This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN58965

for the current year.

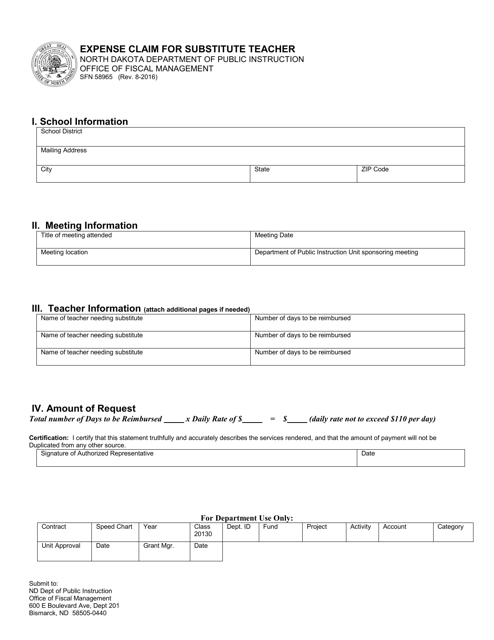

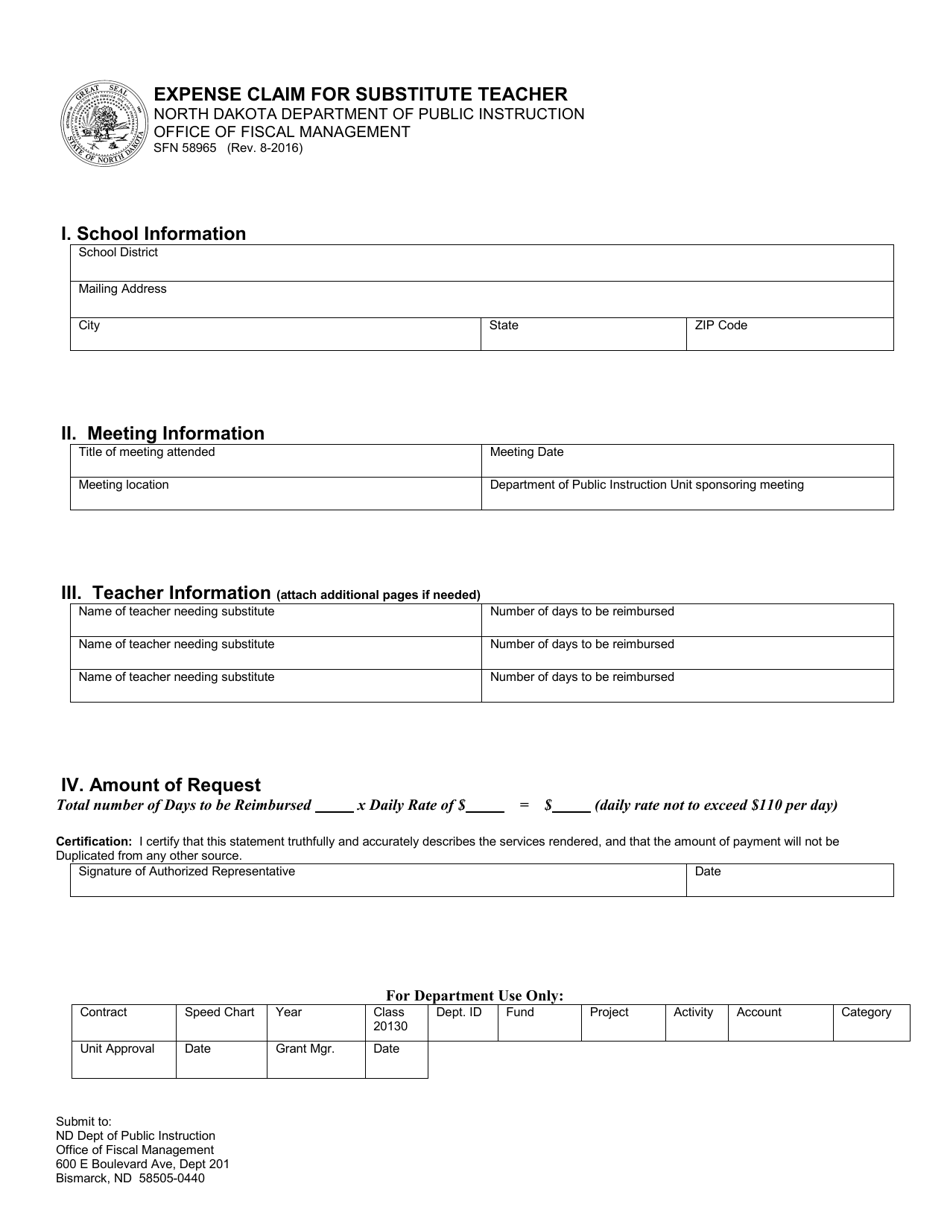

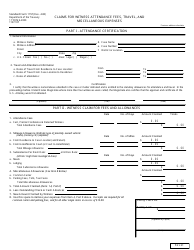

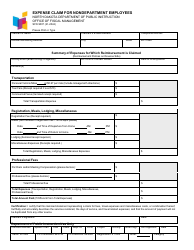

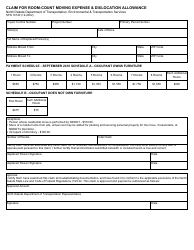

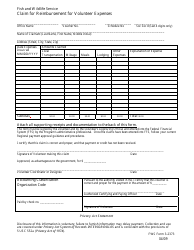

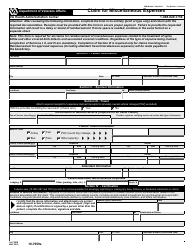

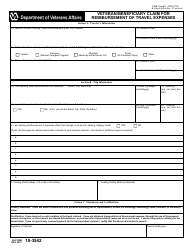

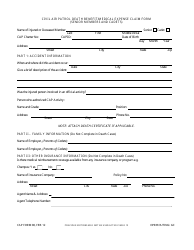

Form SFN58965 Expense Claim for Substitute Teacher - North Dakota

What Is Form SFN58965?

This is a legal form that was released by the North Dakota Department of Public Instruction - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN58965?

A: Form SFN58965 is an Expense Claim form used by substitute teachers in North Dakota.

Q: Who uses Form SFN58965?

A: Substitute teachers in North Dakota use Form SFN58965 to claim their expenses.

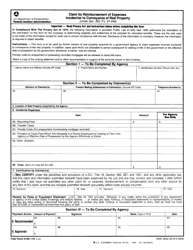

Q: What expenses can be claimed using Form SFN58965?

A: Expenses related to substitute teaching, such as travel expenses and supply costs, can be claimed using Form SFN58965.

Q: How do I fill out Form SFN58965?

A: You should fill out Form SFN58965 by providing your personal information, details of your expenses, and any required supporting documentation.

Q: Are there any deadlines for submitting Form SFN58965?

A: It is recommended to submit Form SFN58965 within a reasonable time frame after incurring the expenses, but specific deadlines may vary.

Q: Who do I submit Form SFN58965 to?

A: Form SFN58965 should be submitted to the appropriate authority or office designated by the North Dakota Department of Public Instruction.

Q: Can I claim expenses for substitute teaching in other states using Form SFN58965?

