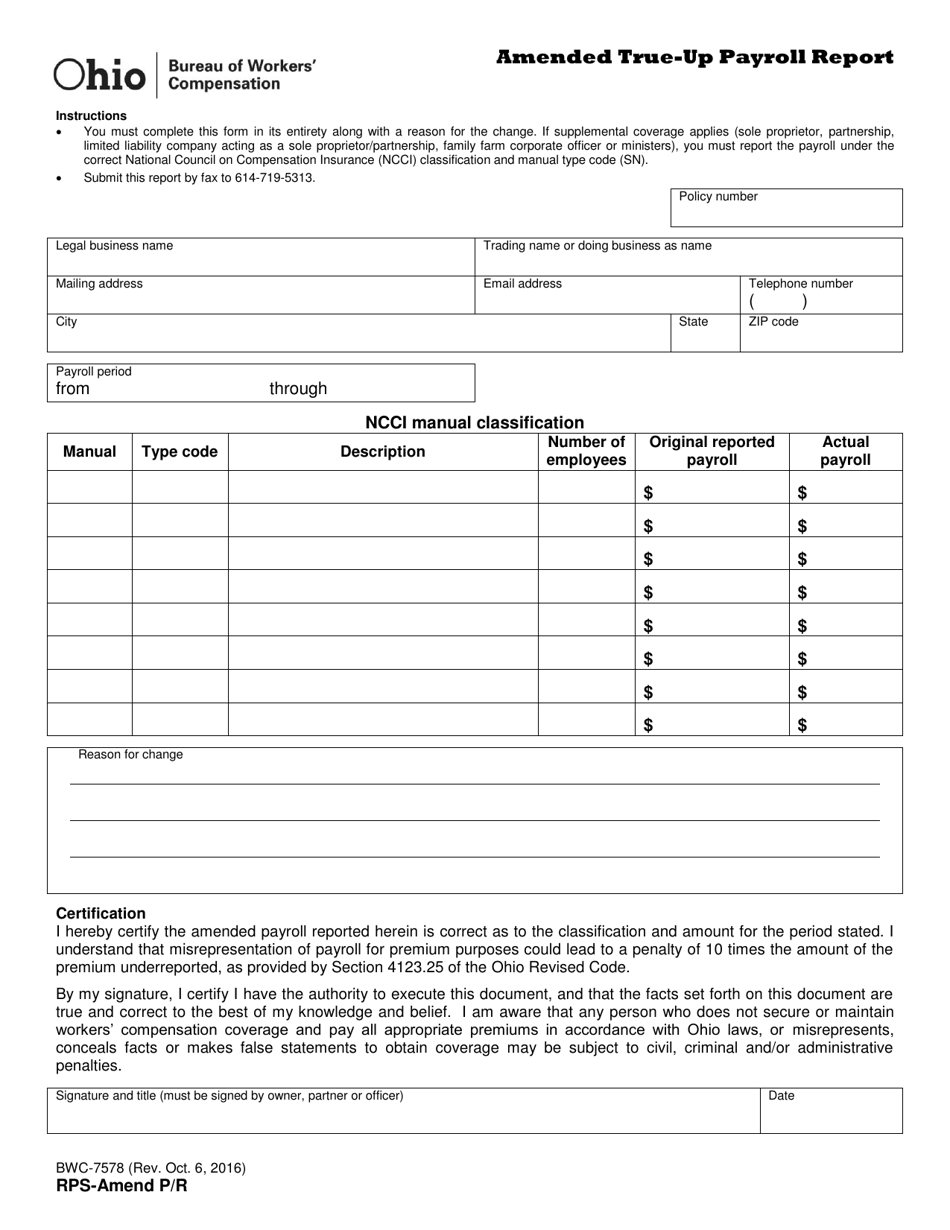

Form RPS-AMEND P/R (BWC-7578)

for the current year.

Form RPS-AMEND P / R (BWC-7578) Amended True-Up Payroll Report - Ohio

What Is Form RPS-AMEND P/R (BWC-7578)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RPS-AMEND P/R (BWC-7578)?

A: Form RPS-AMEND P/R (BWC-7578) is the Amended True-Up Payroll Report for Ohio.

Q: What is the purpose of the Amended True-Up Payroll Report?

A: The purpose of the Amended True-Up Payroll Report is to correct any errors or omissions in the original True-Up Payroll Report.

Q: Who needs to file the Amended True-Up Payroll Report?

A: Employers in Ohio who need to correct their original True-Up Payroll Report must file the Amended True-Up Payroll Report.

Q: When is the deadline to submit the Amended True-Up Payroll Report?

A: The deadline to submit the Amended True-Up Payroll Report is typically within 45 days of discovering the error or omission in the original True-Up Payroll Report.

Q: Are there any penalties for not filing the Amended True-Up Payroll Report?

A: Failure to file the Amended True-Up Payroll Report or filing it late may result in penalties or additional fees imposed by the Ohio Bureau of Workers' Compensation.

Form Details:

- Released on October 6, 2016;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPS-AMEND P/R (BWC-7578) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.