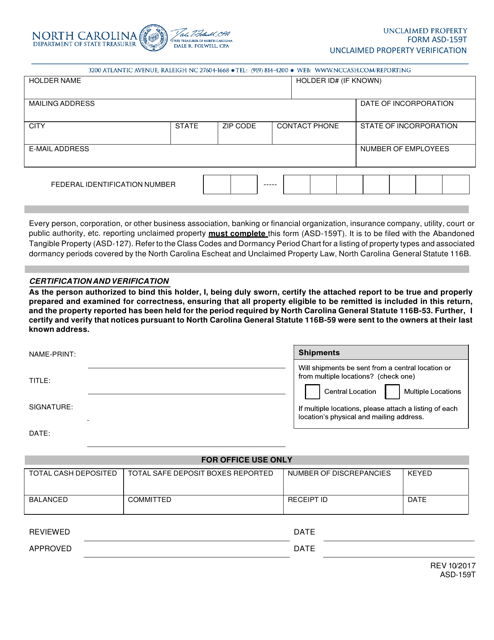

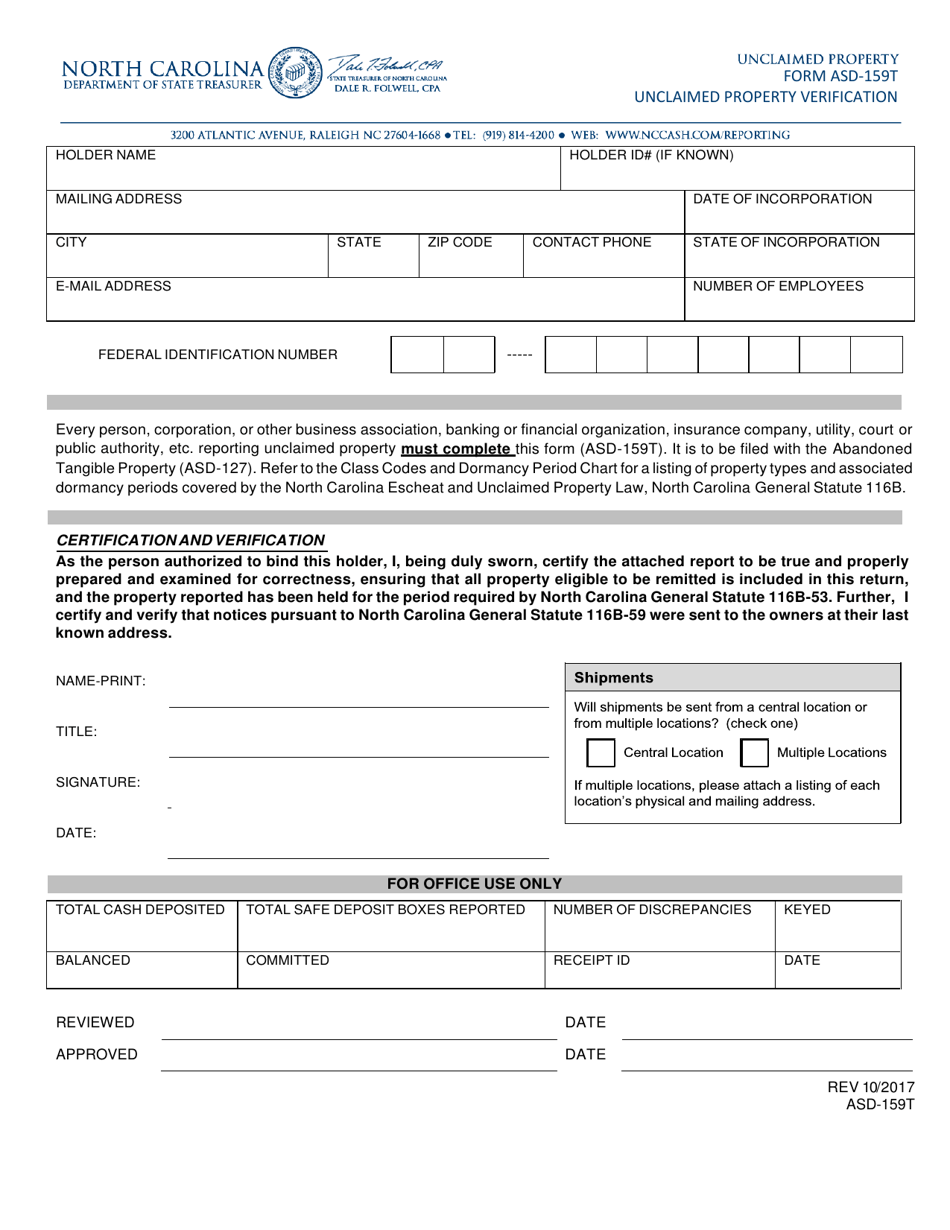

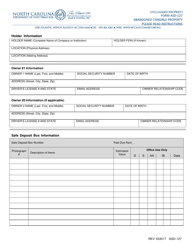

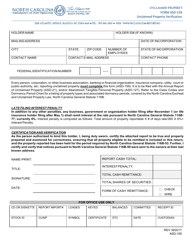

Form ASD-159T Unclaimed Property Verification - North Carolina

What Is Form ASD-159T?

This is a legal form that was released by the North Carolina Department of State Treasurer - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ASD-159T?

A: Form ASD-159T is the Unclaimed Property Verification form used in North Carolina.

Q: What is Unclaimed Property?

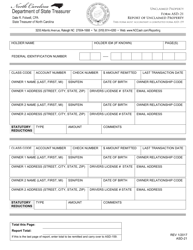

A: Unclaimed Property refers to financial assets that have been abandoned by their owners. These assets can include bank accounts, uncashed checks, and safe deposit box contents.

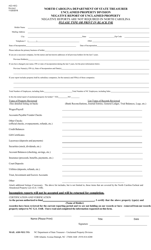

Q: Who needs to file Form ASD-159T?

A: Anyone who holds unclaimed property in North Carolina must file Form ASD-159T to report and remit the property to the North Carolina Department of State Treasurer.

Q: When is Form ASD-159T due?

A: Form ASD-159T is due by November 1st of each year for holders reporting unclaimed property in North Carolina.

Q: Are there any penalties for late or non-filing?

A: Yes, there are penalties for late or non-filing of Form ASD-159T. The penalties can include fines and interest on the unremitted property.

Q: What information do I need to provide on Form ASD-159T?

A: On Form ASD-159T, you need to provide information about the unclaimed property you are reporting, as well as details about the owners of the property.

Q: Is there a fee for filing Form ASD-159T?

A: No, there is no fee for filing Form ASD-159T to report unclaimed property in North Carolina.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the North Carolina Department of State Treasurer;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ASD-159T by clicking the link below or browse more documents and templates provided by the North Carolina Department of State Treasurer.