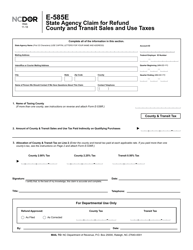

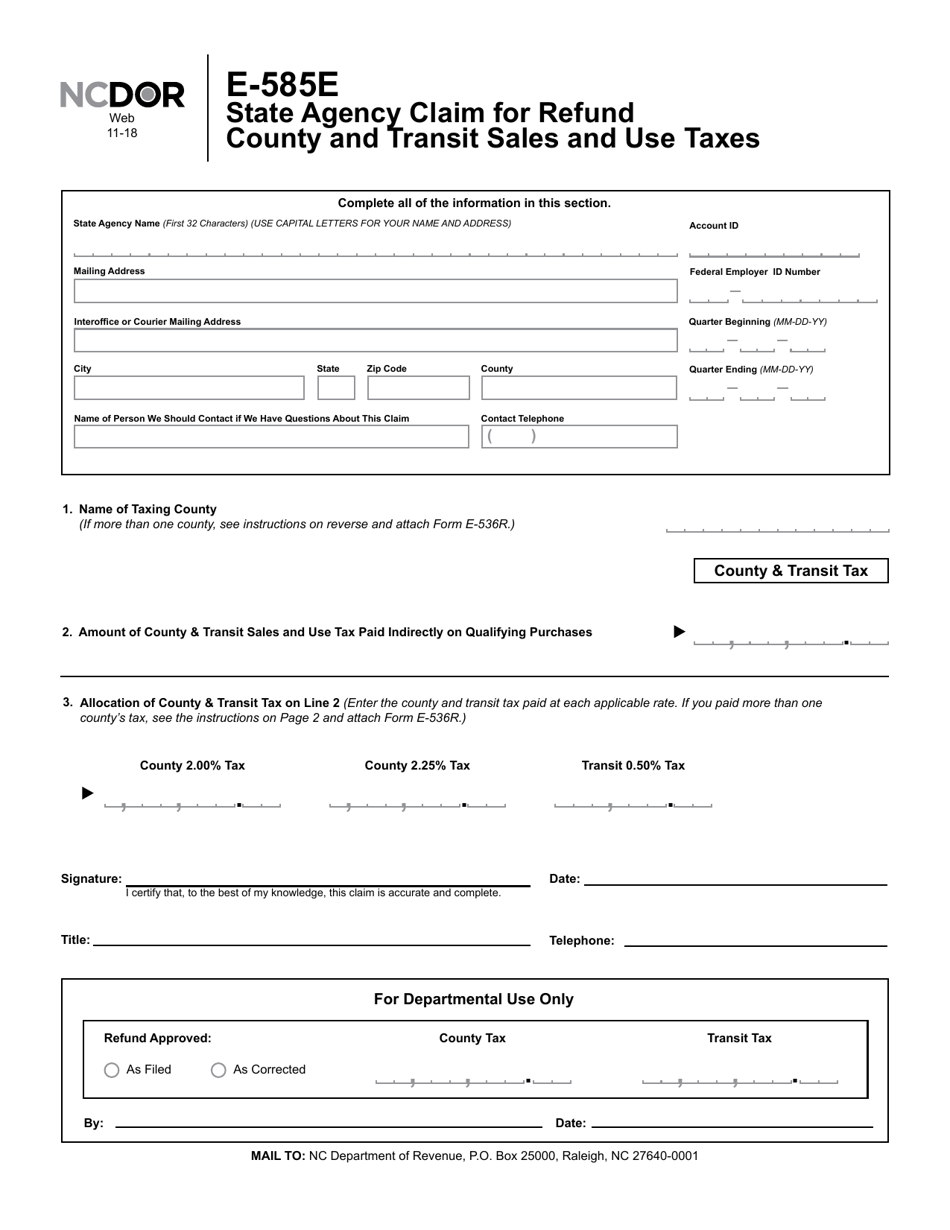

Form E-585E State Agency Claim for Refund County and Transit Sales and Use Taxes - North Carolina

What Is Form E-585E?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-585E?

A: Form E-585E is the State Agency Claim for Refund County and Transit Sales and Use Taxes in North Carolina.

Q: Who can use Form E-585E?

A: Form E-585E can be used by state agencies in North Carolina to claim a refund of county and transit sales and use taxes.

Q: What is the purpose of Form E-585E?

