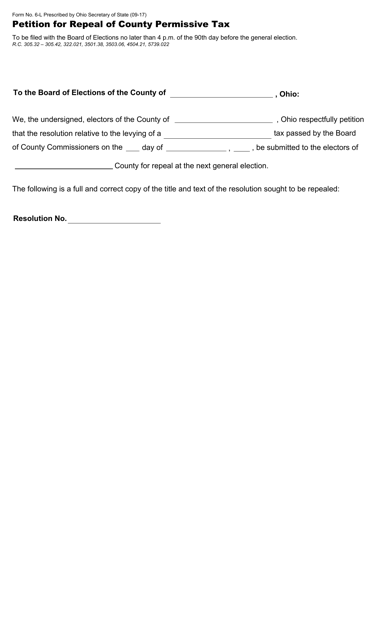

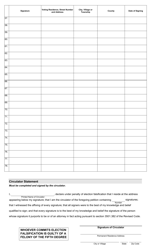

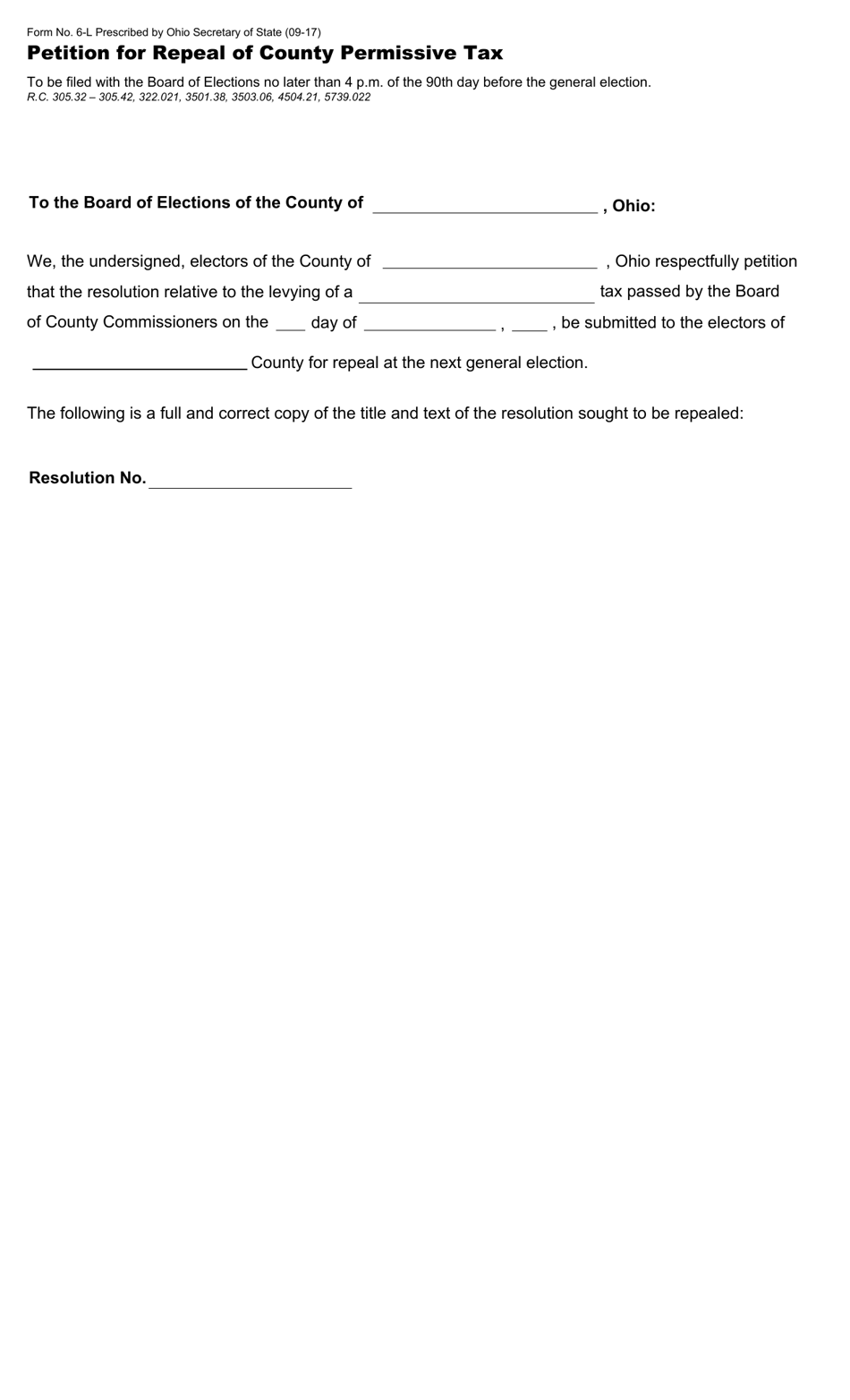

Form 6-L Petition for Repeal of County Permissive Tax - Ohio

What Is Form 6-L?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

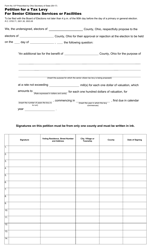

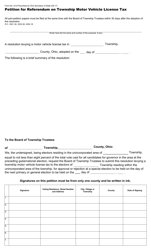

Q: What is a Form 6-L Petition?

