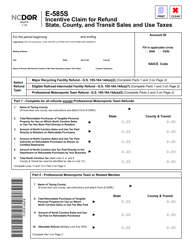

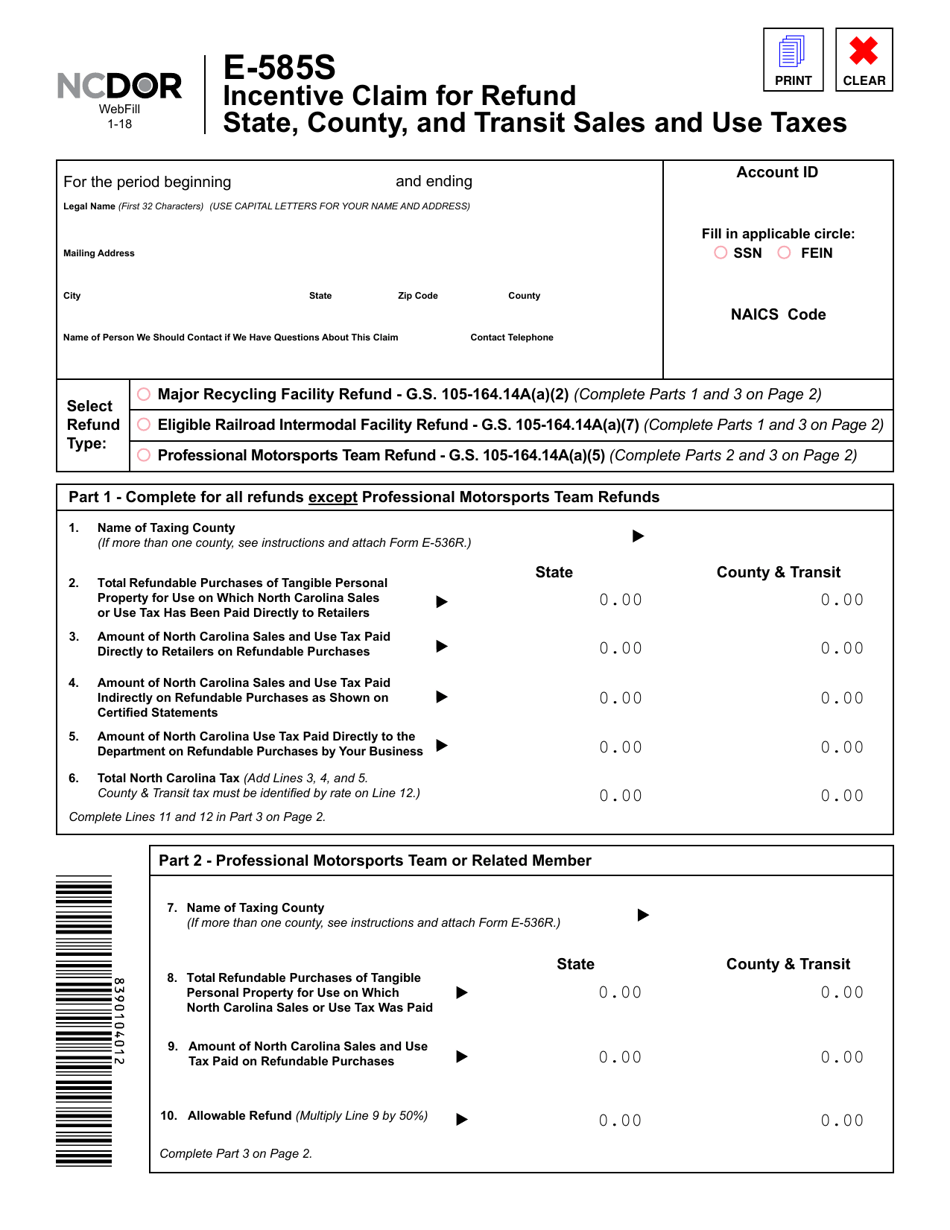

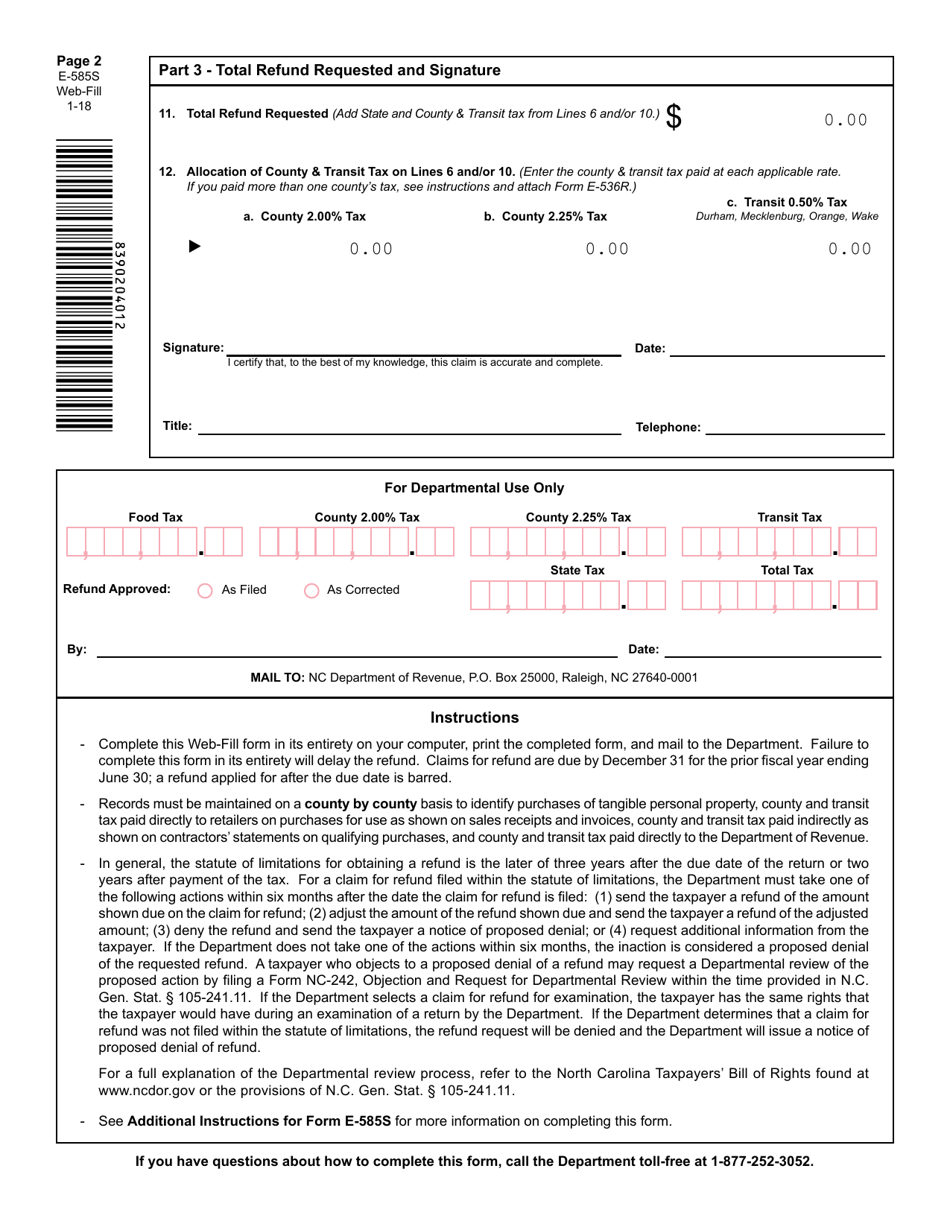

Form E-585S Incentive Claim for Refund State, County, and Transit Sales and Use Taxes - North Carolina

What Is Form E-585S?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-585S?

A: Form E-585S is a form used to claim a refund for state, county, and transit sales and use taxes in North Carolina.

Q: What taxes can be refunded using Form E-585S?

A: Form E-585S can be used to claim a refund for state, county, and transit sales and use taxes.

Q: Who can use Form E-585S?

A: Any individual or business that has paid state, county, and transit sales and use taxes in North Carolina can use Form E-585S to claim a refund.

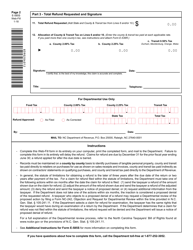

Q: How do I file Form E-585S?

A: To file Form E-585S, you need to complete the form with all the required information and submit it to the North Carolina Department of Revenue.

Q: Can I claim a refund for sales and use taxes paid in other states?

A: No, Form E-585S can only be used to claim a refund for sales and use taxes paid in North Carolina.

Q: What supporting documentation do I need to submit with Form E-585S?

A: You need to submit copies of your sales and use tax returns, along with any other supporting documentation that shows the taxes paid.

Q: Is there a deadline for filing Form E-585S?

A: Yes, Form E-585S must be filed within three years from the due date of the original sales and use tax return for the period in which the taxes were paid.

Q: How long does it take to receive a refund after filing Form E-585S?

A: The processing time for refund claims can vary, but the North Carolina Department of Revenue aims to process refund requests within 90 days of receiving a complete and accurate claim.

