This version of the form is not currently in use and is provided for reference only. Download this version of

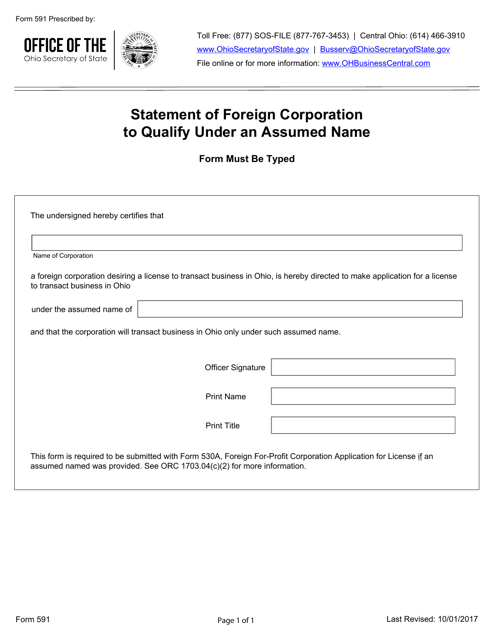

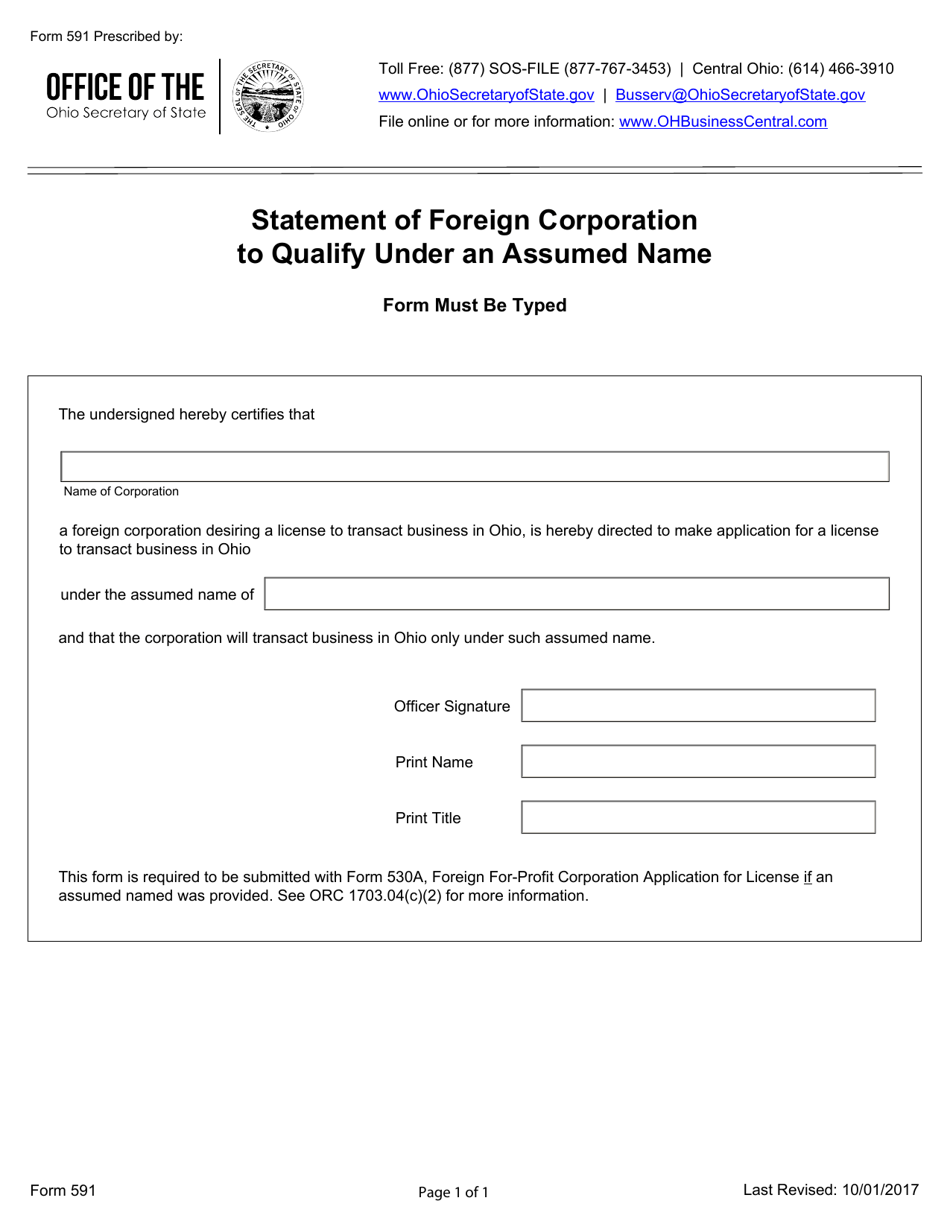

Form 591

for the current year.

Form 591 Statement of Foreign Corporation to Qualify Under an Assumed Name - Ohio

What Is Form 591?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 591?

A: Form 591 is a Statement of Foreign Corporation to Qualify Under an Assumed Name in Ohio.

Q: Who needs to file Form 591?

A: Foreign corporations that wish to do business in Ohio under an assumed name need to file Form 591.

Q: What is the purpose of filing Form 591?

A: Filing Form 591 allows foreign corporations to legally operate in Ohio under an assumed name.

Q: What information is required on Form 591?

A: Form 591 requires foreign corporations to provide their legal name, state or country of incorporation, assumed name they wish to use in Ohio, and other relevant information.

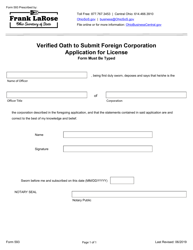

Q: Are there any additional requirements or documents to submit along with Form 591?

A: Foreign corporations may need to provide a Certificate of Good Standing from their home state or country, as well as any other documents required by the Ohio Secretary of State.

Q: What happens after I file Form 591?

A: Once Form 591 is filed and the required fees are paid, the Ohio Secretary of State will review the application. If approved, the foreign corporation will be qualified to operate in Ohio under the assumed name.

Q: Do I need to renew Form 591?

A: No, there is no renewal requirement for Form 591. However, foreign corporations are required to file annual reports with the Ohio Secretary of State to maintain their qualification in Ohio.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

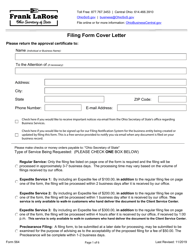

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 591 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.