This version of the form is not currently in use and is provided for reference only. Download this version of

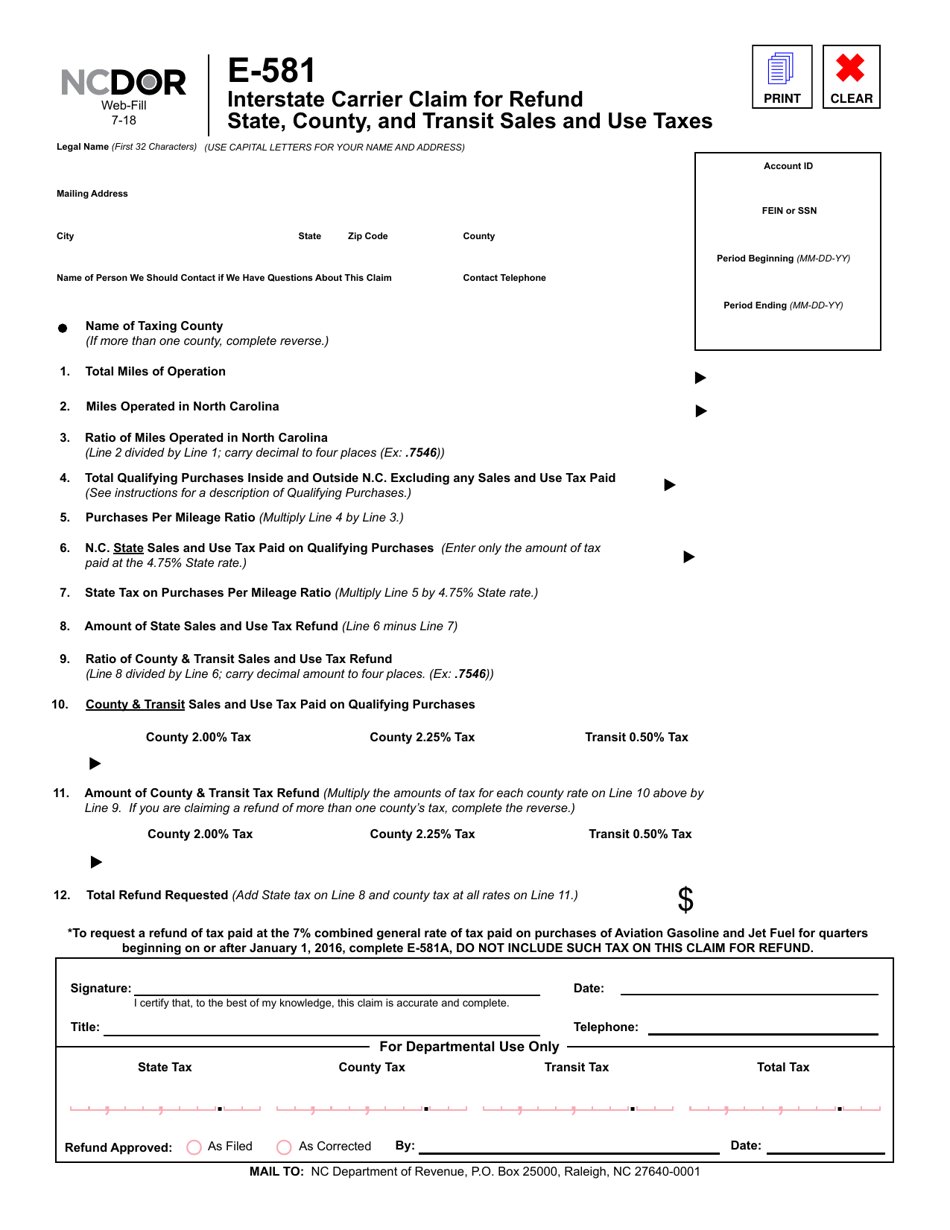

Form E-581

for the current year.

