Form E-581A Interstate Carrier Claim for Refund Combined General Rate Sales and Use Taxes - North Carolina

What Is Form E-581A?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-581A?

A: Form E-581A is the Interstate Carrier Claim for Refund for Combined General Rate Sales and Use Taxes in North Carolina.

Q: Who can use Form E-581A?

A: Interstate carriers who paid combined general rate sales and use taxes in North Carolina can use Form E-581A to claim a refund.

Q: What is the purpose of Form E-581A?

A: The purpose of Form E-581A is to request a refund for combined general rate sales and use taxes paid by interstate carriers in North Carolina.

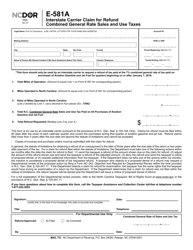

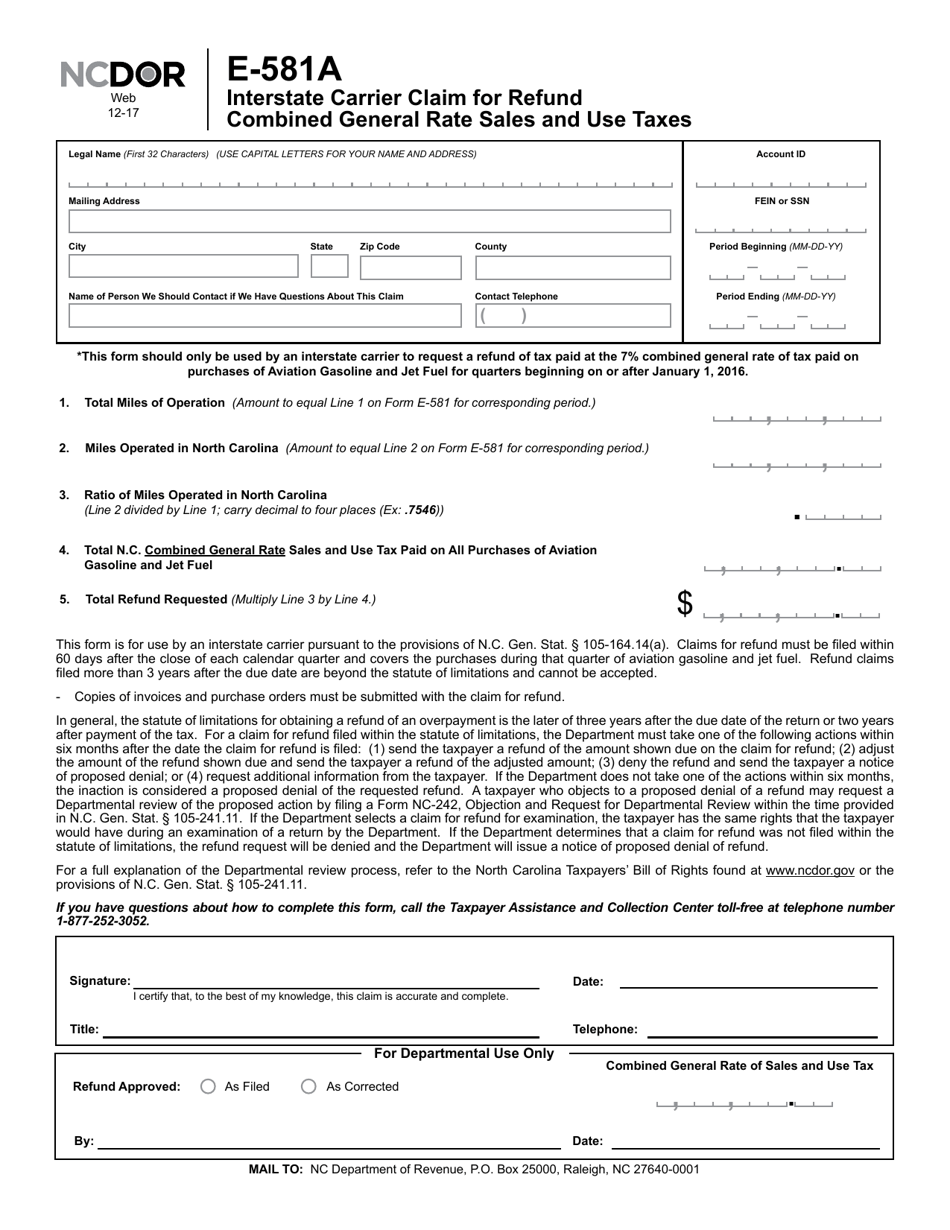

Q: What information is required to complete Form E-581A?

