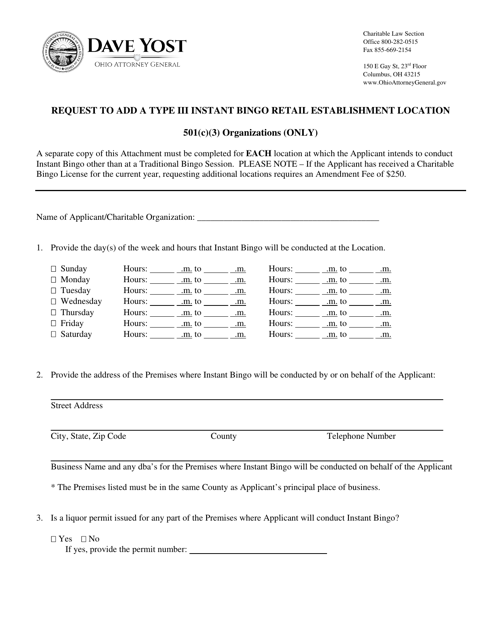

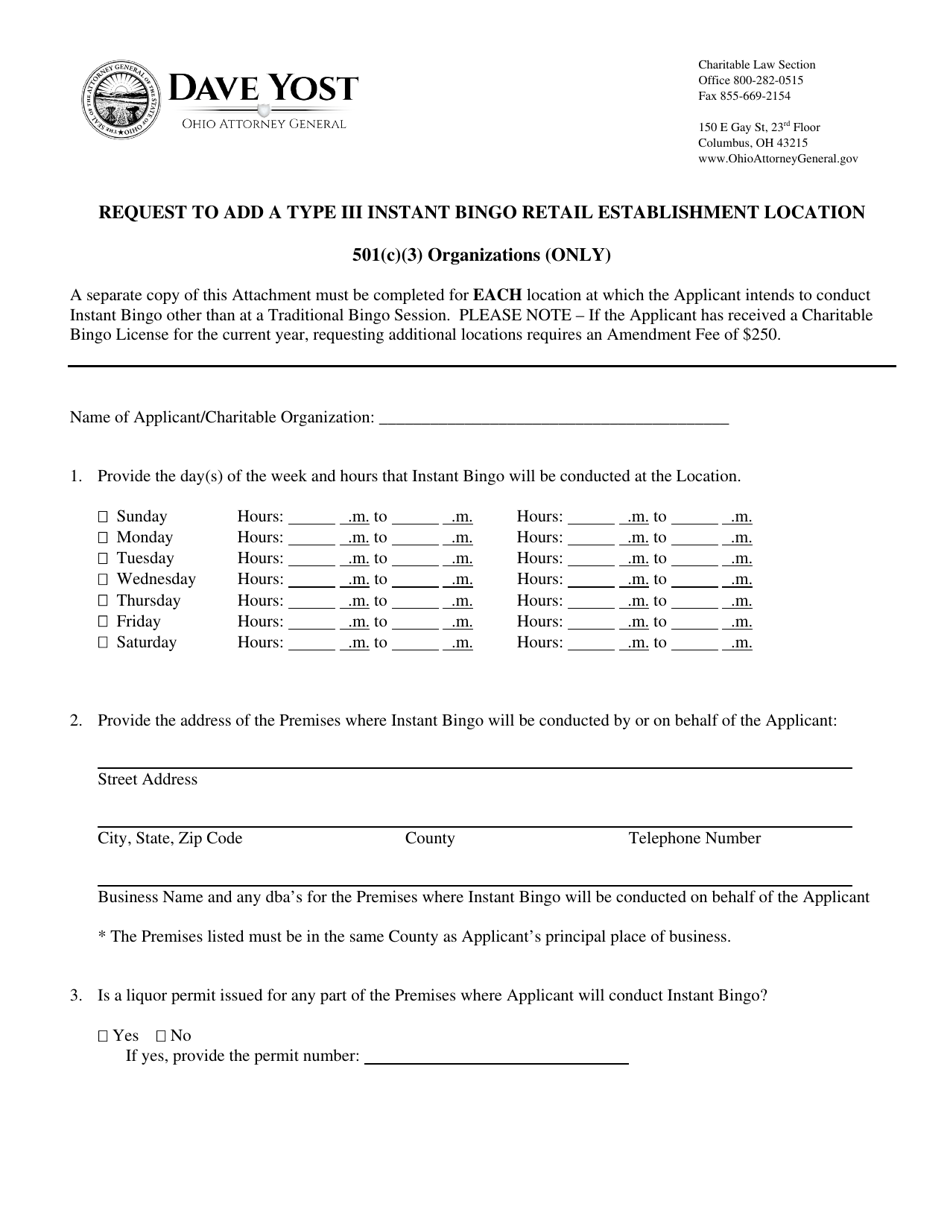

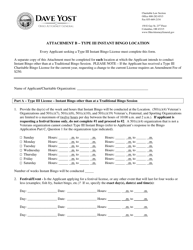

Request to Add a Type Iii Instant Bingo Retail Establishment Location - 501(C)(3) Organizations - Ohio

