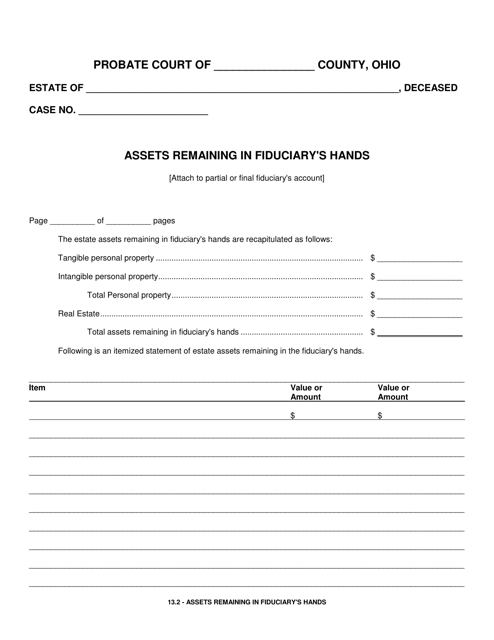

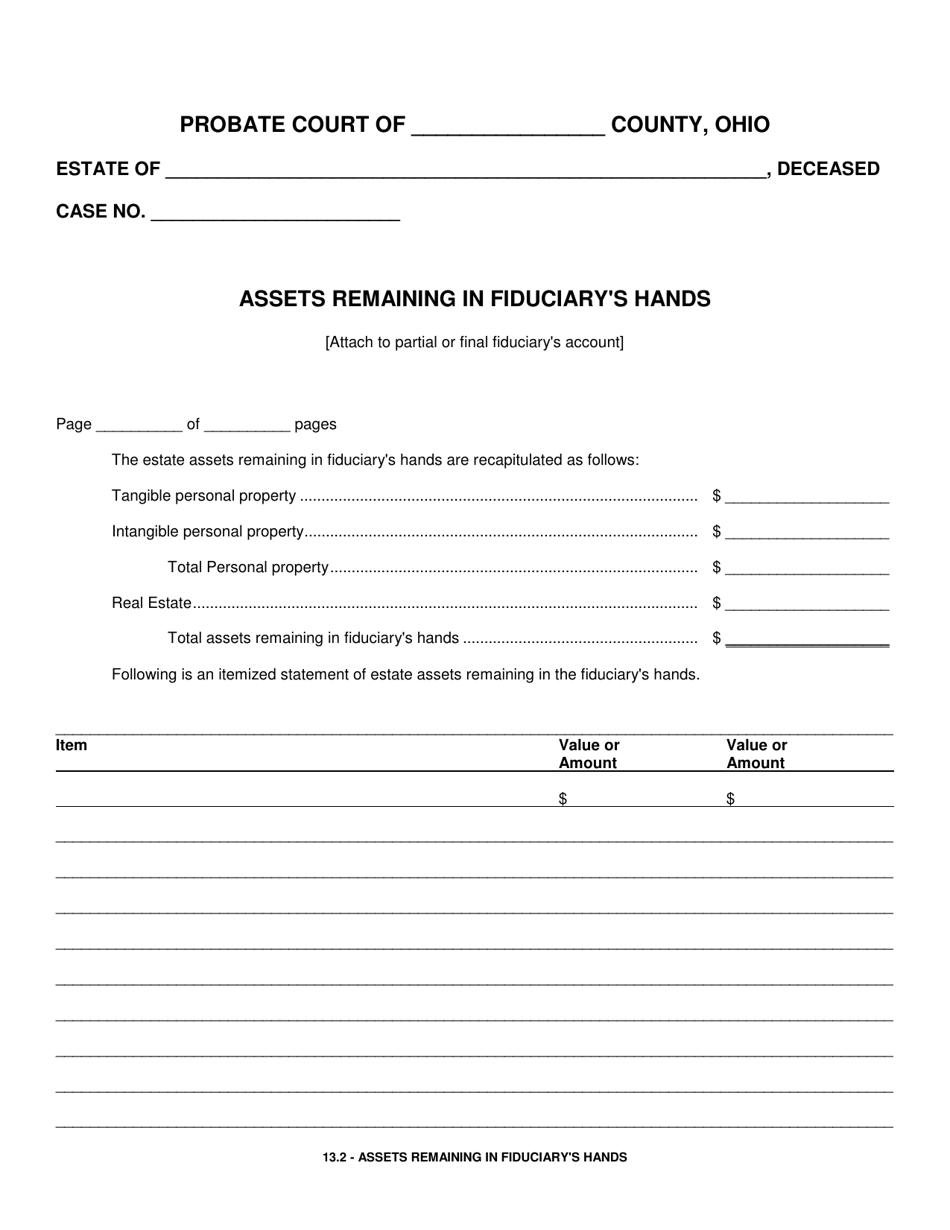

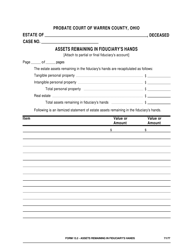

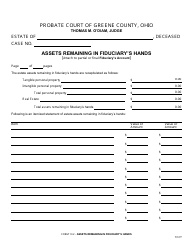

Form 13.2 Assets Remaining in Fiduciary's Hands - Ohio

What Is Form 13.2?

This is a legal form that was released by the Ohio Courts of Common Pleas - Probate Division - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 13.2?

