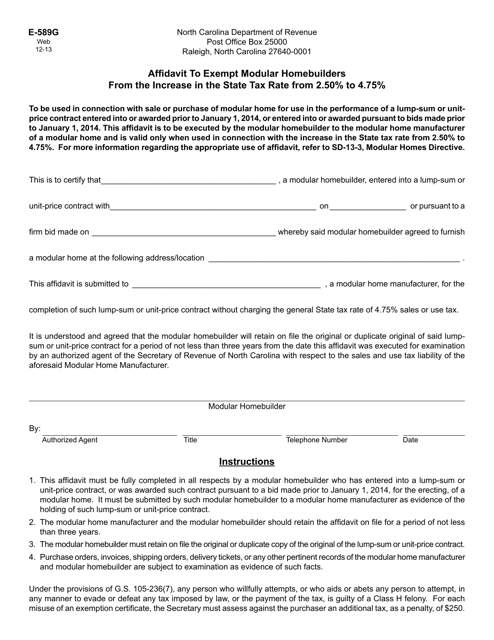

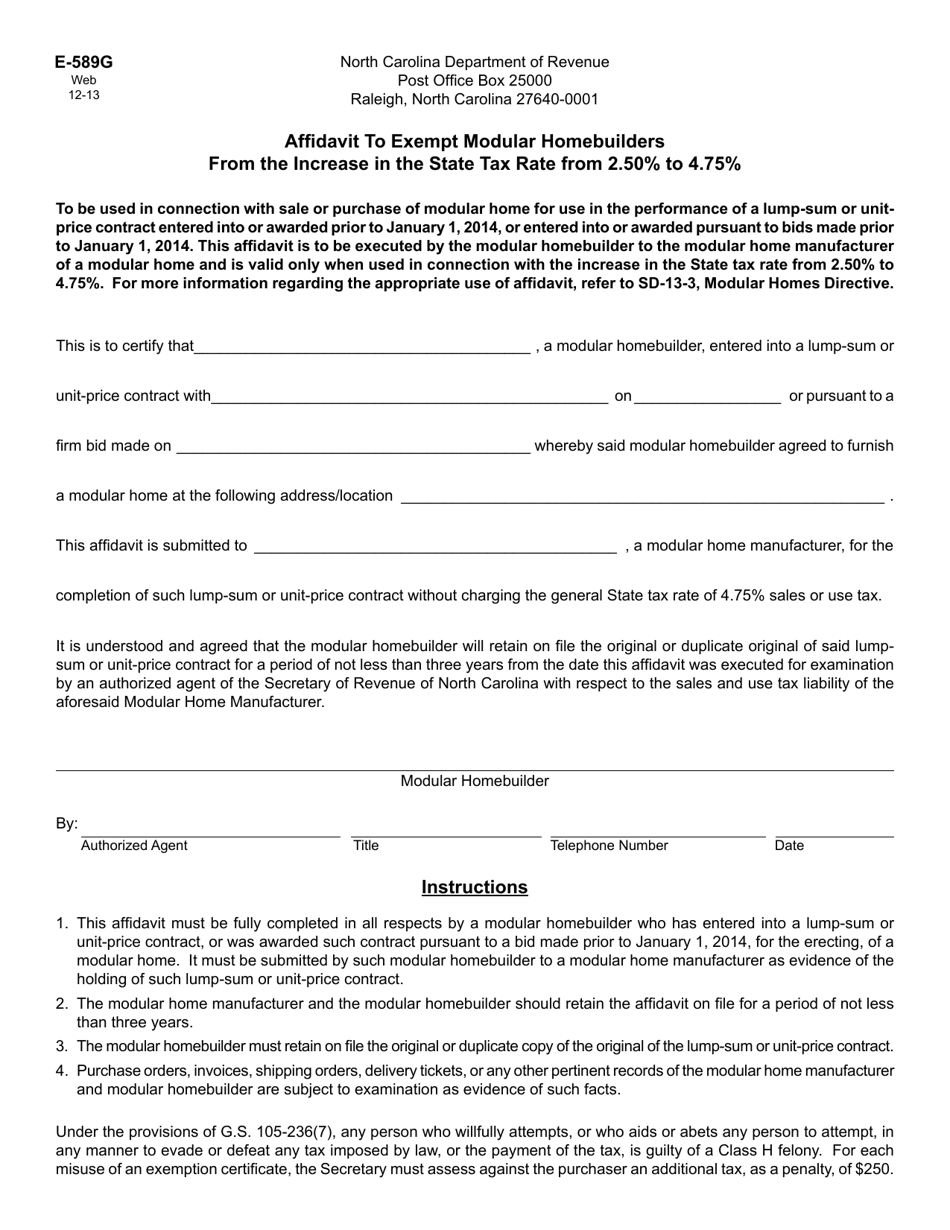

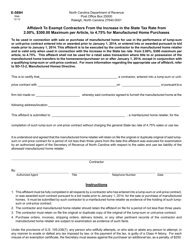

Form E-589G Affidavit to Exempt Modular Homebuilders From the Increase in the State Tax Rate From 2.50% to 4.75% - North Carolina

What Is Form E-589G?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-589G?

A: Form E-589G is an affidavit used to exempt modular homebuilders from the increase in the state tax rate in North Carolina.

Q: What is the purpose of Form E-589G?

A: The purpose of Form E-589G is to provide an exemption for modular homebuilders from the increased state tax rate.

Q: Who needs to fill out Form E-589G?

A: Modular homebuilders in North Carolina need to fill out Form E-589G to claim the exemption.

Q: What is the tax rate increase in North Carolina?

A: The tax rate in North Carolina increased from 2.50% to 4.75%.

Q: Why are modular homebuilders exempt from the tax rate increase?

A: Modular homebuilders are exempt from the tax rate increase as an incentive for the construction industry in North Carolina.

Q: Are there any eligibility requirements for the exemption?

A: Yes, modular homebuilders must meet certain criteria to be eligible for the exemption. These criteria can be found on the Form E-589G.

Q: Can individuals who are not modular homebuilders claim the exemption?

A: No, only modular homebuilders are eligible to claim the exemption using Form E-589G.

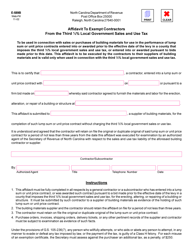

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-589G by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.