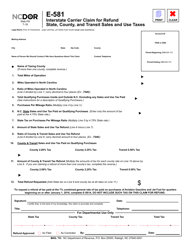

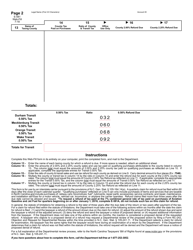

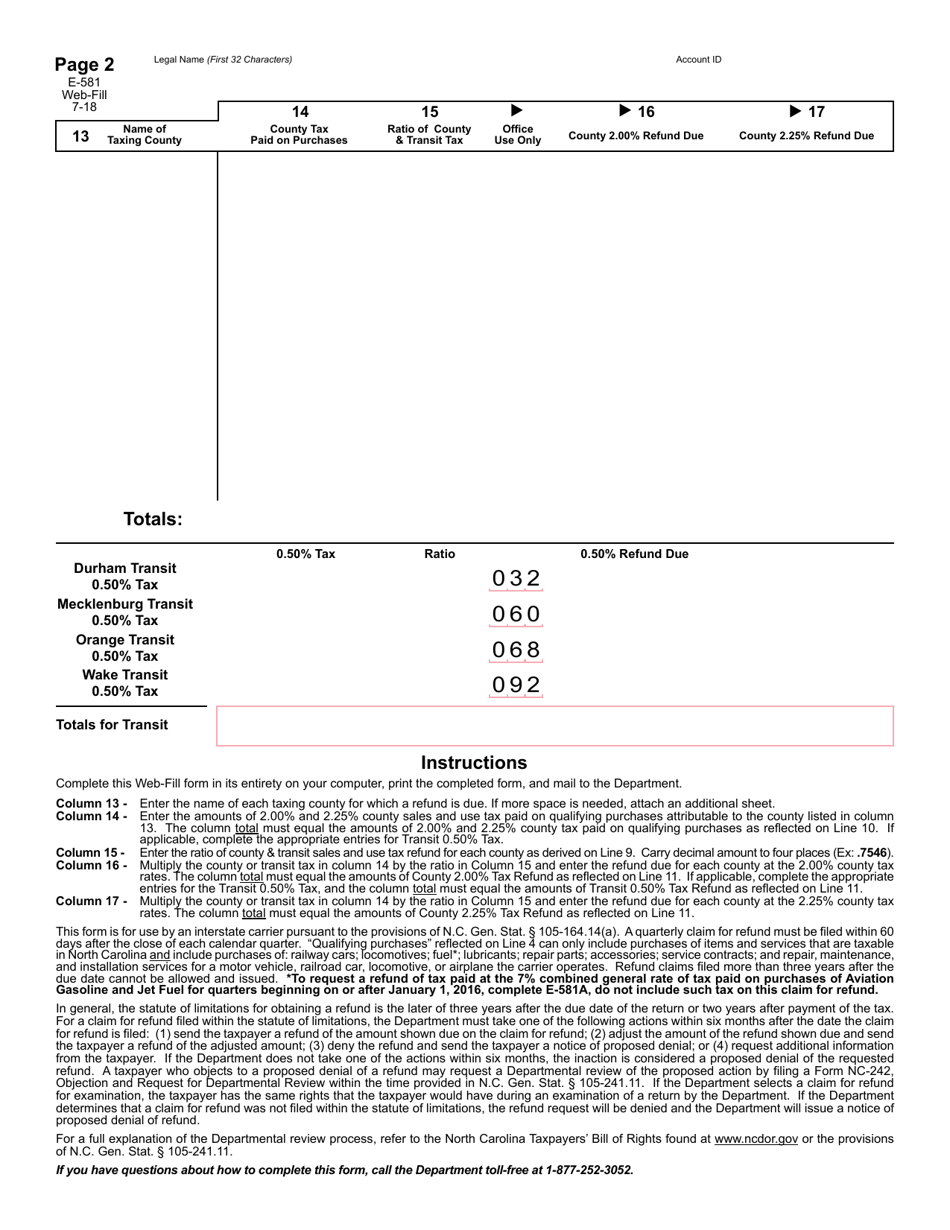

Form E-581 Interstate Carrier Claim for Refund State, County, and Transit Sales and Use Taxes - North Carolina

What Is Form E-581?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-581?

A: Form E-581 is a document used to claim a refund for state, county, and transit sales and use taxes in North Carolina.

Q: Who can use Form E-581?

A: Interstate carriers can use Form E-581 to claim a refund for sales and use taxes in North Carolina.

Q: What taxes can be refunded with Form E-581?

A: Form E-581 can be used to claim a refund for state, county, and transit sales and use taxes.

Q: What is the purpose of Form E-581?

A: The purpose of Form E-581 is to allow interstate carriers to request a refund for sales and use taxes paid in North Carolina.

