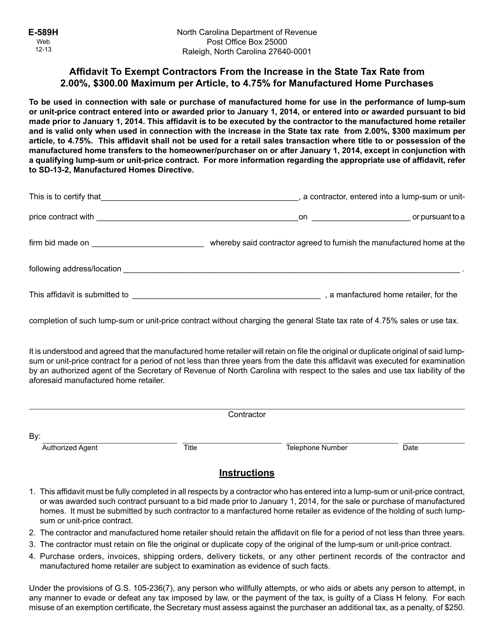

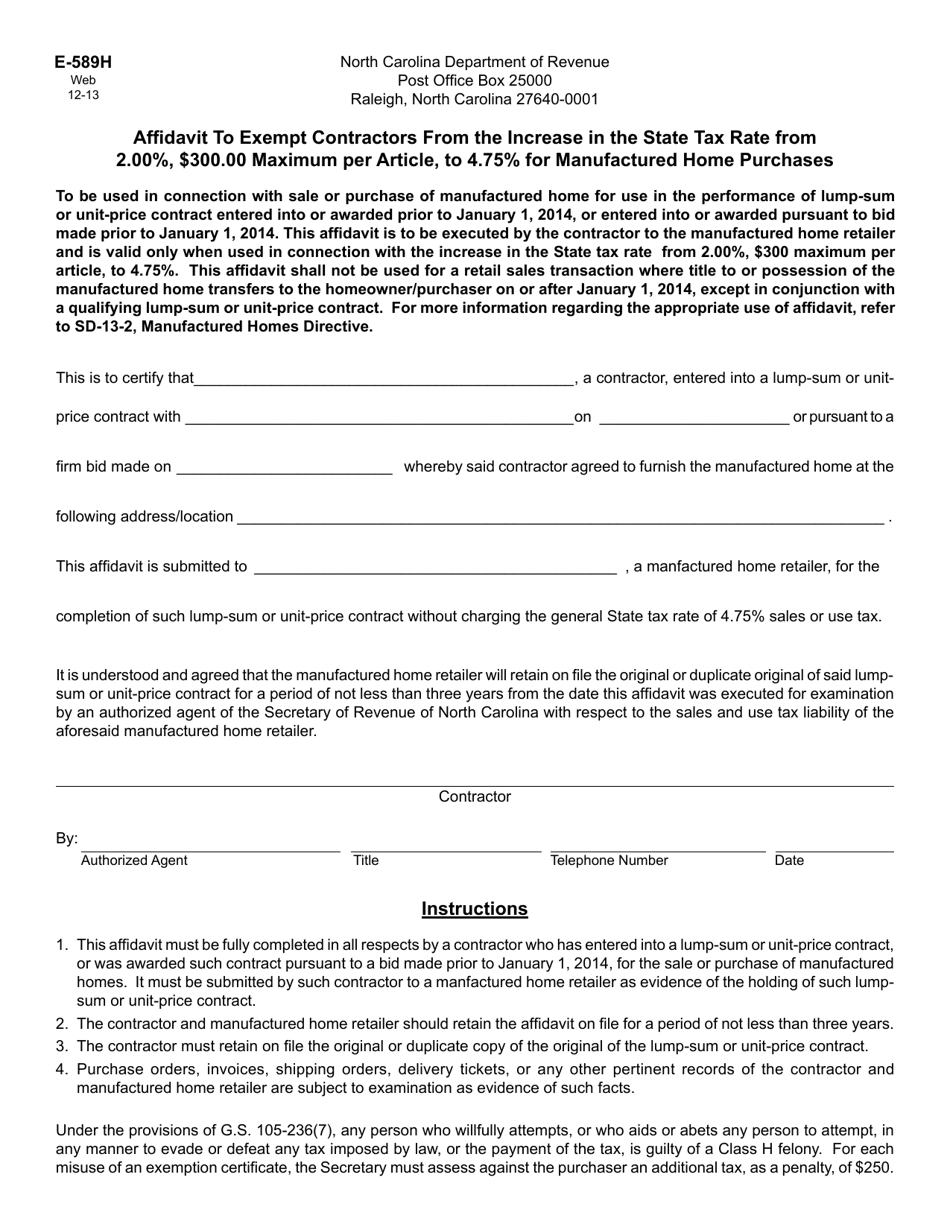

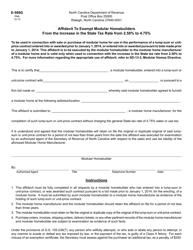

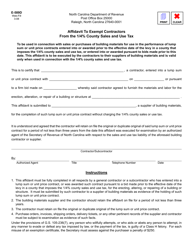

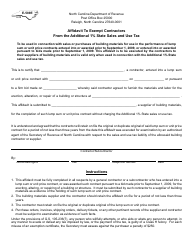

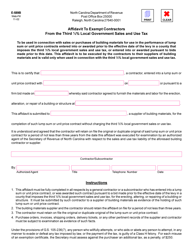

Form E-589H Affidavit to Exempt Contractors From the Increase in the State Tax Rate From 2.00%, $300.00 Maximum Per Article, to 4.75% for Manufactured Home Purchases - North Carolina

What Is Form E-589H?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-589H?

A: Form E-589H is an affidavit used to exempt contractors from the increase in the state tax rate for manufactured home purchases in North Carolina.

Q: What is the purpose of Form E-589H?

A: The purpose of Form E-589H is to provide an exemption for contractors from the increased state tax rate on manufactured home purchases.

Q: What is the state tax rate for manufactured home purchases in North Carolina?

A: The state tax rate for manufactured home purchases in North Carolina is 4.75%.

Q: Who can use Form E-589H?

A: Contractors can use Form E-589H to claim exemption from the increased state tax rate for manufactured home purchases in North Carolina.

Q: What is the previous state tax rate for manufactured home purchases in North Carolina?

A: The previous state tax rate for manufactured home purchases in North Carolina was 2.00%, with a maximum of $300.00 per article.

Q: What information is required on Form E-589H?

A: Form E-589H requires contractors to provide their name, address, contact information, and other details about the manufactured homes they are purchasing.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-589H by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.