This version of the form is not currently in use and is provided for reference only. Download this version of

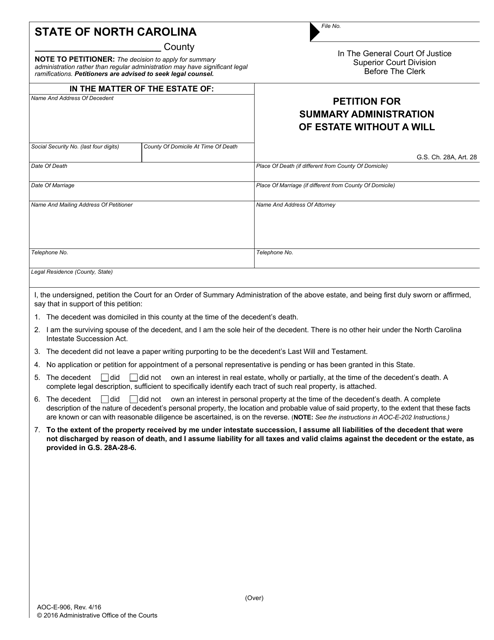

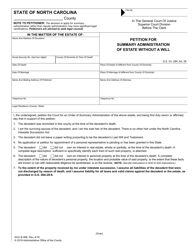

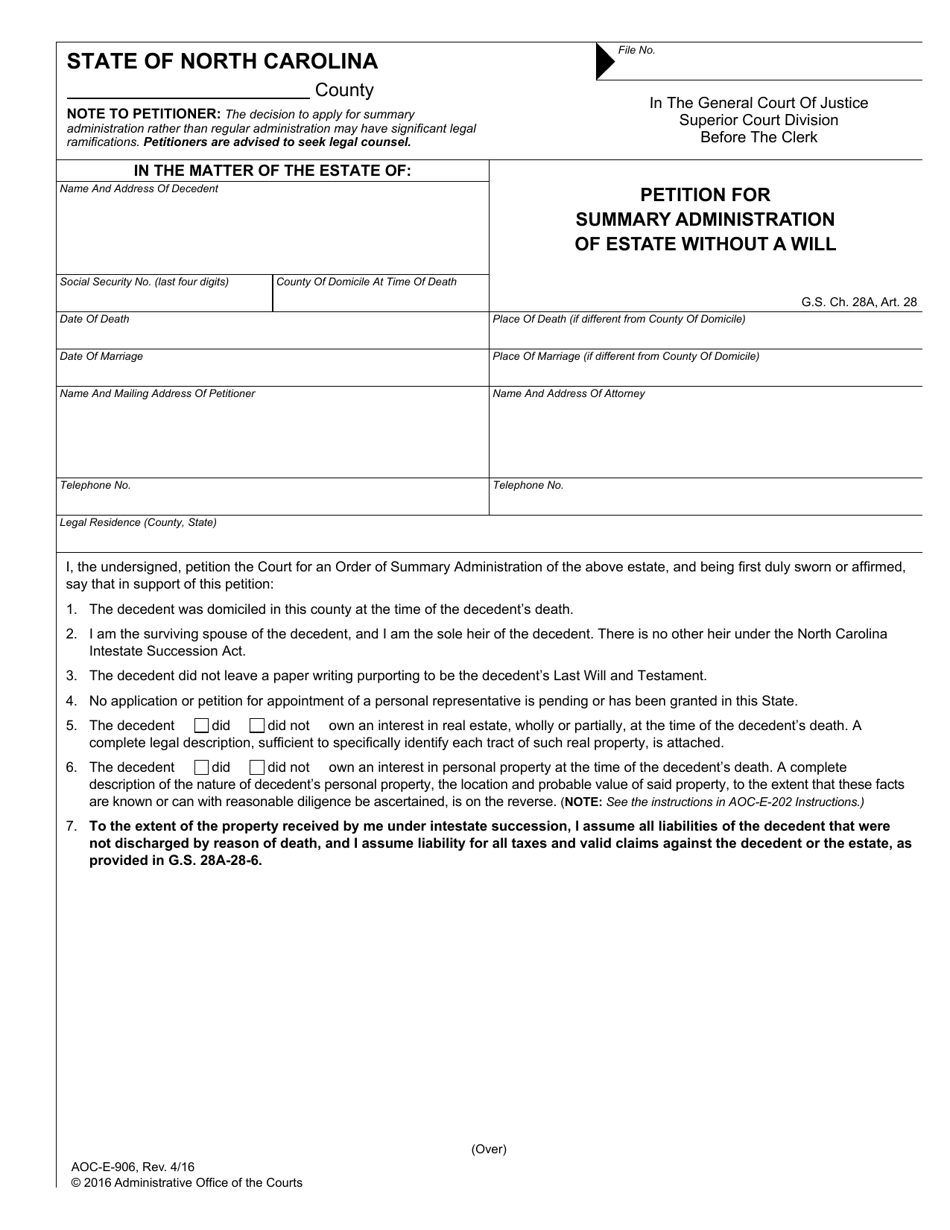

