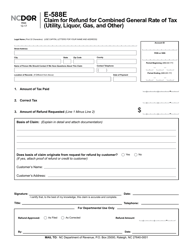

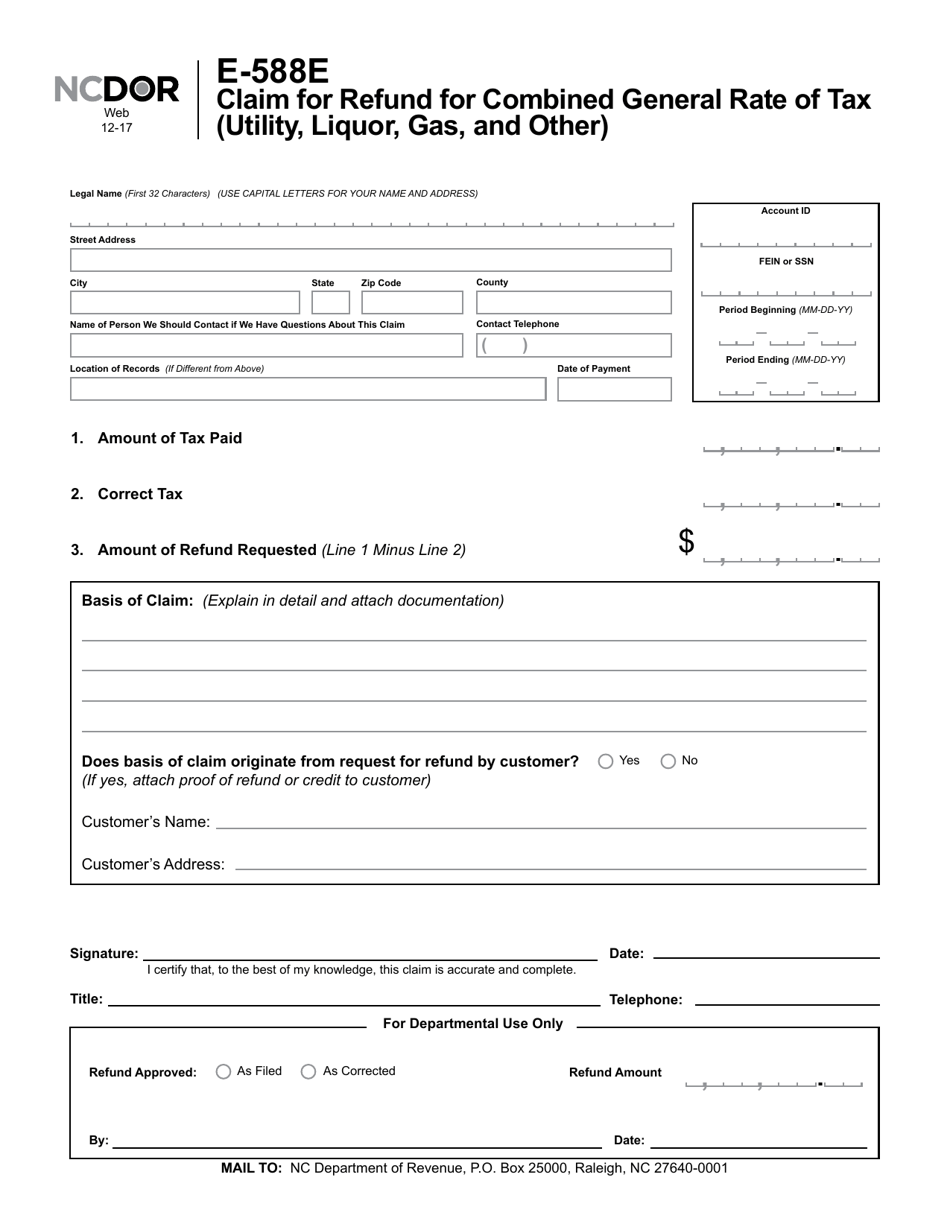

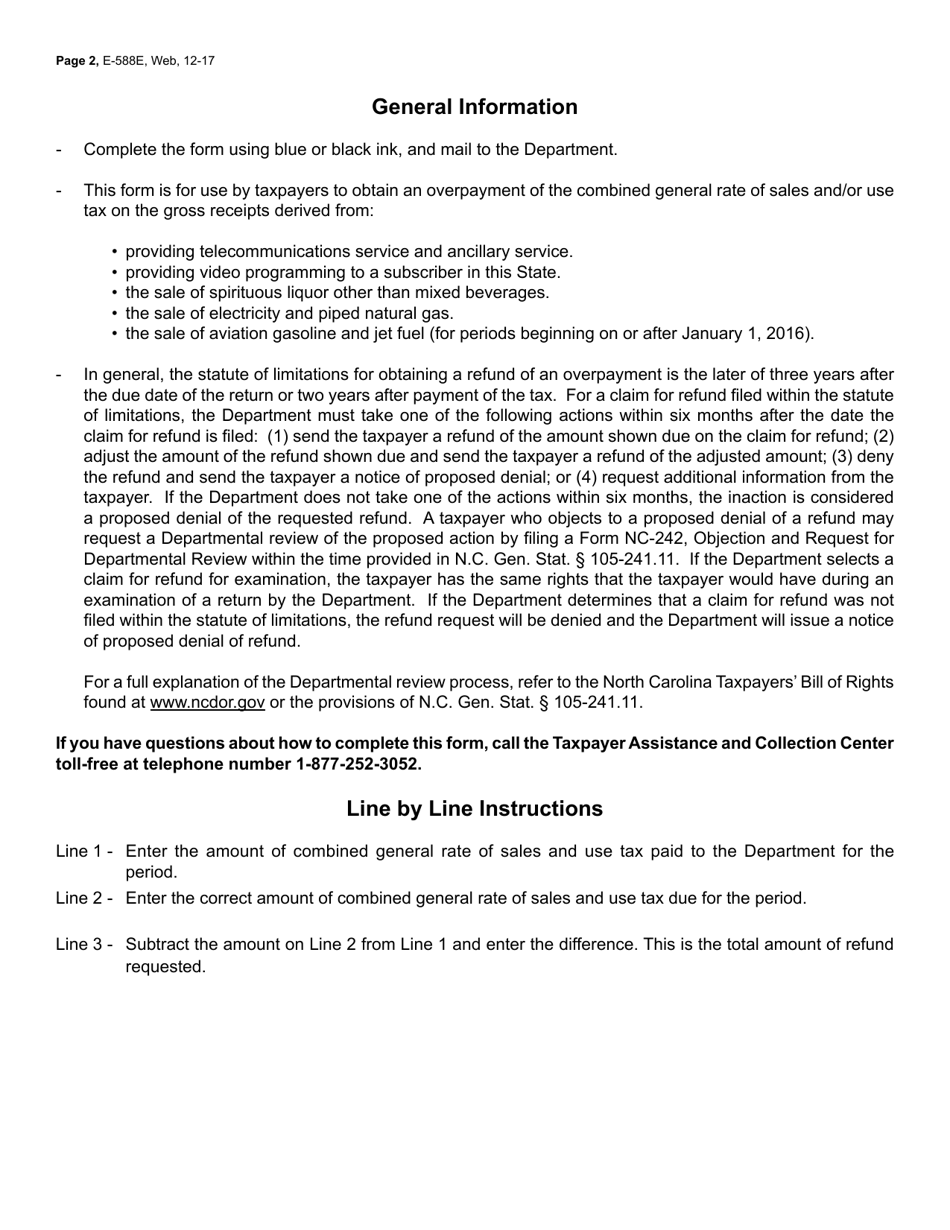

Form E-588E Claim for Refund for Combined General Rate of Tax (Utility, Liquor, Gas, and Other) - North Carolina

What Is Form E-588E?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-588E?

A: Form E-588E is a claim for refund form for the combined general rate of tax in North Carolina for utility, liquor, gas, and other items.

Q: Who can use Form E-588E?

A: Any individual or business who paid the combined general rate of tax in North Carolina for utility, liquor, gas, and other items and wants to claim a refund can use Form E-588E.

Q: What is the purpose of Form E-588E?

A: The purpose of Form E-588E is to allow individuals and businesses to claim a refund for the combined general rate of tax paid in North Carolina for utility, liquor, gas, and other items.

Q: What information do I need to complete Form E-588E?

A: To complete Form E-588E, you will need information such as the amount of combined general rate of tax paid, the date of payment, and the reason for the refund claim.

Q: When should I submit Form E-588E?

