This version of the form is not currently in use and is provided for reference only. Download this version of

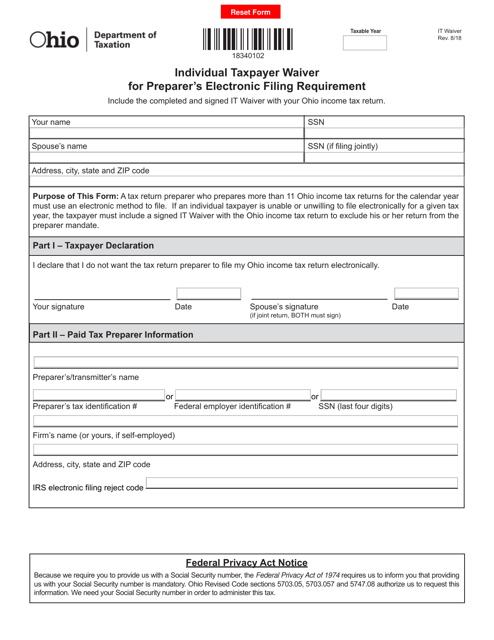

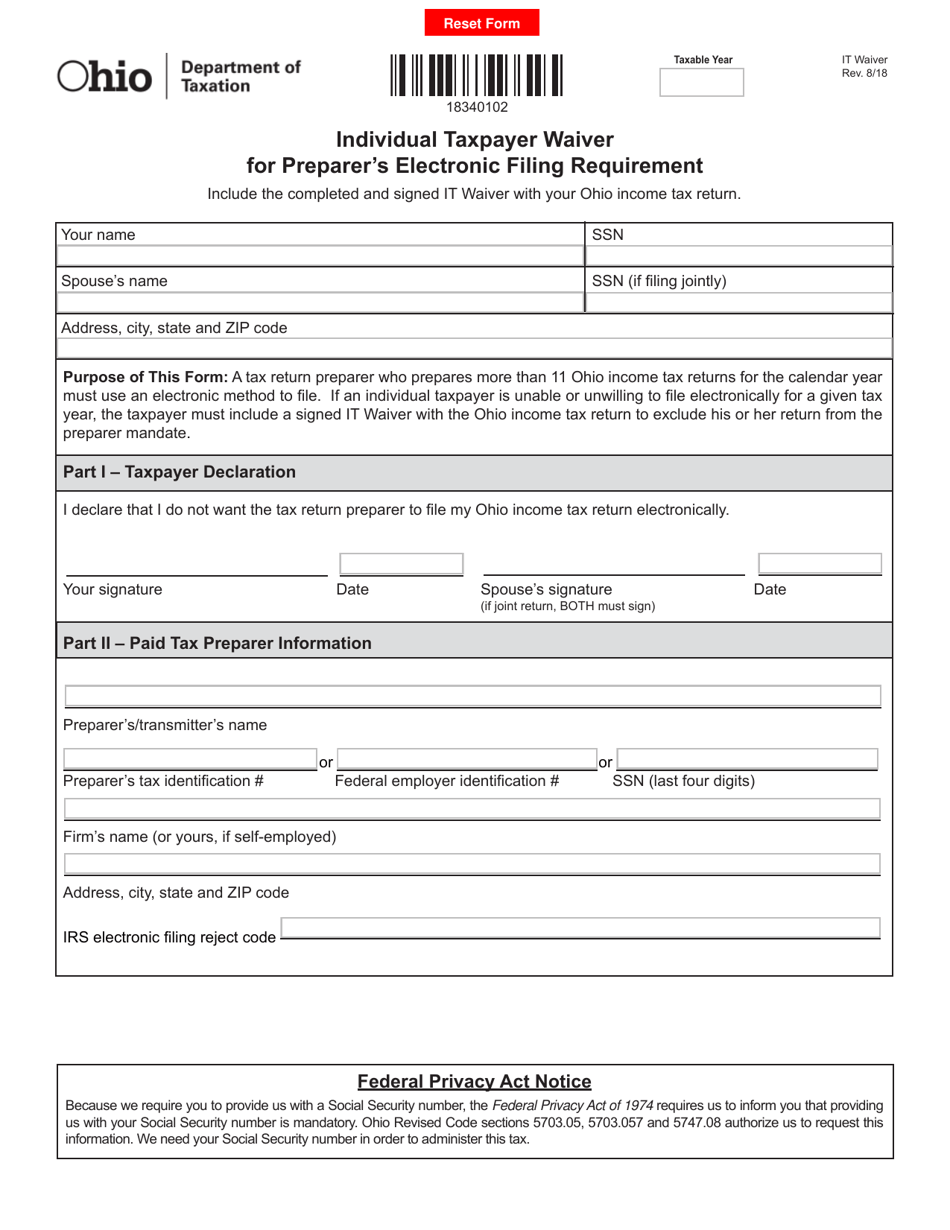

Form IT WAIVER

for the current year.

Form IT WAIVER Individual Taxpayer Waiver for Preparer's Electronic Filing Requirement - Ohio

What Is Form IT WAIVER?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT WAIVER?

A: Form IT WAIVER is the Individual Taxpayer Waiver for Preparer's Electronic Filing Requirement - Ohio.

Q: What does the Form IT WAIVER do?

A: The Form IT WAIVER allows individual taxpayers in Ohio to request a waiver from the electronic filing requirement for their tax returns.

Q: Who is eligible to use the Form IT WAIVER?

A: Individual taxpayers in Ohio who meet certain criteria may be eligible to use the Form IT WAIVER.

Q: What information do I need to include in the Form IT WAIVER?

A: The Form IT WAIVER requires you to provide your personal information, explain why you are requesting a waiver, and submit any necessary supporting documentation.

Q: Is there a deadline to submit the Form IT WAIVER?

A: Yes, the Form IT WAIVER must be submitted by the due date of your tax return, or within 30 days of receiving a request for the waiver from the Ohio Department of Taxation.

Q: Is there a fee for filing the Form IT WAIVER?

A: No, there is no fee for filing the Form IT WAIVER.

Q: Can I file the Form IT WAIVER electronically?

A: No, the Form IT WAIVER must be submitted by mail or in person to the Ohio Department of Taxation.

Q: What happens after I submit the Form IT WAIVER?

A: After you submit the Form IT WAIVER, the Ohio Department of Taxation will review your request and notify you of their decision.

Q: Can I appeal if my Form IT WAIVER is denied?

A: Yes, if your Form IT WAIVER is denied, you have the right to appeal the decision within a certain timeframe.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT WAIVER by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.