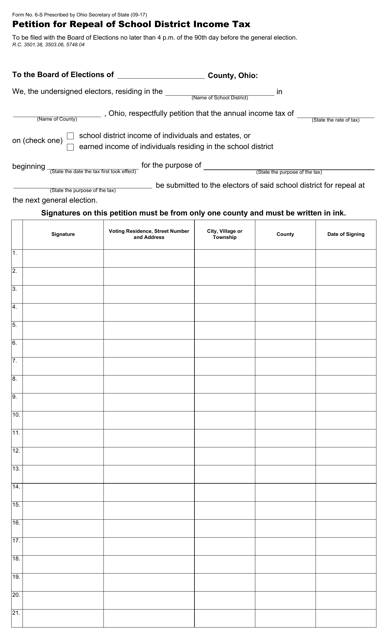

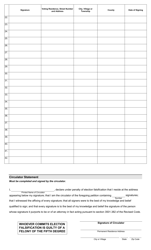

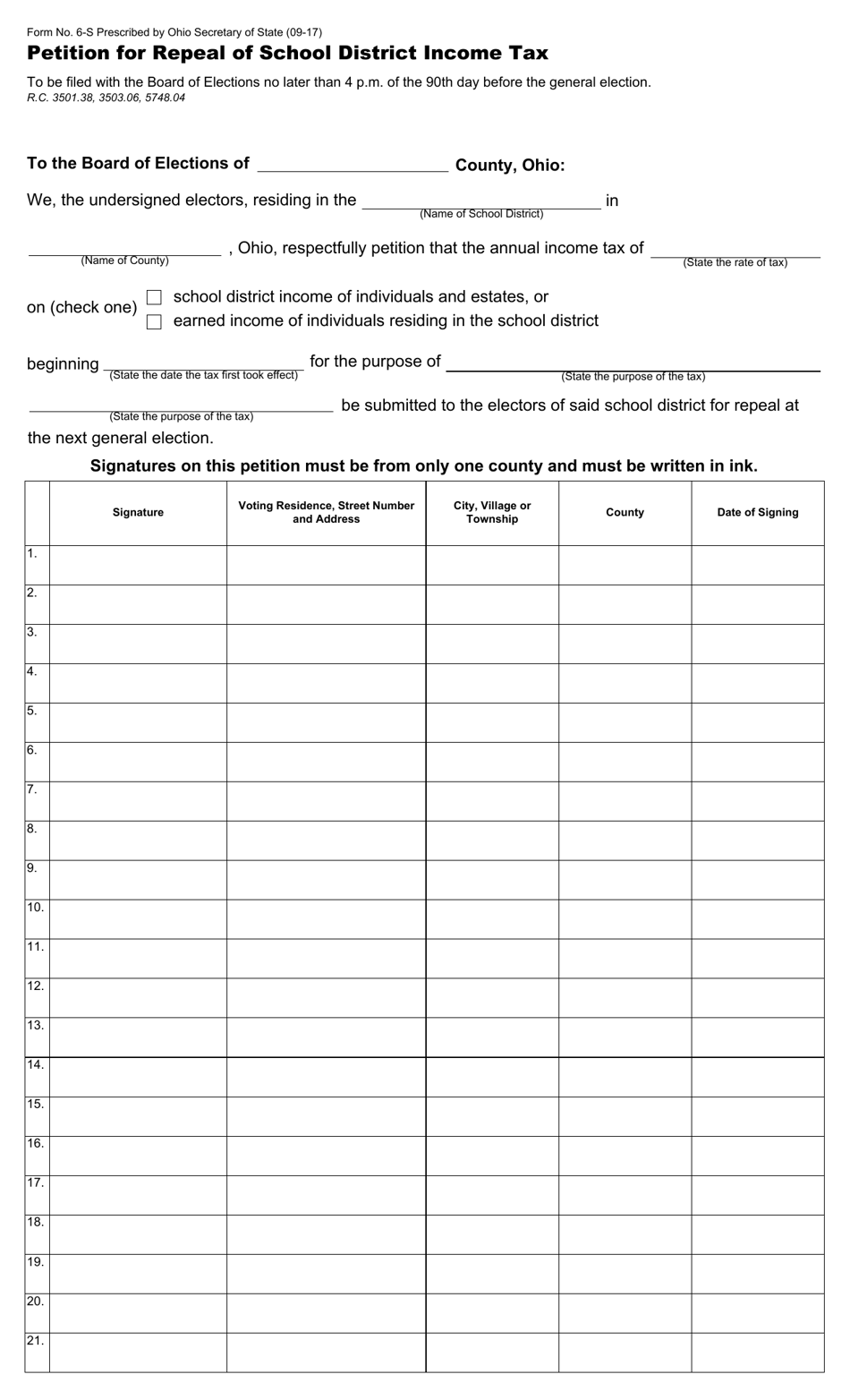

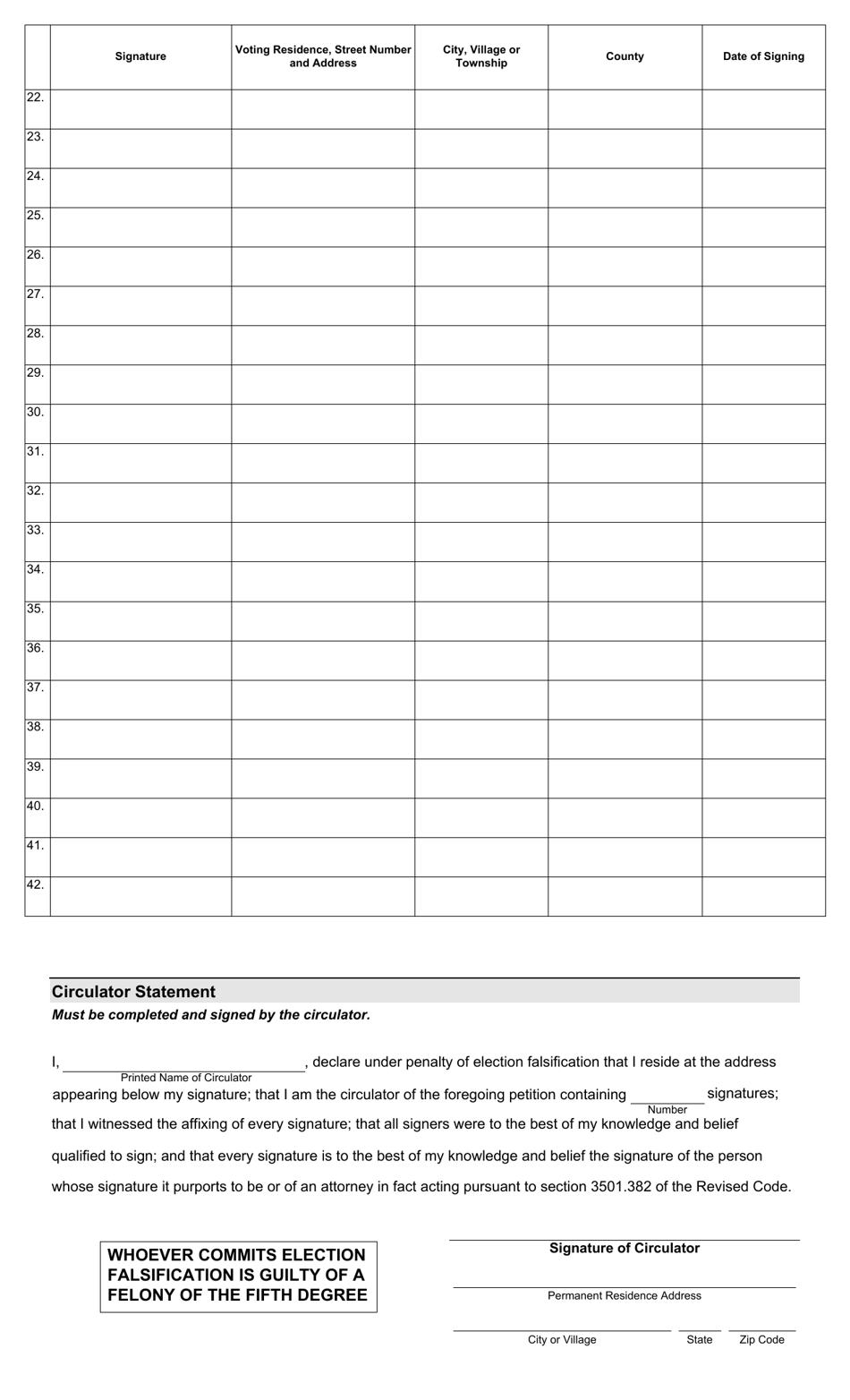

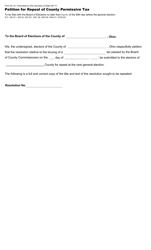

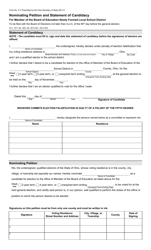

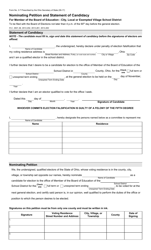

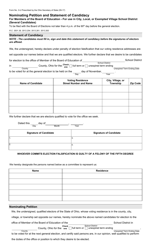

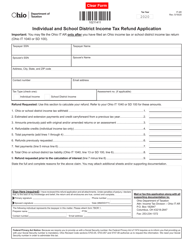

Form 6-S Petition for Repeal of School District Income Tax - Ohio

What Is Form 6-S?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

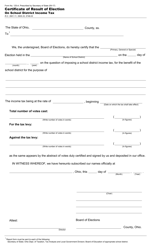

Q: What is Form 6-S?

A: Form 6-S is a petition for the repeal of school district income tax in Ohio.

Q: Who can use Form 6-S?

A: Any individual or group of individuals who want to repeal the school district income tax in Ohio can use Form 6-S.

Q: What is the purpose of Form 6-S?

A: The purpose of Form 6-S is to gather signatures to support the repeal of school district income tax in Ohio.

Q: How should Form 6-S be filled out?

A: Form 6-S should be filled out with the required information, including the names and addresses of the petitioners.

Q: What should be done with the completed Form 6-S?

A: The completed Form 6-S should be submitted to the Ohio Department of Taxation.

Q: Is there a deadline for submitting Form 6-S?

A: Yes, Form 6-S must be submitted within 90 days of the effective date of the school district income tax ordinance.

Q: Can Form 6-S be submitted electronically?

A: No, Form 6-S must be submitted in hard copy format.

Q: What happens after Form 6-S is submitted?

A: Once Form 6-S is submitted, the Ohio Department of Taxation will review the petition and determine its validity.

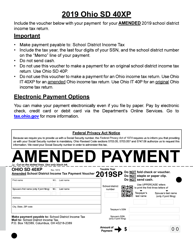

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6-S by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.