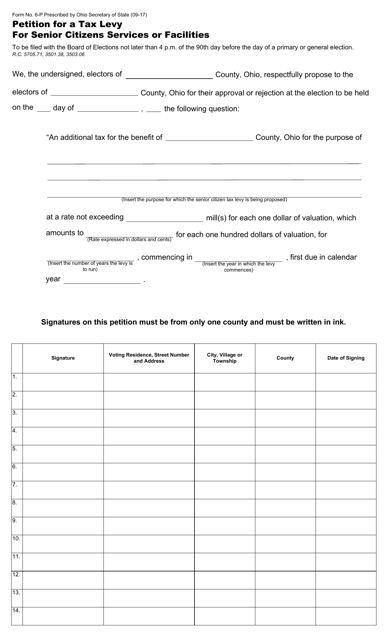

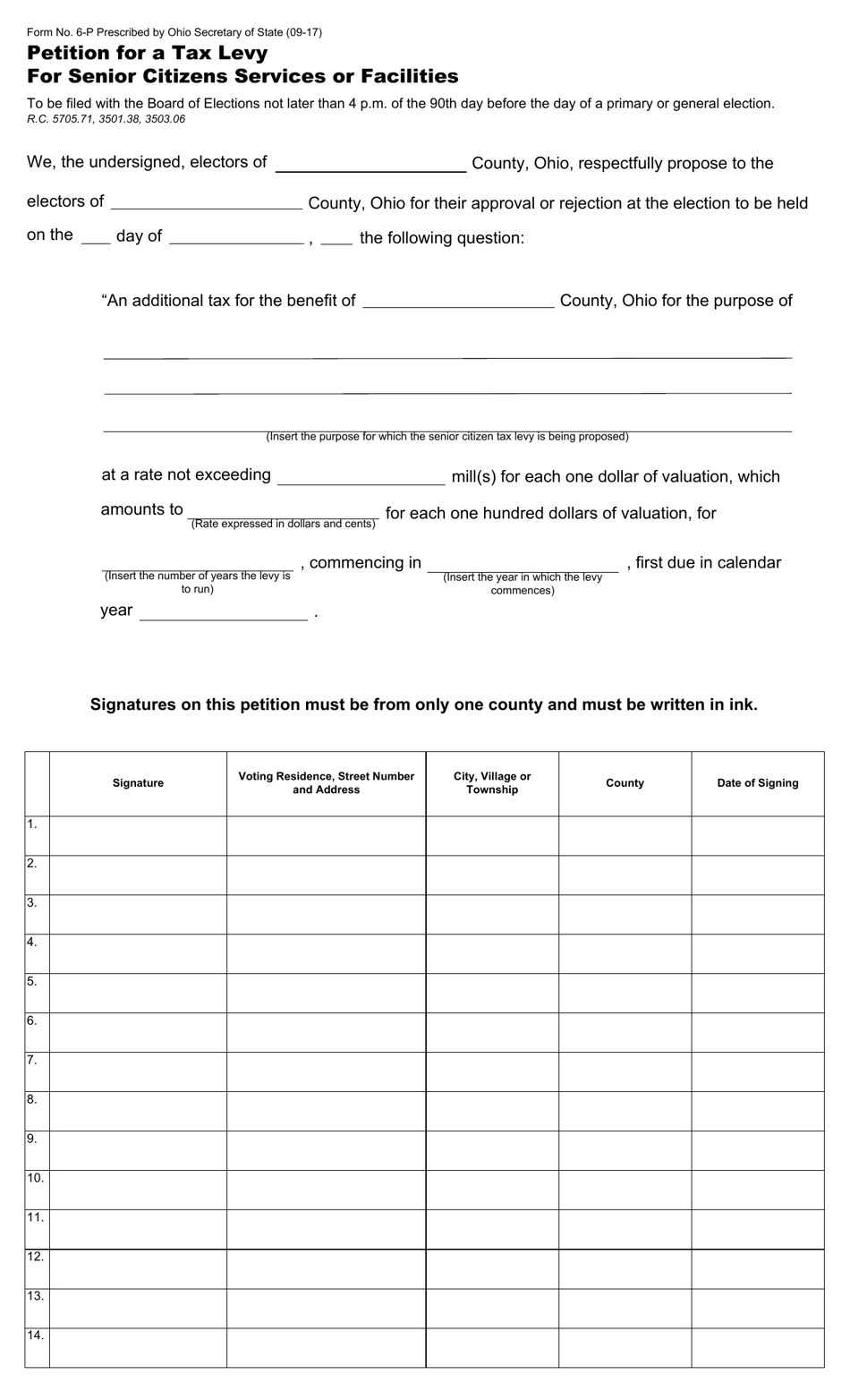

Form 6-P Petition for a Tax Levy for Senior Citizens Services or Facilities - Ohio

What Is Form 6-P?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6-P?

A: Form 6-P is a petition for a tax levy for senior citizens services or facilities in Ohio.

Q: What is the purpose of Form 6-P?

