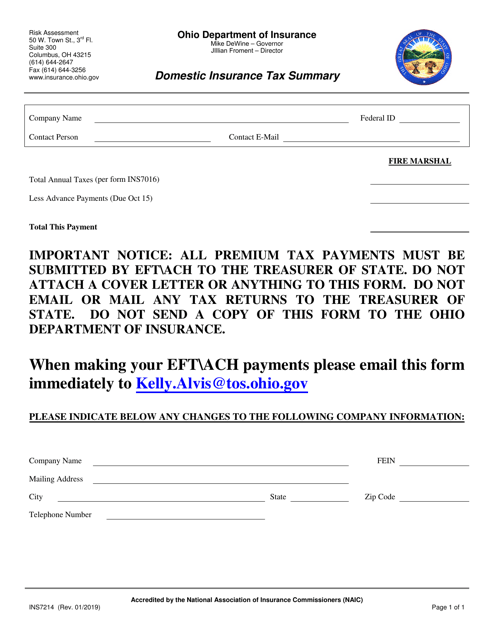

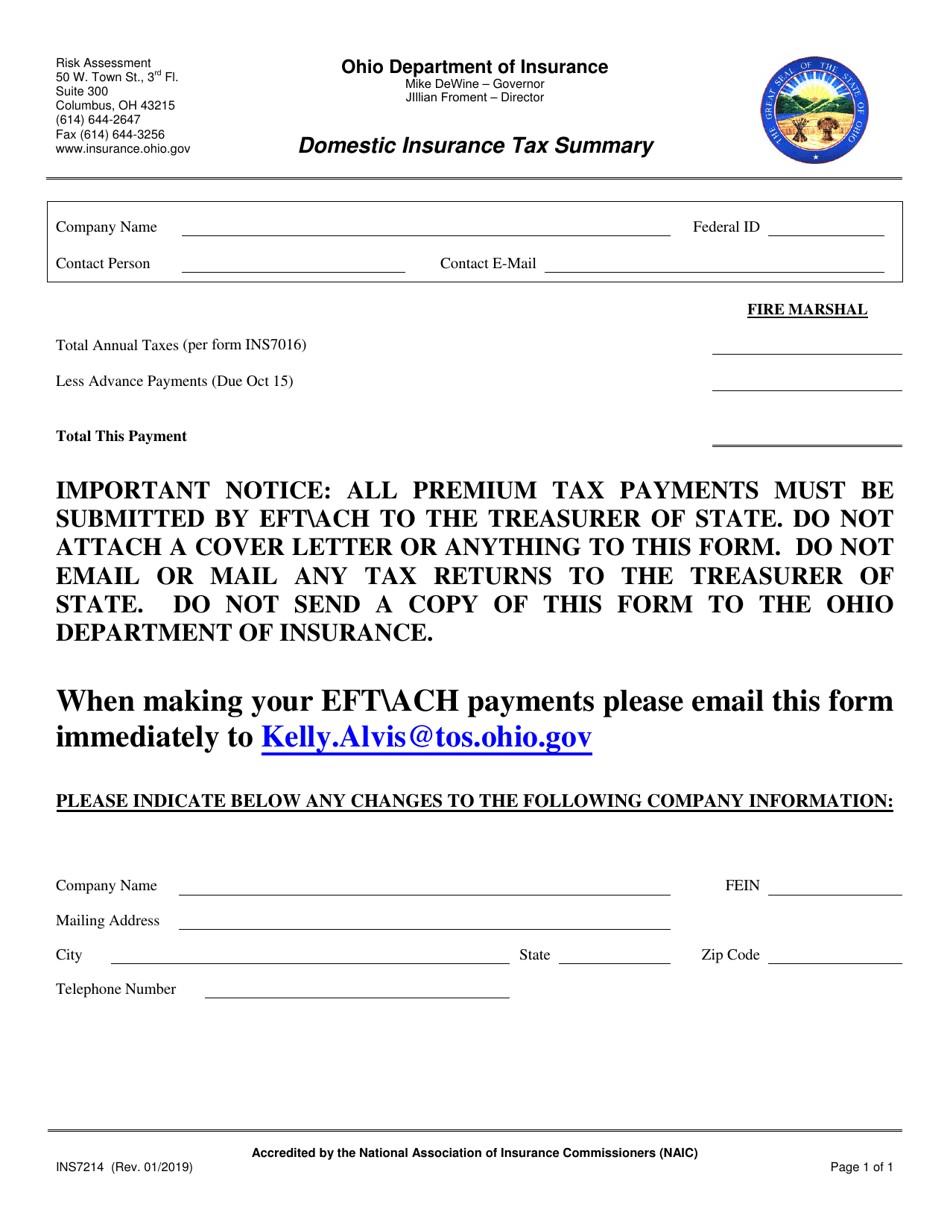

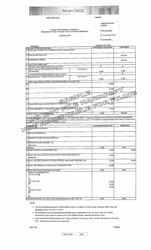

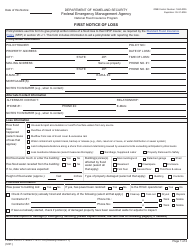

Form INS7214 Domestic Insurance Tax Summary - Ohio

What Is Form INS7214?

This is a legal form that was released by the Ohio Department of Insurance - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form INS7214?

A: Form INS7214 is the Domestic Insurance Tax Summary form used in the state of Ohio.

Q: What is the purpose of Form INS7214?

A: The purpose of Form INS7214 is to summarize domestic insurance tax information in Ohio.

Q: Who needs to file Form INS7214?

A: Insurers domiciled in Ohio need to file Form INS7214.

Q: What information is required on Form INS7214?

A: Form INS7214 requires information on premiums, deductions, and taxes.

Q: When is Form INS7214 due?

A: Form INS7214 is due on or before March 1st of each year.

Q: Is there a penalty for late filing of Form INS7214?

A: Yes, there is a penalty for late filing of Form INS7214. The penalty is $100 per day, up to a maximum of $1,000.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Ohio Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INS7214 by clicking the link below or browse more documents and templates provided by the Ohio Department of Insurance.