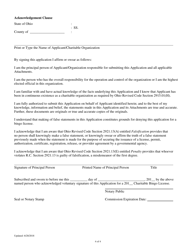

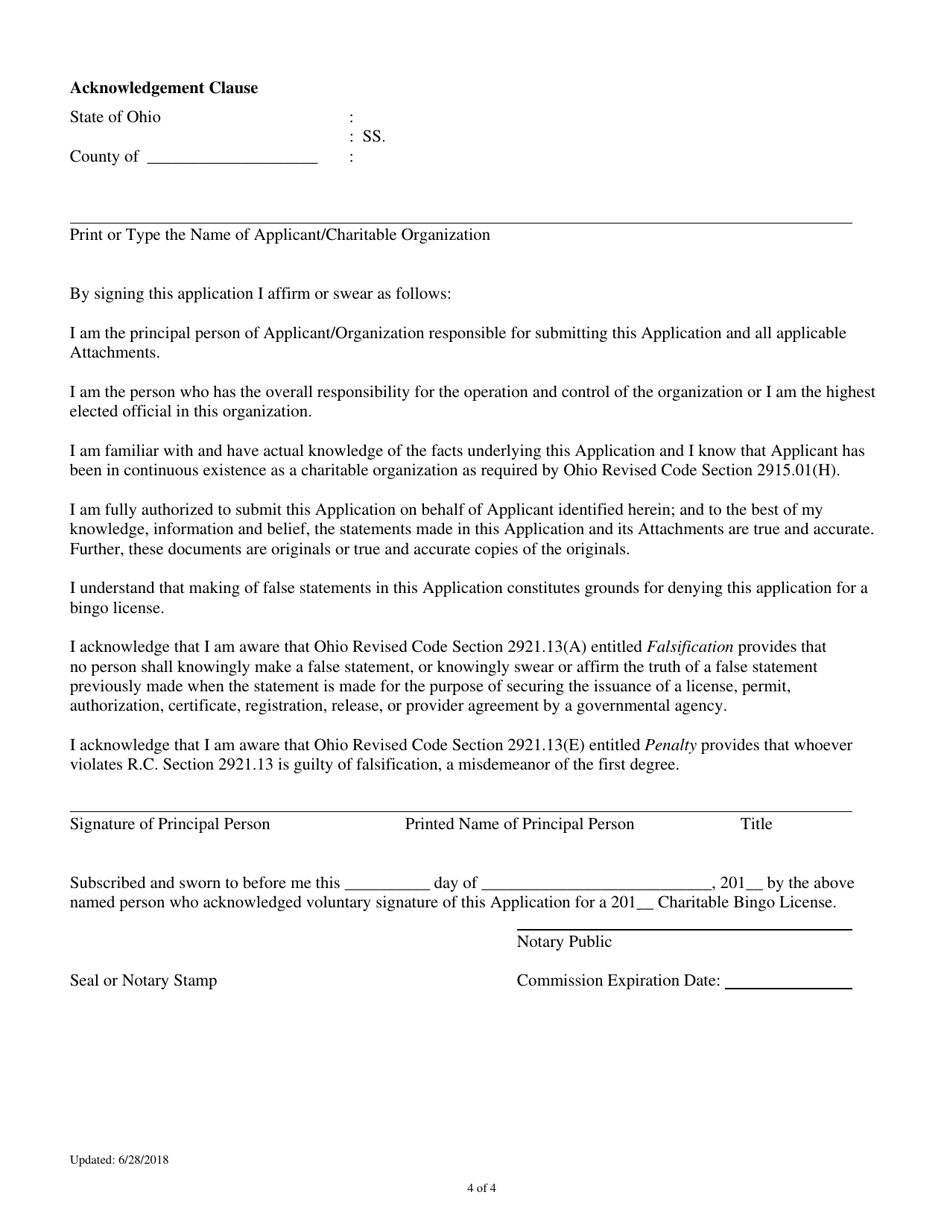

Request to Add a Retail Establishment Location - 501(C)(3) Organizations is a legal document that was released by the Ohio Attorney General - a government authority operating within Ohio.

FAQ

Q: What is a Type III instant bingo retail establishment?

