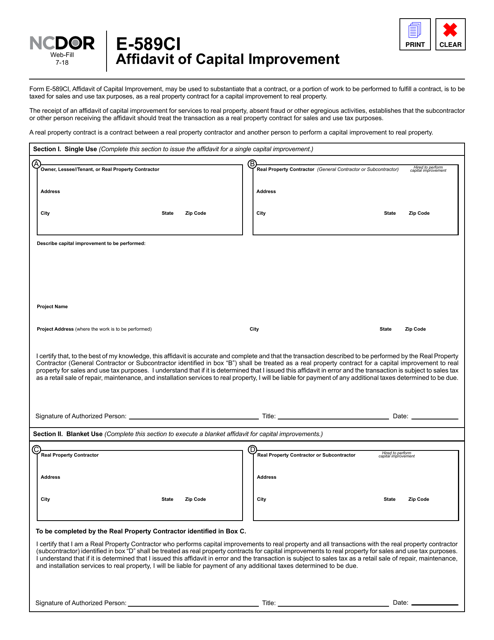

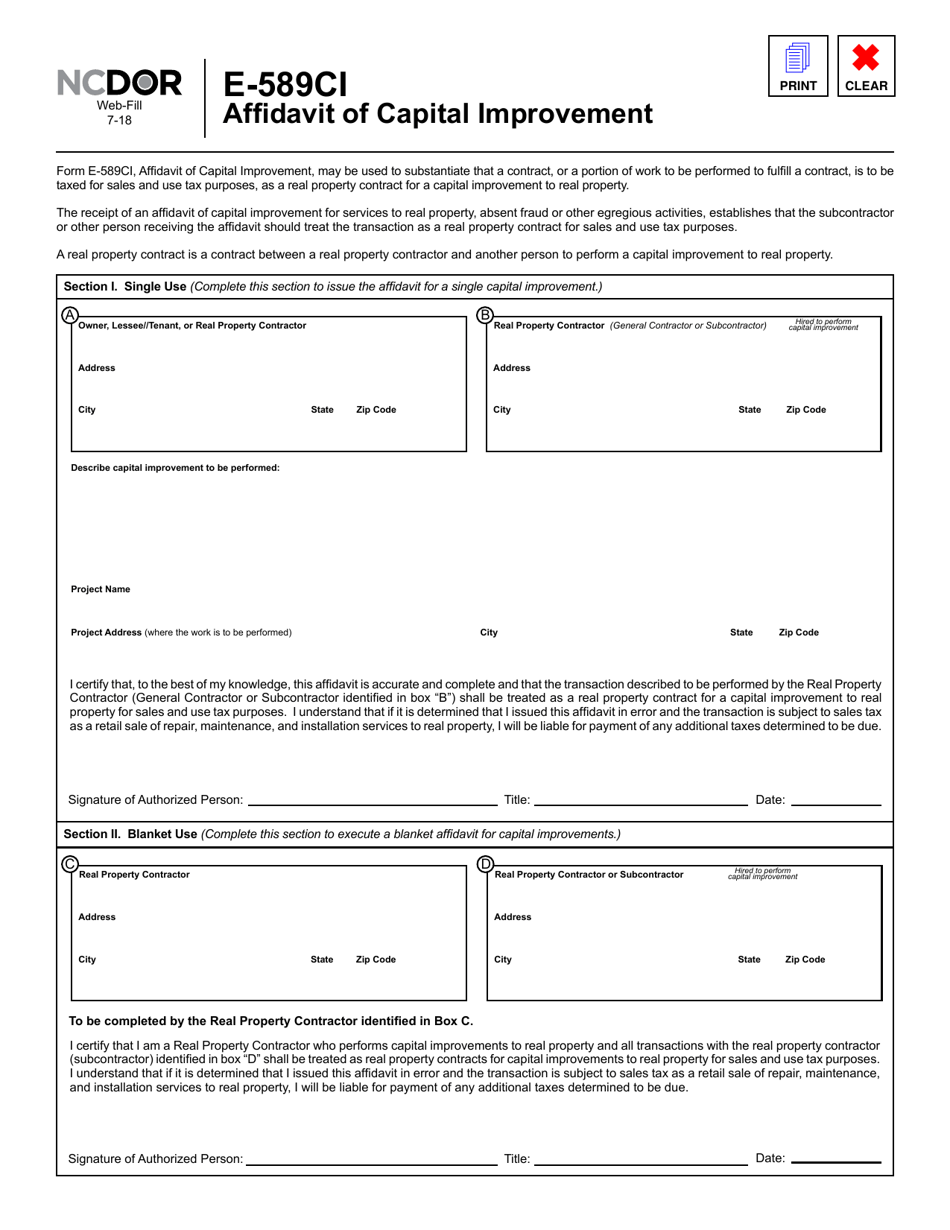

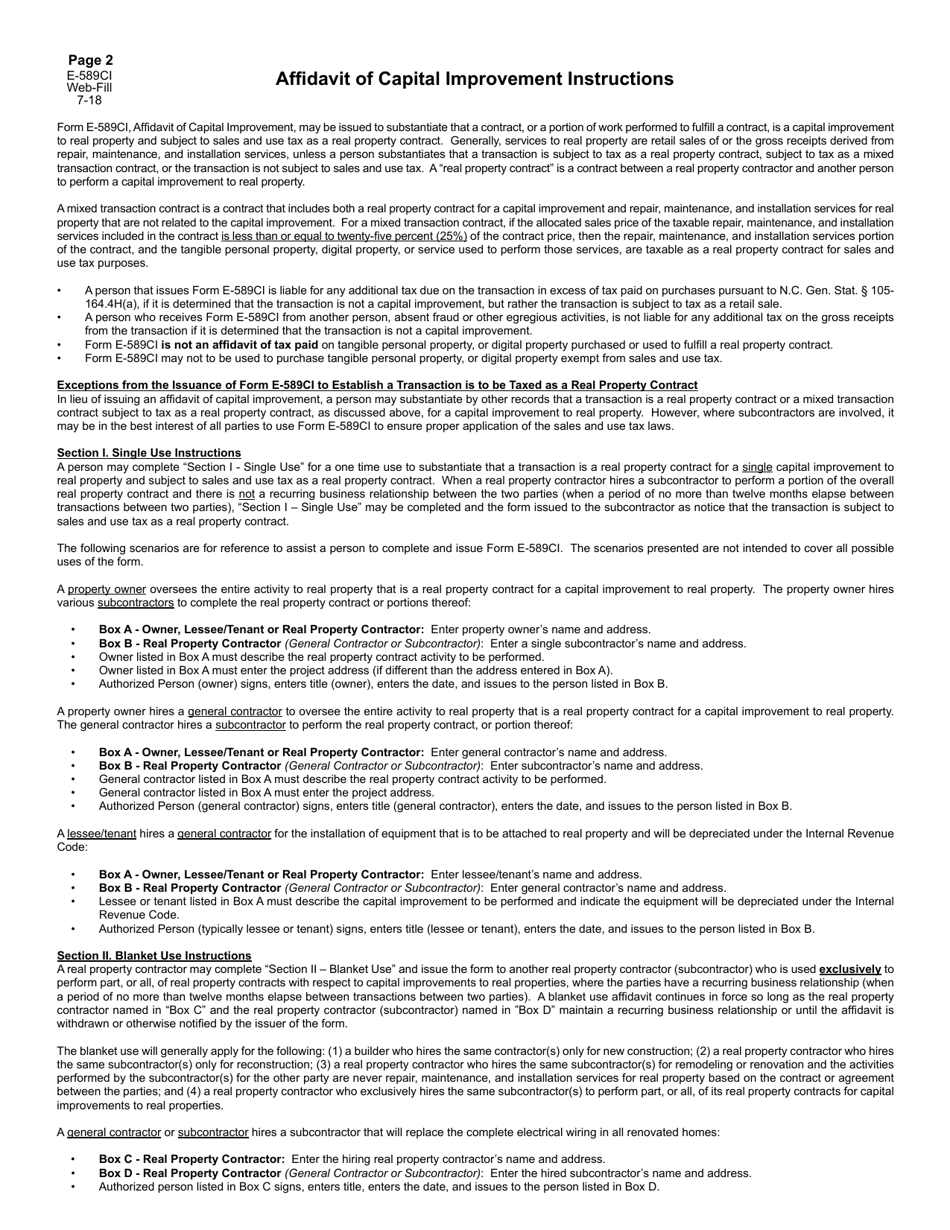

Form E-589CI Affidavit of Capital Improvement - North Carolina

What Is Form E-589CI?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-589CI?

A: Form E-589CI is an Affidavit of Capital Improvement in North Carolina.

Q: What is the purpose of Form E-589CI?

A: The purpose of Form E-589CI is to claim a sales tax exemption for capital improvements made to a real property.

Q: Who needs to file Form E-589CI?

A: Anyone who has made capital improvements to a real property in North Carolina and wants to claim a sales tax exemption needs to file Form E-589CI.

Q: What are capital improvements?

A: Capital improvements are permanent improvements made to land or buildings that increase their value or prolong their useful life.

Q: What is the deadline for filing Form E-589CI?

A: Form E-589CI must be filed within three years from the date the capital improvement was completed.

Q: Are there any fees associated with filing Form E-589CI?

A: No, there are no fees associated with filing Form E-589CI.

Q: Do I need to attach any documentation to Form E-589CI?

A: Yes, you need to attach supporting documentation such as invoices or receipts for the capital improvements.

Q: Can I file Form E-589CI electronically?

A: No, Form E-589CI must be filed by mail or in person.

Q: What happens after I file Form E-589CI?

A: After you file Form E-589CI, the North Carolina Department of Revenue will review your application and determine if you are eligible for the sales tax exemption.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-589CI by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.