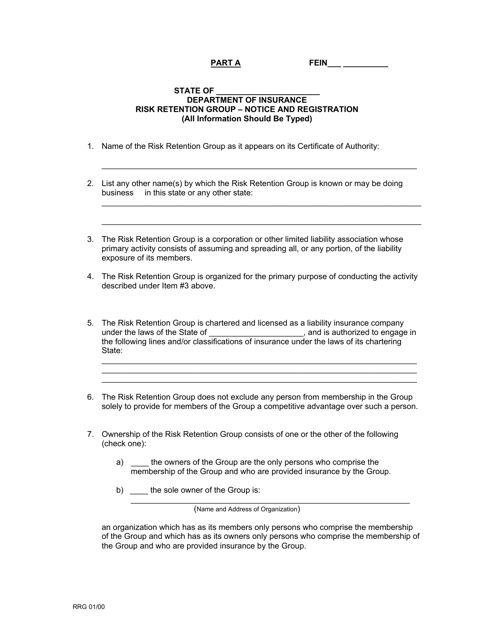

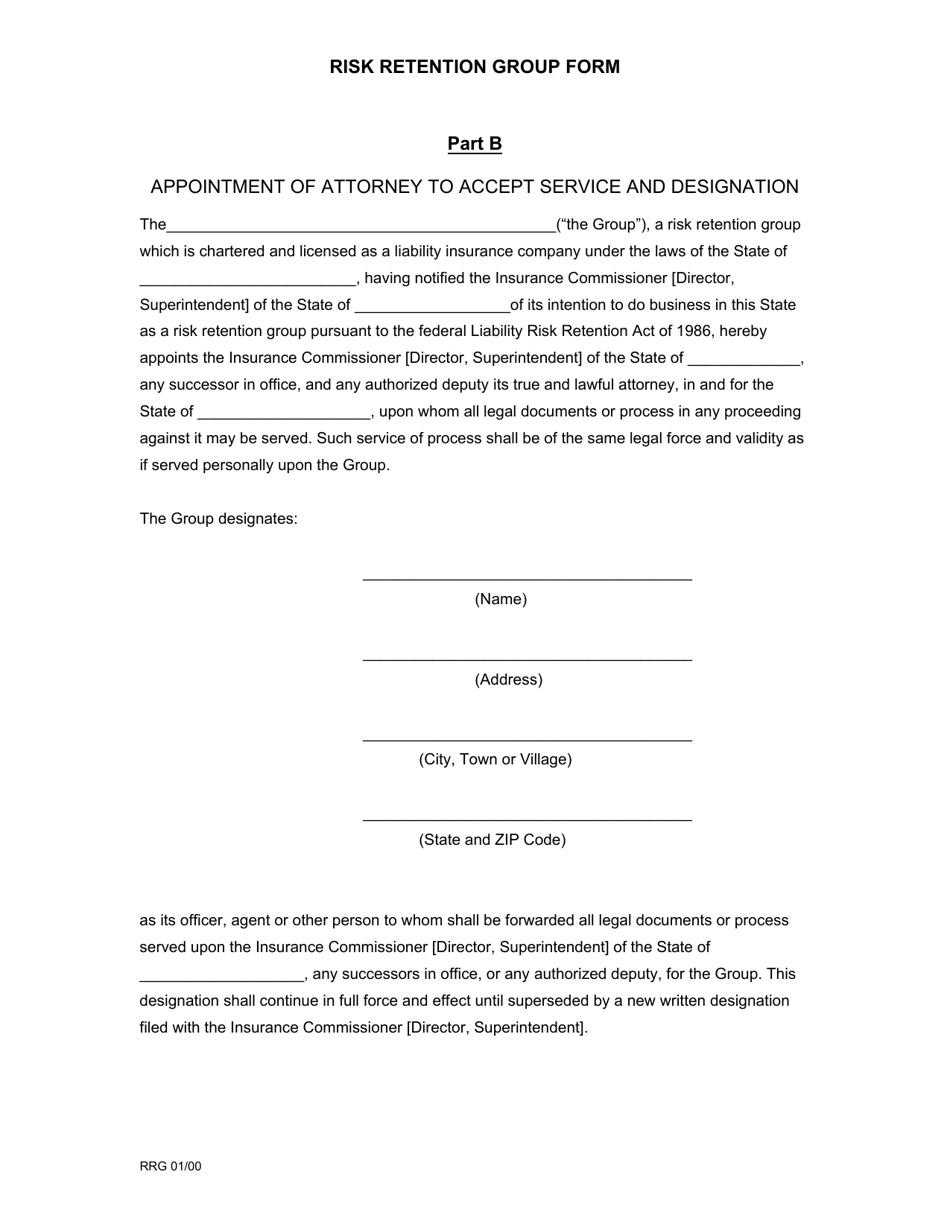

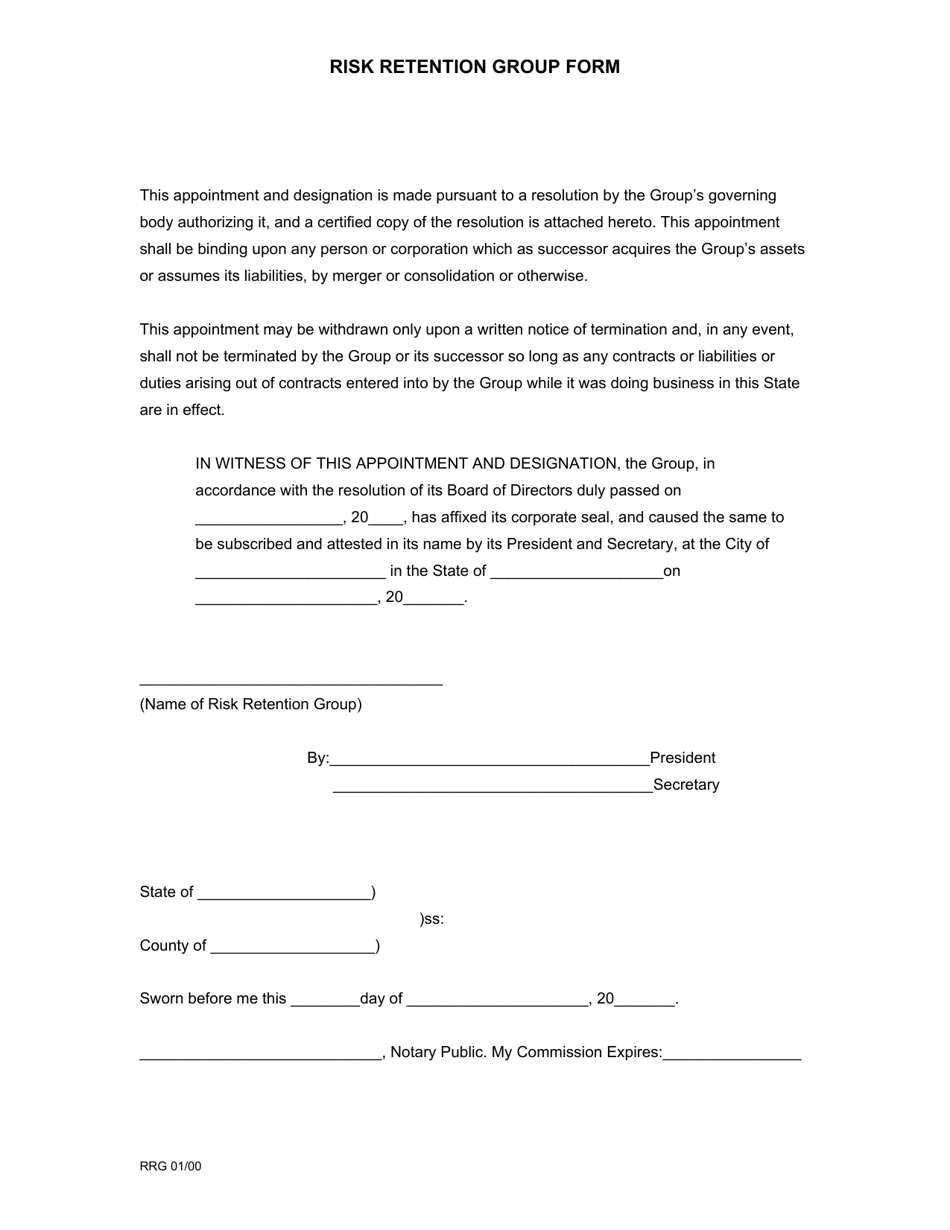

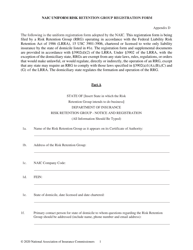

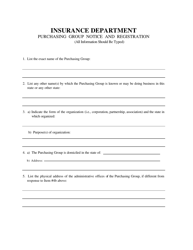

Naic Risk Retention Group Registration Form - Ohio

Naic Risk Retention Group Registration Form is a legal document that was released by the Ohio Department of Insurance - a government authority operating within Ohio.

FAQ

Q: What is a Naic Risk Retention Group?

A: A Naic Risk Retention Group is a type of insurance company that is formed under the Risk Retention Act of 1986.

Q: Why do Naic Risk Retention Groups need to register?

A: Naic Risk Retention Groups need to register in order to operate and provide insurance coverage in a specific state.