A: A Form 6-L Petition is a document used to request the repeal of a county permissive tax in Ohio.

Q: What is a county permissive tax?

A: A county permissive tax is a tax imposed by a county government in Ohio.

Q: Who can file a Form 6-L Petition?

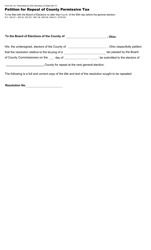

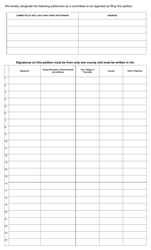

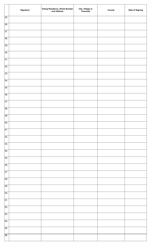

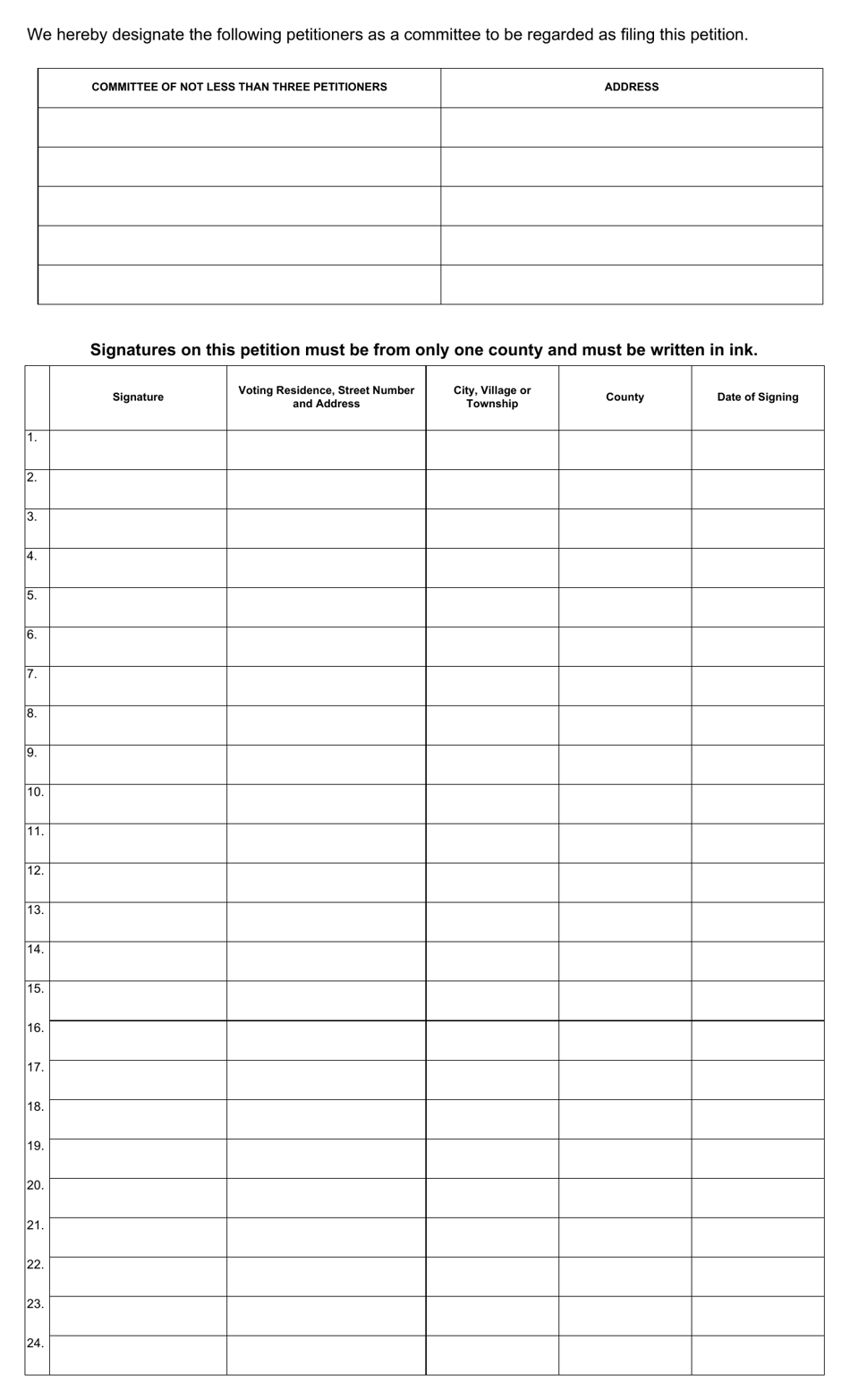

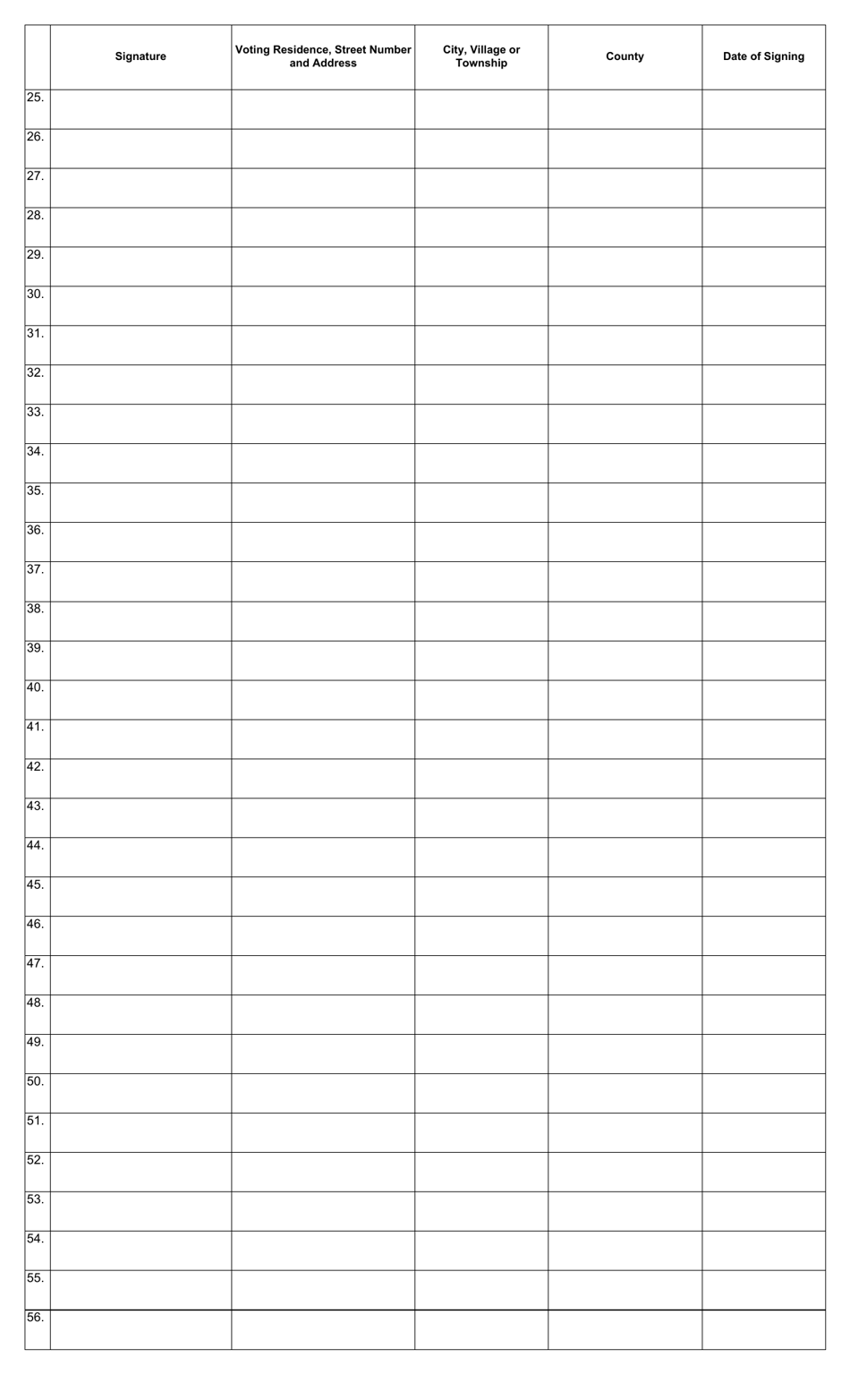

A: Any individual or organization can file a Form 6-L Petition as long as they are registered voters in the county where the tax is imposed.

