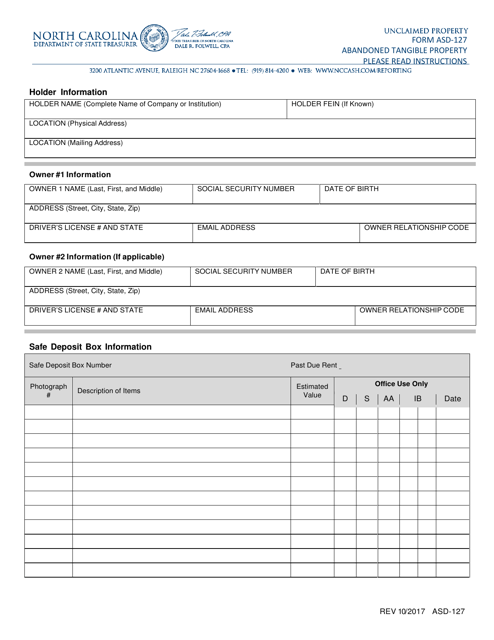

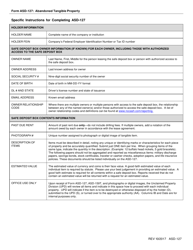

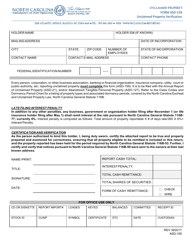

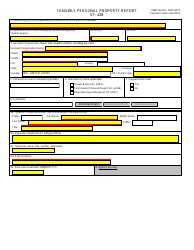

Form ASD-127 Abandoned Tangible Property - North Carolina

What Is Form ASD-127?

This is a legal form that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ASD-127?

A: Form ASD-127 is the Abandoned Tangible Property form used in North Carolina.

Q: What is the purpose of Form ASD-127?

A: The purpose of Form ASD-127 is to report abandoned tangible property in North Carolina.

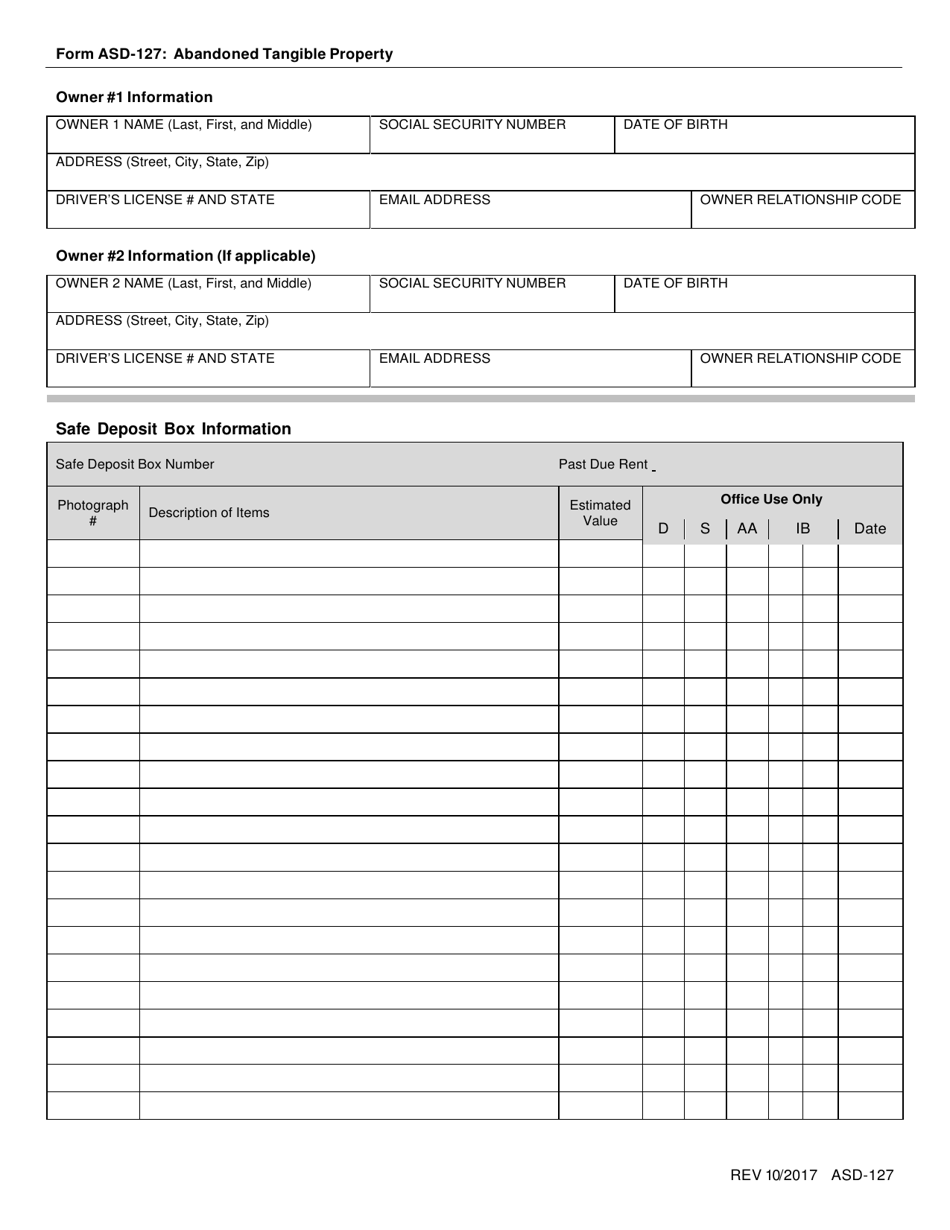

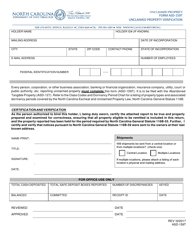

Q: Who needs to file Form ASD-127?

