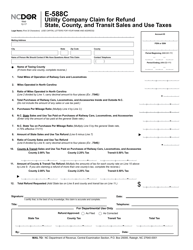

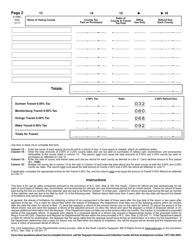

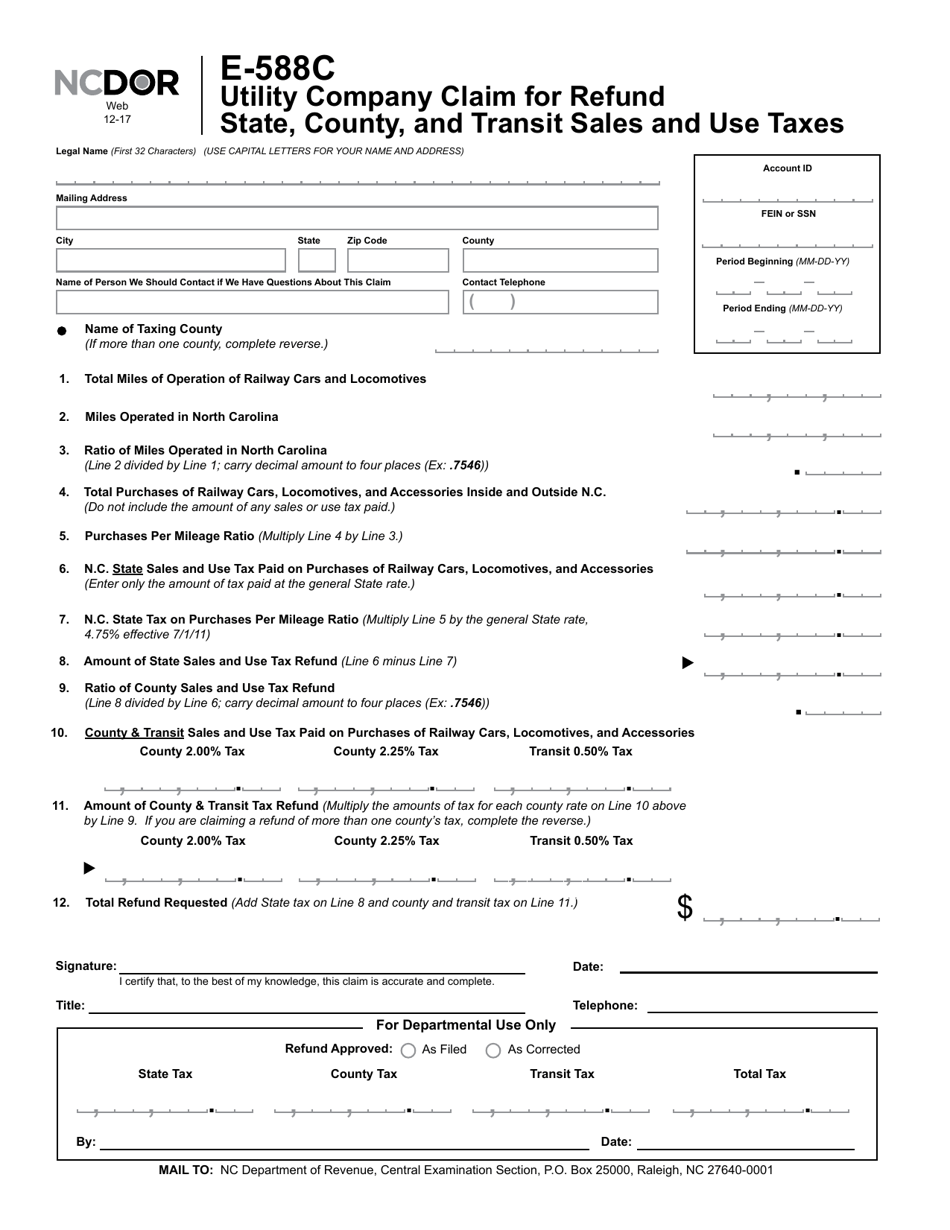

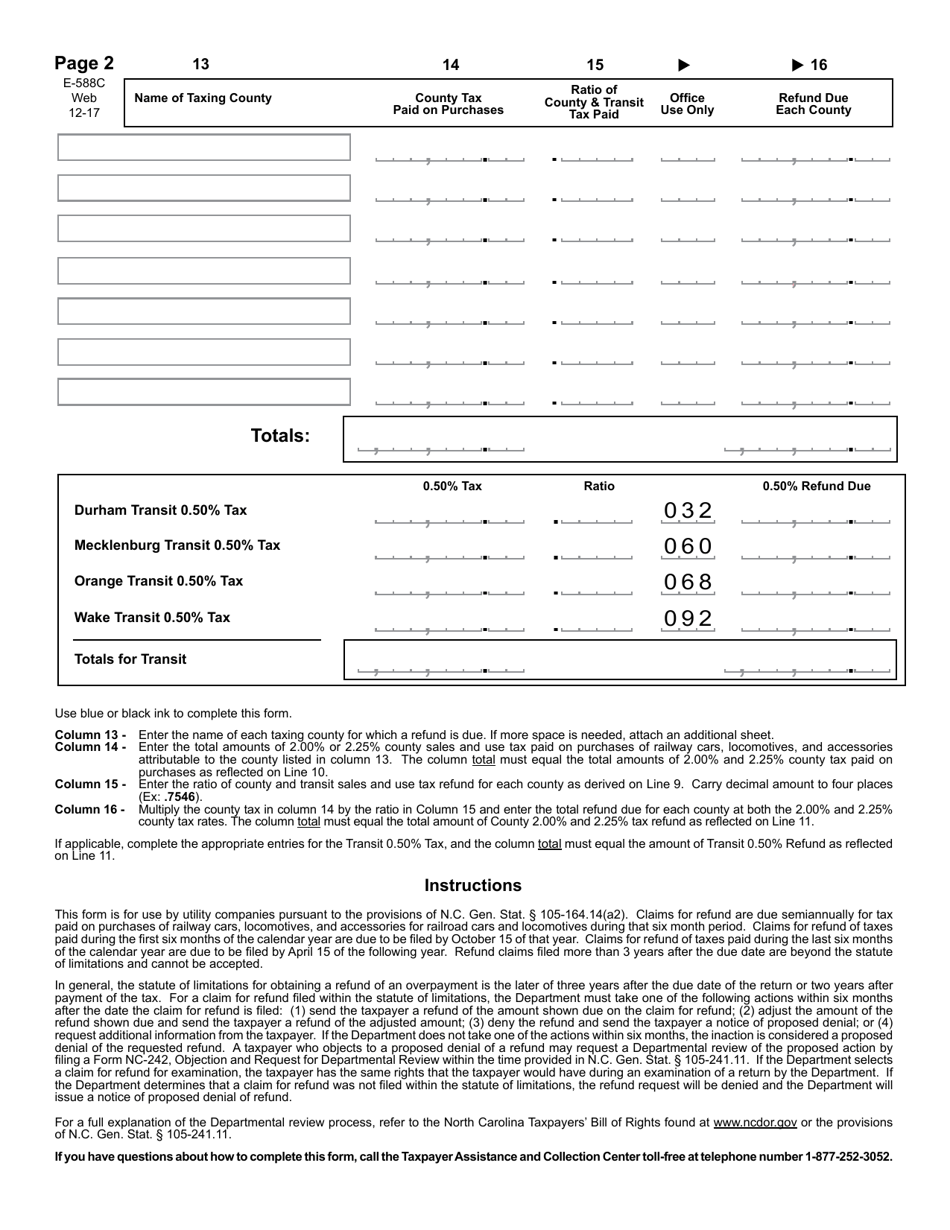

Form E-588C Utility Company Claim for Refund State, County, and Transit Sales and Use Taxes - North Carolina

What Is Form E-588C?

