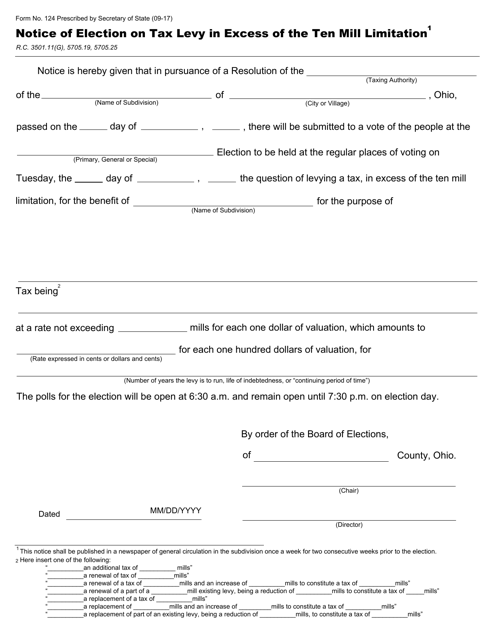

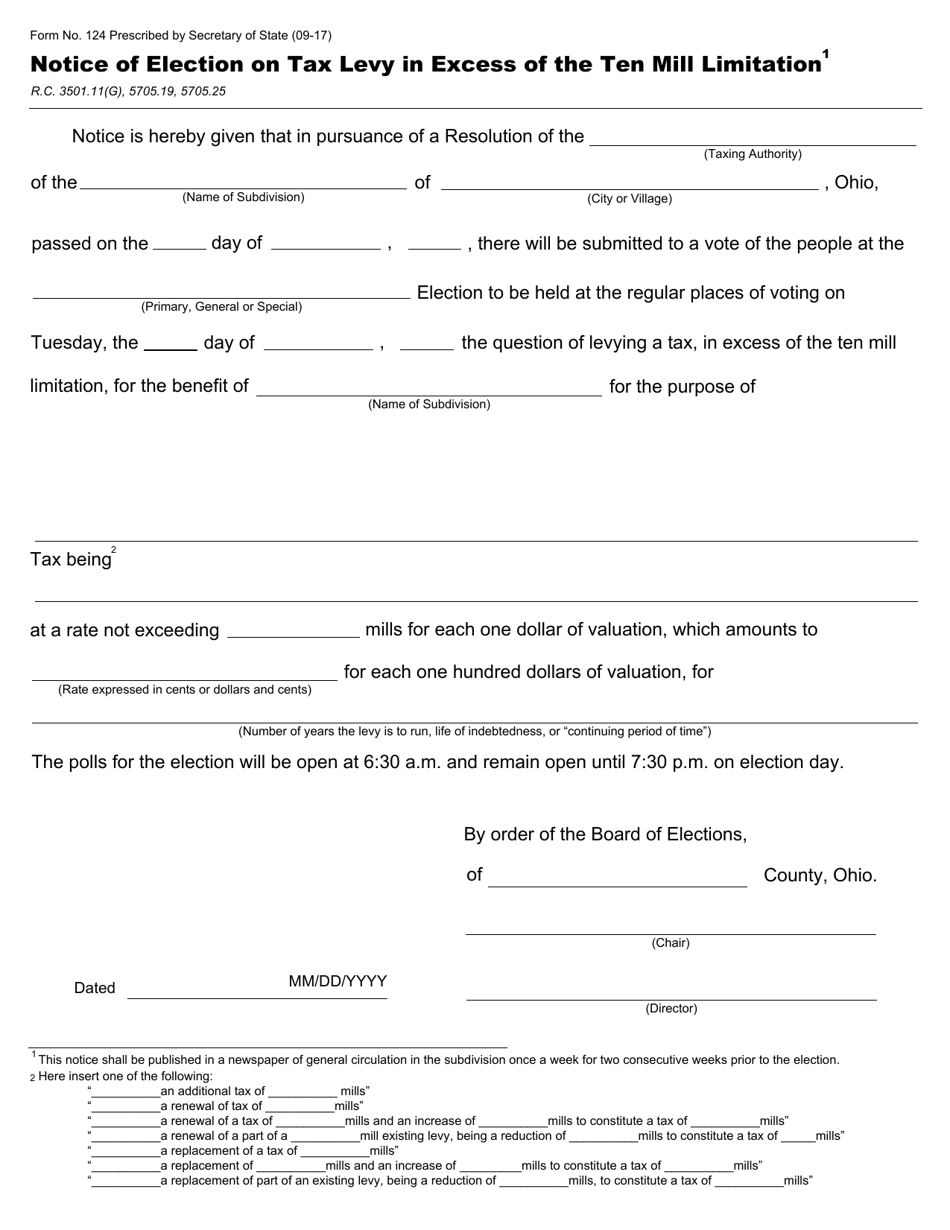

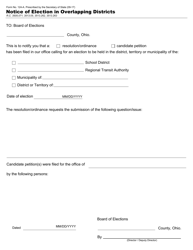

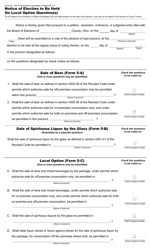

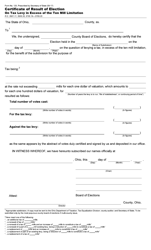

Form 124 Notice of Election on Tax Levy in Excess of the Ten Mill Limitation - Ohio

What Is Form 124?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 124?

A: Form 124 is a Notice of Election on Tax Levy in Excess of the Ten Mill Limitation in Ohio.

Q: What is the purpose of Form 124?

A: The purpose of Form 124 is to provide notice of an election to levy taxes in excess of the ten mill limitation in Ohio.

Q: Who is required to use Form 124?

A: Any entity or political subdivision in Ohio that wishes to levy taxes in excess of the ten mill limitation is required to use Form 124.

Q: What does the ten mill limitation mean?

A: The ten mill limitation refers to the maximum rate at which a political subdivision in Ohio can levy property taxes.

Q: When should Form 124 be filed?

A: Form 124 should be filed at least 90 days prior to the election in which the tax levy will be voted on.

Q: Are there any fees associated with filing Form 124?

A: There are no fees associated with filing Form 124.

Q: What happens after Form 124 is filed?

A: After Form 124 is filed, the fiscal officer will forward a copy to the county auditor and board of elections for review and inclusion on the ballot.

Q: Can Form 124 be filed electronically?

A: Yes, Form 124 can be filed electronically through the Ohio Secretary of State's office.

Q: Is Form 124 specific to Ohio?

A: Yes, Form 124 is specific to Ohio and is used for tax levies in excess of the ten mill limitation in the state.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 124 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.