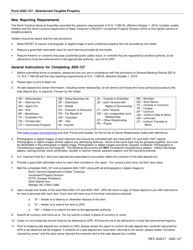

A: Businesses and organizations that have abandoned tangible property in North Carolina are required to file Form ASD-127.

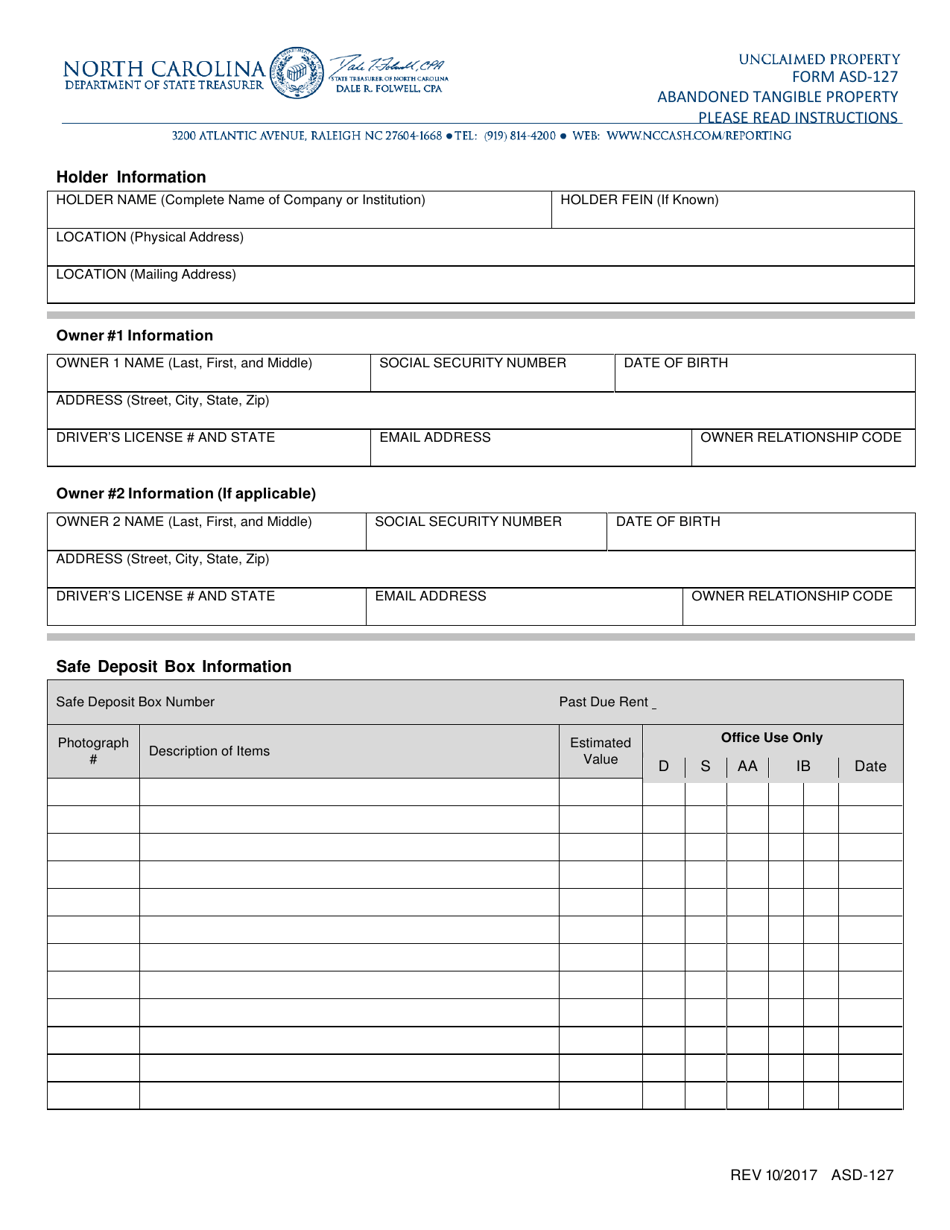

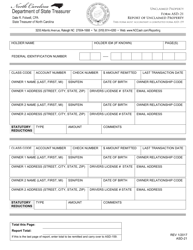

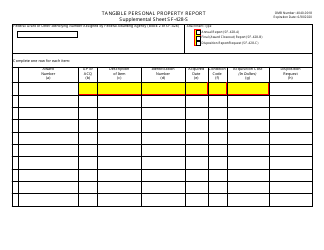

Q: What information do I need to provide on Form ASD-127?

A: You need to provide details about the abandoned tangible property, such as its description, value, and the last known owner's information.

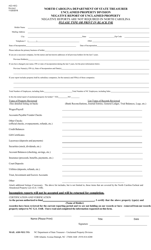

Q: When is the deadline to file Form ASD-127?

A: The deadline to file Form ASD-127 depends on the reporting period. Check the instructions or contact the North Carolina Department of Revenue for specific deadlines.

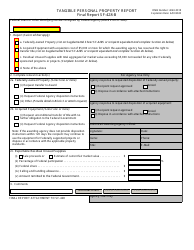

Q: Are there any penalties for not filing Form ASD-127?

A: Yes, there can be penalties for failure to file Form ASD-127, including interest and possible assessment of the value of the abandoned property.

Q: Can I amend Form ASD-127 after it has been filed?

A: Yes, if you need to correct or update the information provided on Form ASD-127, you can file an amended form.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the North Carolina Department of State Treasurer;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ASD-127 by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.