A: A Type III instant bingo retail establishment is a location where instant bingo tickets can be sold.

Q: What are 501(c)(3) organizations?

A: 501(c)(3) organizations are non-profit organizations that are exempt from federal income tax.

Q: Can 501(c)(3) organizations operate instant bingo retail establishments in Ohio?

A: Yes, 501(c)(3) organizations can operate Type III instant bingo retail establishments in Ohio.

Q: How can a 501(c)(3) organization apply to operate a Type III instant bingo retail establishment in Ohio?

A: 501(c)(3) organizations can apply for a license from the Ohio Attorney General's Charitable Law Section to operate a Type III instant bingo retail establishment.

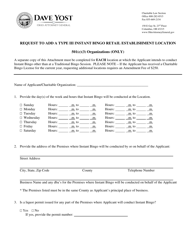

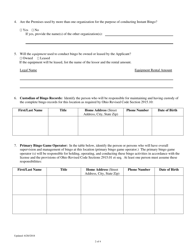

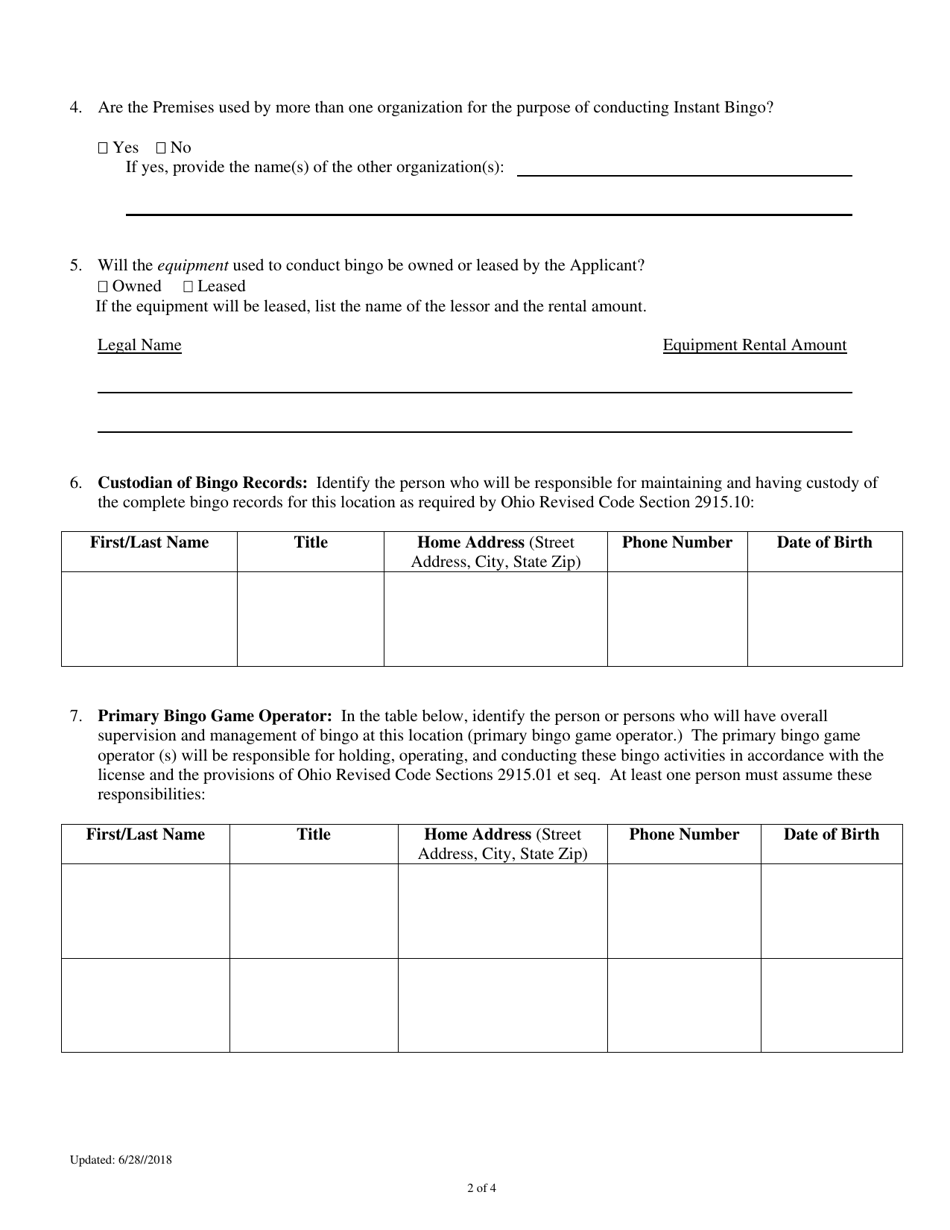

Q: What are the requirements for a Type III instant bingo retail establishment operated by a 501(c)(3) organization in Ohio?

