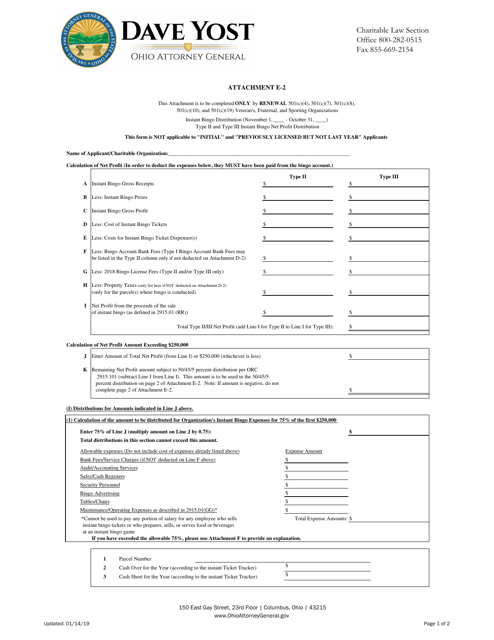

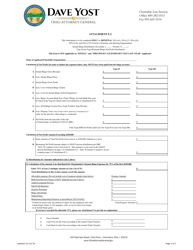

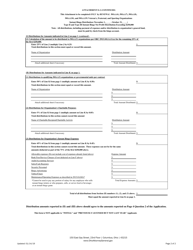

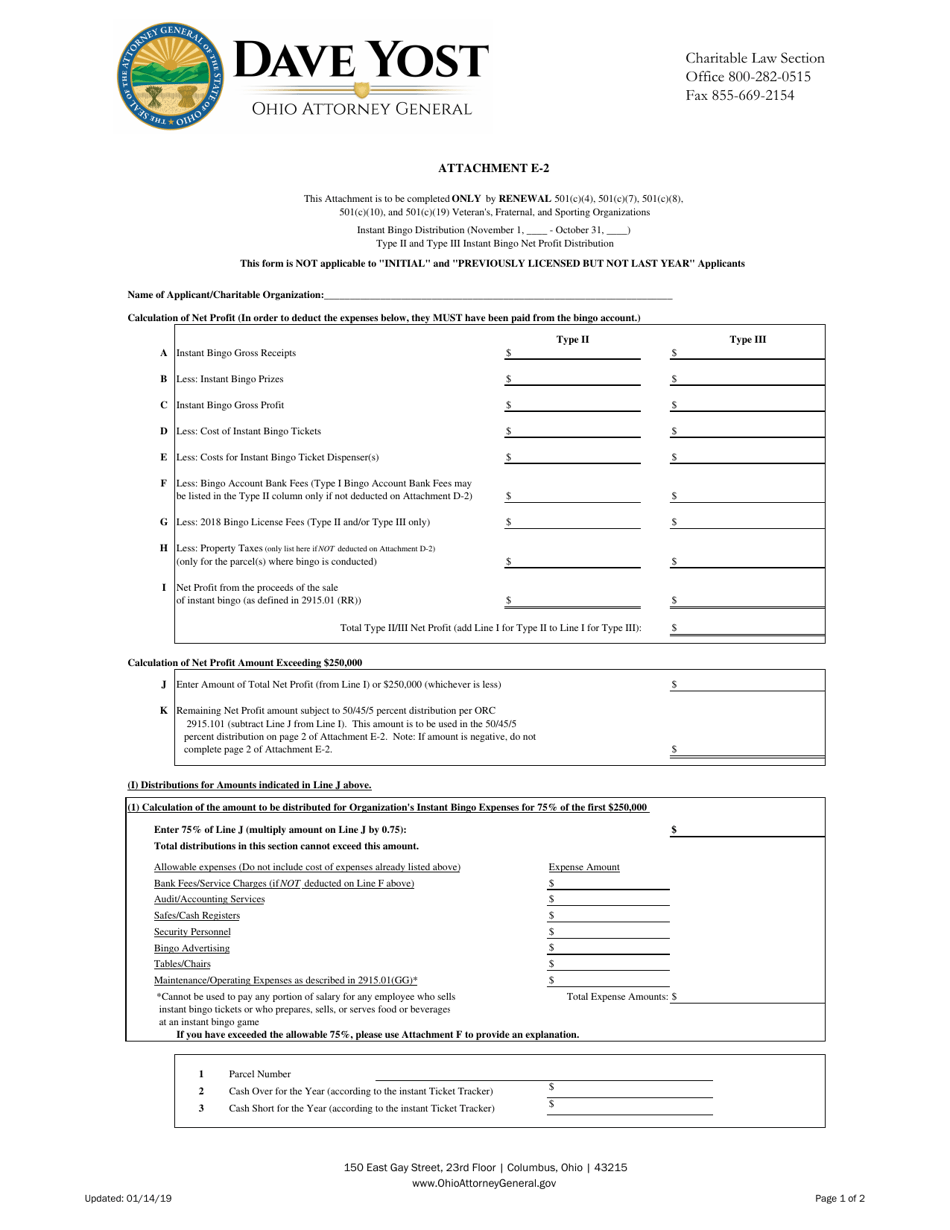

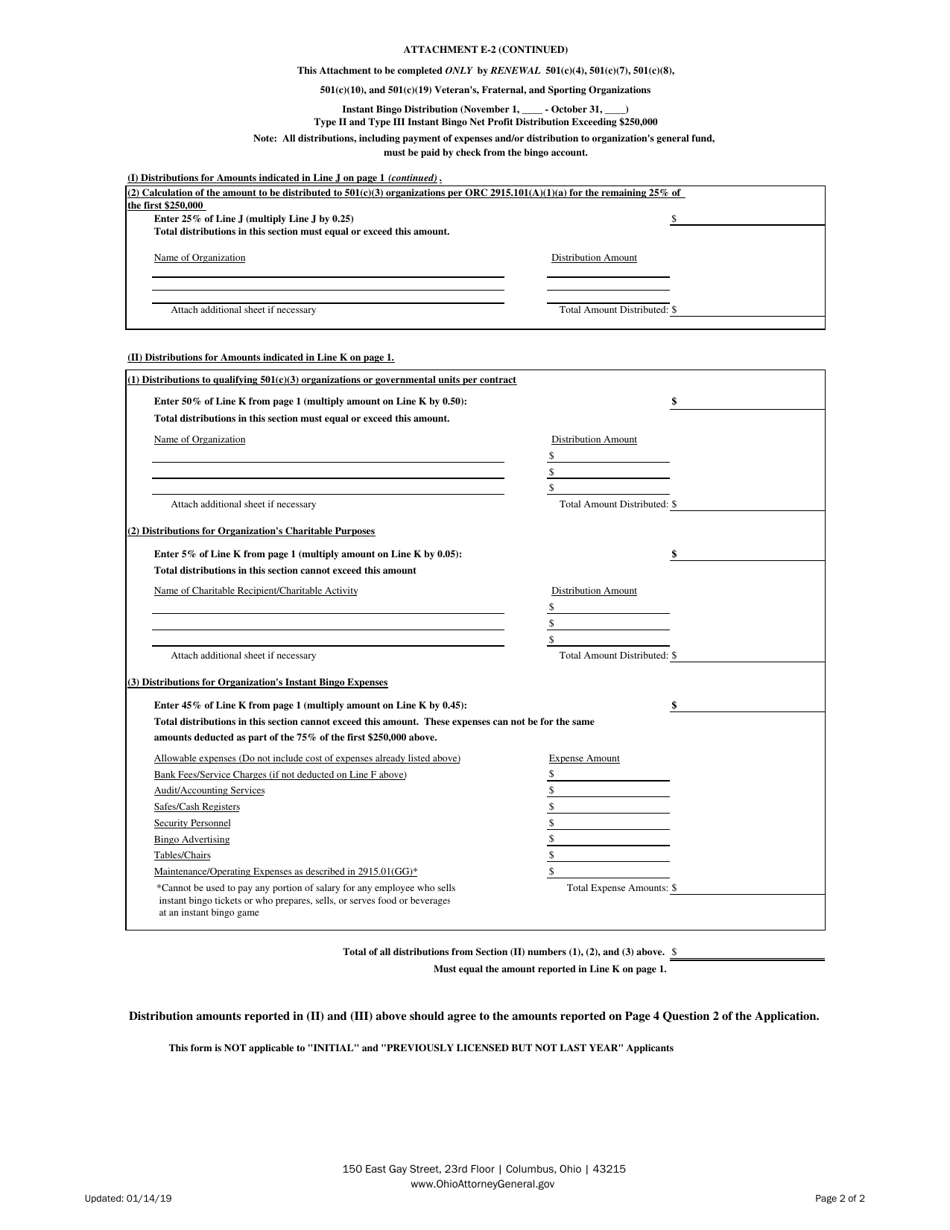

Attachment E-2 Type II and Type Iii Net Profit Distribution - Veteran, Fraternal, and Sporting - Ohio

What Is Attachment E-2?

This is a legal form that was released by the Ohio Attorney General - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Attachment E-2?

A: Attachment E-2 is a document that pertains to the net profit distribution for veteran, fraternal, and sporting organizations in Ohio.

Q: What does Type II and Type III refer to in the document?

A: Type II and Type III refer to different categories of organizations that are eligible for net profit distribution.

Q: What organizations are included in Type II?

A: Type II organizations include veteran organizations.

Q: What organizations are included in Type III?

A: Type III organizations include fraternal and sporting organizations.

Q: What does the net profit distribution entail?

A: The net profit distribution refers to the allocation of profits to eligible organizations based on certain criteria.

Q: Is the net profit distribution specific to Ohio?

A: Yes, the net profit distribution mentioned in Attachment E-2 is specific to Ohio.

Form Details:

- Released on January 14, 2019;

- The latest edition provided by the Ohio Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Attachment E-2 by clicking the link below or browse more documents and templates provided by the Ohio Attorney General.