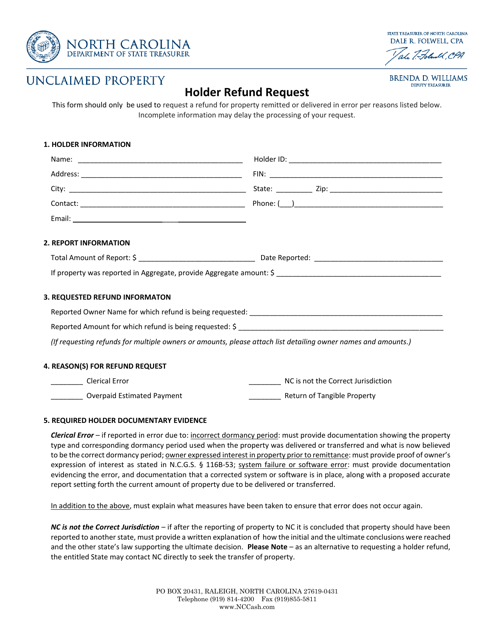

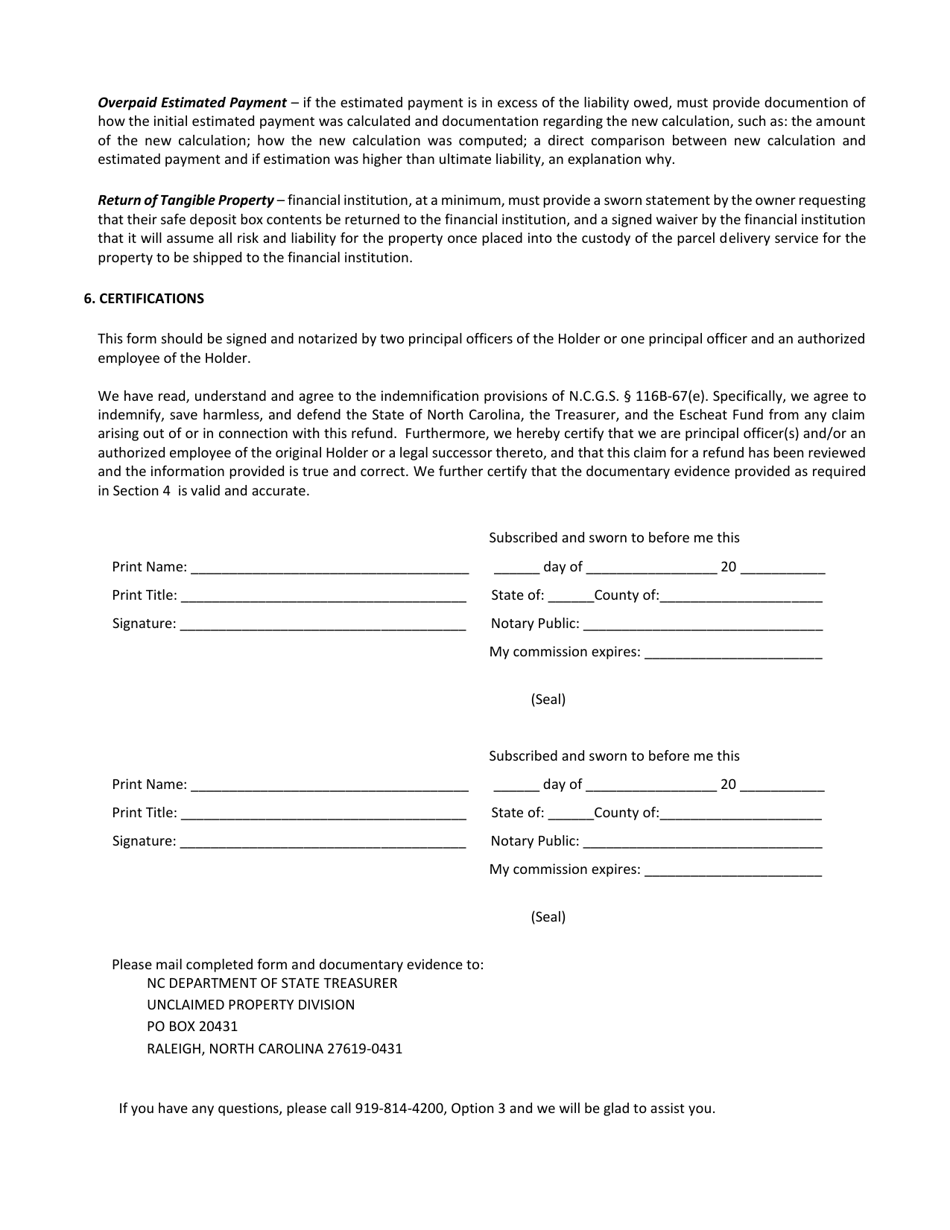

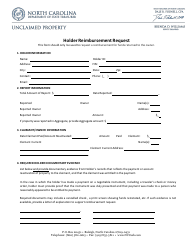

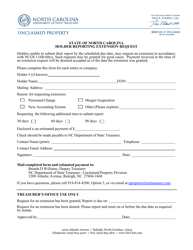

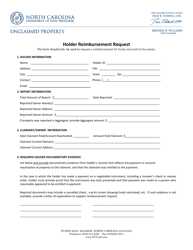

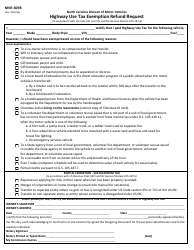

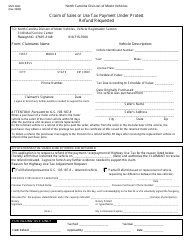

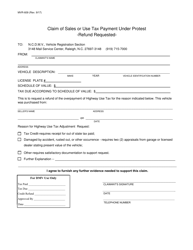

Holder Refund Request Form - North Carolina

Holder Refund Request Form is a legal document that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina.