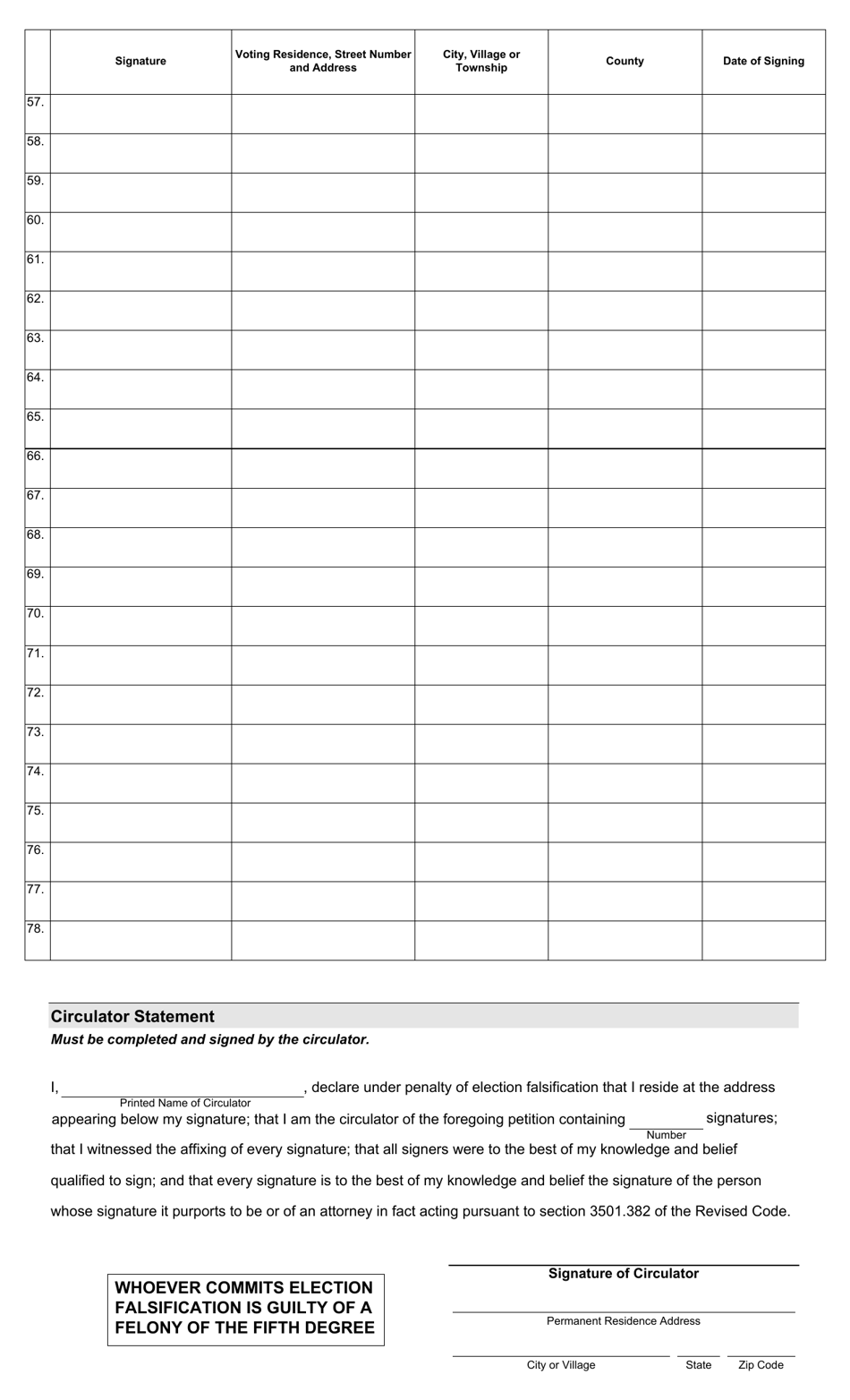

Q: How do I file a Form 6-L Petition?

A: To file a Form 6-L Petition, you need to complete the form with the required information, including signatures of registered voters, and submit it to the appropriate county office.

Q: What happens after filing a Form 6-L Petition?

A: After filing a Form 6-L Petition, the county government will review the petition and determine whether to put the repeal of the permissive tax on the ballot for a vote.

Q: Can a county permissive tax be repealed through a Form 6-L Petition?

A: Yes, if enough valid signatures of registered voters are obtained and the county government approves the petition, the repeal of the permissive tax can be placed on the ballot for a vote.

Q: What is the purpose of repealing a county permissive tax?

A: The purpose of repealing a county permissive tax is to eliminate or reduce the tax burden on residents and businesses in the county.

Q: Are there any fees associated with filing a Form 6-L Petition?

A: No, there are no fees associated with filing a Form 6-L Petition.

Q: What is the deadline for filing a Form 6-L Petition?

A: The deadline for filing a Form 6-L Petition is determined by the specific county. It is advisable to check with the county office for the deadline information.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6-L by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.