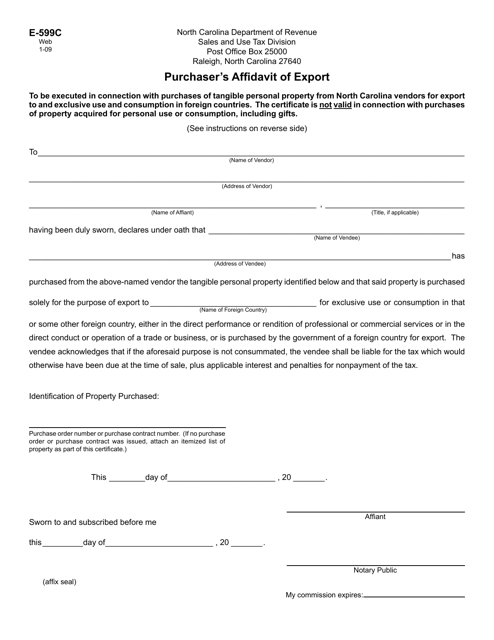

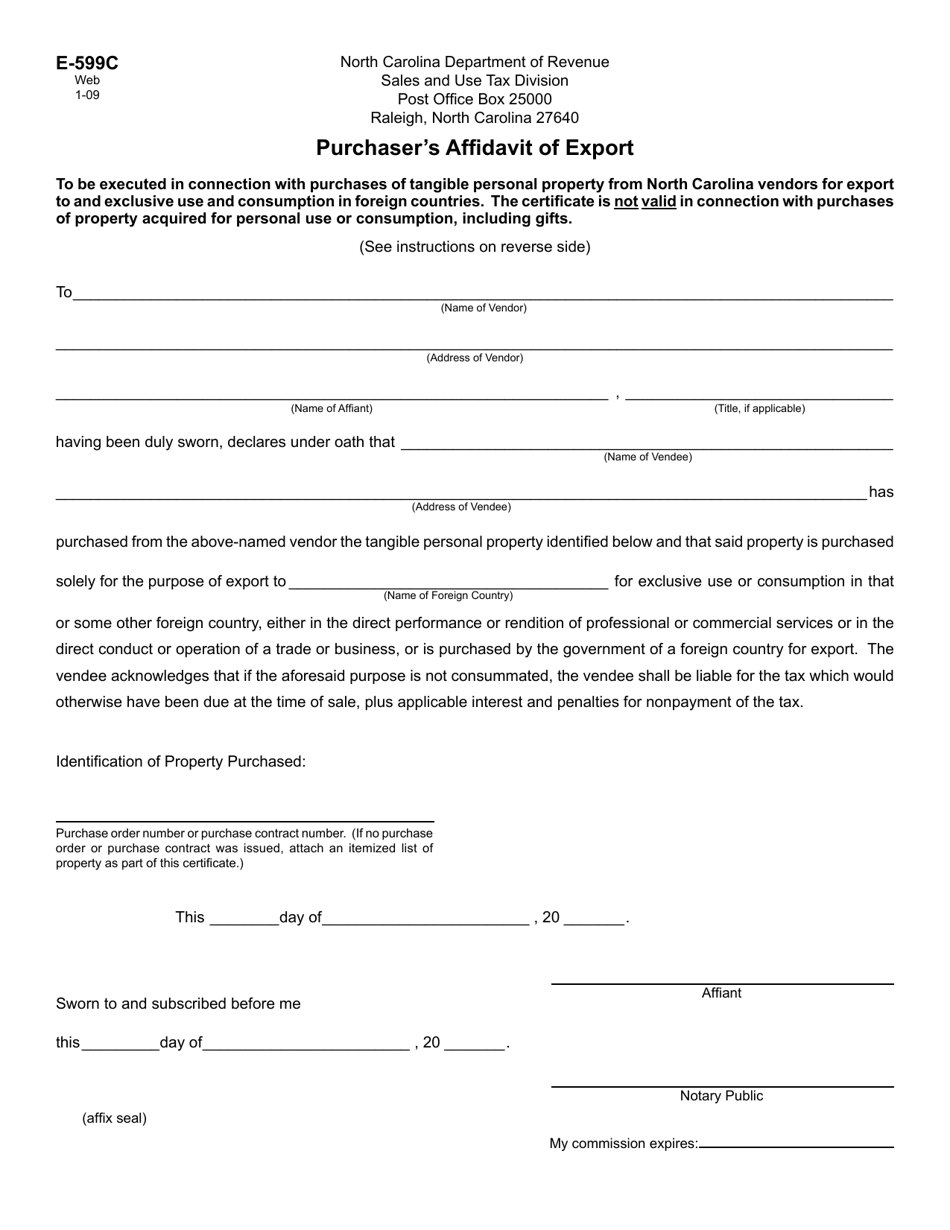

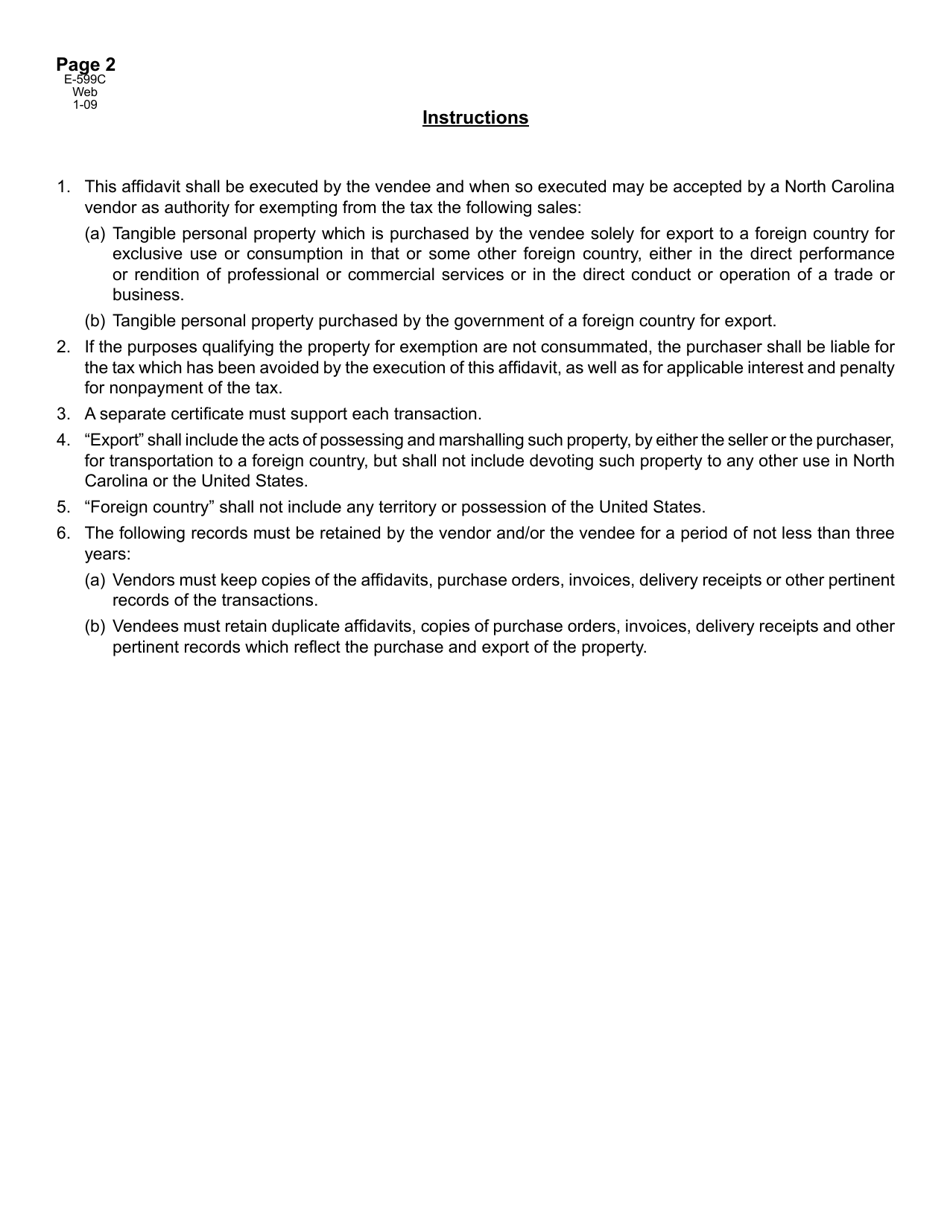

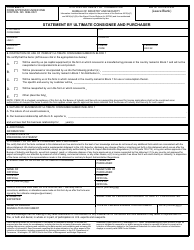

Form E-599C Purchaser's Affidavit of Export - North Carolina

What Is Form E-599C?

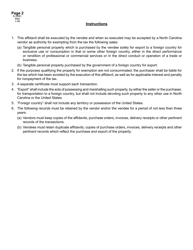

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form E-599C?

A: Form E-599C is the Purchaser's Affidavit of Export.

Q: What is the purpose of Form E-599C?

A: The purpose of Form E-599C is to document the exemption from North Carolina sales and use tax on tangible personal property sold to a purchaser for export.

Q: Who should use Form E-599C?

A: This form should be used by purchasers who buy tangible personal property for export out of North Carolina.

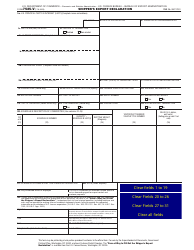

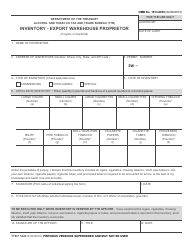

Q: What information is required on Form E-599C?

A: Form E-599C requires information about the purchaser, the seller, the exported property, and the export destination.

Q: Are there any deadlines for submitting Form E-599C?

A: Yes, Form E-599C must be completed and provided to the seller at the time of purchase.

Q: Is there a fee for filing Form E-599C?

A: No, there is no fee for filing Form E-599C.

Q: Can Form E-599C be used for multiple purchases?

A: Yes, Form E-599C can be used for multiple purchases by the same purchaser.

Q: Is Form E-599C only applicable in North Carolina?

A: Yes, Form E-599C is specific to North Carolina and is used to claim exemption from North Carolina sales and use tax.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form E-599C by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.