A: The purpose of Form E-585E is to facilitate the refund process for state agencies that have paid county and transit sales and use taxes.

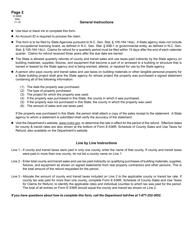

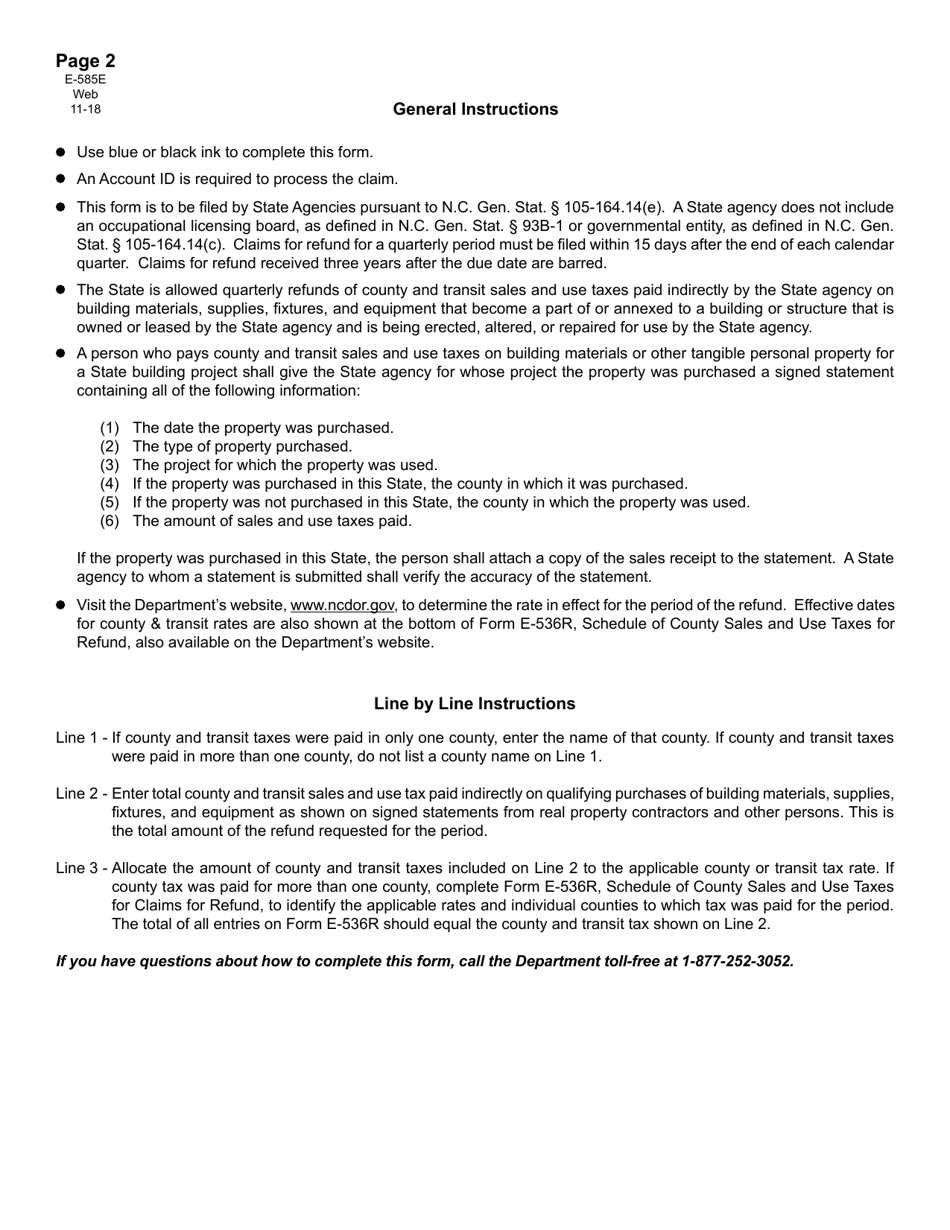

Q: How do I fill out Form E-585E?

A: To fill out Form E-585E, provide the required information regarding the agency, tax period, amount of taxes paid, and supporting documentation.

Q: Are there any deadlines for filing Form E-585E?

A: Yes, Form E-585E must be filed within three years from the date the taxes were paid to be eligible for a refund.

Q: What supporting documentation should be included with Form E-585E?

