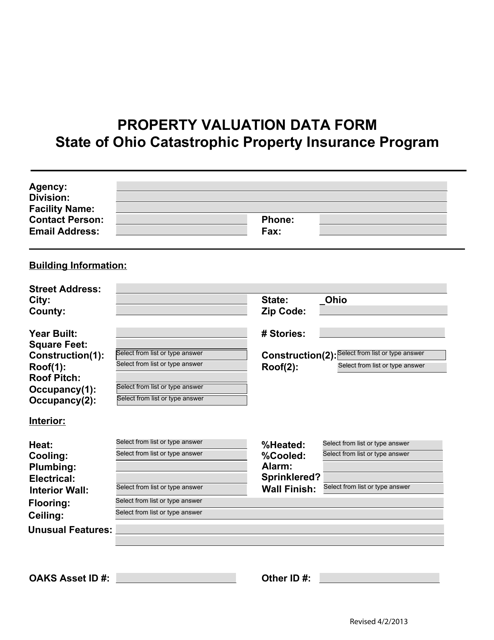

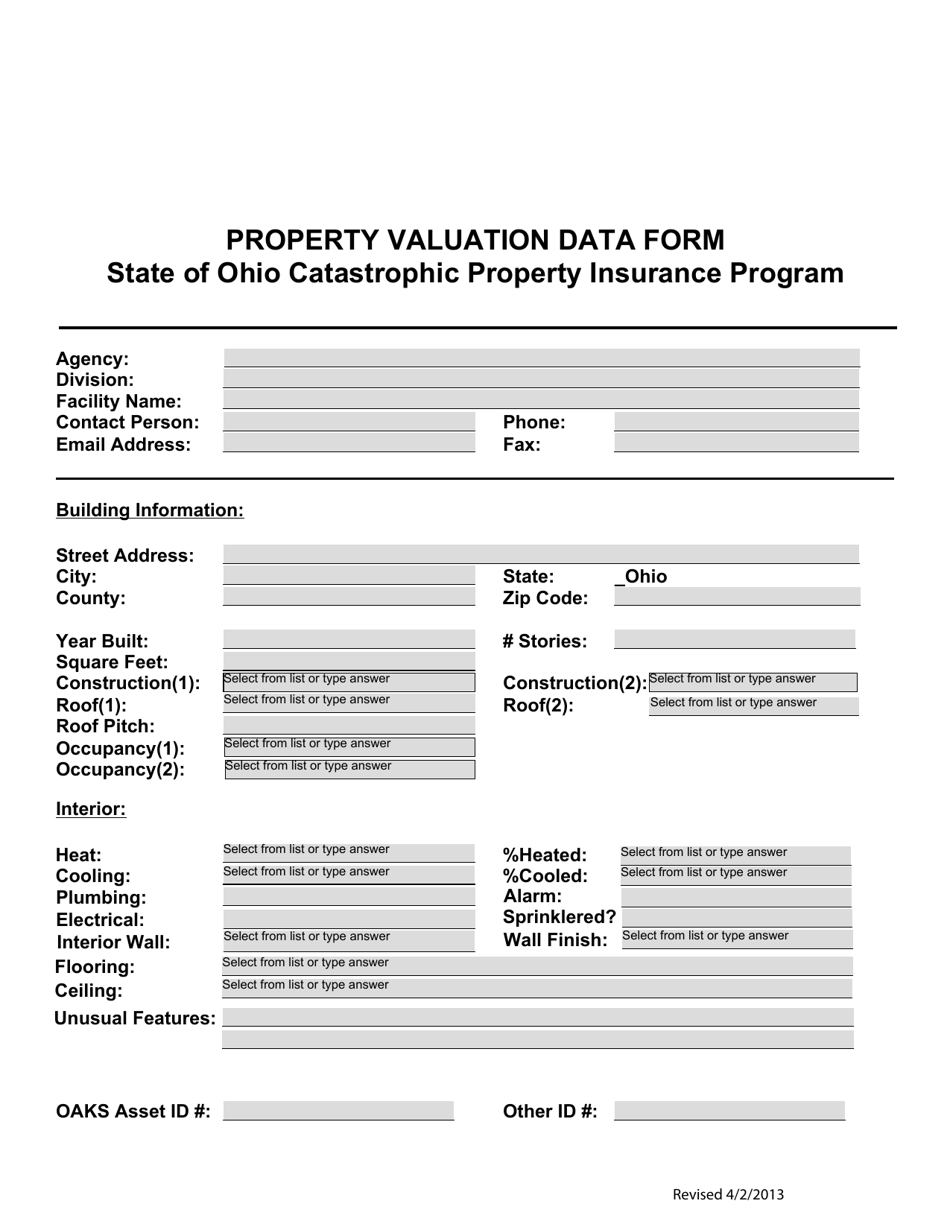

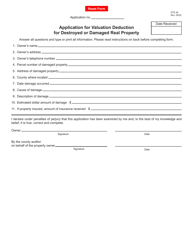

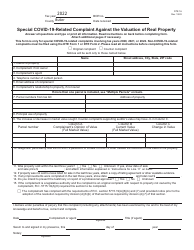

Property Valuation Data Form - Ohio

Property Valuation Data Form is a legal document that was released by the Ohio Department of Administrative Services - a government authority operating within Ohio.

FAQ

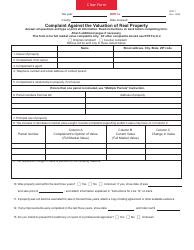

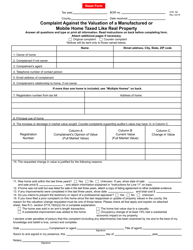

Q: What is a Property Valuation Data Form?

A: A Property Valuation Data Form is a document used to collect information about a property for tax assessment purposes.

Q: Why is a Property Valuation Data Form required in Ohio?

A: A Property Valuation Data Form is required in Ohio to help determine the estimated market value of a property for property tax purposes.

Q: Who is responsible for completing the Property Valuation Data Form?

A: The property owner is responsible for completing the Property Valuation Data Form in Ohio.

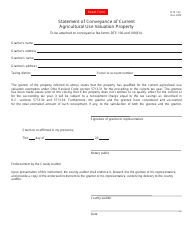

Q: What information is typically required on the Property Valuation Data Form?

A: The Property Valuation Data Form typically asks for information such as the property address, owner's name, number of rooms, square footage, and details about any improvements or changes made to the property.

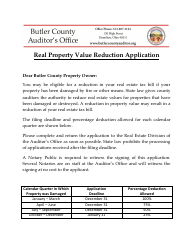

Q: When is the Property Valuation Data Form due in Ohio?

A: The due date for the Property Valuation Data Form varies by county in Ohio, but it is typically required to be submitted by the first week of March.

Q: What happens if the Property Valuation Data Form is not submitted?

A: If the Property Valuation Data Form is not submitted, the assessor's office may estimate the value of the property based on available information, which could lead to an inaccurate assessment and potentially higher property taxes.

Q: Can the information provided on the Property Valuation Data Form be changed?

A: Yes, the information provided on the Property Valuation Data Form can be updated or revised if there are changes to the property.

Q: Is the information on the Property Valuation Data Form confidential?

A: In Ohio, the information provided on the Property Valuation Data Form is generally considered public record and may be accessible to others, but certain exemptions may apply.

Q: Are there any penalties for not completing the Property Valuation Data Form accurately?

A: Failure to accurately complete the Property Valuation Data Form in Ohio may result in penalties, such as fines or increased property taxes.

Form Details:

- Released on April 2, 2013;

- The latest edition currently provided by the Ohio Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Administrative Services.