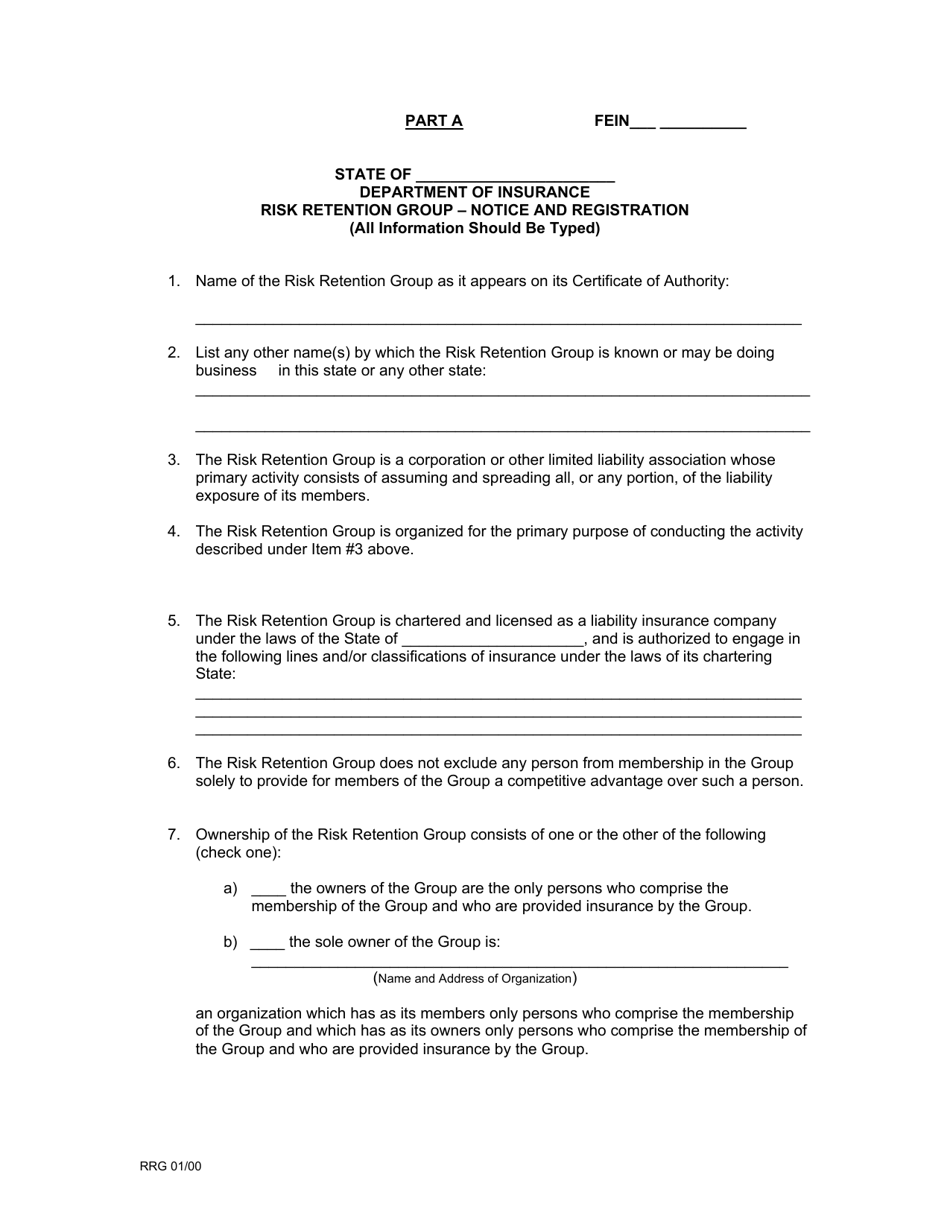

Q: What is the purpose of the Naic Risk Retention Group Registration Form in Ohio?

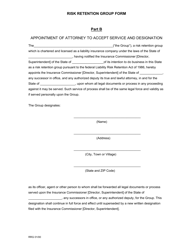

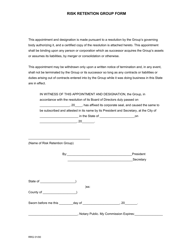

A: The Naic Risk Retention Group Registration Form in Ohio is used to collect information about the Risk Retention Group and its operations.

Q: Who needs to complete the Naic Risk Retention Group Registration Form in Ohio?

A: Risk Retention Groups that wish to operate in Ohio need to complete the registration form.

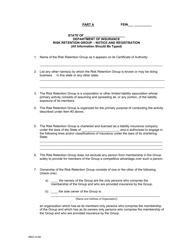

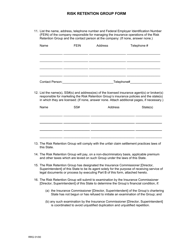

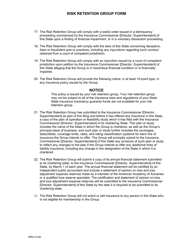

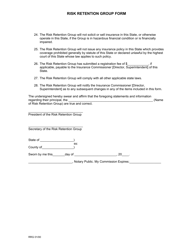

Q: What information do I need to provide on the Naic Risk Retention Group Registration Form in Ohio?

A: The registration form will require information about the Risk Retention Group's name, address, contact information, and details about its operations and financials.

Q: Is the Naic Risk Retention Group Registration Form in Ohio specific to Ohio only?

A: Yes, the registration form is specific to Ohio and is required for Risk Retention Groups that want to operate in the state.

Q: What is the deadline for submitting the Naic Risk Retention Group Registration Form in Ohio?

A: The deadline for submitting the registration form may vary. It is best to check with the Ohio Department of Insurance for the specific deadline.

Q: What happens after I submit the Naic Risk Retention Group Registration Form in Ohio?

A: After submitting the registration form, the Ohio Department of Insurance will review the application and may request additional information. Once approved, the Risk Retention Group can begin operating in Ohio.

Form Details:

- Released on January 1, 2000;

- The latest edition currently provided by the Ohio Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Insurance.