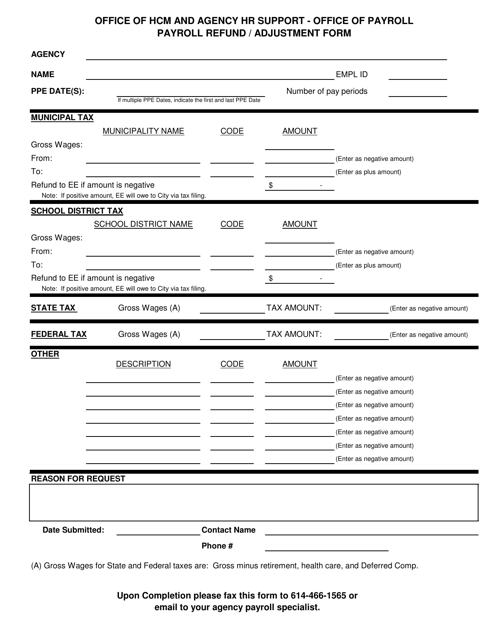

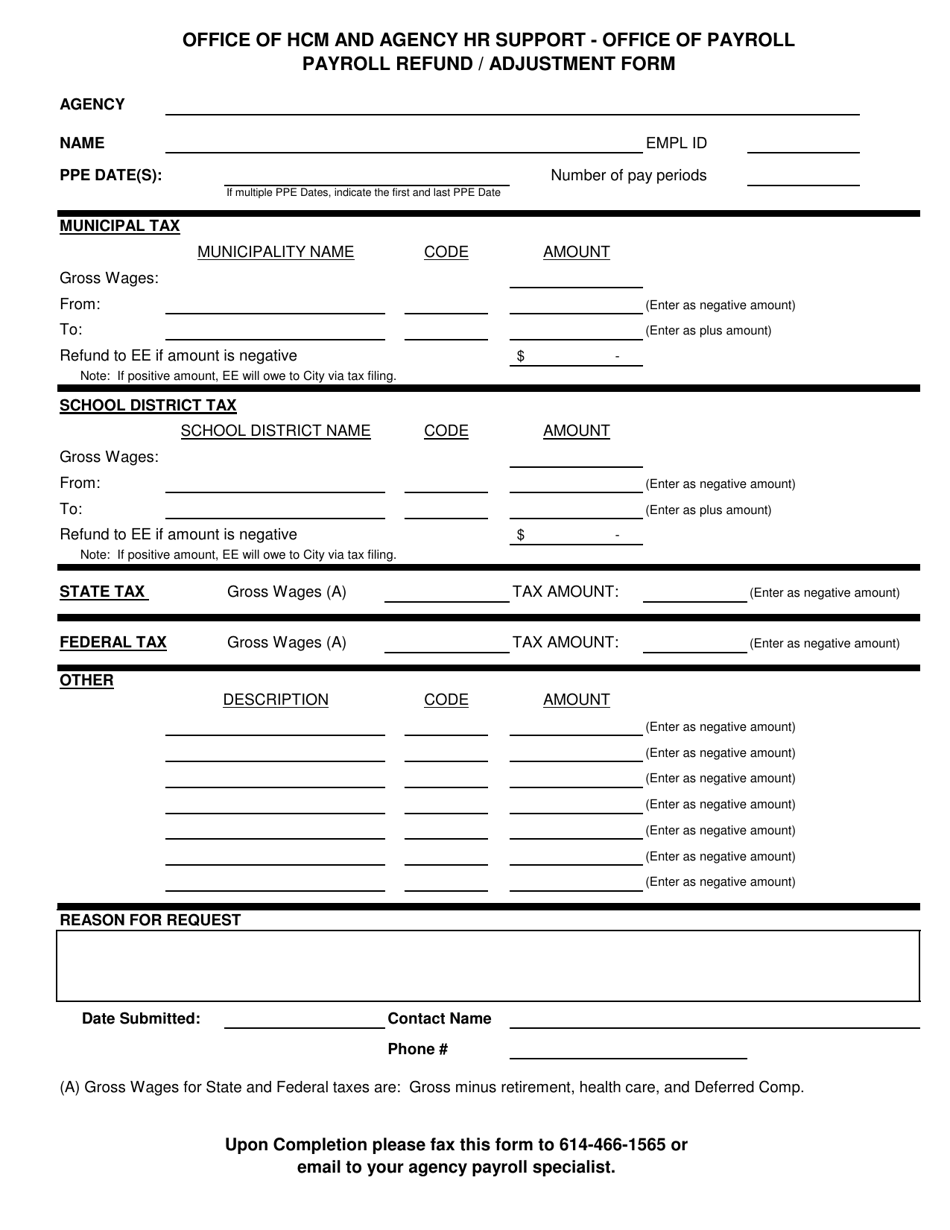

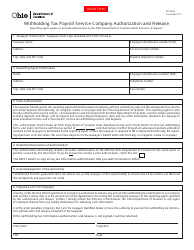

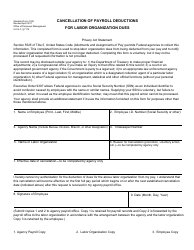

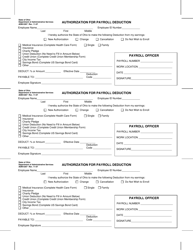

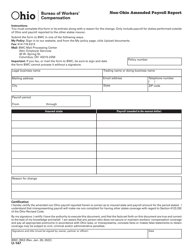

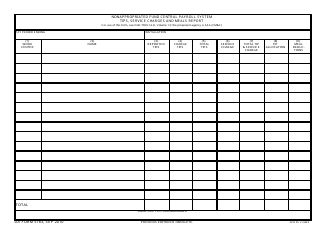

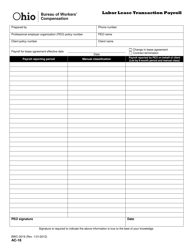

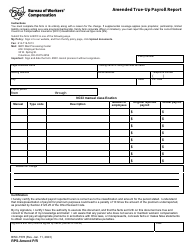

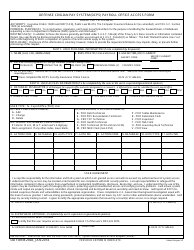

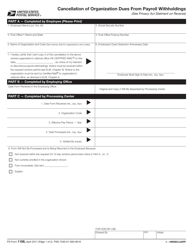

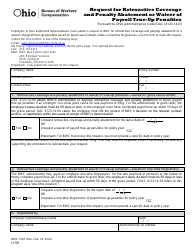

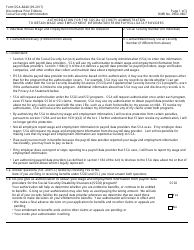

Payroll Refund / Adjustment Form - Ohio

Payroll Refund/Adjustment Form is a legal document that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio.

FAQ

Q: What is a Payroll Refund/Adjustment Form?

A: A Payroll Refund/Adjustment Form is a document used to request a refund or make adjustments to payroll deductions or payments.

Q: Who needs to fill out a Payroll Refund/Adjustment Form?

A: Employees who need to request a refund or make adjustments to their payroll deductions or payments.

Q: What information is required on a Payroll Refund/Adjustment Form?

A: Typically, you will need to provide your personal information, such as your name, employee ID, and contact information. You will also need to specify the reason for the refund or adjustment and provide any supporting documentation.

Q: How long does it take to process a Payroll Refund/Adjustment Form?

A: Processing times may vary, but typically it takes a few weeks for the form to be reviewed and processed by the payroll department.

Q: Is there a deadline to submit a Payroll Refund/Adjustment Form?

A: It is best to submit the form as soon as possible. Check with your employer or payroll department for any specific deadlines.

Form Details:

- The latest edition currently provided by the Ohio Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.