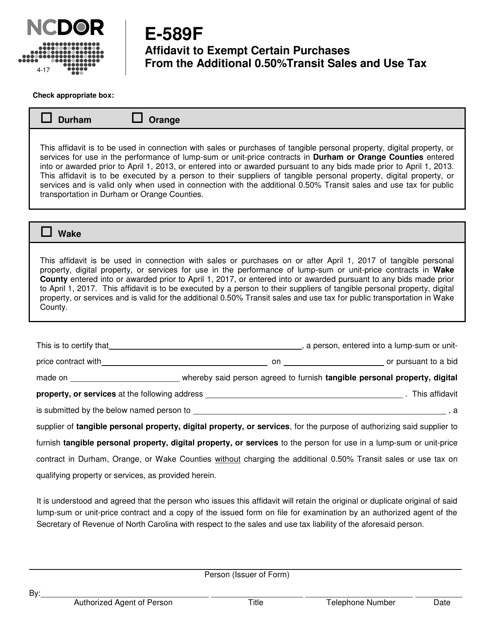

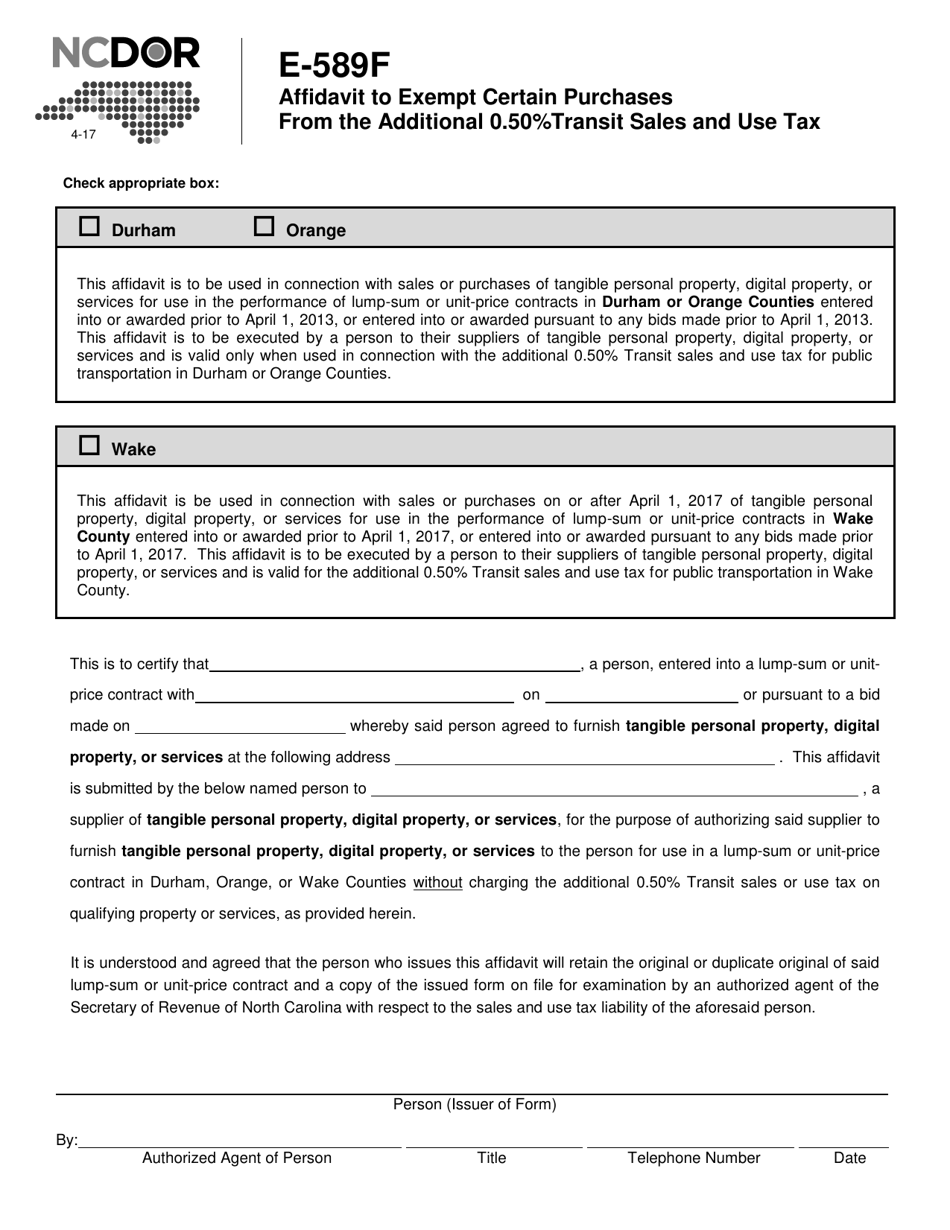

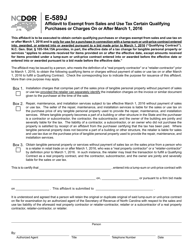

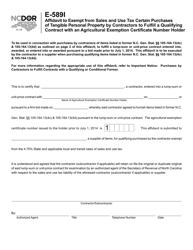

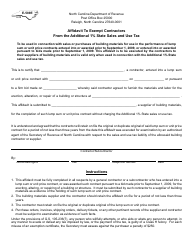

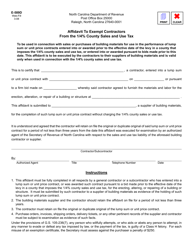

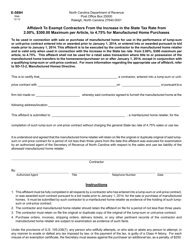

Form E-589F Affidavit to Exempt Certain Purchases From the Additional 0.50%transit Sales and Use Tax - North Carolina

What Is Form E-589F?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-589F?

