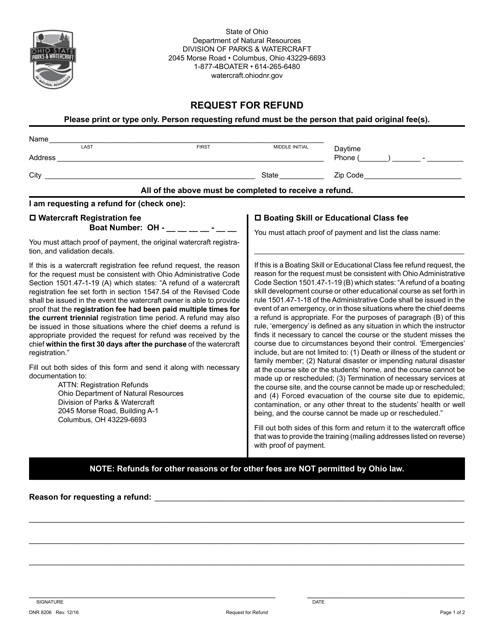

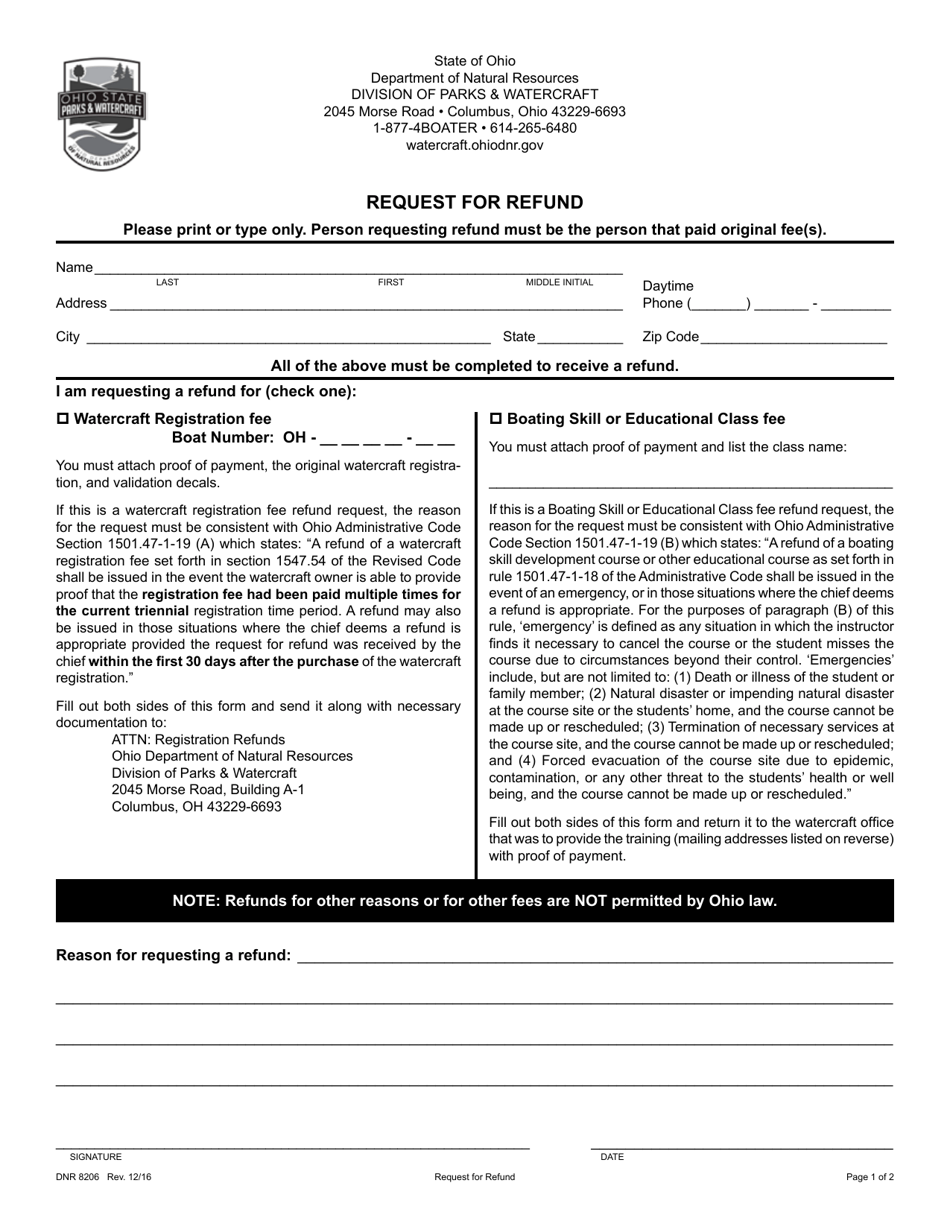

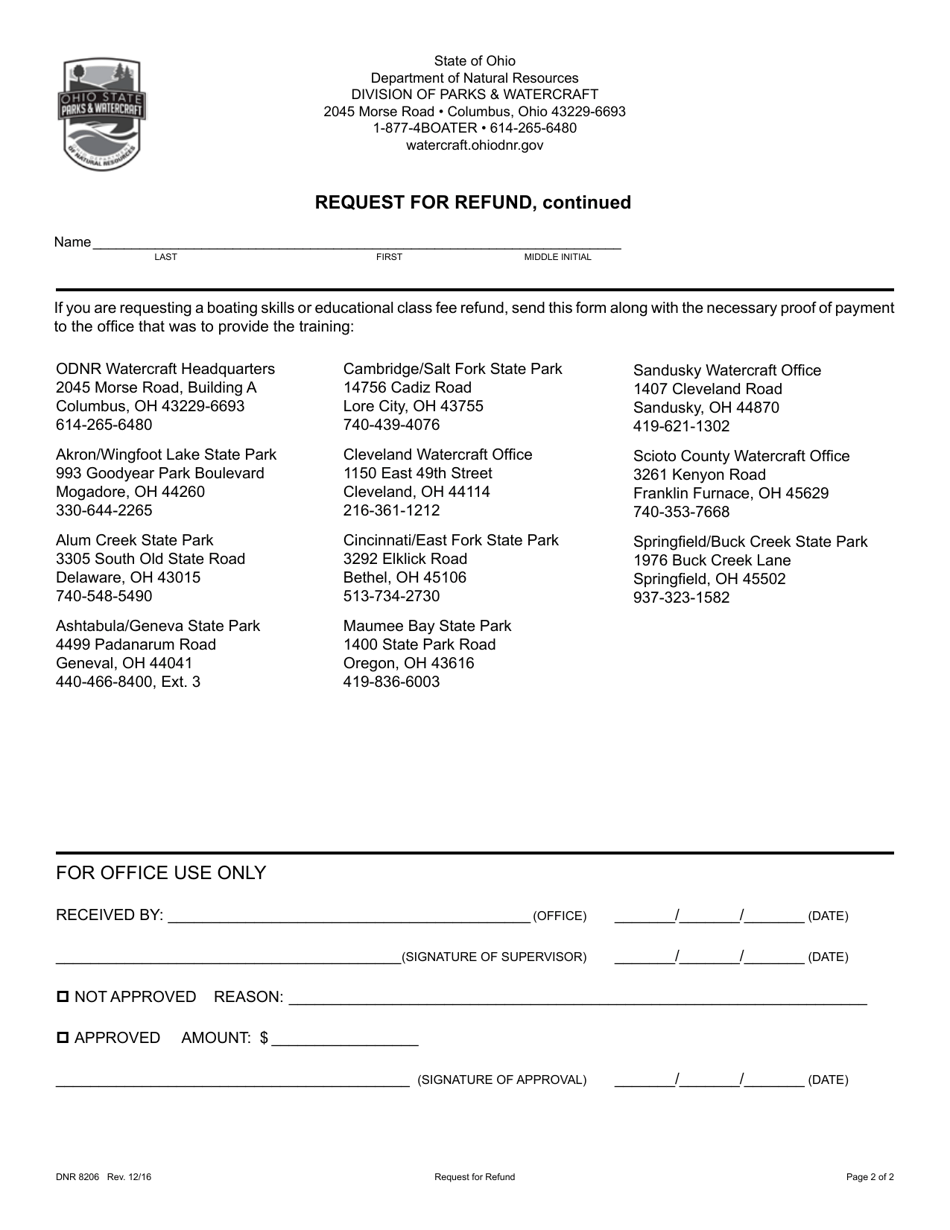

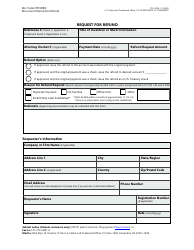

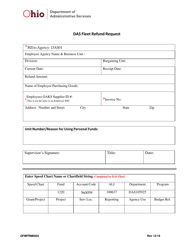

Form DNR8206 Request for Refund - Ohio

What Is Form DNR8206?

This is a legal form that was released by the Ohio Department of Natural Resources - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DNR8206?

A: Form DNR8206 is a Request for Refund form in Ohio.

Q: What is the purpose of Form DNR8206?

A: The purpose of Form DNR8206 is to request a refund for overpaid taxes or fees in Ohio.

Q: Who can use Form DNR8206?

A: Any individual or business who overpaid taxes or fees in Ohio can use Form DNR8206.

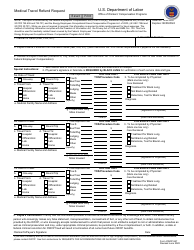

Q: What information do I need to provide on Form DNR8206?

A: You will need to provide your name, contact information, the type of tax or fee paid, the amount paid, the reason for the refund request, and any supporting documentation.

Q: Is there a deadline to submit Form DNR8206?

A: Yes, there is a deadline to submit Form DNR8206. It must be filed within a certain timeframe specified by the Ohio Department of Natural Resources.

Q: How long does it take to process a refund request with Form DNR8206?

A: The processing time for a refund request with Form DNR8206 may vary. It is best to contact the Ohio Department of Natural Resources for an estimated timeframe.

Q: What should I do if I made a mistake on Form DNR8206?

A: If you made a mistake on Form DNR8206, you should contact the Ohio Department of Natural Resources to request guidance on how to correct the error.

Q: Is there a fee to file Form DNR8206?

A: No, there is no fee to file Form DNR8206.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Ohio Department of Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DNR8206 by clicking the link below or browse more documents and templates provided by the Ohio Department of Natural Resources.