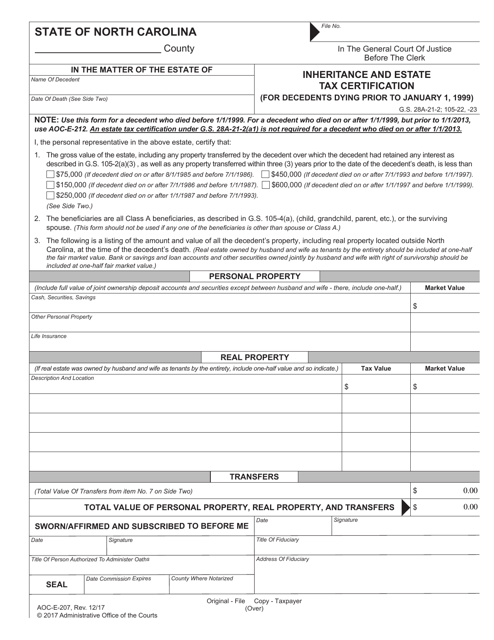

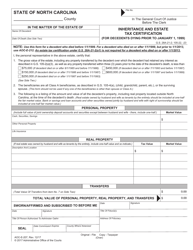

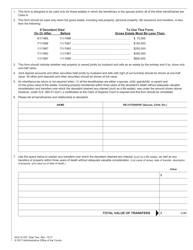

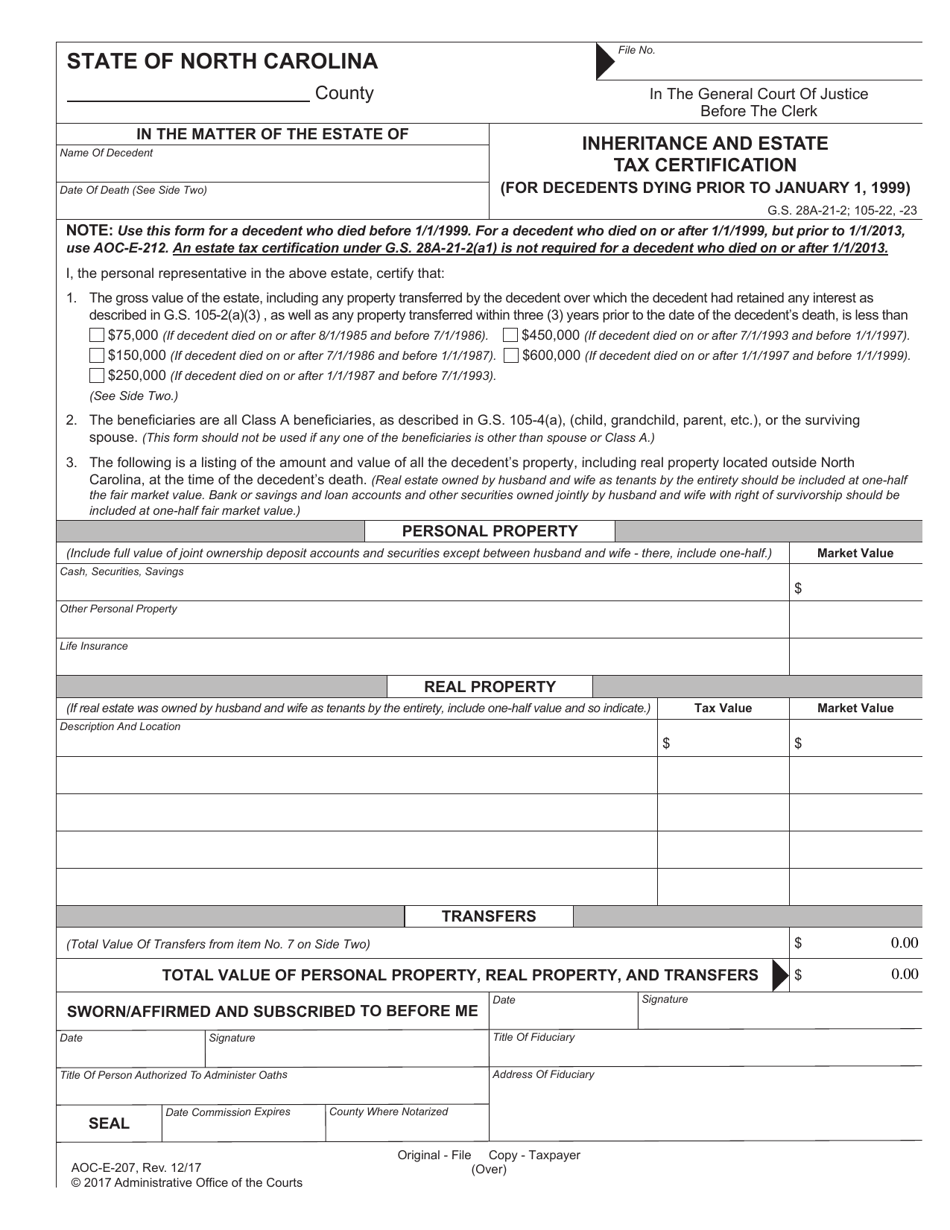

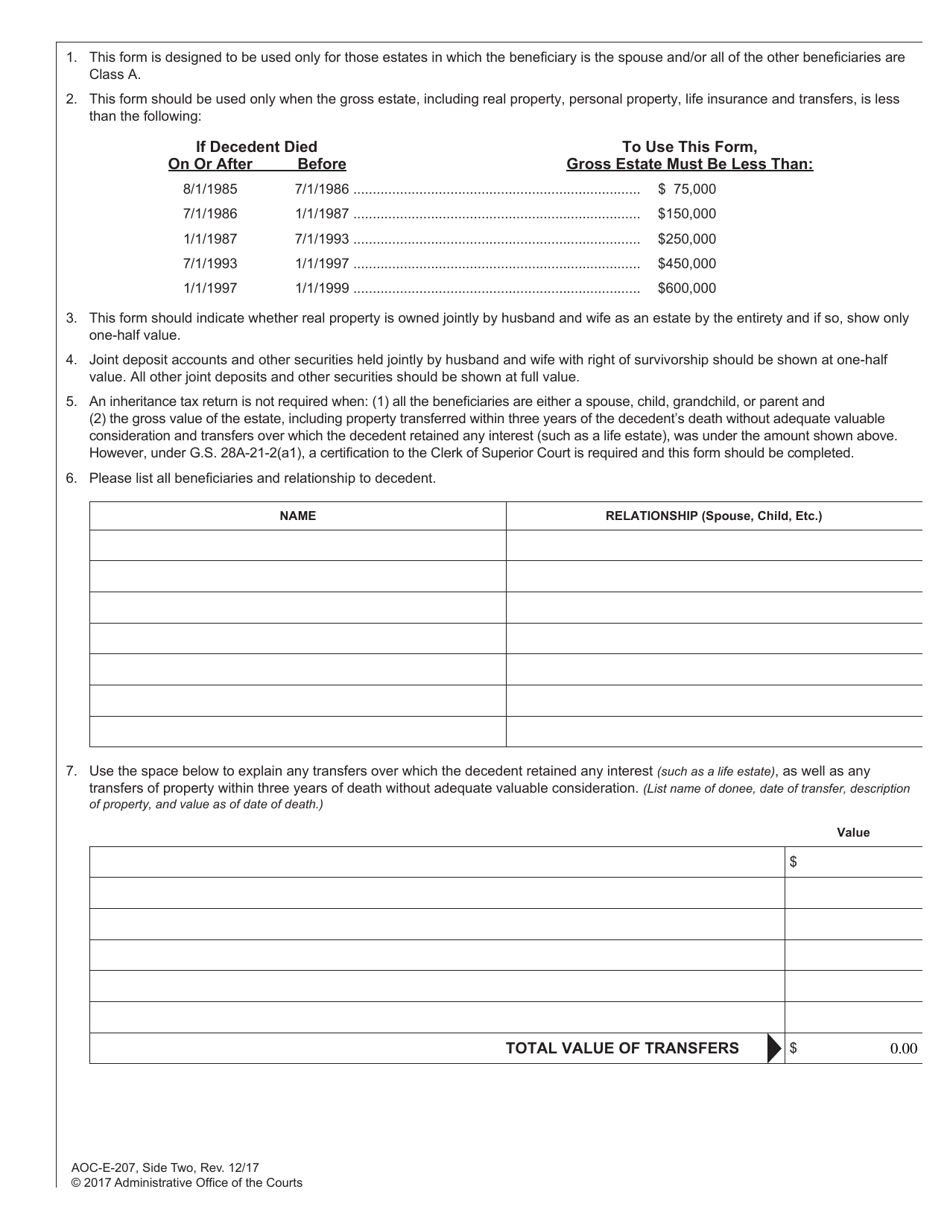

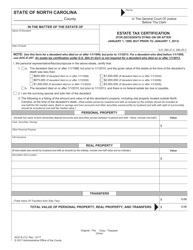

Form AOC-E-207 Inheritance and Estate Tax Certification (For Decedents Dying Prior to January 1, 1999) - North Carolina

What Is Form AOC-E-207?

This is a legal form that was released by the North Carolina Court System - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AOC-E-207?

A: Form AOC-E-207 is the Inheritance and Estate Tax Certification form for decedents who died before January 1, 1999, in North Carolina.

Q: Who needs to fill out this form?

A: This form needs to be completed by the executor or personal representative of the decedent's estate.

Q: What is the purpose of this form?

A: The purpose of Form AOC-E-207 is to certify that the estate has paid all required inheritance and estate taxes up to the date of the decedent's death.

Q: When is this form due?

A: This form is due within nine months after the decedent's death.

Q: Is there a fee to file this form?

A: No, there is no fee to file Form AOC-E-207.

Q: What should I do with the completed form?

A: The completed form should be filed with the Probate Division of the Superior Court in the county where the decedent resided.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AOC-E-207 by clicking the link below or browse more documents and templates provided by the North Carolina Court System.