A: Form E-589F is an Affidavit to Exempt Certain Purchases From the Additional 0.50% transit Sales and Use Tax in North Carolina.

Q: What is the purpose of Form E-589F?

A: The purpose of Form E-589F is to exempt certain purchases from the additional 0.50% transit sales and use tax in North Carolina.

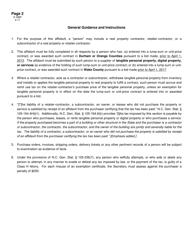

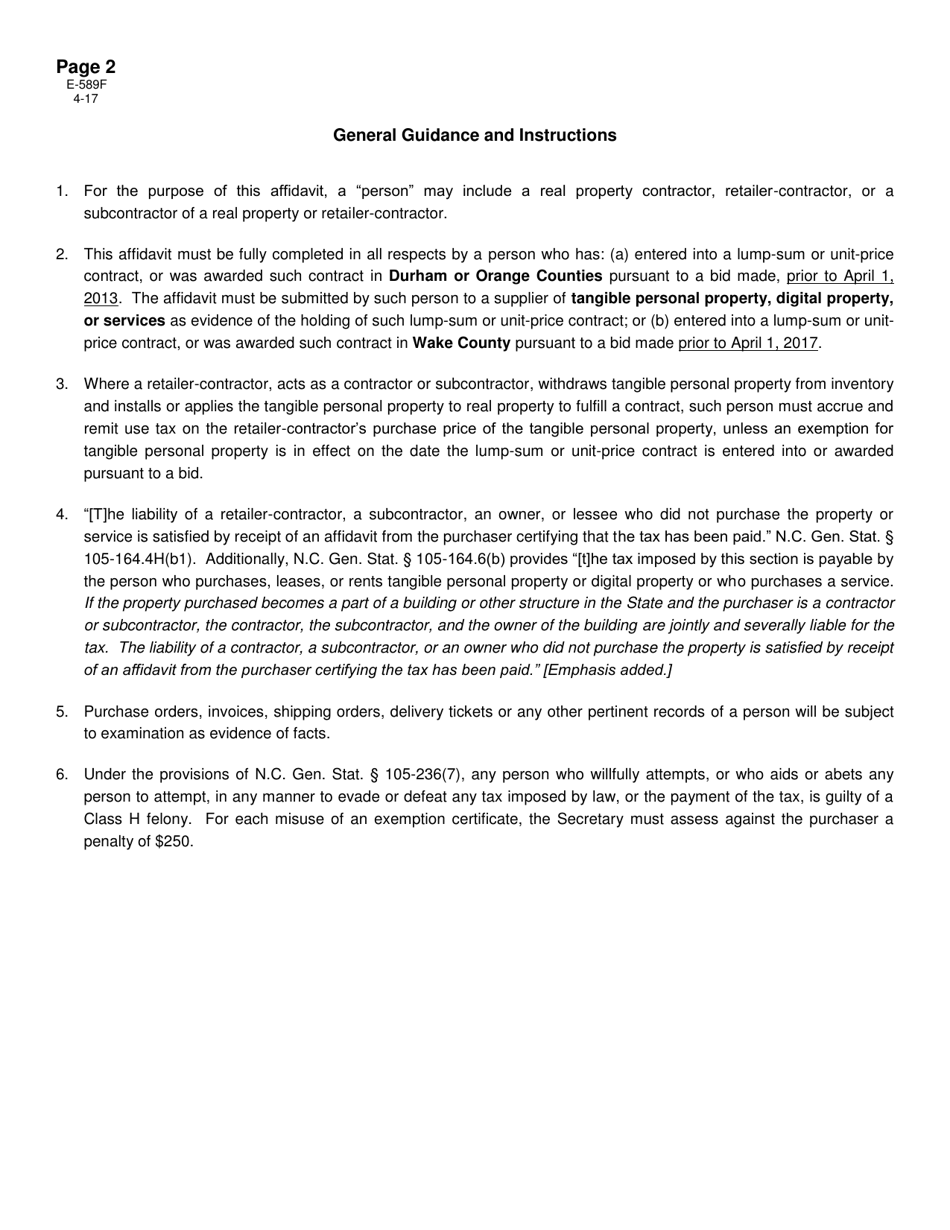

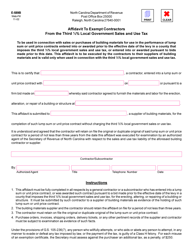

Q: Who needs to fill out Form E-589F?

A: Individuals or companies who qualify for an exemption from the additional 0.50% transit sales and use tax in North Carolina need to fill out this form.

Q: How do I qualify for an exemption?

A: To qualify for an exemption, you must be engaged in the business of interstate transportation, and the property must be used exclusively in interstate commerce.

Q: What information is required on Form E-589F?

A: The form requires information such as the name and address of the purchaser, description of the property, and certification of eligibility.

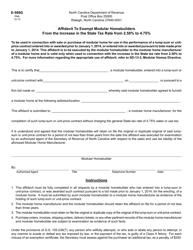

Q: Is there a deadline for submitting Form E-589F?

A: There is no specific deadline mentioned for submitting Form E-589F, but it is best to submit it as soon as possible to claim the exemption.

Q: Are there any fees associated with filing Form E-589F?

A: No, there are no fees associated with filing Form E-589F.

Q: Can I claim a refund if I have already paid the additional transit sales and use tax?

A: Yes, if you qualify for the exemption, you can claim a refund for the additional transit sales and use tax that you have already paid.

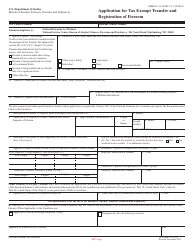

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-589F by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.