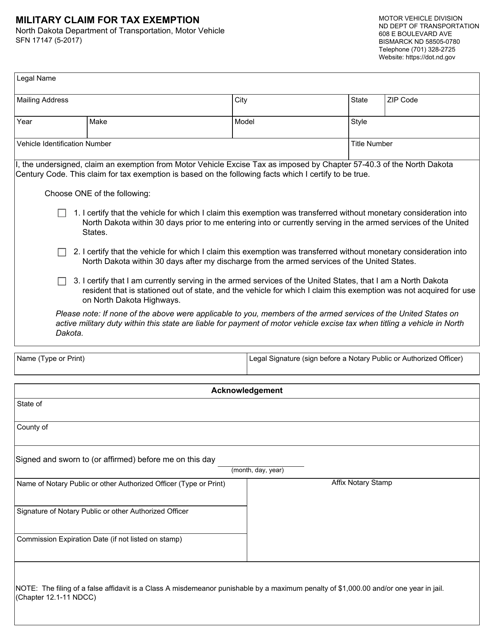

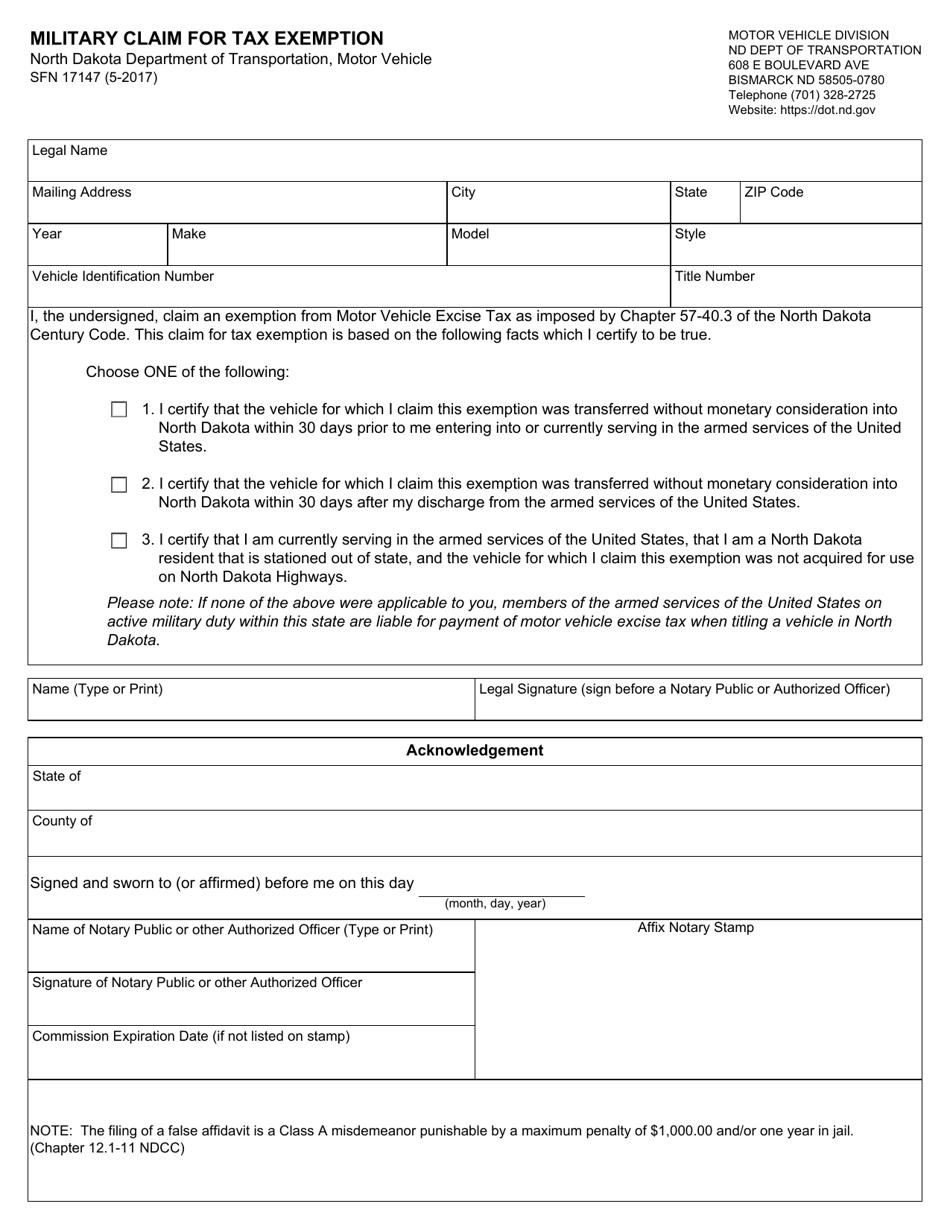

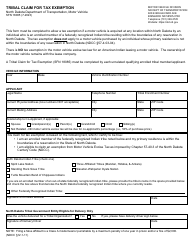

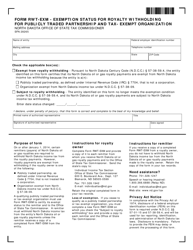

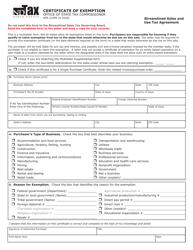

Form SFN17147 Military Claim for Tax Exemption - North Dakota

What Is Form SFN17147?

This is a legal form that was released by the North Dakota Department of Transportation - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN17147?

A: Form SFN17147 is a Military Claim for Tax Exemption form.

Q: Who can use Form SFN17147?

A: Members of the military who are stationed in North Dakota and qualify for tax exemptions can use Form SFN17147.

Q: What is the purpose of Form SFN17147?

A: The purpose of Form SFN17147 is to claim tax exemption for eligible military personnel in North Dakota.

Q: What information is required on Form SFN17147?

A: Form SFN17147 requires information such as the military member's name, contact information, military status, and details on their military orders.

Q: When should I submit Form SFN17147?

A: Form SFN17147 should be submitted to the North Dakota Department of Revenue prior to the tax due date for the applicable tax year.

Q: What kind of tax exemptions does Form SFN17147 cover?

A: Form SFN17147 covers exemptions for income tax, sales tax, use tax, and motor vehicle excise tax.

Q: Can I claim tax exemption for previous years using Form SFN17147?

A: No, Form SFN17147 can only be used to claim exemptions for the current tax year.

Q: Are there any specific eligibility criteria to use Form SFN17147?

A: Yes, military personnel must meet certain criteria, such as being stationed in North Dakota and having valid military orders.

Form Details:

- Released on May 24, 2017;

- The latest edition provided by the North Dakota Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN17147 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Transportation.