FAQ

Q: What is a Holder Refund Request Form?

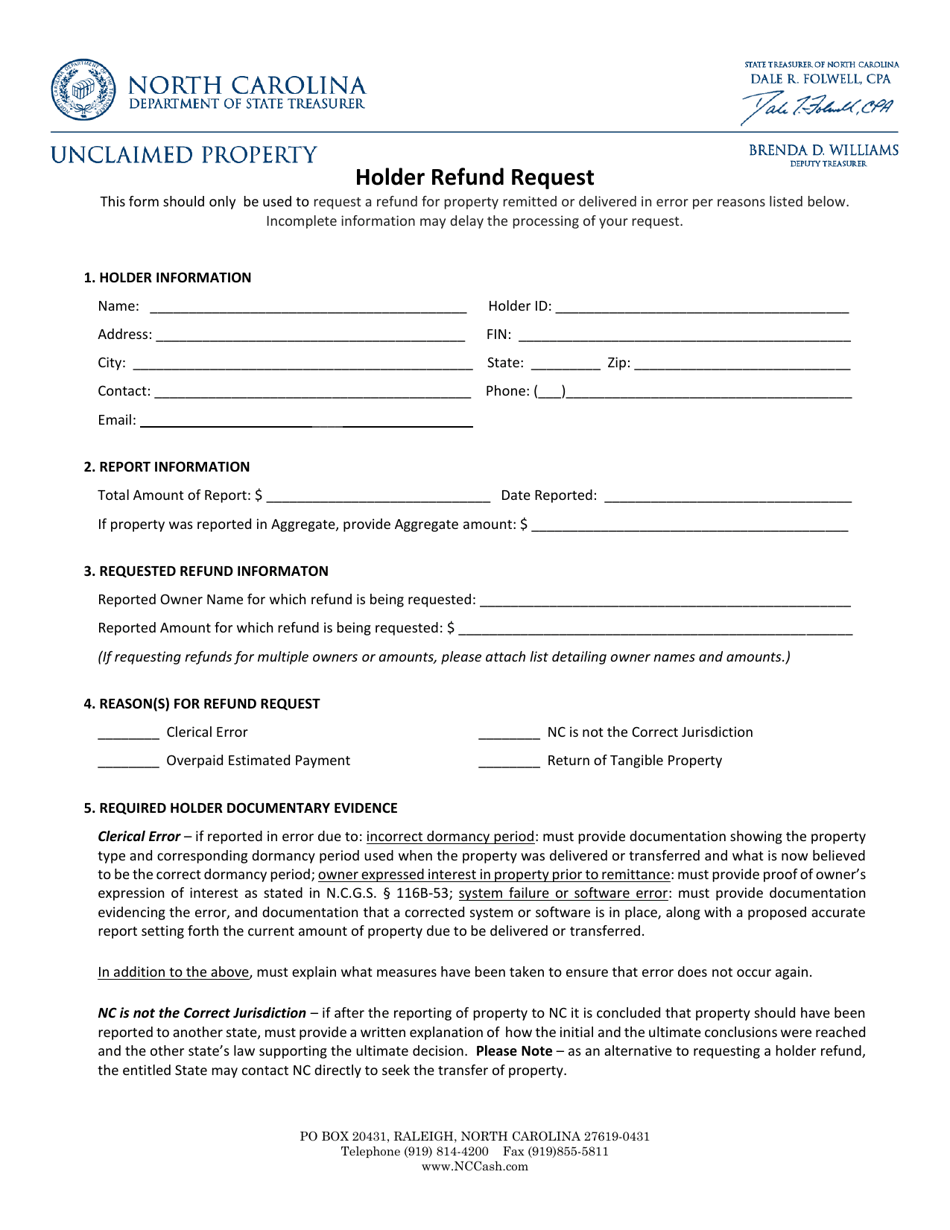

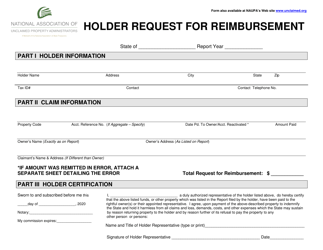

A: A Holder Refund Request Form is a document used in North Carolina to request a refund of unclaimed property previously remitted to the state.

Q: Who can submit a Holder Refund Request Form?

A: Anyone who has remitted unclaimed property to the state of North Carolina can submit a Holder Refund Request Form to request a refund.

Q: What is considered unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned or forgotten by their rightful owners, such as bank accounts, insurance proceeds, or uncashed checks.

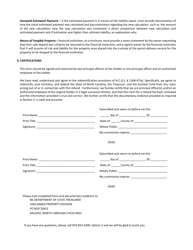

Q: What information is required on the Holder Refund Request Form?

A: The Holder Refund Request Form typically requires information such as the holder's name, contact information, the property type, and the amount remitted to the state.

Q: What is the process for requesting a refund?

A: After submitting a Holder Refund Request Form, the North Carolina Department of State Treasurer will review the request and, if approved, issue a refund to the holder.

Q: Is there a deadline for submitting a Holder Refund Request Form?

A: Yes, the holder must submit the request form within 90 days after the date of remittance.

Q: Can I request a refund for all types of unclaimed property?

A: The holder refund request is generally applicable to all types of unclaimed property, but specific requirements and guidelines may vary based on the property type.

Form Details:

- The latest edition currently provided by the North Carolina Department of State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.