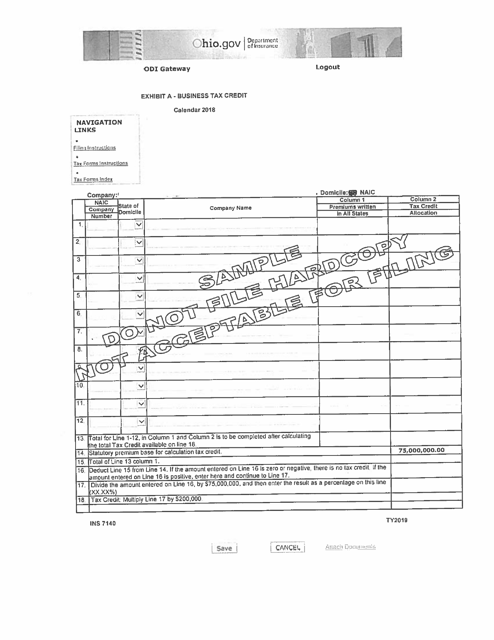

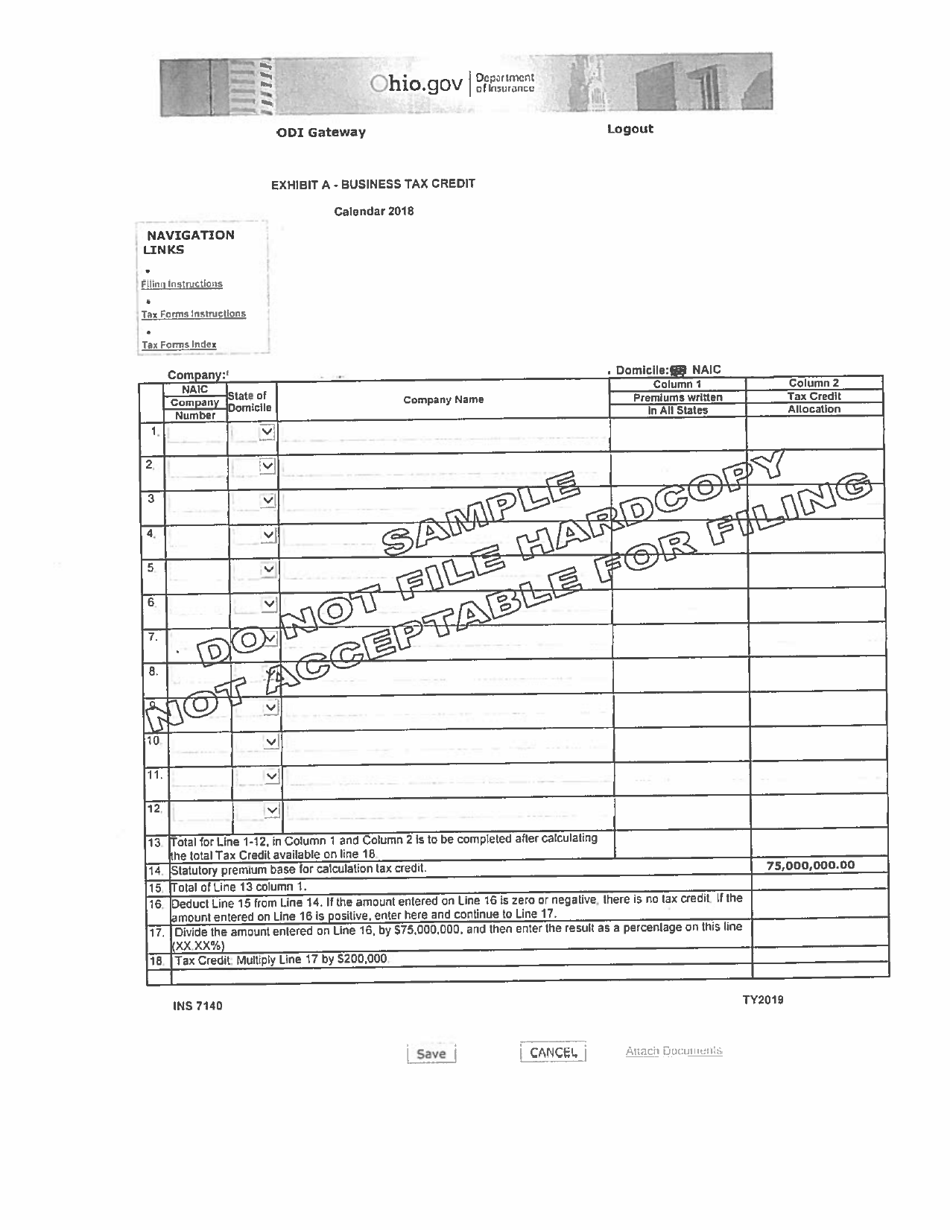

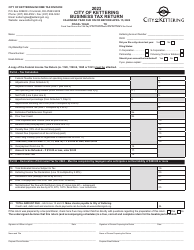

Sample Form INS7140 Exhibit A Business Tax Credit - Ohio

What Is Form INS7140 Exhibit A?

This is a legal form that was released by the Ohio Department of Insurance - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is INS7140 Exhibit A?

A: INS7140 Exhibit A is a form for claiming business tax credits in Ohio.

Q: What is a business tax credit?

A: A business tax credit is a reduction in the amount of taxes a business owes.

Q: How can I qualify for business tax credits in Ohio?

A: To qualify for business tax credits in Ohio, you need to meet the specific criteria outlined by the state.

Q: What types of tax credits can be claimed using INS7140 Exhibit A?

A: INS7140 Exhibit A is used to claim various business tax credits in Ohio, such as the Job CreationTax Credit and the Research and Development Investment Tax Credit.

Q: Are the business tax credits refundable?

A: Some business tax credits in Ohio are refundable, meaning if the credit exceeds the taxes owed, the excess credit can be refunded to the business.

Q: What should I do after completing INS7140 Exhibit A?

A: After completing INS7140 Exhibit A, you should attach it to your business tax return and submit it to the Ohio Department of Taxation.

Q: Is there a deadline for claiming business tax credits in Ohio?

A: Yes, there is a deadline for claiming business tax credits in Ohio. It is generally the same as the deadline for filing your business tax return.

Q: Can I claim business tax credits for previous years?

A: In some cases, you may be able to claim business tax credits for previous years in Ohio. You should consult the Ohio Department of Taxation for specific guidelines.

Q: Are there any limitations on claiming business tax credits in Ohio?

A: Yes, there may be limitations on claiming business tax credits in Ohio, such as maximum credit amounts or restrictions based on the type of credit.

Form Details:

- The latest edition provided by the Ohio Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form INS7140 Exhibit A by clicking the link below or browse more documents and templates provided by the Ohio Department of Insurance.