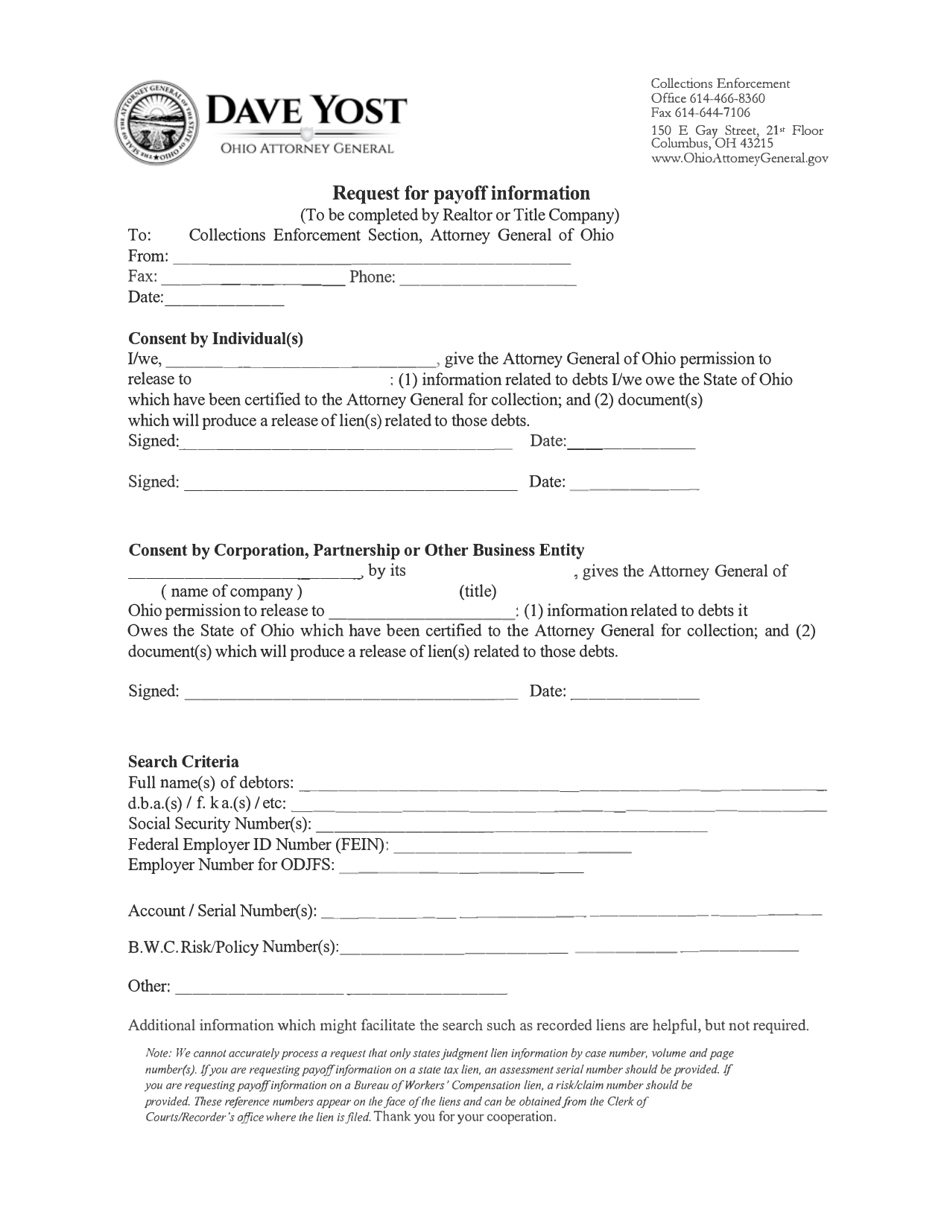

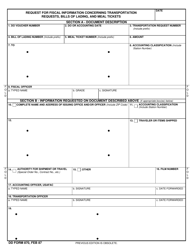

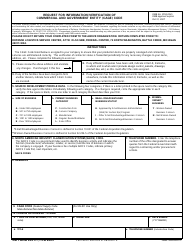

Request for Payoff Information - Ohio

Request for Payoff Information is a legal document that was released by the Ohio Attorney General - a government authority operating within Ohio.

FAQ

Q: What is a payoff information?

A: Payoff information is the amount of money that is required to fully satisfy and close an existing loan or debt.

Q: Why would I need a payoff information?

A: You may need payoff information when you want to pay off a loan or debt in full, including any outstanding interest or fees.

Q: How can I obtain payoff information in Ohio?

A: To obtain payoff information in Ohio, you can contact your lender or the financial institution that holds your loan or debt. They will provide you with the necessary information on how to pay off your loan or debt in full.

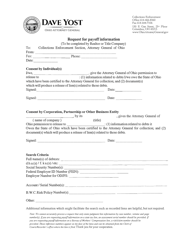

Q: What details should I provide to obtain payoff information?

A: You will typically need to provide your loan or account number, your personal information, and possibly other identification or verification details to obtain payoff information.

Q: Can I negotiate the payoff amount?

A: In some cases, you may be able to negotiate the payoff amount with your lender or financial institution. It's worth discussing your options with them to see if any negotiation is possible.

Q: Are there any fees associated with obtaining payoff information?

A: There may be fees associated with obtaining payoff information, such as administrative fees or fees for requesting additional documentation. You should inquire about any potential fees when contacting your lender or financial institution.

Form Details:

- The latest edition currently provided by the Ohio Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Attorney General.