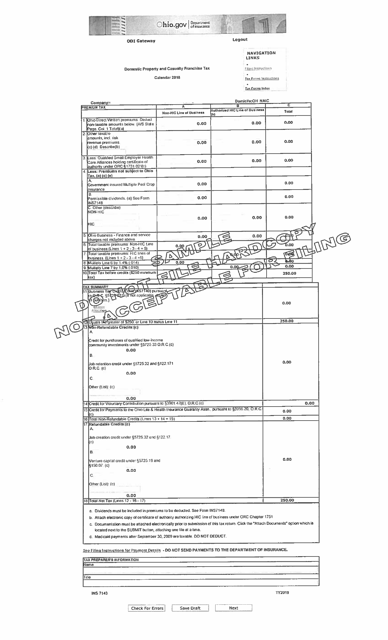

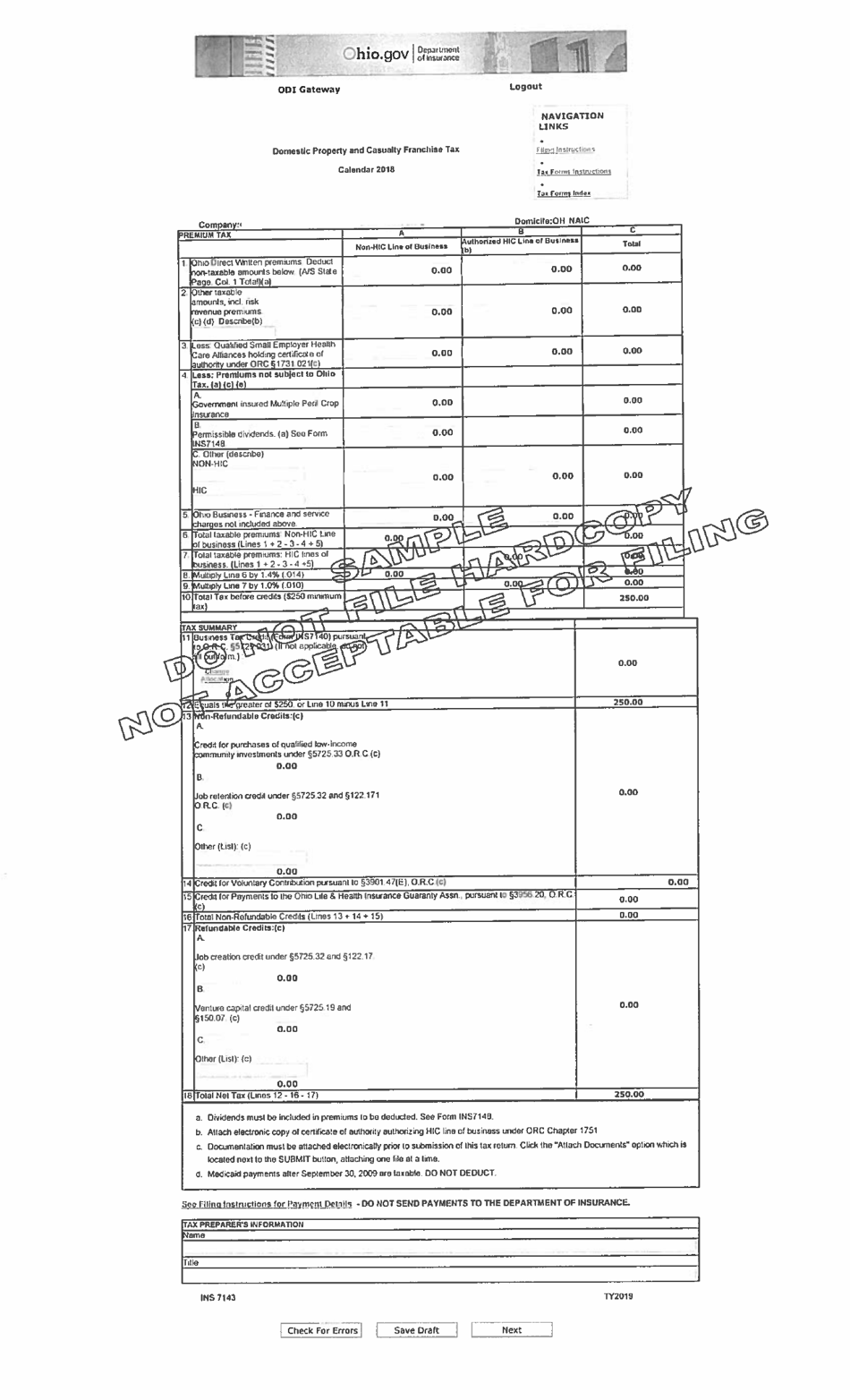

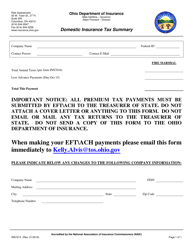

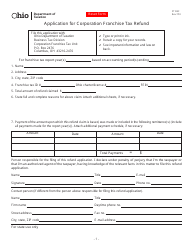

Sample Form INS7143 Domestic Property and Casualty Franchise Tax - Ohio

What Is Form INS7143?

This is a legal form that was released by the Ohio Department of Insurance - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is INS7143 Domestic Property and Casualty Franchise Tax?

A: INS7143 is a form used for reporting and paying the franchise tax for domestic property and casualtyinsurance companies in Ohio.

Q: Who is required to file INS7143?

A: Domestic property and casualty insurance companies operating in Ohio are required to file INS7143.

Q: What is the purpose of the franchise tax?

A: The franchise tax helps support various state programs and services, including education and infrastructure.

Q: How often does INS7143 need to be filed?

A: INS7143 must be filed annually, by the last day of March.

Q: What information is required on INS7143?

A: INS7143 requires information about the company's net premium written in Ohio, net losses paid in Ohio, and other specific details about the company's operations.

Q: What are the consequences of not filing INS7143?

A: Failure to file INS7143 can result in penalties and interest being assessed on the unpaid tax amount.

Q: Are there any exemptions to the franchise tax?

A: Certain small insurance companies may qualify for exemptions from the franchise tax. It is recommended to consult the Ohio Department of Insurance for specific eligibility requirements.

Form Details:

- The latest edition provided by the Ohio Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form INS7143 by clicking the link below or browse more documents and templates provided by the Ohio Department of Insurance.