A: No, Form SFN58965 is specifically for substitute teachers in North Dakota. If you teach in other states, you will need to comply with their respective expense claim processes.

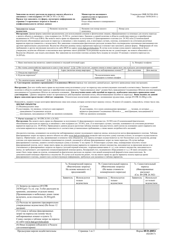

Q: Are there any specific rules or guidelines for reimbursable expenses?

A: Yes, the North Dakota Department of Public Instruction may have specific rules or guidelines regarding reimbursable expenses. It is recommended to refer to the instructions or contact the department for more information.

Q: Is there a limit to the amount of expenses that can be claimed?

A: The North Dakota Department of Public Instruction may have limits or restrictions on the amount of expenses that can be claimed. Please refer to the instructions or contact the department for more information.

Q: Can I claim expenses for non-teaching-related activities?

A: Form SFN58965 is typically used for expenses directly related to substitute teaching. Non-teaching-related activities may not be eligible for reimbursement. It is recommended to review the guidelines provided by the North Dakota Department of Public Instruction.

Q: What should I do if my expenses are not approved for reimbursement?

A: If your expenses are not approved for reimbursement, you may need to follow up with the North Dakota Department of Public Instruction for clarification or additional information.

Q: Can I submit multiple expense claims using Form SFN58965?

A: Yes, you can submit multiple expense claims using Form SFN58965. Each claim should be accompanied by the necessary documentation and comply with the guidelines provided by the North Dakota Department of Public Instruction.

Q: Is there a time limit for submitting expense claims?

A: While there may not be a specific time limit mentioned, it is recommended to submit expense claims in a timely manner, preferably within a reasonable period after incurring the expenses.

