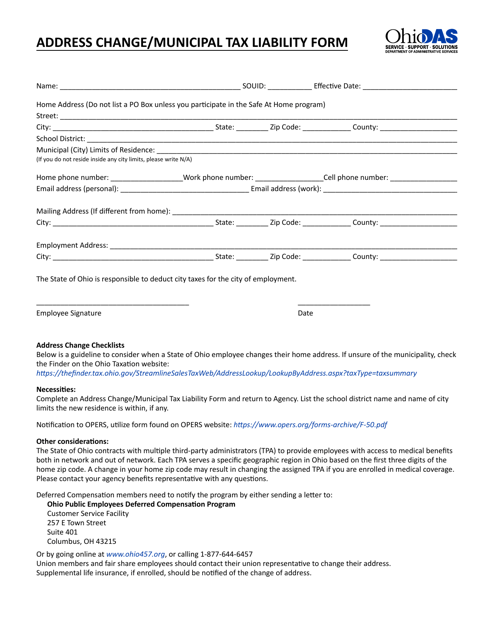

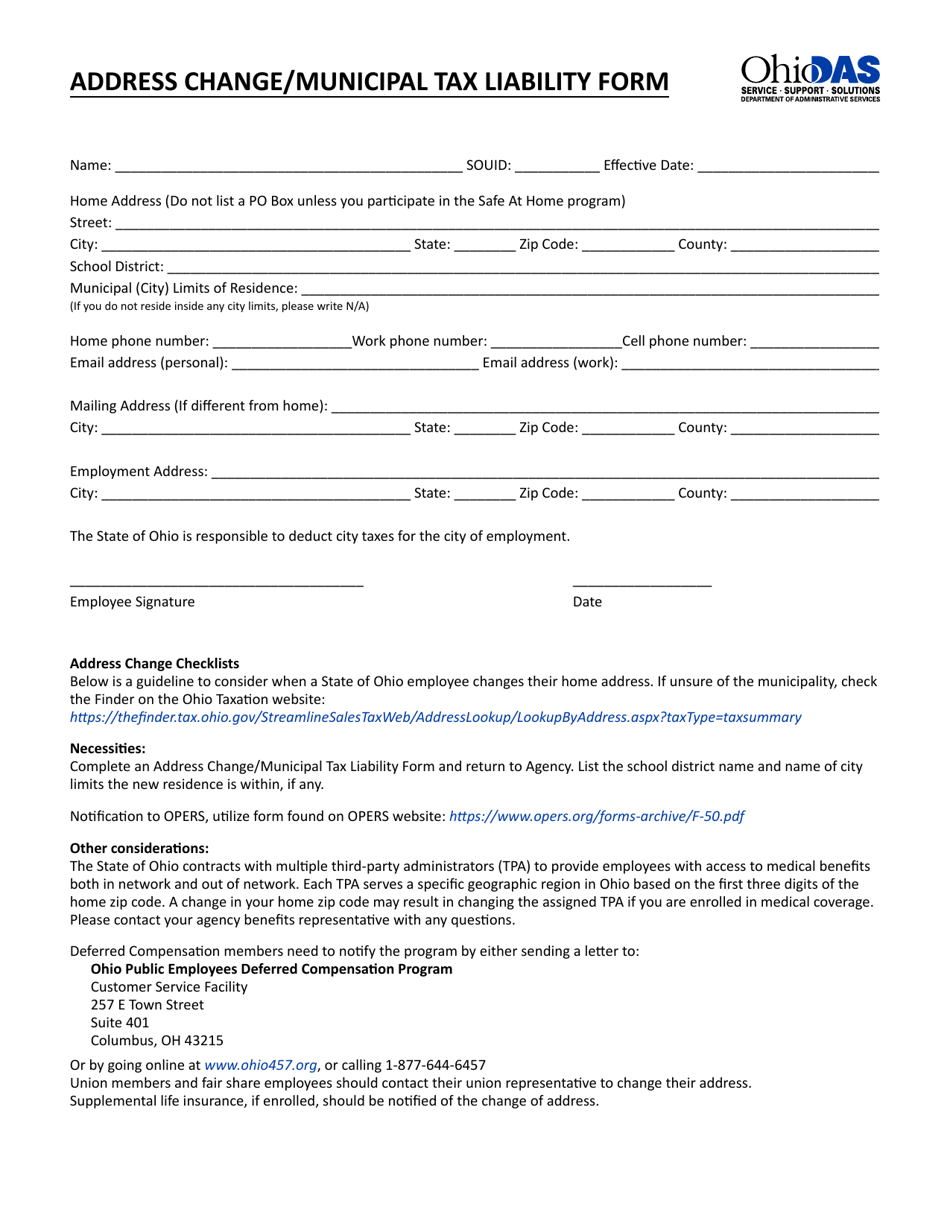

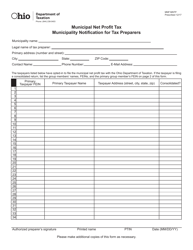

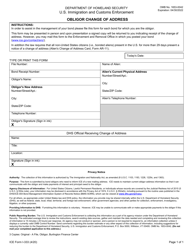

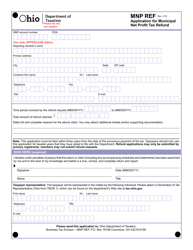

Address Change / Municipal Tax Liability Form - Ohio

Address Change/Municipal Tax Liability Form is a legal document that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio.

FAQ

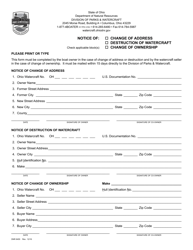

Q: What is the Address Change/Municipal Tax Liability Form?

A: The Address Change/Municipal Tax Liability Form is a document used in Ohio to update your address and assess your municipal tax liability.

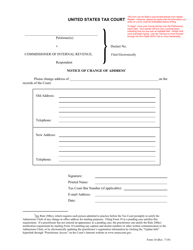

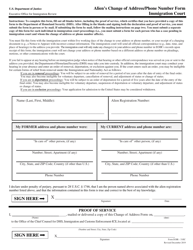

Q: What is the purpose of the Address Change section?

A: The purpose of the Address Change section is to update your address information with the municipal tax office so that they can contact you and send important tax-related correspondence.

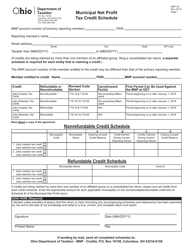

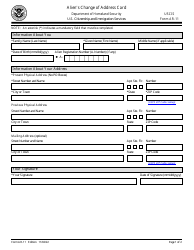

Q: What is the purpose of the Municipal Tax Liability section?

A: The purpose of the Municipal Tax Liability section is to determine the amount of municipal taxes you owe based on your income and other relevant factors.

Q: Do I need to fill out this form if I move within the same municipality?

A: Yes, you need to fill out this form if you move within the same municipality to ensure that your address is updated and your tax liability is correctly assessed.

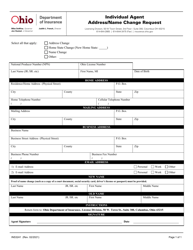

Q: What documents do I need to include with the form?

A: You may need to include proof of your new address, such as a utility bill or lease agreement, along with the completed form. Please check the specific requirements of your municipal tax office.

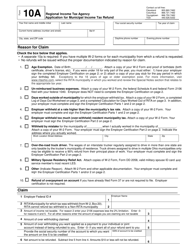

Form Details:

- The latest edition currently provided by the Ohio Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.