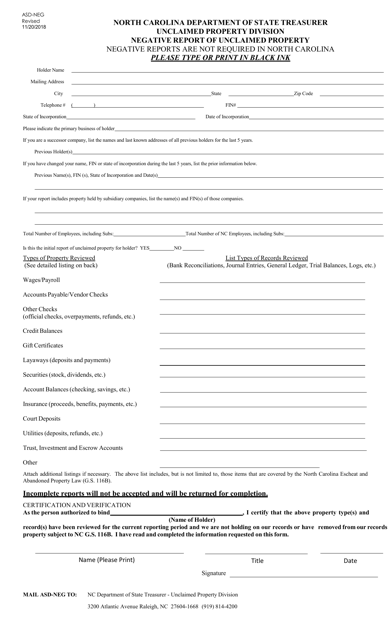

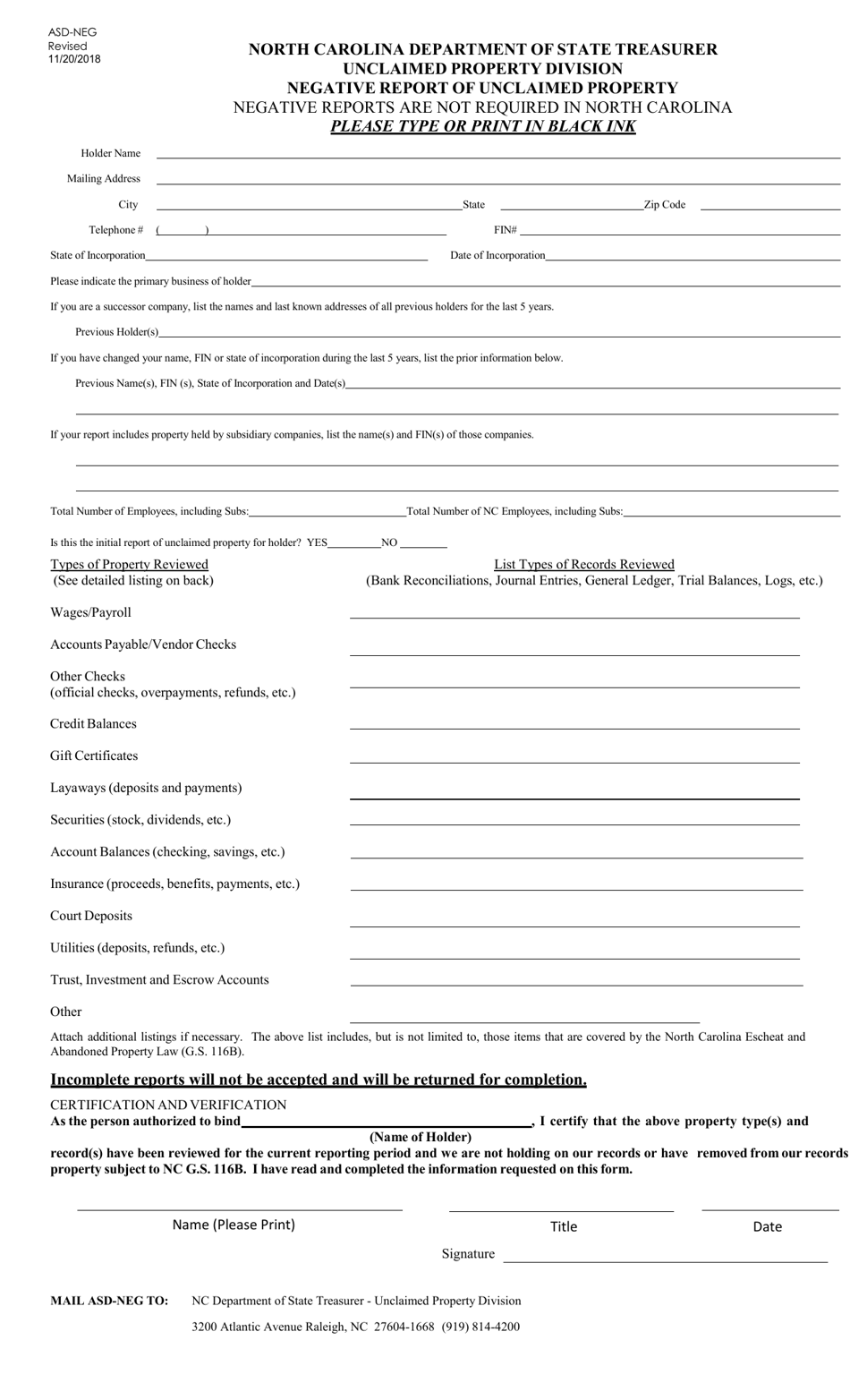

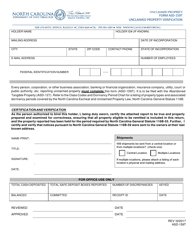

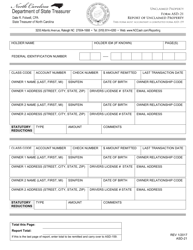

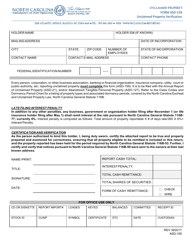

Form ASD-NEG Negative Report of Unclaimed Property - North Carolina

What Is Form ASD-NEG?

This is a legal form that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ASD-NEG?

A: The Form ASD-NEG is the Negative Report of Unclaimed Property in North Carolina.

Q: Who needs to file the Form ASD-NEG?

A: Any business or organization that does not have any unclaimed property to report in North Carolina needs to file the Form ASD-NEG.

Q: When is the deadline to file the Form ASD-NEG?

A: The deadline to file the Form ASD-NEG is typically July 1st of each year.

Q: What information is required on the Form ASD-NEG?

A: The Form ASD-NEG requires basic information about your business or organization, such as name, address, and identification number.

Q: Is there a fee to file the Form ASD-NEG?

A: No, there is no fee to file the Form ASD-NEG if you do not have any unclaimed property to report.

Q: Do I need to file the Form ASD-NEG every year?

A: Yes, even if you do not have any unclaimed property to report, you are required to file the Form ASD-NEG every year.

Q: What happens if I do not file the Form ASD-NEG?

A: Failure to file the Form ASD-NEG by the deadline may result in penalties or other enforcement actions by the North Carolina Department of State Treasurer.

Form Details:

- Released on November 20, 2018;

- The latest edition provided by the North Carolina Department of State Treasurer;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ASD-NEG by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.