Q: Can I claim expenses for substitute teaching in previous years?

A: The eligibility of claiming expenses for previous years may vary. It is recommended to consult the guidelines or contact the North Dakota Department of Public Instruction for specific information on retroactive claims.

Q: Can I claim expenses for substitute teaching if I am not a certified teacher?

A: The eligibility criteria for claiming expenses as a substitute teacher may depend on the requirements of the North Dakota Department of Public Instruction. It is advisable to refer to the guidelines or seek clarification from the department.

Q: What should I do if I need assistance in filling out Form SFN58965?

A: If you need assistance in filling out Form SFN58965, you can reach out to the North Dakota Department of Public Instruction or the designated office for support.

Q: Are there any specific requirements for supporting documentation?

A: The North Dakota Department of Public Instruction may have specific requirements for supporting documentation. It is advisable to review the instructions or contact the department for guidance.

Q: Can Form SFN58965 be submitted electronically?

A: The acceptance of electronic submission for Form SFN58965 may vary. It is recommended to check the instructions or contact the North Dakota Department of Public Instruction for guidance on submission methods.

Q: What should I do if there are errors or changes needed in a submitted Form SFN58965?

A: If there are errors or changes needed in a submitted Form SFN58965, you should contact the North Dakota Department of Public Instruction or the designated office to inquire about the appropriate steps to rectify the situation.

Q: Can I claim expenses for substitute teaching if I am an independent contractor?

A: The eligibility for claiming expenses as an independent contractor substitute teacher may depend on the specific arrangements and requirements set by the North Dakota Department of Public Instruction. It is recommended to review the guidelines or seek clarification from the department.

Q: Are there any tax implications for claimed expenses?

A: The tax implications of claimed expenses may depend on state and federal tax laws. It is advisable to consult with a tax professional or the North Dakota Department of Public Instruction for information specific to your situation.

Q: Can I claim expenses for substitute teaching if I am employed by a school district?

A: The eligibility for claiming expenses as a substitute teacher employed by a school district may depend on the specific policies and guidelines of the North Dakota Department of Public Instruction. It is recommended to review the instructions or seek clarification from the department.

Q: What should I do if I have additional questions not covered in the instructions?

A: If you have additional questions not covered in the instructions, you can contact the North Dakota Department of Public Instruction or the designated office for further assistance.

Q: Is there a fee for submitting Form SFN58965?

A: There is no specific mention of a fee for submitting Form SFN58965. It is recommended to review the instructions or contact the North Dakota Department of Public Instruction for information on any associated fees.

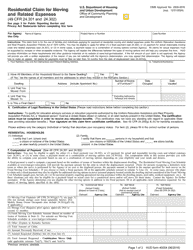

Q: Can I claim mileage expenses as a substitute teacher?

A: Mileage expenses may generally be eligible for reimbursement as a substitute teacher. However, specific rules and rates may apply. It is recommended to review the guidelines or contact the North Dakota Department of Public Instruction for more information.

Q: Can I claim expenses for professional development as a substitute teacher?

A: The eligibility of claiming expenses for professional development may depend on the guidelines and policies of the North Dakota Department of Public Instruction. It is advisable to review the instructions or seek clarification from the department.

Q: Can I claim expenses for classroom supplies as a substitute teacher?

A: Expenses for classroom supplies may generally be eligible for reimbursement as a substitute teacher. However, specific rules and documentation requirements may apply. It is recommended to review the guidelines or contact the North Dakota Department of Public Instruction for more information.

Q: What should I do if my expense claim is denied?

A: If your expense claim is denied, you may need to follow up with the North Dakota Department of Public Instruction or the designated office for clarification or to appeal the decision.

Q: Can I claim expenses for meals during substitute teaching?

A: The eligibility for claiming expenses for meals may depend on the specific guidelines and policies of the North Dakota Department of Public Instruction. It is advisable to refer to the instructions or seek clarification from the department.

Q: Can I claim expenses for lodging during substitute teaching?

A: The eligibility for claiming expenses for lodging may depend on the specific guidelines and policies of the North Dakota Department of Public Instruction. It is recommended to review the instructions or contact the department for more information.

Q: Can I claim expenses for parking during substitute teaching?

A: The eligibility for claiming expenses for parking may depend on the specific guidelines and policies of the North Dakota Department of Public Instruction. It is advisable to refer to the instructions or seek clarification from the department.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the North Dakota Department of Public Instruction;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFN58965 by clicking the link below or browse more documents and templates provided by the North Dakota Department of Public Instruction.