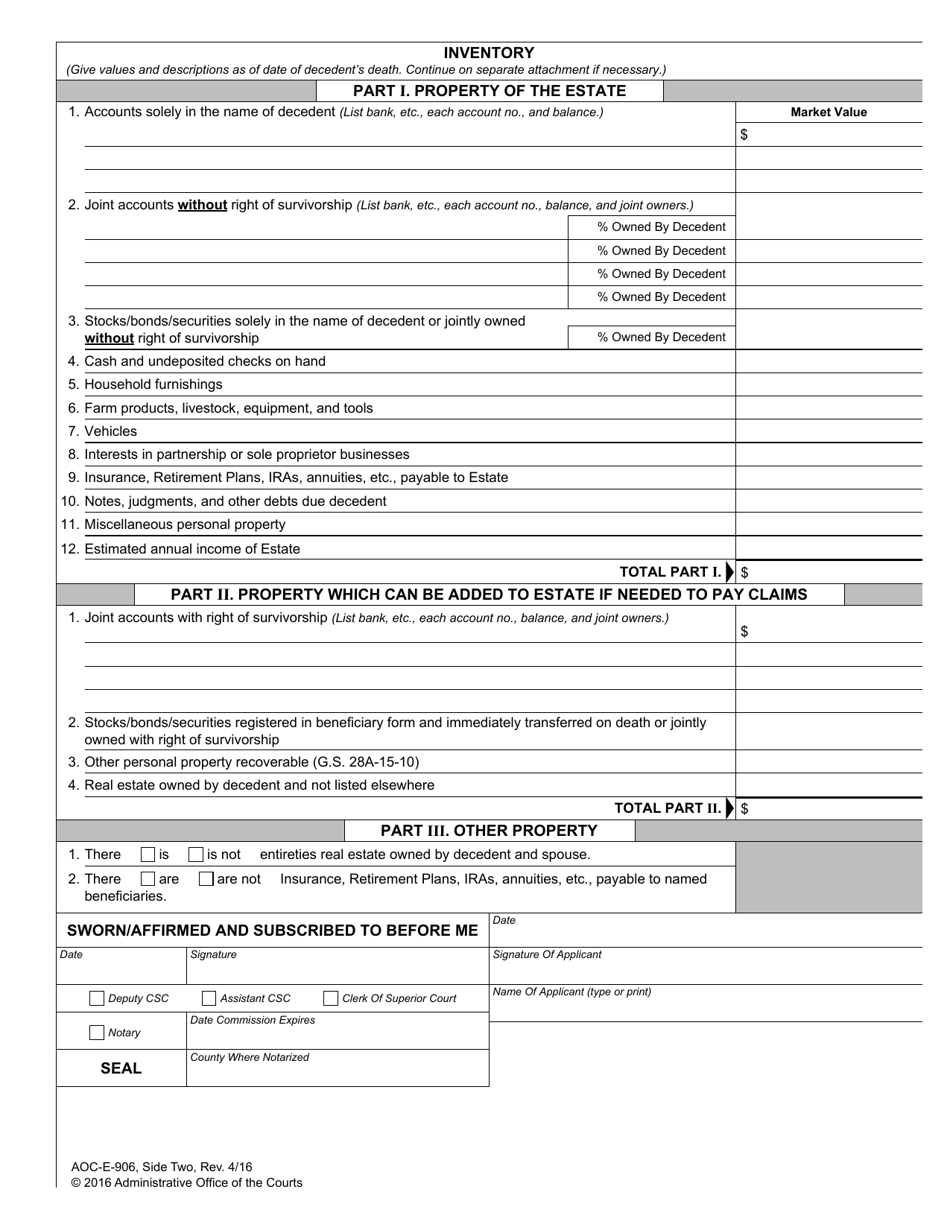

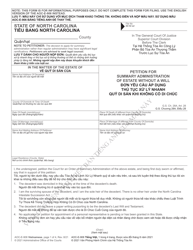

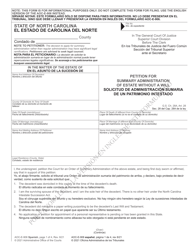

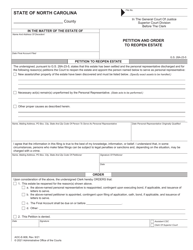

Form AOC-E-906

for the current year.