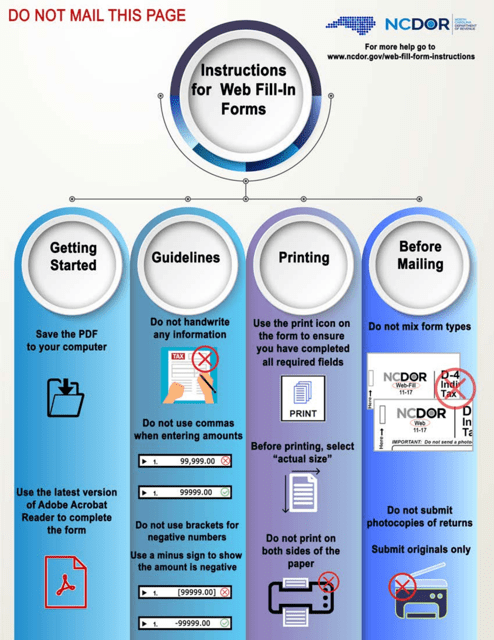

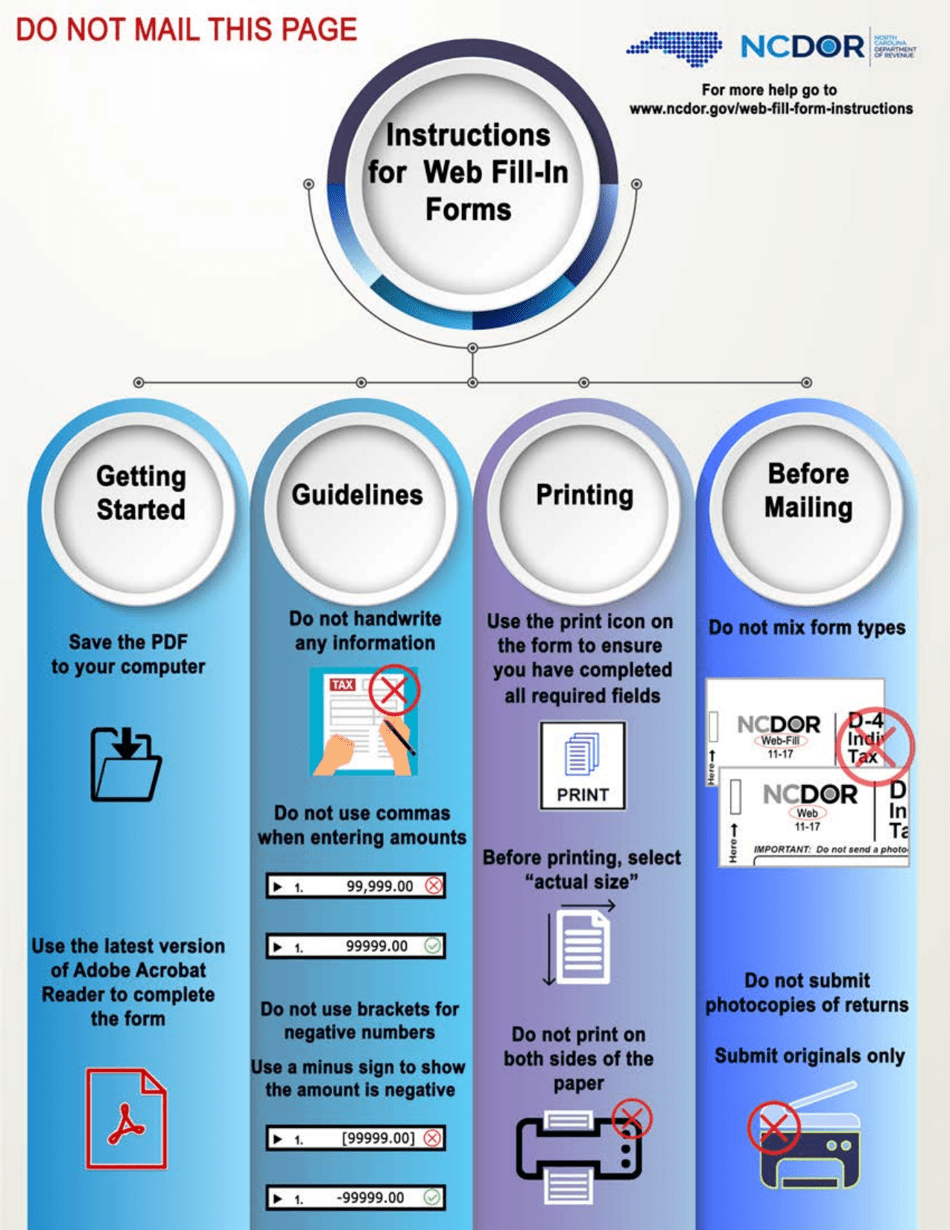

Q: How do I fill out Form E-581?

A: To fill out Form E-581, provide your carrier information, details of taxes paid, and supporting documentation.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E-581 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.