A: Supporting documentation may include copies of invoices, receipts, or other proof of payment for the county and transit sales and use taxes.

Q: How long does it take to receive a refund after submitting Form E-585E?

A: The processing time for a refund claim submitted on Form E-585E can vary, but it generally takes several weeks.

Q: What should I do if my Form E-585E refund claim is denied?

A: If your refund claim on Form E-585E is denied, you have the option to appeal the decision and provide additional supporting documentation if needed.

Q: Can I file Form E-585E electronically?

A: No, currently Form E-585E cannot be filed electronically and must be submitted by mail or in person.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

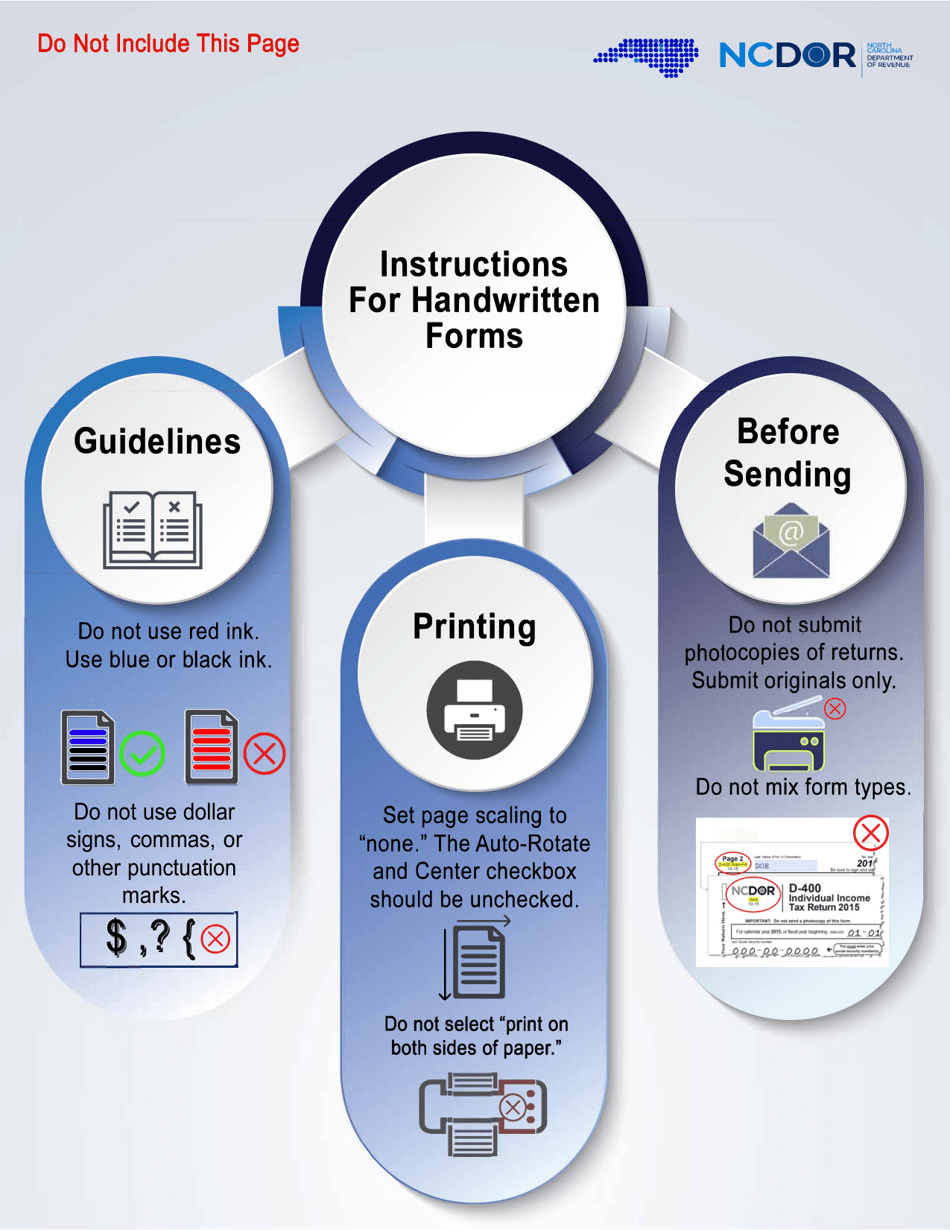

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-585E by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.