A: Form 13.2 is a document used in Ohio for reporting the assets remaining in a fiduciary's hands.

Q: Who uses Form 13.2?

A: Form 13.2 is used by fiduciaries in Ohio.

Q: What does Form 13.2 report?

A: Form 13.2 reports the assets that are still held by a fiduciary.

Q: Why is Form 13.2 required?

A: Form 13.2 is required to provide transparency and accountability for the remaining assets in a fiduciary's possession.

Q: When should Form 13.2 be filed?

A: Form 13.2 should be filed as required by the relevant Ohio regulations and deadlines.

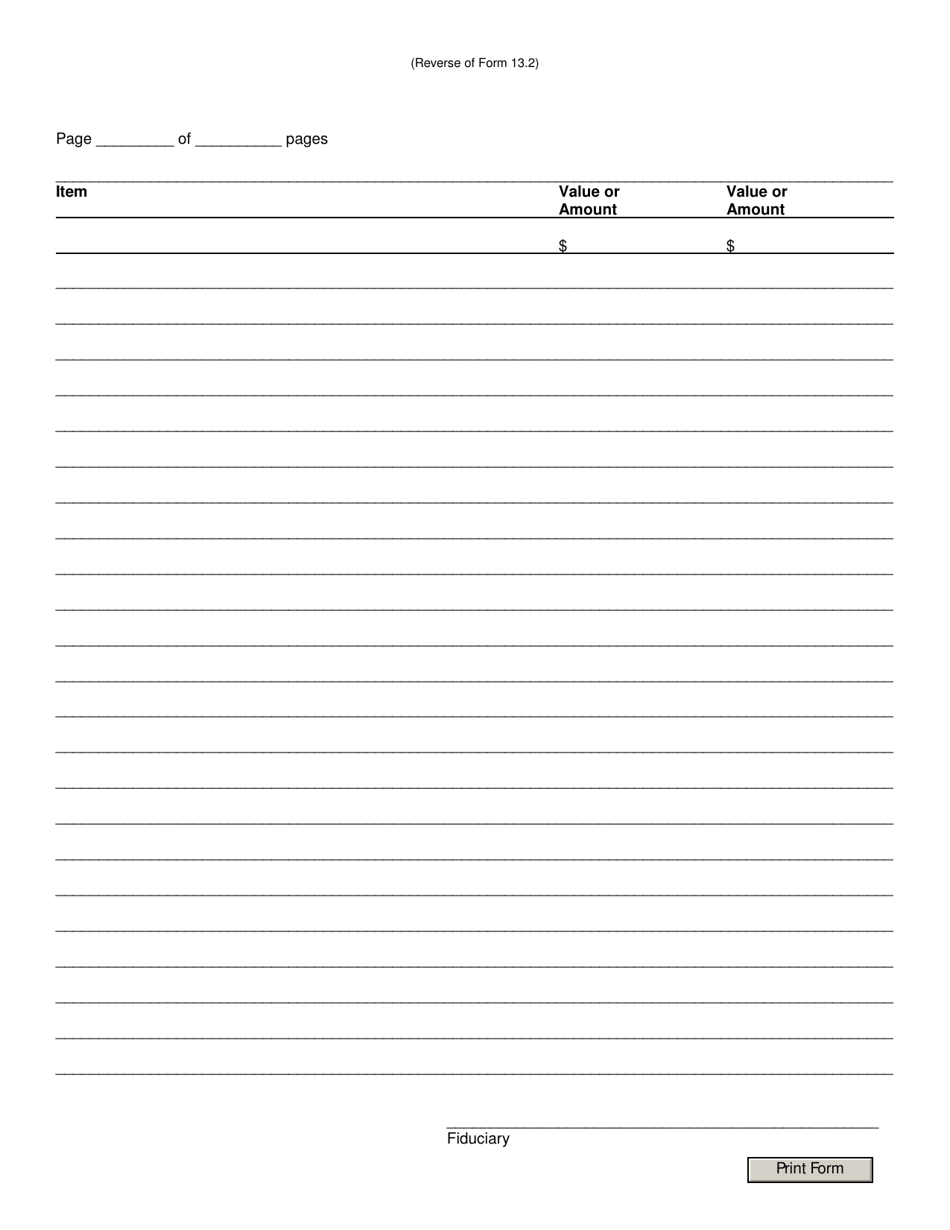

Q: How should Form 13.2 be completed?

A: Form 13.2 should be completed accurately and thoroughly, providing all necessary information about the remaining assets in the fiduciary's hands.

Q: Are there any fees associated with filing Form 13.2?

A: Fees may be associated with filing Form 13.2. It is recommended to check with the relevant authorities or consult legal advice for specific details.

Q: Can Form 13.2 be filed electronically?

A: In some cases, Form 13.2 may be filed electronically. It is advisable to check with the relevant authorities or consult legal advice for specific instructions.

Q: What happens after filing Form 13.2?

A: After filing Form 13.2, the relevant authorities will review the information provided and ensure compliance with Ohio regulations.

Q: What are the consequences of not filing Form 13.2?

A: Not filing Form 13.2 may result in penalties or legal consequences, as it is required by Ohio law to report the remaining assets in a fiduciary's hands.

Form Details:

- The latest edition provided by the Ohio Courts of Common Pleas - Probate Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 13.2 by clicking the link below or browse more documents and templates provided by the Ohio Courts of Common Pleas - Probate Division.