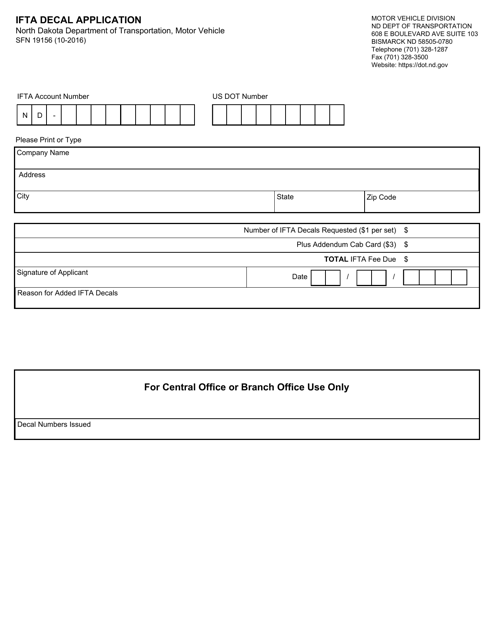

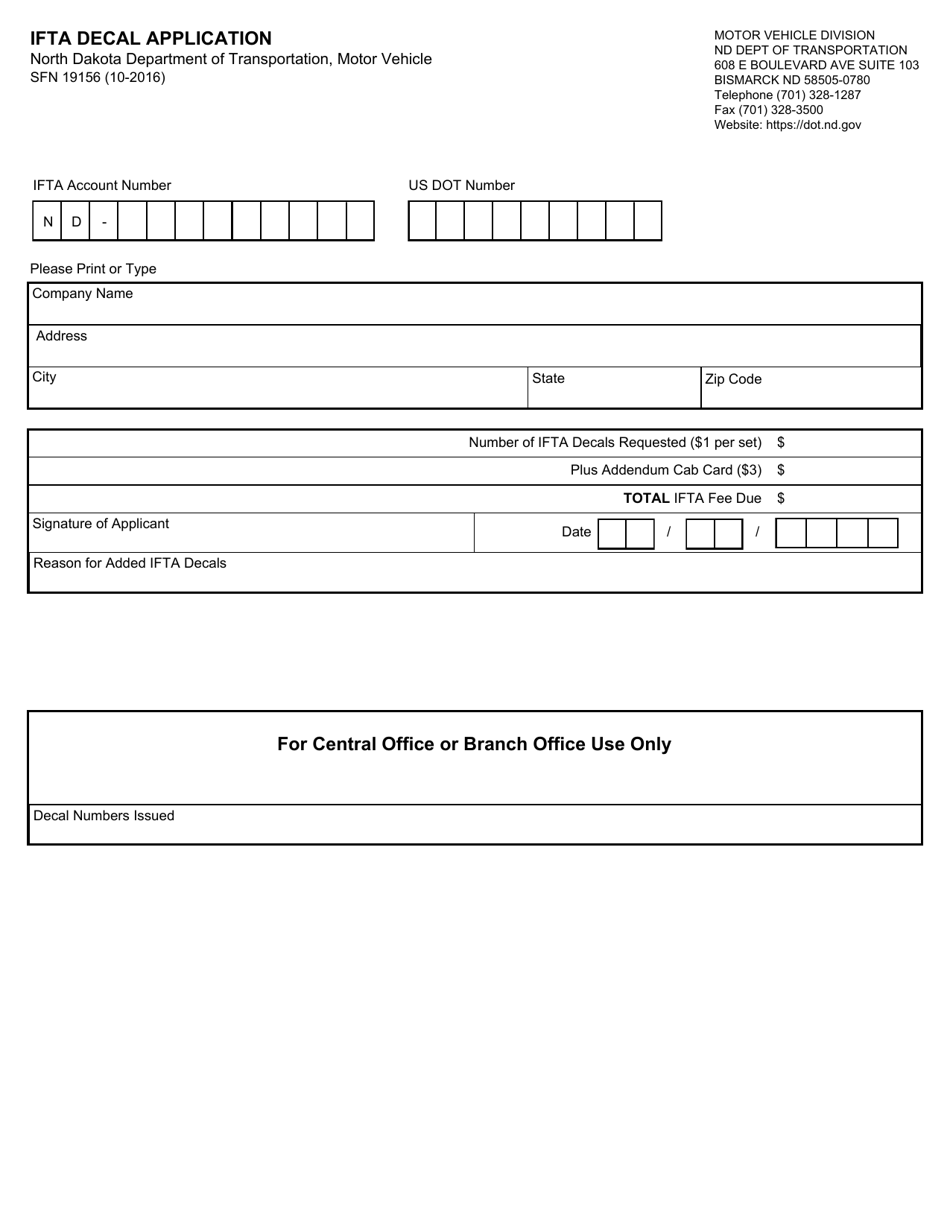

Form SFN19156 Ifta Decal Application - North Dakota

What Is Form SFN19156?

This is a legal form that was released by the North Dakota Department of Transportation - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN19156?

A: Form SFN19156 is the Ifta Decal Application form for North Dakota.

Q: What is IFTA?

A: IFTA stands for International Fuel Tax Agreement. It is a cooperative agreement between the lower 48 states of the United States and the Canadian provinces for the collection and distribution of fuel taxes paid by motor carriers.

Q: Who needs to fill out Form SFN19156?

A: Motor carriers based in North Dakota who operate qualified motor vehicles in more than one jurisdiction under the International Fuel Tax Agreement (IFTA) must fill out Form SFN19156.

Q: What is the purpose of Form SFN19156?

A: The purpose of Form SFN19156 is to apply for IFTA decals for qualified motor vehicles.

Q: What information is required on Form SFN19156?

A: Form SFN19156 requires information such as the name of the account holder, the company name, vehicle details, and payment information.

Q: When should Form SFN19156 be submitted?

A: Form SFN19156 should be submitted at least 15 days prior to the desired effective date.

Q: Is there a fee for applying for IFTA decals?

A: Yes, there is a fee associated with applying for IFTA decals. The fee amount may vary, so it is best to contact the North Dakota Motor Vehicle Division for the current fee schedule.

Q: Are there any additional requirements for IFTA decal applicants?

A: Yes, applicants must have a valid IFTA license and provide proof of liability insurance coverage.

Form Details:

- Released on October 14, 2016;

- The latest edition provided by the North Dakota Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN19156 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Transportation.