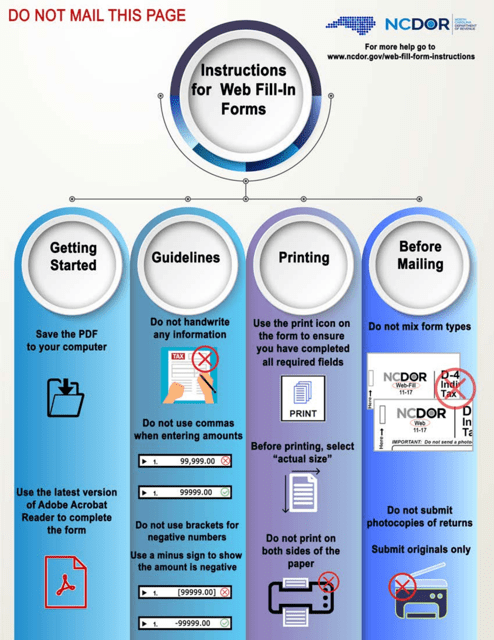

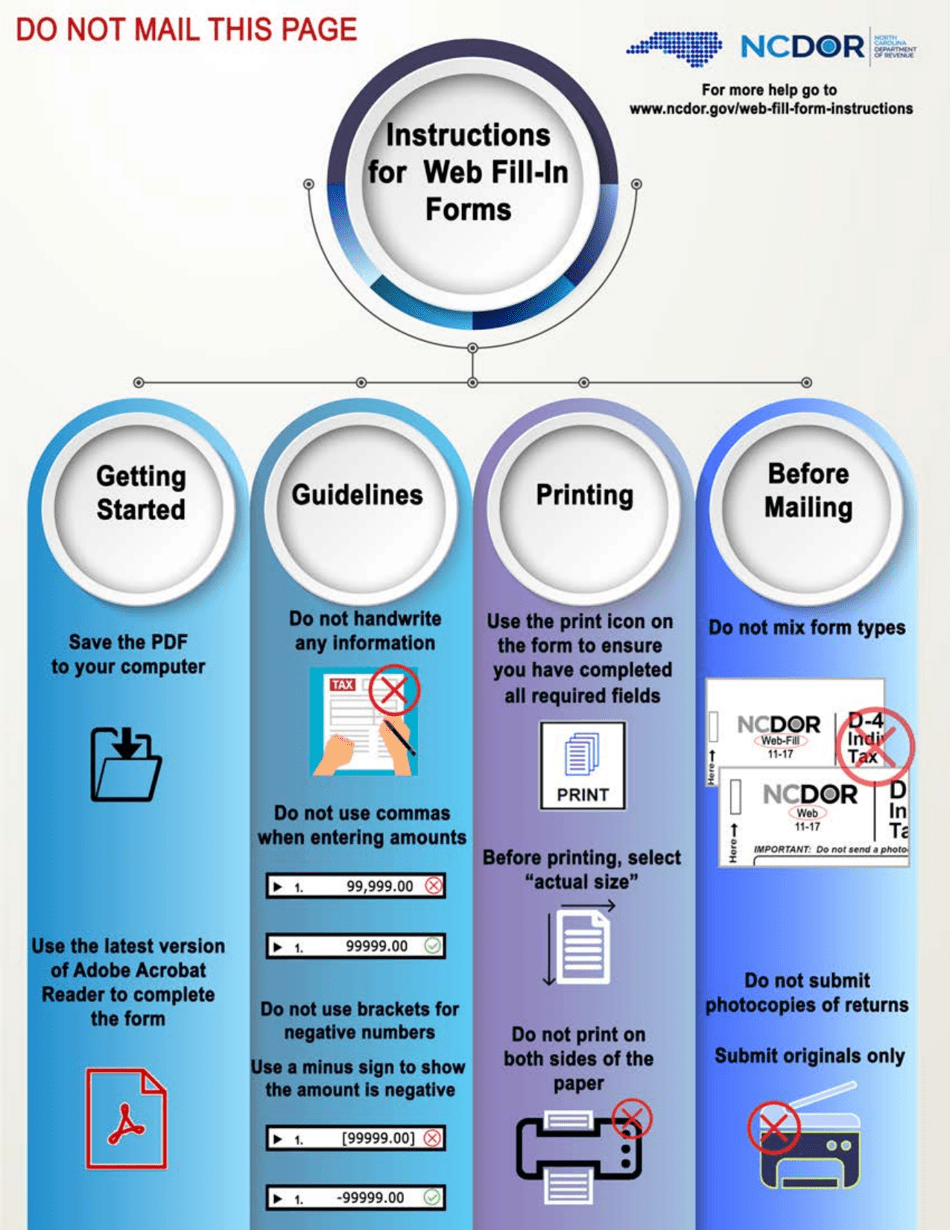

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-585S by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.