A: To complete Form E-581A, you will need to provide your carrier information, details of the tax transactions, and supporting documentation.

Q: Is there a deadline for submitting Form E-581A?

A: Yes, Form E-581A must be submitted within one year from the date the tax was paid or within six months from the date the tax was assessed.

Q: How long does it take to receive a refund after submitting Form E-581A?

A: The processing time for a refund claim on Form E-581A can vary, but it typically takes around 90 days to receive a refund.

Q: Are there any fees associated with filing Form E-581A?

A: No, there are no fees associated with filing Form E-581A.

Q: Can I file Form E-581A if I am not an interstate carrier?

A: No, Form E-581A is specifically for interstate carriers who have paid combined general rate sales and use taxes in North Carolina.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the North Carolina Department of Revenue;

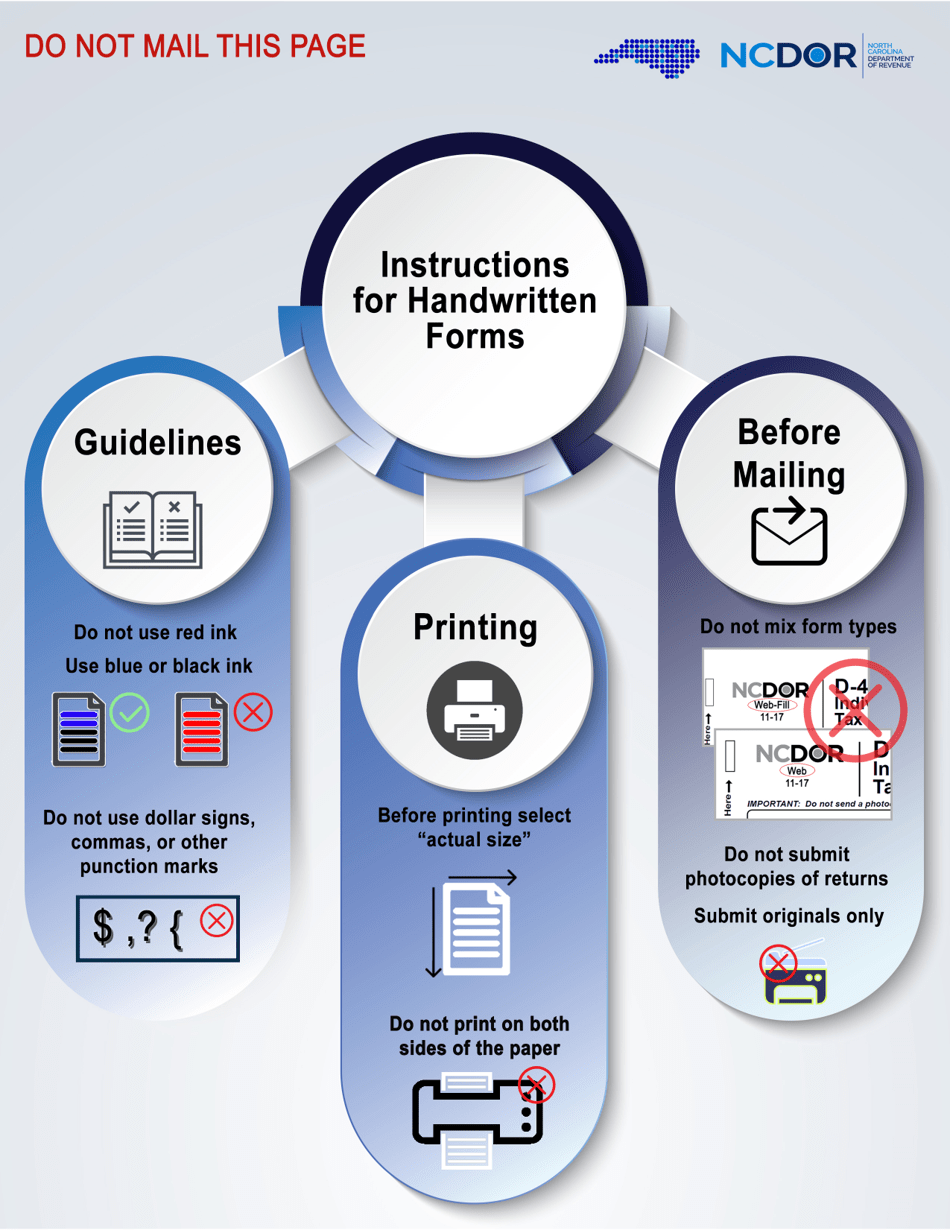

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-581A by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.