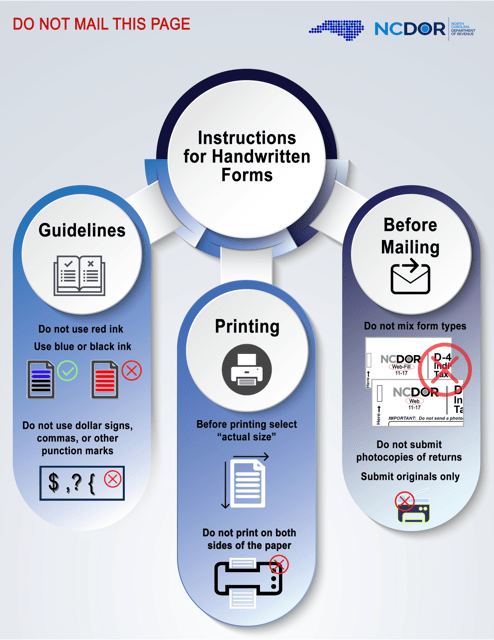

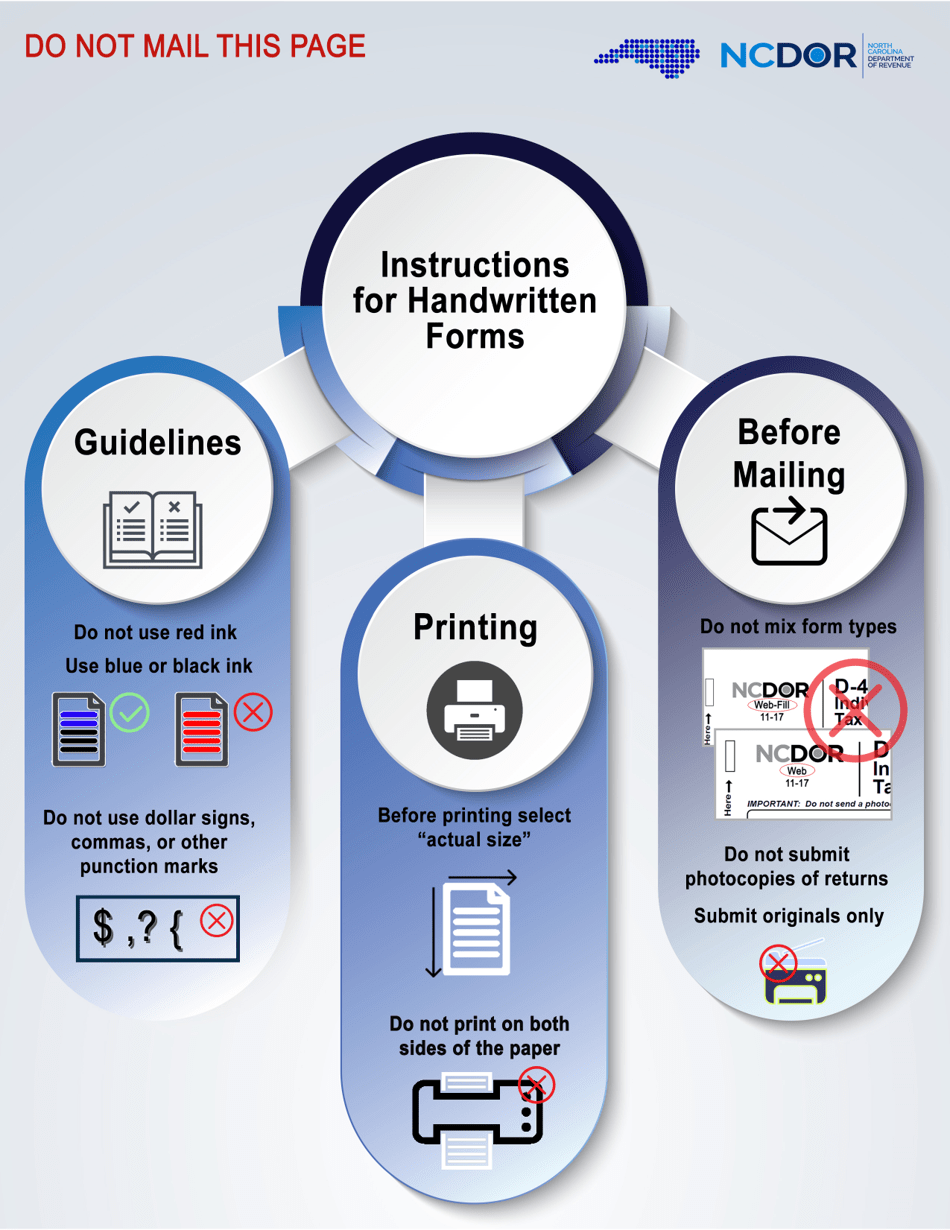

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-588C?

A: Form E-588C is a claim form used by utility companies in North Carolina to request a refund of state, county, and transit sales and use taxes.

Q: Who uses Form E-588C?

A: Utility companies in North Carolina use Form E-588C.

Q: What is the purpose of Form E-588C?

A: The purpose of Form E-588C is to request a refund of state, county, and transit sales and use taxes paid by utility companies in North Carolina.

Q: What taxes can be refunded using Form E-588C?

A: Form E-588C is used to request a refund of state, county, and transit sales and use taxes.

Q: Is there a deadline for submitting Form E-588C?

A: Yes, utility companies must submit Form E-588C within three years from the date the taxes were paid.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-588C by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.