A: The organization must be qualified under Section 501(c)(3) of the Internal Revenue Code, and the premises must be used primarily for the purposes of the organization.

Q: Is there a fee for the license to operate a Type III instant bingo retail establishment?

A: Yes, there is a fee associated with the license application. The fee amount may vary.

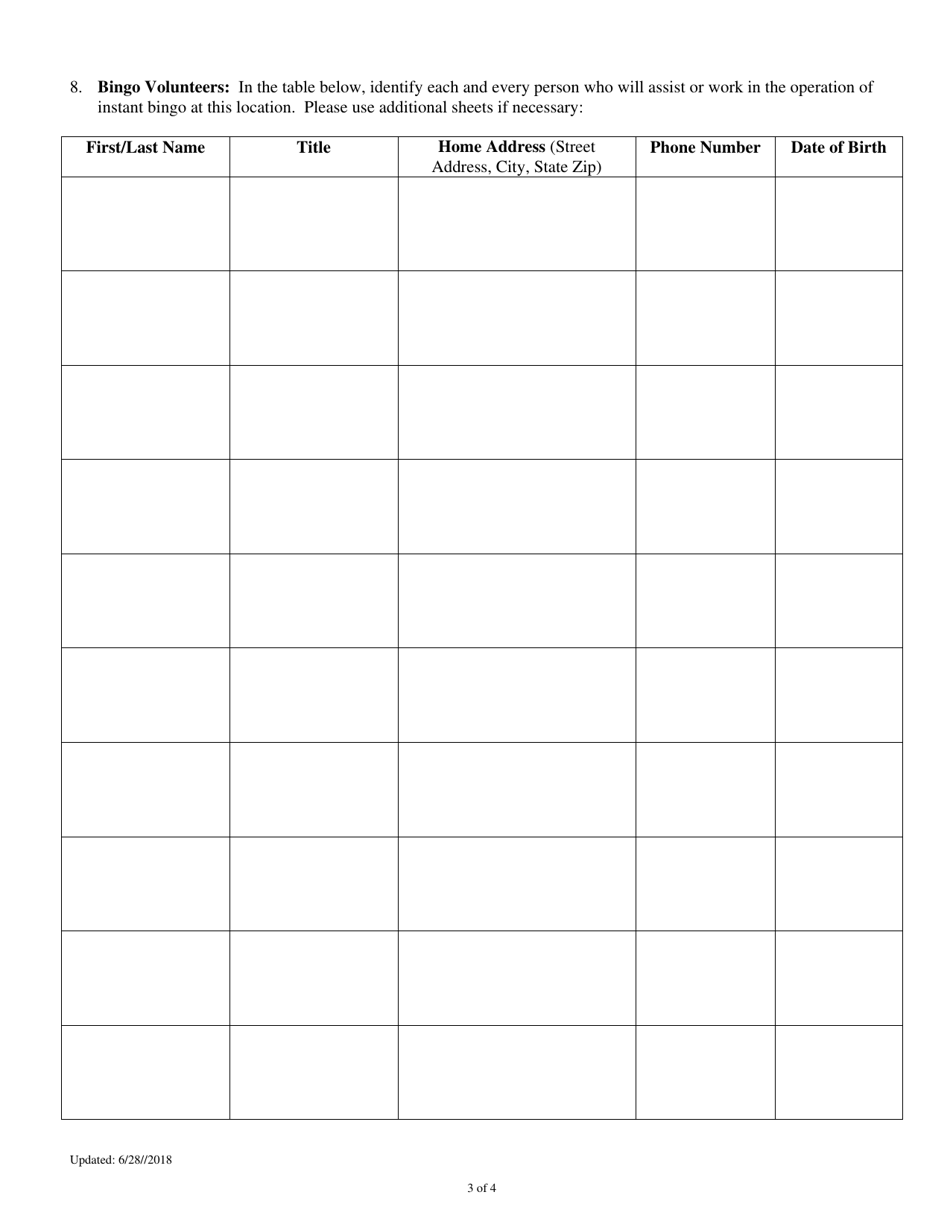

Q: Are there any restrictions on the operation of a Type III instant bingo retail establishment by a 501(c)(3) organization in Ohio?

A: Yes, there are certain restrictions on the operation, such as selling instant bingo tickets only during specified hours and complying with Ohio's gambling laws.

Form Details:

- Released on June 28, 2018;

- The latest edition currently provided by the Ohio Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Attorney General.