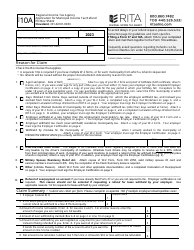

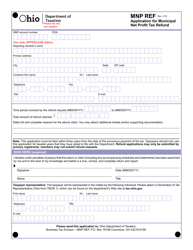

Application for Administrative Review of Income Tax Refund Offset - Ohio

Application for Administrative Review of Income Tax Refund Offset is a legal document that was released by the Ohio Attorney General - a government authority operating within Ohio.

FAQ

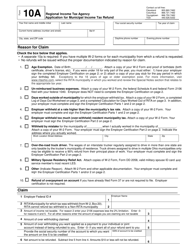

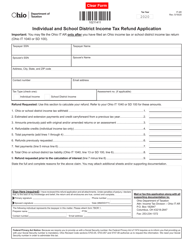

Q: What is an Administrative Review of Income Tax Refund Offset?

A: An Administrative Review of Income Tax Refund Offset is a process to dispute the offset of your income tax refund.

Q: Who can apply for an Administrative Review of Income Tax Refund Offset in Ohio?

A: Any taxpayer whose income tax refund has been offset can apply for an Administrative Review.

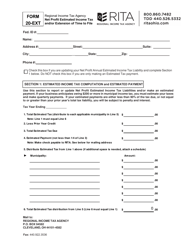

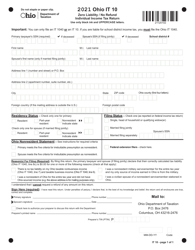

Q: How can I apply for an Administrative Review of Income Tax Refund Offset in Ohio?

A: You can apply by completing and submitting the Application for Administrative Review of Income Tax Refund Offset form to the Ohio Department of Taxation.

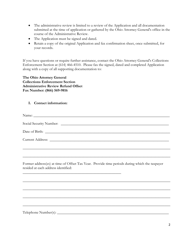

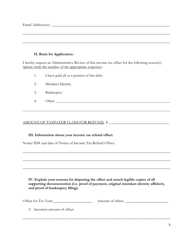

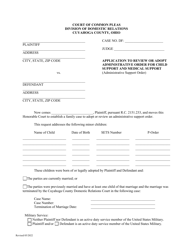

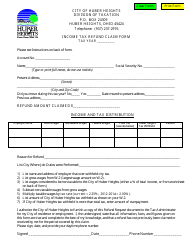

Q: What information do I need to provide in the application form?

A: You need to provide your personal information, details about the tax refund offset, and reasons for disputing the offset.

Q: Is there a deadline for applying for an Administrative Review of Income Tax Refund Offset in Ohio?

A: Yes, you must apply within 60 days from the date of the offset notification.

Form Details:

- The latest edition currently provided by the Ohio Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Attorney General.