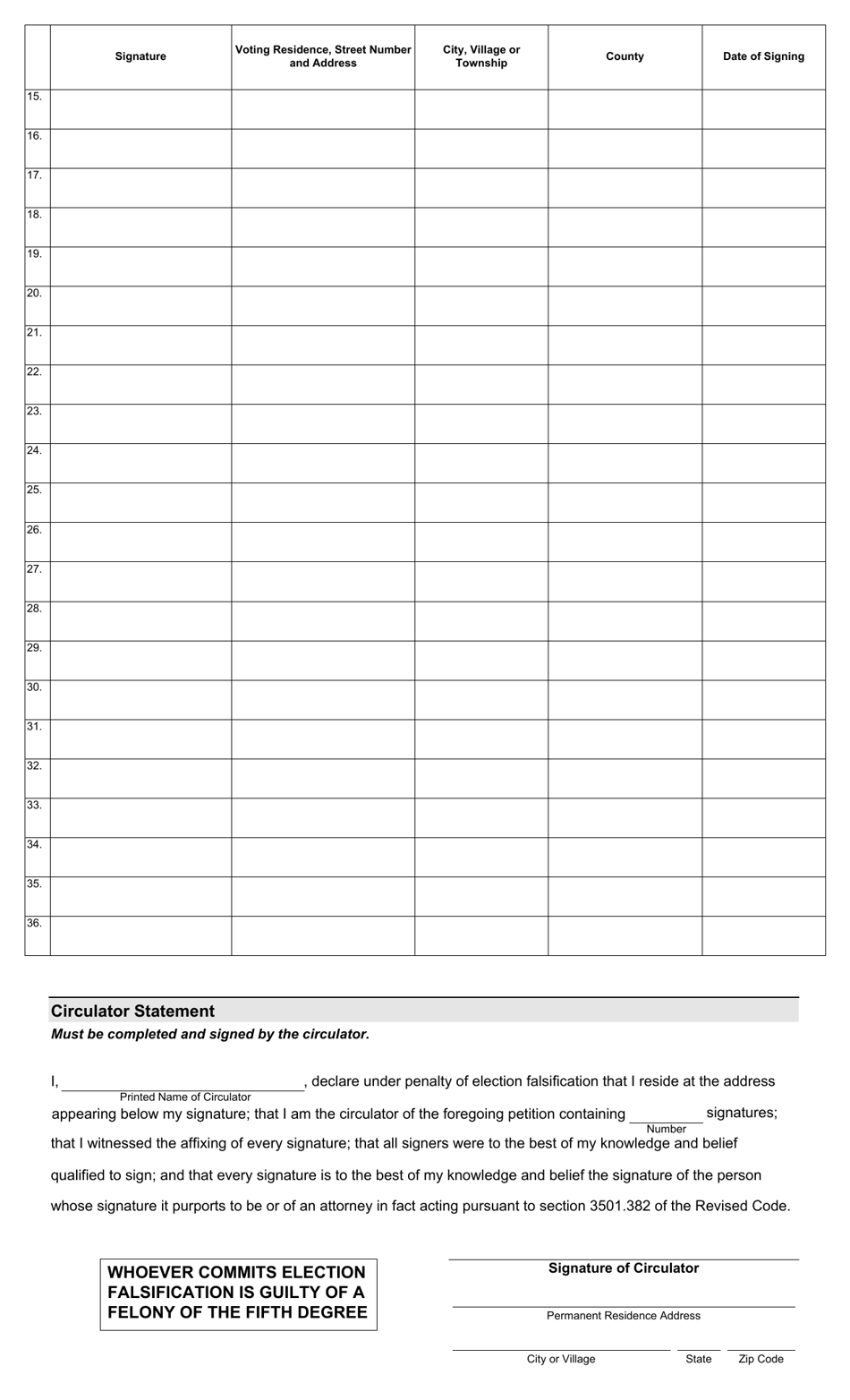

A: The purpose of Form 6-P is to gather signatures from Ohio residents in support of a tax levy to fund senior citizens services or facilities.

Q: Who can use Form 6-P?

A: Any Ohio resident who supports the funding for senior citizens services or facilities can use Form 6-P to collect signatures.

Q: How do I fill out Form 6-P?

A: Form 6-P requires information such as the petitioner's name, address, and contact information. It also requires the number of signatures collected in support of the tax levy.

Q: What happens after I submit Form 6-P?

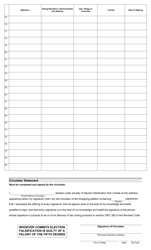

A: After submitting Form 6-P, the collected signatures will be verified and reviewed by the appropriate authorities. If the required number of signatures is met, the tax levy may be approved.

Q: Are there any fees associated with Form 6-P?

A: There are no fees associated with Form 6-P. However, there may be costs involved in collecting the signatures.

Q: Can I submit multiple copies of Form 6-P?

A: Yes, you can submit multiple copies of Form 6-P if you have collected additional signatures after the initial submission.

Q: Is there a deadline for submitting Form 6-P?

A: The deadline for submitting Form 6-P varies and is set by the specific local government authority. It is important to check the deadline for your jurisdiction.

Q: Can I withdraw my support for the tax levy after submitting Form 6-P?

A: Once you have submitted Form 6-P, you cannot withdraw your support for the tax levy. It is important to carefully consider your decision before submitting the form.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6-P by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.