A: Form E-588E should be submitted within three years from the date the tax was paid or within six months from the date of overpayment, whichever is later.

Q: Can I claim a refund for taxes paid in previous years using Form E-588E?

A: Yes, you can claim a refund for taxes paid in previous years using Form E-588E as long as the claim is submitted within the applicable time limits.

Q: What should I do if I have more questions about Form E-588E?

A: If you have more questions about Form E-588E or the refund process, you can contact the North Carolina Department of Revenue's customer service for assistance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

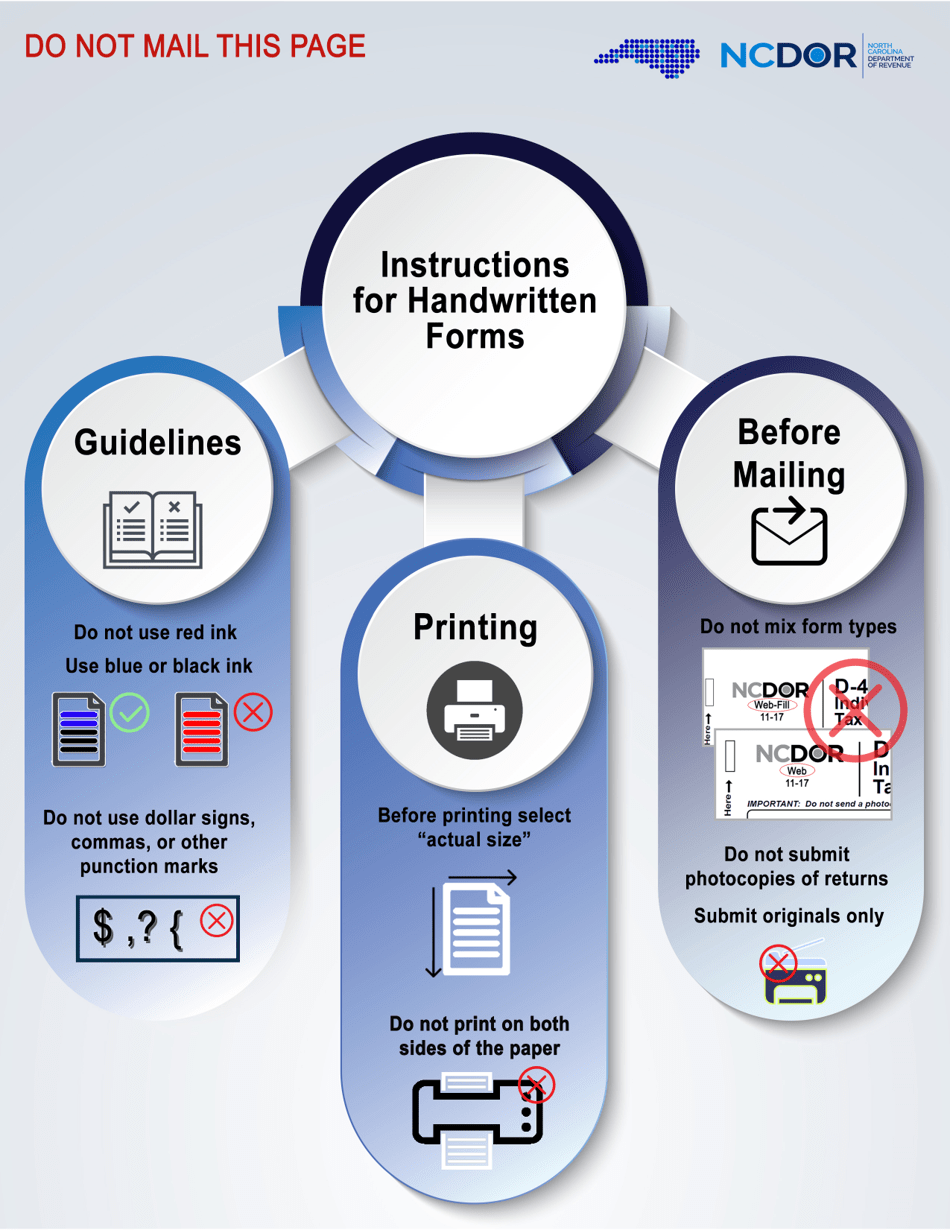

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-588E by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.