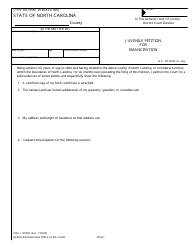

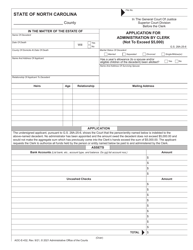

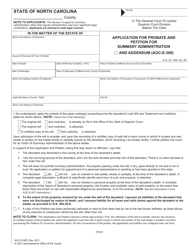

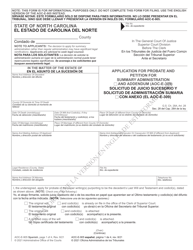

Form AOC-E-906 Petition for Summary Administration of Estate Without a Will - North Carolina

What Is Form AOC-E-906?

This is a legal form that was released by the North Carolina Court System - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AOC-E-906?

A: Form AOC-E-906 is a petition used in North Carolina to request summary administration of an estate without a will.

Q: When is Form AOC-E-906 used?

A: Form AOC-E-906 is used when someone passes away without a will and their estate is eligible for summary administration.

Q: What is summary administration of an estate?

A: Summary administration is a simplified probate process that can be used when the value of the estate is below a certain threshold.

Q: Who can file Form AOC-E-906?

A: Generally, the surviving spouse or next of kin can file Form AOC-E-906 to request summary administration.

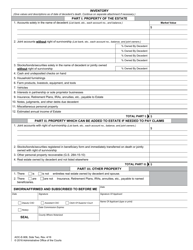

Q: What information is needed to complete Form AOC-E-906?

A: The form requires information about the deceased person, their estate, and the petitioner. It may also require additional supporting documents.

Q: Are there any fees for filing Form AOC-E-906?

A: Yes, there may be filing fees associated with filing Form AOC-E-906. The specific fees can vary, so it's best to check with the probate court.

Q: What happens after filing Form AOC-E-906?

A: After filing Form AOC-E-906, a hearing will be scheduled to review the petition. If approved, the court will issue an order for summary administration.

Q: Is legal representation required to file Form AOC-E-906?

A: While legal representation is not required, it can be helpful to consult with an attorney familiar with probate laws to navigate the process.

Q: Can Form AOC-E-906 be used for all estates without a will?

A: No, Form AOC-E-906 can only be used for estates that meet the eligibility criteria for summary administration in North Carolina.

Q: What other options are available for administering an estate without a will?

A: If an estate does not meet the eligibility criteria for summary administration, other probate processes such as regular administration or heirship proceedings may need to be pursued.

Q: Can I contest the summary administration of an estate if I disagree with it?

A: Yes, if you have legal grounds, you may contest the summary administration of an estate through the appropriate legal channels.

Q: Is Form AOC-E-906 specific to North Carolina?

A: Yes, Form AOC-E-906 is specific to North Carolina and should be used for estates in that state only.

Q: Can I use Form AOC-E-906 for a will contest or dispute?

A: No, Form AOC-E-906 is not used for will contests or disputes. It is specifically for the administration of estates without a will.

Q: How long does the summary administration process typically take?

A: The length of time for the summary administration process can vary depending on various factors, such as the complexity of the estate and the court's schedule.

Q: Can I file Form AOC-E-906 if the deceased person had debts?

A: Yes, you can still file Form AOC-E-906 even if the deceased person had debts. However, the payment of debts may need to be addressed during the probate process.

Q: What should I do if I need help with Form AOC-E-906?

A: If you need help with Form AOC-E-906, consider seeking guidance from an attorney or contacting the probate court in North Carolina.

Q: Is there a deadline for filing Form AOC-E-906?

A: While there may not be a strict deadline, it is generally recommended to file Form AOC-E-906 within a reasonable timeframe after the death of the individual.

Q: Can I file Form AOC-E-906 if there is a dispute among the heirs?

A: If there is a dispute among the heirs, it may be necessary to resolve the dispute before or during the summary administration process. In some cases, a different probate process may be more appropriate.

Q: What happens to the assets of the estate after summary administration?

A: After summary administration, the assets of the estate are typically distributed to the rightful heirs or beneficiaries according to the court's order.

Q: Can I use Form AOC-E-906 if the deceased person owned real estate?

A: Yes, Form AOC-E-906 can be used even if the deceased person owned real estate. However, additional documentation and processes may be required for the transfer of real estate.

