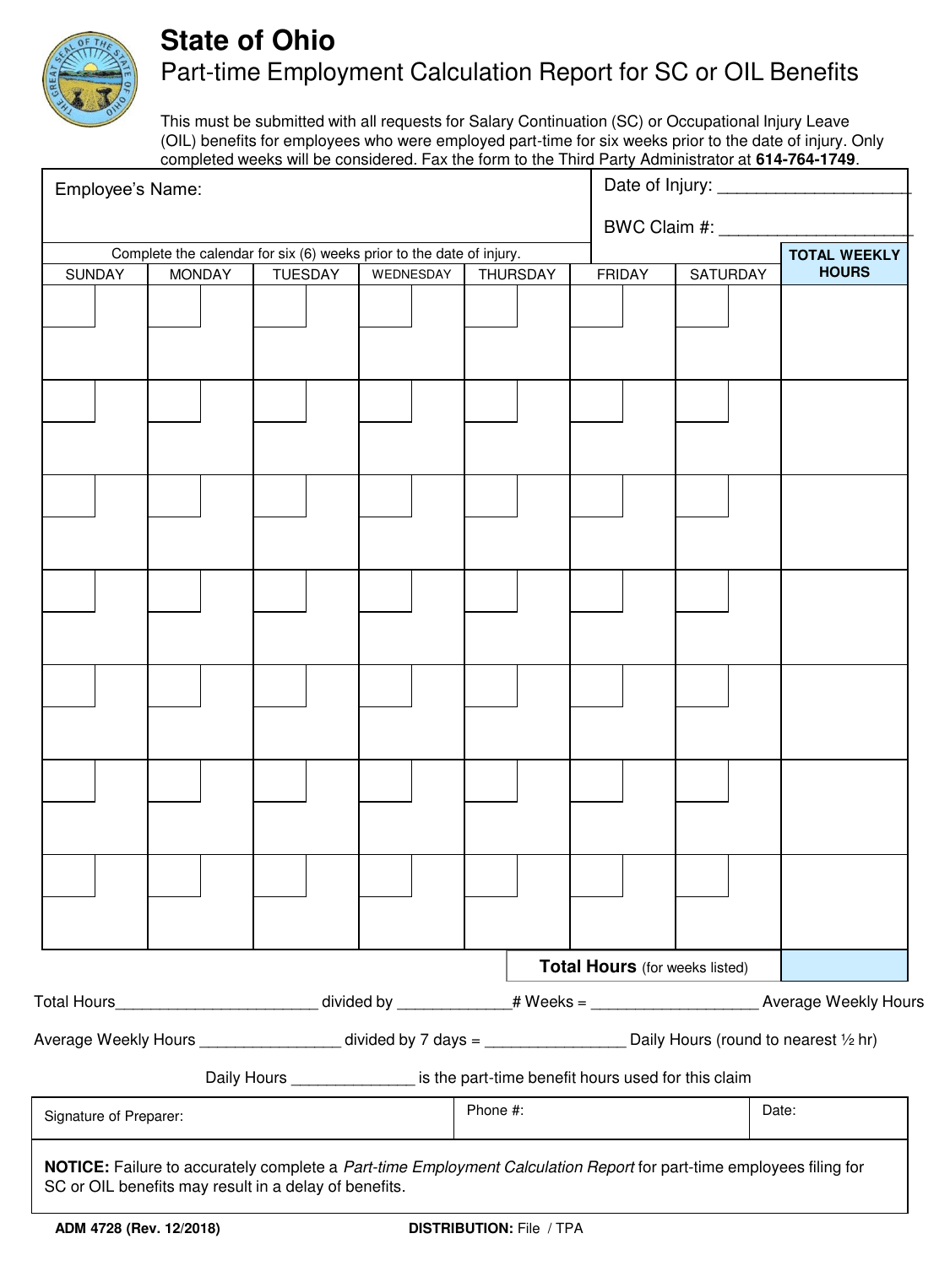

Form ADM4728 Part-Time Employment Calculation Report for Sc or Oil Benefits - Ohio

What Is Form ADM4728?

This is a legal form that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ADM4728 Form?

A: The ADM4728 Form is the Part-Time Employment Calculation Report for Sc or Oil Benefits in Ohio.

Q: What is the purpose of the ADM4728 Form?

A: The purpose of the ADM4728 Form is to report part-time employment and calculate eligibility for Sc or Oil Benefits in Ohio.

Q: Who needs to fill out the ADM4728 Form?

A: Individuals who are receiving Sc or Oil Benefits in Ohio and have part-time employment need to fill out the ADM4728 Form.

Q: What information is required on the ADM4728 Form?

A: The ADM4728 Form requires information such as the individual's personal details, details of their part-time employment, and income information.

Q: Is there a deadline to submit the ADM4728 Form?

A: Yes, there may be a deadline to submit the ADM4728 Form. It is advisable to check the instructions on the form or contact ODJFS for specific deadlines.

Q: What happens after I submit the ADM4728 Form?

A: After you submit the ADM4728 Form, ODJFS will review your information and calculate your eligibility for Sc or Oil Benefits based on your part-time employment.

Q: What should I do if I have questions about the ADM4728 Form?

A: If you have questions about the ADM4728 Form, you should contact the Ohio Department of Job and Family Services (ODJFS) for assistance.

Q: Are there any penalties for not submitting the ADM4728 Form?

A: Failure to submit the ADM4728 Form or providing false information may result in a loss of eligibility or other penalties. It is important to accurately complete and submit the form.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Ohio Department of Administrative Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADM4728 by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.