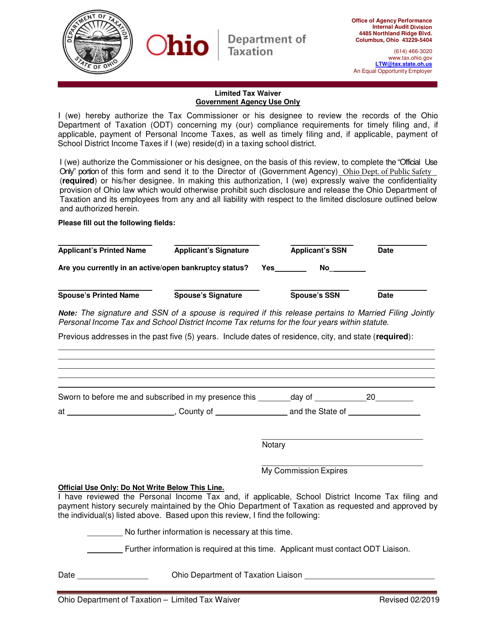

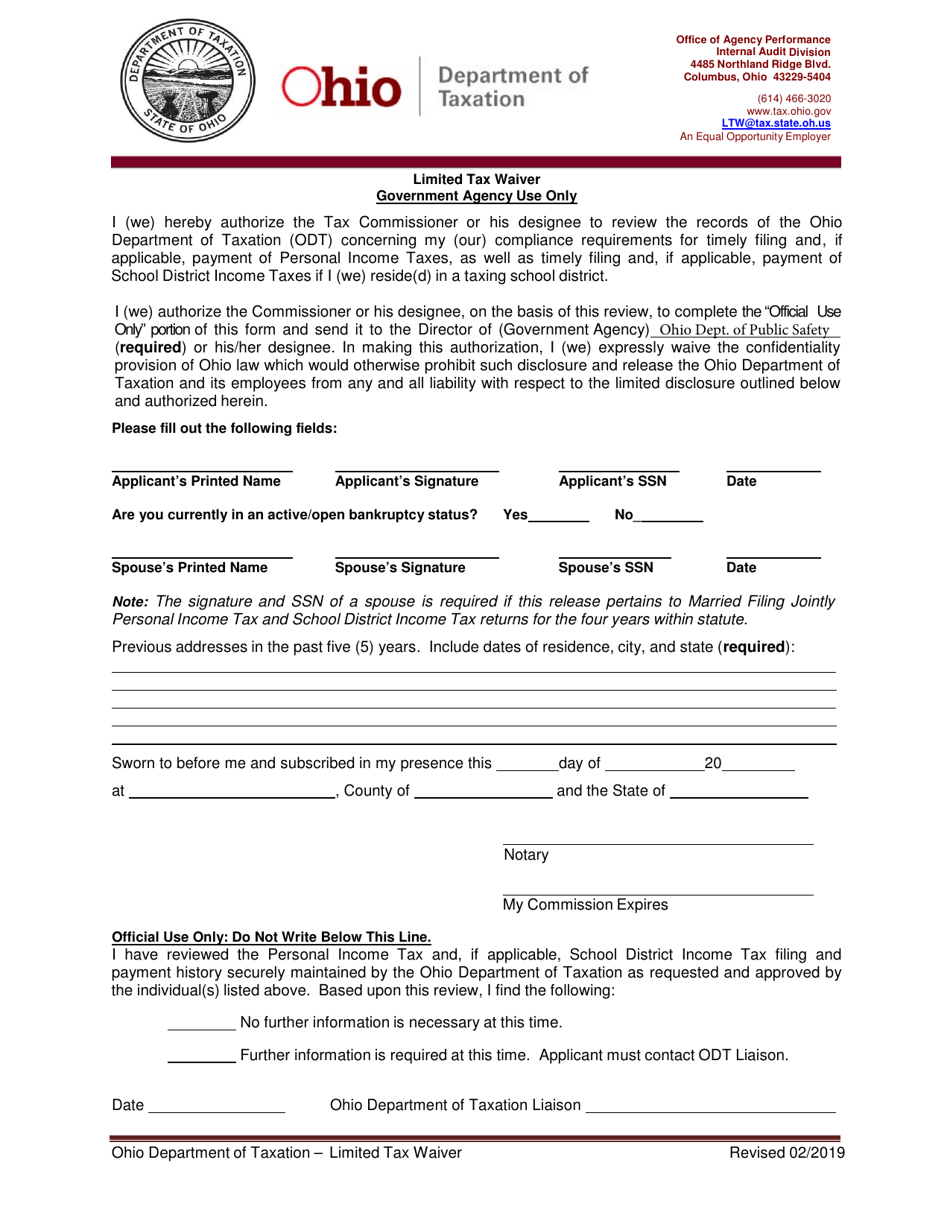

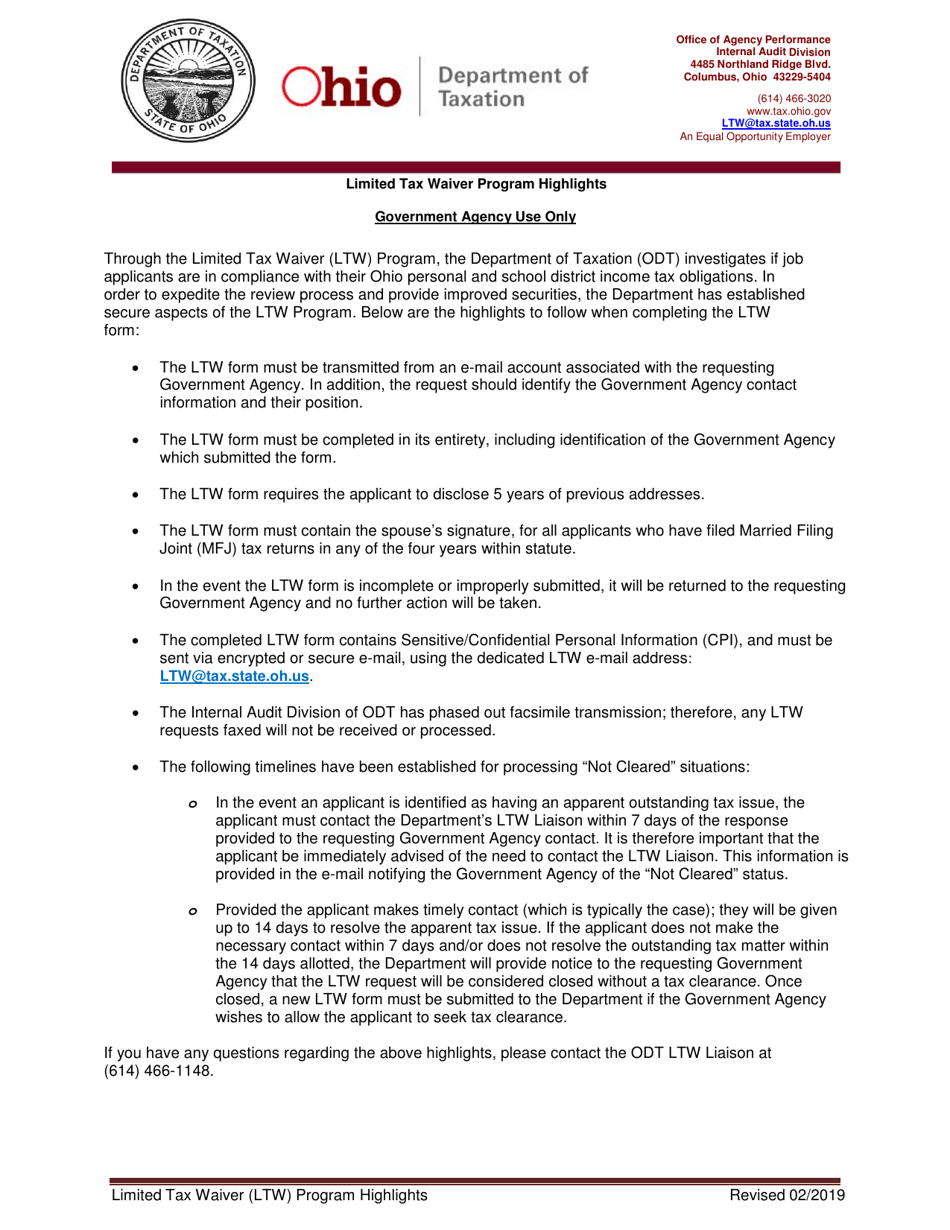

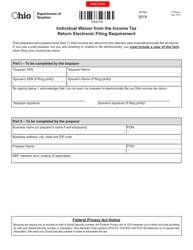

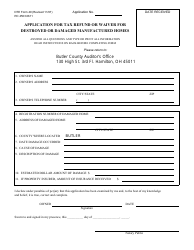

Limited Tax Waiver Form - Ohio

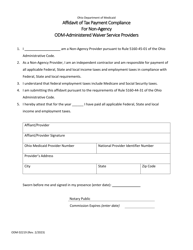

Limited Tax Waiver Form is a legal document that was released by the Ohio Department of Taxation - a government authority operating within Ohio.

FAQ

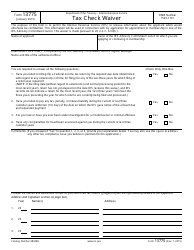

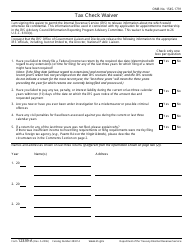

Q: What is a Limited Tax Waiver Form?

A: The Limited Tax Waiver Form is a document used in Ohio to request a waiver of property taxes for a specific period of time.

Q: Who can use the Limited Tax Waiver Form?

A: Property owners or their representatives can use the Limited Tax Waiver Form in Ohio.

Q: What is the purpose of the Limited Tax Waiver Form?

A: The form is used to request a temporary waiver of property taxes in specific situations, such as when a property is undergoing renovations or is uninhabitable.

Q: How long can a tax waiver be requested for?

A: The length of the tax waiver period varies and is determined by the county or municipality.

Q: What information is required on the Limited Tax Waiver Form?

A: The form typically requires information about the property owner, the property address, the reason for the tax waiver request, and supporting documentation.

Form Details:

- Released on February 1, 2019;

- The latest edition currently provided by the Ohio Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.