Q: Can I use Form AOC-E-906 for a small estate in North Carolina?

A: Yes, Form AOC-E-906 can be used for small estates in North Carolina that meet the eligibility criteria for summary administration.

Q: What is the purpose of Form AOC-E-906?

A: The purpose of Form AOC-E-906 is to initiate the process of summary administration for estates without a will in North Carolina.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding tax obligations?

A: Yes, if the deceased person had outstanding tax obligations, those obligations should be addressed during the probate process. Consult the appropriate tax authorities for guidance.

Q: Is the information provided in Form AOC-E-906 confidential?

A: The information provided in Form AOC-E-906 is generally a matter of public record and may be accessible to interested parties.

Q: Can Form AOC-E-906 be used for trusts?

A: No, Form AOC-E-906 is specifically for estates without a will and cannot be used for trusts.

Q: What is the role of the court in the summary administration process?

A: The court reviews the petition and supporting documents, conducts a hearing if necessary, and issues an order for summary administration if appropriate.

Q: What if I made a mistake on Form AOC-E-906?

A: If you made a mistake on Form AOC-E-906, you may need to consult with an attorney or contact the probate court for guidance on how to correct the mistake.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding loans?

A: Yes, if the deceased person had outstanding loans, the loans may need to be addressed during the probate process. Consult with the appropriate creditors for guidance.

Q: What are the benefits of summary administration?

A: The benefits of summary administration include a simplified probate process, lower costs, and shorter timeframes for distribution of the estate's assets.

Q: Can I use Form AOC-E-906 if the deceased person had minor children?

A: If the deceased person had minor children, additional considerations and proceedings may be necessary. Consult with an attorney or the probate court for guidance.

Q: What happens if Form AOC-E-906 is not approved?

A: If Form AOC-E-906 is not approved, other probate processes may need to be pursued to administer the estate without a will.

Q: Can I use Form AOC-E-906 if the deceased person had joint assets with another person?

A: Yes, Form AOC-E-906 can be used even if the deceased person had joint assets with another person. However, the specific ownership rights and obligations will need to be considered.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding debts?

A: Yes, you can still use Form AOC-E-906 even if the deceased person had outstanding debts. The payment of debts may need to be addressed during the probate process.

Q: Can I use Form AOC-E-906 if the deceased person had a small business?

A: If the deceased person had a small business, additional considerations and proceedings may be necessary. It is recommended to consult with an attorney.

Q: Is the assistance of an attorney required to complete Form AOC-E-906?

A: While the assistance of an attorney is not required, it can be beneficial to consult with an attorney familiar with probate laws to ensure proper completion of Form AOC-E-906.

Q: Can I file Form AOC-E-906 if the deceased person had outstanding medical bills?

A: Yes, if the deceased person had outstanding medical bills, those bills may need to be addressed during the probate process. Consult with the medical service providers for guidance.

Q: Can I use Form AOC-E-906 if the deceased person had assets in multiple states?

A: If the deceased person had assets in multiple states, additional considerations and proceedings may be necessary. It is recommended to consult with an attorney.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding child support obligations?

A: Yes, if the deceased person had outstanding child support obligations, those obligations may need to be addressed during the probate process. Consult with the appropriate authorities for guidance.

Q: Can I use Form AOC-E-906 if the deceased person owed taxes?

A: Yes, if the deceased person owed taxes, the tax obligations should be addressed during the probate process. Consult the appropriate tax authorities for guidance.

Q: Is Form AOC-E-906 the only document needed for summary administration?

A: No, in addition to Form AOC-E-906, you may need to provide supporting documents such as death certificates, inventories, and other relevant records.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding credit card debts?

A: Yes, if the deceased person had outstanding credit card debts, those debts may need to be addressed during the probate process. Consult with the credit card companies for guidance.

Q: What is the cost associated with filing Form AOC-E-906?

A: The cost associated with filing Form AOC-E-906 can vary depending on the specific filing fees set by the probate court.

Q: Can I file Form AOC-E-906 if the deceased person had outstanding mortgage payments?

A: Yes, if the deceased person had outstanding mortgage payments, those payments may need to be addressed during the probate process. Consult with the mortgage lender for guidance.

Q: Can I use Form AOC-E-906 if the deceased person had outstanding utility bills?

A: Yes, if the deceased person had outstanding utility bills, those bills may need to be addressed during the probate process. Consult with the utility companies for guidance.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the North Carolina Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AOC-E-906 by clicking the link below or browse more documents and templates provided by the North Carolina Court System.