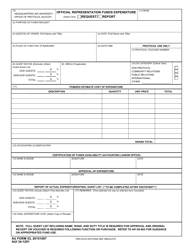

Form 31-F Statement of Expenditures for Social or Fund-Raising Event - Ohio

What Is Form 31-F?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

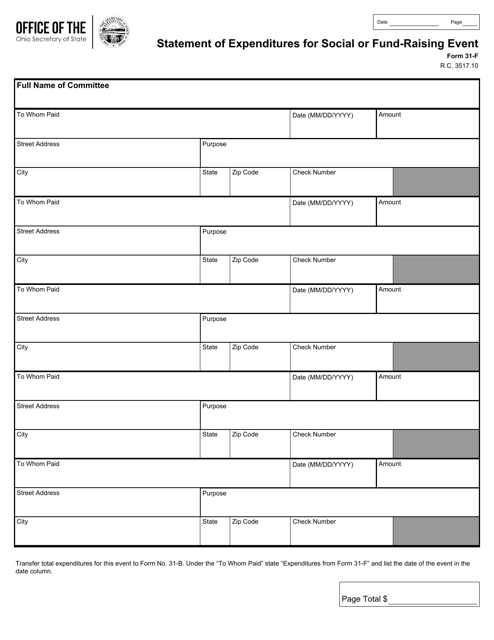

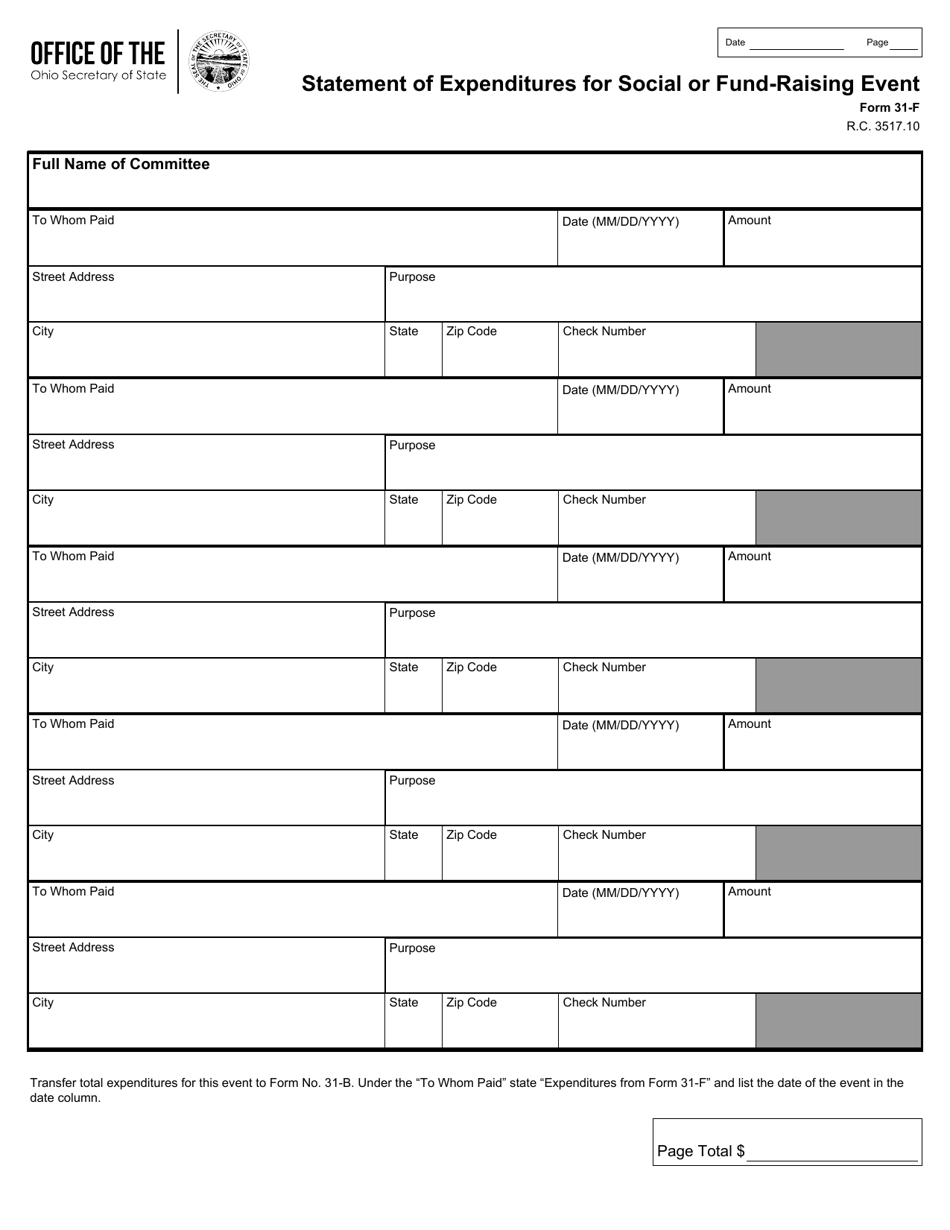

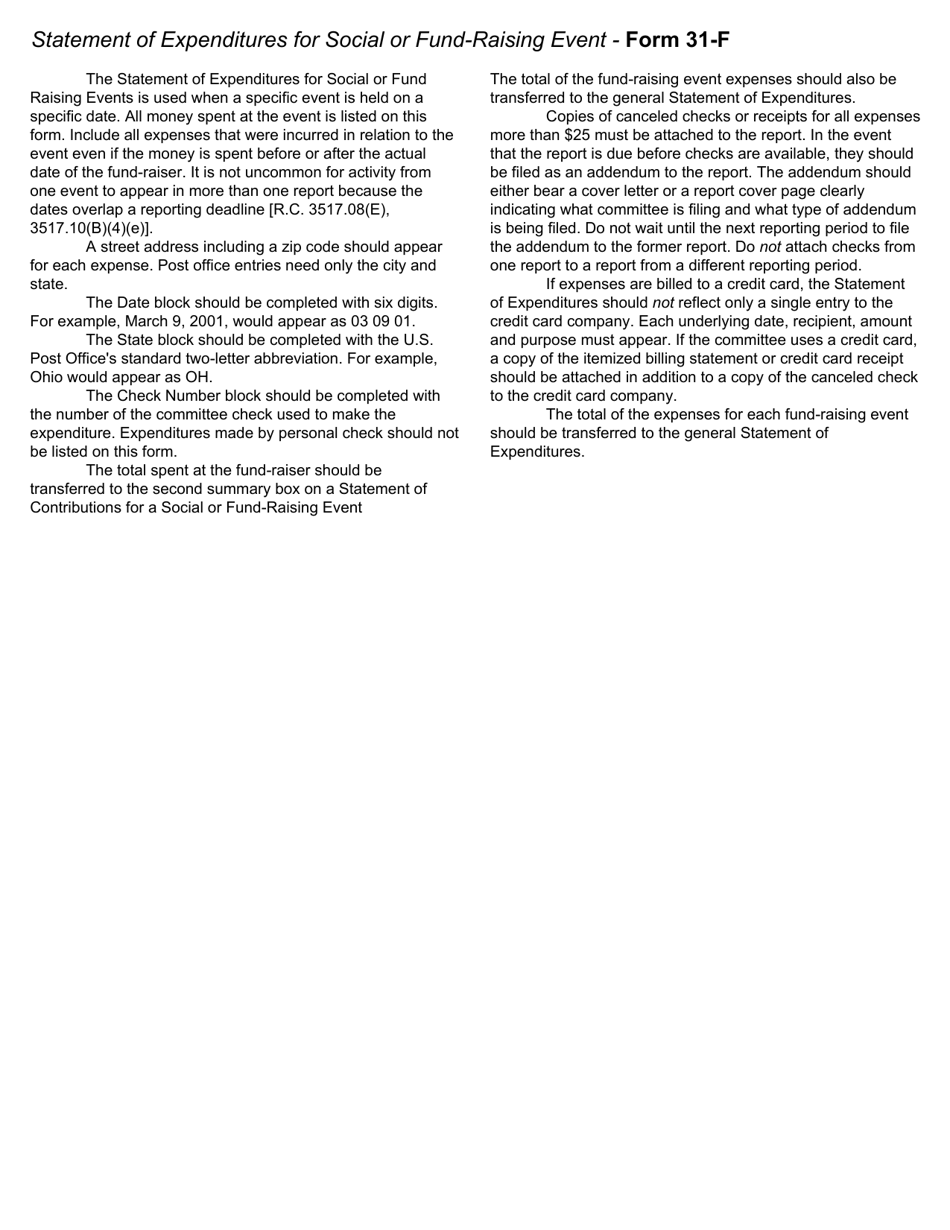

Q: What is Form 31-F?

A: Form 31-F is a statement of expenditures for a social or fund-raising event in Ohio.

Q: Who needs to file Form 31-F?

A: Individuals or organizations that have organized a social or fund-raising event in Ohio and have incurred expenditures need to file Form 31-F.

Q: What is the purpose of Form 31-F?

A: The purpose of Form 31-F is to report the expenditures made for a social or fund-raising event in Ohio.

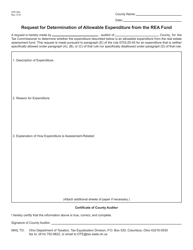

Q: What information is required on Form 31-F?

A: Form 31-F requires information such as the event's name, date, location, organization's details, and a detailed breakdown of the expenditures.

Q: When is Form 31-F due?

A: Form 31-F is due within 90 days after the social or fund-raising event's conclusion.

Q: Is there a fee for filing Form 31-F?

A: No, there is no fee for filing Form 31-F.

Q: Can Form 31-F be filed electronically?

A: Yes, Form 31-F can be filed electronically through the Ohio Business Gateway.

Q: Are there any penalties for not filing Form 31-F?

A: Yes, failure to file Form 31-F or filing false information may result in penalties imposed by the Ohio Department of Taxation.

Form Details:

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 31-F by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.