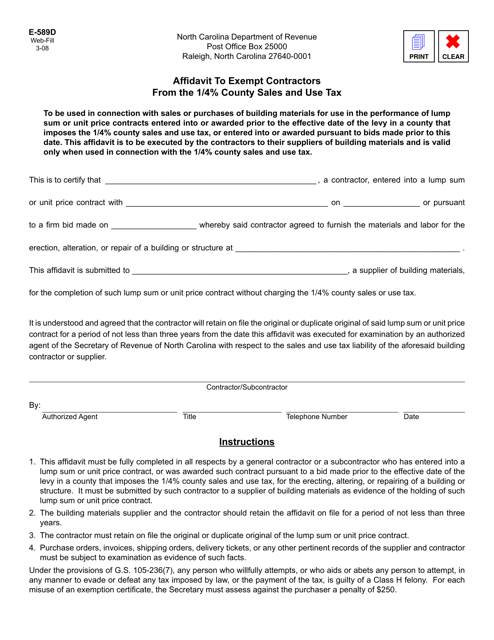

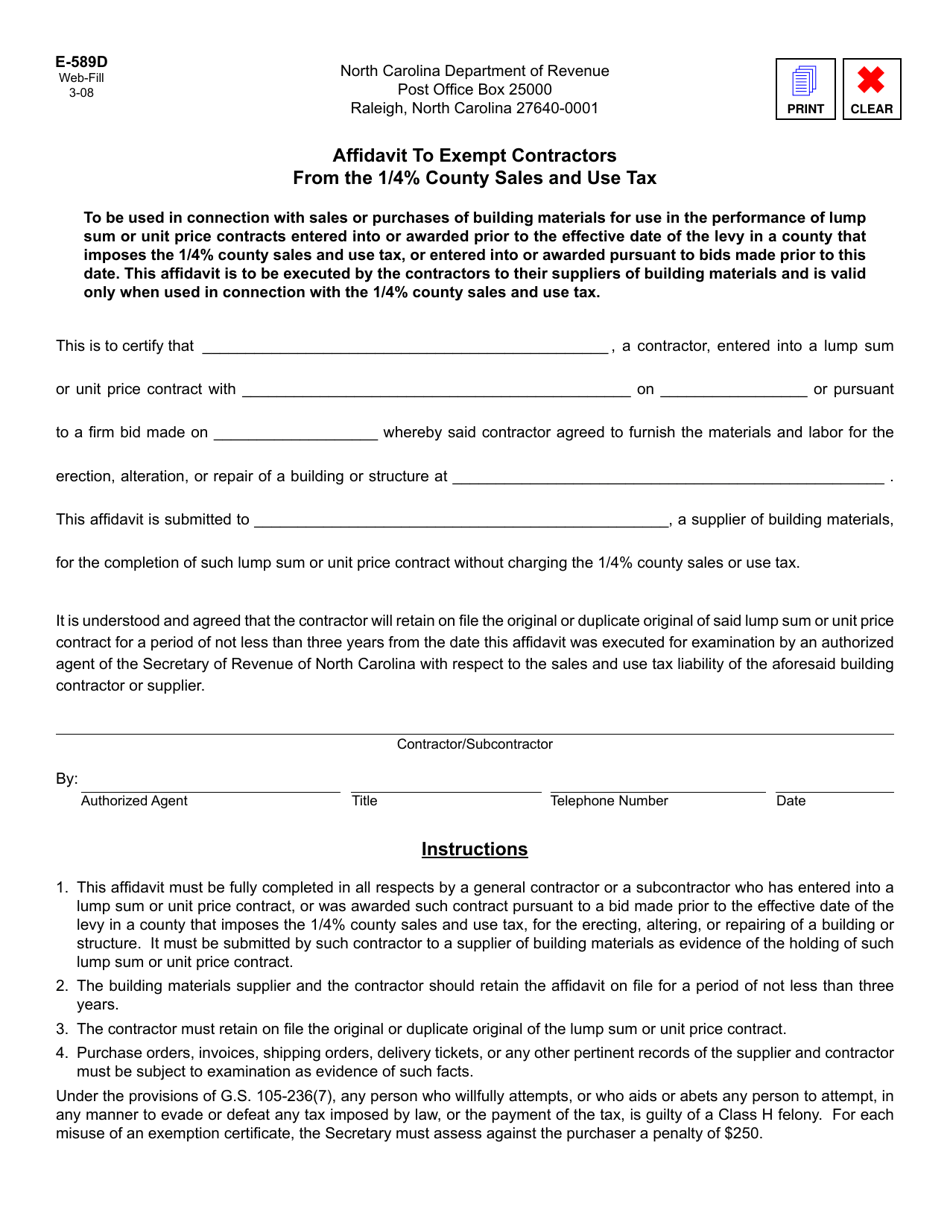

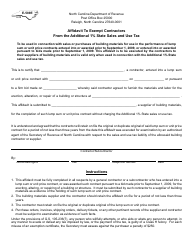

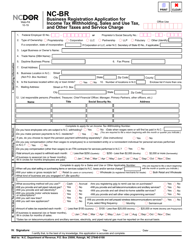

Form E-589D Affidavit to Exempt Contractors From the 1 / 4% County Sales and Use Tax - North Carolina

What Is Form E-589D?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-589D?

A: Form E-589D is the Affidavit to Exempt Contractors from the 1/4% County Sales and Use Tax in North Carolina.

Q: Who needs to fill out Form E-589D?

A: Contractors in North Carolina who are eligible for an exemption from the 1/4% county sales and use tax need to fill out Form E-589D.

Q: What is the purpose of Form E-589D?

A: The purpose of Form E-589D is to claim an exemption from the 1/4% county sales and use tax for eligible contractors in North Carolina.

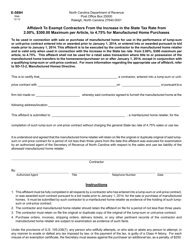

Q: Are all contractors eligible for the exemption?

A: No, only certain contractors who meet the eligibility criteria are eligible for the exemption.

Q: What are the eligibility criteria for the exemption?

A: To be eligible for the exemption, contractors must meet specific criteria related to their business activities and the types of contracts they have.

Q: Is there a deadline for submitting Form E-589D?

A: Yes, Form E-589D must be submitted within 30 days of commencing a qualifying contract.

Q: What happens if I don't submit Form E-589D?

A: If you don't submit Form E-589D, you may be liable for the 1/4% county sales and use tax on your contracts in North Carolina.

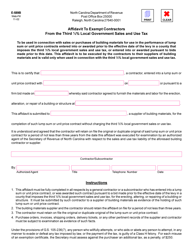

Q: Can Form E-589D be used for multiple contracts?

A: Yes, you can use one Form E-589D for multiple qualifying contracts if they meet certain conditions.

Q: Are there any penalties for providing false information on Form E-589D?

A: Yes, providing false information on Form E-589D may result in penalties and other legal consequences.

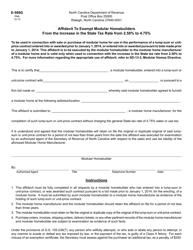

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-589D by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.